Biotic Ingredients in Home Care Market Size (2025 – 2030)

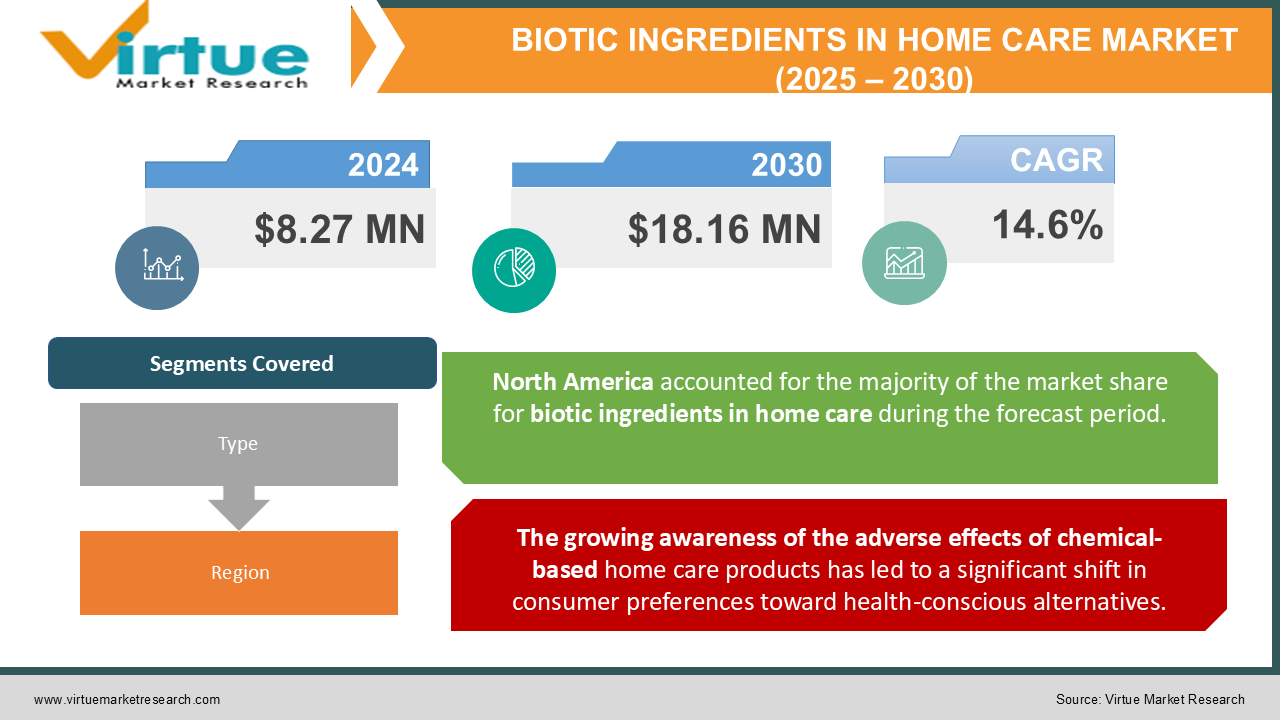

The Biotic Ingredients in Home Care Market was valued at USD 8.27 Million in 2024 and is projected to reach a market size of USD 18.16 Million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 14.6%.

The biotic ingredients in the home care market are a dynamic and rapidly evolving segment of the home care industry. With an increasing consumer focus on sustainable, health-conscious, and environmentally friendly products, the integration of biotic ingredients—such as probiotics, postbiotics, and synbiotics—into home care solutions has become a significant trend. These ingredients offer unique benefits, leveraging their natural microbial activity to enhance cleaning efficacy, eliminate harmful bacteria, and create a healthier indoor environment. Unlike conventional chemical-based cleaning agents, biotic-infused products focus on balancing microbial ecosystems, making them safer for human health and the environment. The industry has seen significant investment from both startups and established players aiming to differentiate their offerings in a highly competitive market. Innovation is key, as companies are exploring ways to incorporate biotic ingredients in various formulations, from sprays and powders to biodegradable pods. Scientists are exploring novel strains of probiotics and optimizing fermentation processes to enhance the functional properties of postbiotics and synbiotics.

