Biopolymers for Packaging’s Market Size (2023 – 2030)

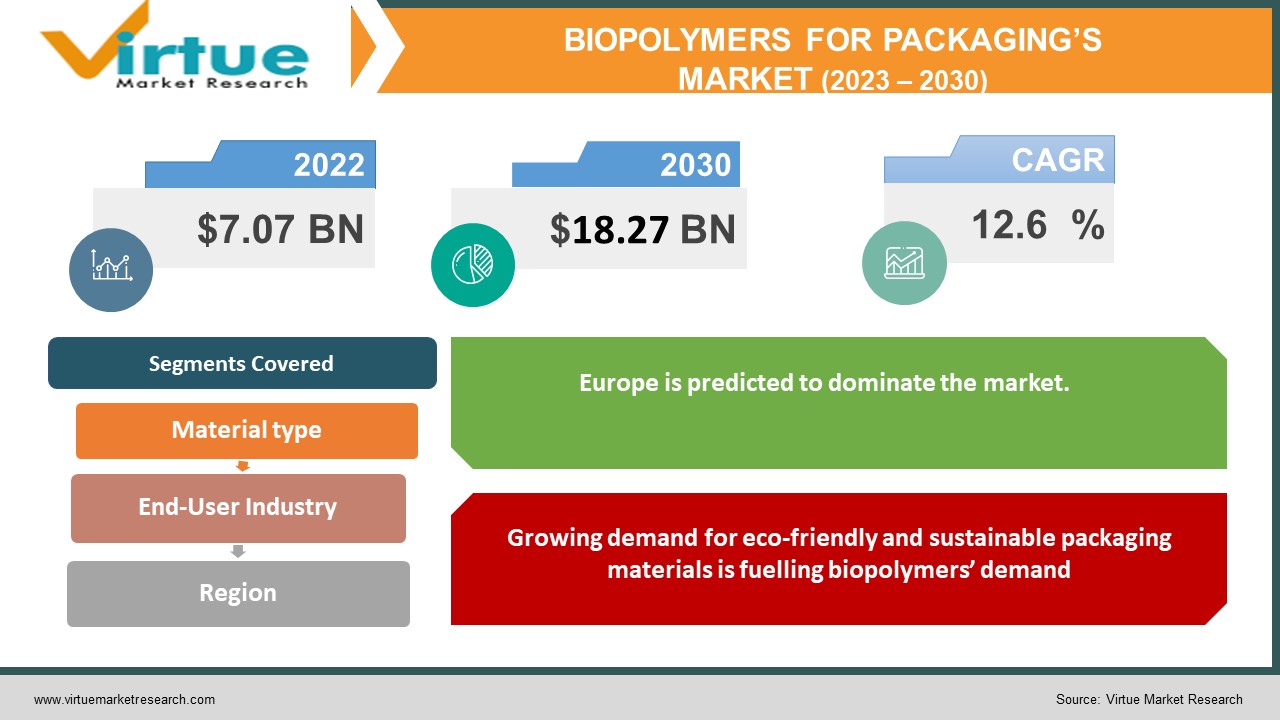

The Global Biopolymers for Packaging Market was estimated to be worth USD 7.07 Billion in 2022 and is projected to reach a value of USD 18.27 Billion by 2030, growing at a CAGR of 12.6% during the forecast period 2023-2030.

Biopolymers are organic materials made from living things that are renewable, such as plants, animals, and microorganisms. Numerous uses for these biopolymers exist, including the production of packaging materials. The biopolymers used in packaging are frequently compostable and biodegradable, making them an environmentally friendly substitute for conventional packaging materials like plastic. The biopolymers for the packaging market, including its growth drivers, obstacles, and opportunities, will be covered in this article.

The market for biopolymers used in packaging is anticipated to expand significantly over the next few years as a result of consumer preferences, regulatory initiatives, and technological advancements as well as environmental concerns. The market is still confronted with difficulties related to cost, performance, supply chain, and end-of-life disposal. By addressing these issues and taking advantage of opportunities like innovation, teamwork, market expansion, and the circular economy, we can encourage the use of biopolymers for environmentally