Key Market Insights:

-

Consumer awareness of biotic home care benefits surged by 35% through targeted marketing campaigns.

-

Over 70% of surveyed consumers recognized the term "probiotic cleaners" by mid-2023.

-

The average price of biotic-infused home care products was 20% higher than conventional alternatives.

-

Approximately 62% of biotic ingredient suppliers invested in developing postbiotic formulations.

-

Around 48% of surveyed households expressed interest in switching to biotic home care solutions.

-

Global investments in R&D for biotic home care products reached $620 million in 2023.

-

Small and medium enterprises (SMEs) accounted for 35% of new biotic product launches.

-

Digital campaigns promoting biotic home care products experienced a click-through rate increase of 18%.

Market Drivers:

The growing awareness of the adverse effects of chemical-based home care products has led to a significant shift in consumer preferences toward health-conscious alternatives.

Biotic ingredients in home care products meet this demand by offering solutions that are both effective and gentle on human health and the environment. Traditional cleaners often contain harsh chemicals that cause skin irritations, respiratory issues, and other health concerns, especially for families with children or pets. In contrast, products infused with probiotics and postbiotics provide natural cleaning mechanisms without leaving behind toxic residues. Probiotic cleaners actively work by introducing beneficial microorganisms into the cleaning process. These microorganisms break down dirt and harmful pathogens while creating a microbial environment that continues to maintain cleanliness over time. This dynamic cleaning approach is particularly appealing to consumers who value long-term efficacy and safety over immediate results. Moreover, the integration of biotic ingredients into products like air purifiers and fabric refreshers further highlights their versatility, catering to diverse consumer needs. Heightened focus on indoor air quality has also emerged as a critical factor driving the adoption of biotic home care products. With urbanization and prolonged indoor living, consumers are increasingly aware of the effects of volatile organic compounds (VOCs) emitted by conventional cleaning agents.

The rapid advancement of biotechnology and microbial science has significantly bolstered the growth of biotic ingredients in the home care market.

Innovations in probiotic strain isolation, fermentation techniques, and postbiotic extraction have allowed manufacturers to optimize their formulations for enhanced cleaning performance and stability. Research into microbial ecosystems has provided valuable insights into how probiotics and postbiotics can be tailored for specific cleaning applications, from breaking down grease on kitchen surfaces to eliminating allergens in laundry fabrics. One of the most notable breakthroughs is the development of encapsulation technologies that preserve the viability of probiotics in diverse formulations. These encapsulations protect the microorganisms during storage and ensure their release during use, enhancing their effectiveness. Similarly, advancements in enzyme stabilization have made postbiotics a reliable option for high-performance cleaning solutions, particularly in regions with varying environmental conditions. Another driving factor is the growing collaboration between academia and industry players, facilitating the translation of cutting-edge microbial research into practical applications. These partnerships have accelerated the development of biotic ingredients, reducing time-to-market for innovative products.

Market Restraints and Challenges:

One of the primary challenges lies in the cost-intensive production processes for biotic ingredients such as probiotics, postbiotics, and synbiotics. Unlike conventional cleaning agents synthesized through chemical formulations, biotic ingredients require advanced fermentation techniques, precise environmental controls, and rigorous quality assurance to maintain microbial viability. These processes increase the overall cost of production, translating to higher retail prices for consumers. While eco-conscious and health-aware households may be willing to pay a premium, cost-sensitive markets remain a significant hurdle for widespread adoption. Additionally, scaling the production of biotic ingredients to meet growing demand without compromising quality presents another barrier. The cultivation of probiotics, for instance, requires specialized infrastructure and expertise. Even minor variations in production conditions can impact the potency and effectiveness of the final product, posing challenges for manufacturers looking to scale efficiently. Startups and small-scale producers, in particular, struggle with achieving economies of scale, limiting their ability to compete with established players. The biotic home care market operates in a regulatory landscape that is still evolving. Unlike traditional cleaning agents with clearly defined standards, biotic formulations often lack uniformity in terms of ingredient definitions, safety testing protocols, and efficacy claims.

Market Opportunities:

The biotic ingredients in the home care market are poised to capitalize on numerous growth opportunities, driven by shifts in consumer preferences, technological advancements, and increasing global focus on sustainability. These opportunities offer a fertile ground for innovation, market expansion, and collaboration, enabling players in the sector to solidify their presence and attract a broader customer base. As the global consciousness around environmental sustainability grows, consumers are increasingly seeking home care products that align with their eco-friendly values. Traditional cleaning products often contain harsh chemicals and are packaged in non-biodegradable materials, contributing to environmental degradation. Biotic ingredients, on the other hand, offer a sustainable alternative with reduced ecological impact. Probiotics, postbiotics, and synbiotics naturally degrade in the environment, minimizing water pollution and harm to ecosystems. This shift creates a significant market opportunity for brands to position biotic home care products as the go-to choice for environmentally conscious consumers. Companies that invest in transparent sustainability practices, such as biodegradable packaging and carbon-neutral production methods, can gain a competitive edge in this growing segment. This health-conscious trend presents a lucrative opportunity for manufacturers to highlight the dual benefits of biotic products: effective cleaning and long-term wellness. Educational campaigns focusing on the science behind probiotics and postbiotics can further drive consumer interest, transforming biotic home care solutions into a mainstream choice.

BIOTIC INGREDIENTS IN HOME CARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

14.6% |

|

Segments Covered |

By Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Croda Home Care, Novozymes, Betco, SCD Probiotics, HeiQ Materials AG, Pollet, Proklean Technologies Pvt. Ltd, Pure Ingenious Ltd t/a Ingenious Probiotics,Ceiba Green, P2 Probiotic Power, 4Biotech, Kiilto |

Biotic Ingredients in Home Care Market Segmentation: by Type

-

Probiotics

-

Detergents

-

Laundry Additives

-

Dishwashing Agents

-

Surface Cleaners

-

Toilet Cleaners

-

Postbiotics

-

Detergents

-

Surface cleaners

-

Toilet cleaners

-

Synbiotics

-

Detergents

-

Laundry Additives

-

Dishwashing Agents

-

Surface Cleaners

Among these, probiotics hold the dominant position in the market. Their wide application in surface cleaners, laundry detergents, and air fresheners, combined with growing consumer awareness of their health benefits, makes them a preferred choice.

Synbiotics are emerging as the fastest-growing type. Their ability to combine the benefits of probiotics and prebiotics into a single formulation resonates with consumers looking for multipurpose and highly effective solutions. This growth is further fueled by ongoing research into their long-term health and environmental benefits.

Biotic Ingredients in Home Care Market Segmentation - by Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

North America leads the market by 35% market share, driven by high consumer awareness, strong regulatory support for sustainable products, and significant investment in biotic research. The U.S., in particular, has a well-established market for biotic home care products, with consumers willing to pay a premium for innovative and eco-friendly solutions.

Asia-Pacific is the fastest-growing region, attributed to the increasing urbanization, rising disposable incomes, and heightened environmental awareness. Countries like China, India, and Japan are emerging as lucrative markets, with consumers embracing biotic solutions as part of their modern and eco-conscious lifestyles.

COVID-19 Impact Analysis:

As consumers became more conscious of the importance of home hygiene to prevent virus transmission, the demand for effective yet gentle cleaning solutions surged. Biotic ingredients, known for their ability to maintain microbial balance while eliminating harmful pathogens, emerged as an attractive alternative to traditional chemical-based cleaners. This trend accelerated the adoption of biotic products, particularly among health-conscious consumers. The pandemic disrupted global supply chains, impacting the availability of raw materials and delaying production cycles for biotic home care products. Manufacturers faced challenges in sourcing probiotics and other biotic components, particularly those imported from regions with stringent lockdown measures. These disruptions underscored the need for localized production and diversified supply chains to ensure business continuity. With physical retail outlets temporarily closed or operating at reduced capacity, e-commerce became the primary distribution channel for biotic home care products. Brands that invested in digital transformation and online sales platforms during the pandemic experienced significant growth. Social media campaigns, influencer marketing, and virtual product demonstrations became key strategies to engage with consumers and drive sales.

Latest Trends and Developments:

The biotic ingredients in home care market are undergoing rapid transformation, driven by technological advancements, consumer preferences, and regulatory initiatives. These developments are shaping the market landscape, creating opportunities for innovation and growth. One of the most prominent trends is the increasing use of AI and machine learning in product development. These technologies are enabling manufacturers to optimize formulations by analysing vast datasets on microbial interactions and consumer usage patterns. For example, AI-driven research is facilitating the creation of biotic products tailored to specific cleaning needs, such as allergen reduction or odor control. The rise of subscription-based models is another notable trend, particularly in the e-commerce space. Consumers are embracing the convenience of regular product deliveries, often accompanied by personalized recommendations and discounts. These models also provide brands with a steady revenue stream and valuable insights into consumer preferences. In terms of sustainability, companies are exploring zero-waste packaging solutions, such as refillable containers and compostable materials. These initiatives resonate with environmentally conscious consumers and reinforce brand loyalty. Similarly, the adoption of carbon-neutral manufacturing processes is gaining traction, with companies investing in renewable energy sources and offsetting emissions through reforestation projects. Collaboration between biotech firms and home care manufacturers is driving innovation in biotic formulations. These partnerships are yielding products with enhanced stability, longer shelf lives, and multifunctional capabilities. For instance, recent advancements in encapsulation technology are ensuring that probiotics remain active throughout the product lifecycle, addressing a critical challenge in the market.

Key Players:

-

Croda Home Care

-

Novozymes

-

Betco

-

SCD Probiotics

-

HeiQ Materials AG

-

Pollet

-

Proklean Technologies Pvt. Ltd

-

Pure Ingenious Ltd t/a Ingenious Probiotics

-

Ceiba Green

-

P2 Probiotic Power

-

4Biotech

-

Kiilto

Chapter 1. BIOTIC INGREDIENTS IN HOME CARE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. BIOTIC INGREDIENTS IN HOME CARE MARKET – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. BIOTIC INGREDIENTS IN HOME CARE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. BIOTIC INGREDIENTS IN HOME CARE MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. BIOTIC INGREDIENTS IN HOME CARE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. BIOTIC INGREDIENTS IN HOME CARE MARKET – By Type

6.1 Introduction/Key Findings

6.2 Probiotics

6.3 Detergents

6.4 Laundry Additives

6.5 Dishwashing Agents

6.6 Surface Cleaners

6.7 Toilet Cleaners

6.8 Postbiotics

6.9 Detergents

6.10 Surface cleaners

6.11 Toilet cleaners

6.12 Synbiotics

6.13 Detergents

6.14 Laundry Additives

6.15 Dishwashing Agents

6.16 Surface Cleaners

6.17 Y-O-Y Growth trend Analysis By Type

6.18 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. BIOTIC INGREDIENTS IN HOME CARE MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Type

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Type

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Type

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Type

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Type

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. BIOTIC INGREDIENTS IN HOME CARE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Croda Home Care

8.2 Novozymes

8.3 Betco

8.4 SCD Probiotics

8.5 HeiQ Materials AG

8.6 Pollet

8.7 Proklean Technologies Pvt. Ltd

8.8 Pure Ingenious Ltd t/a Ingenious Probiotics

8.9 Ceiba Green

8.10 P2 Probiotic Power

8.11 4Biotech

8.12 Kiilto

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The modern consumer is increasingly informed about the potential hazards associated with synthetic chemicals in household products. This awareness has created a strong preference for natural and biotic-based solutions, which are perceived as safer for both users and the environment.

One of the primary challenges in the biotic ingredients in home care market is a lack of widespread awareness and understanding among consumers. While the concept of probiotics and biotics is well-known in the food and beverage or healthcare sectors, its application in home care is relatively new and less familiar.

Leading players like Croda Home Care, Novozymes, Betco have been pivotal in advancing biotic formulations, leveraging their extensive research capabilities and global distribution networks.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.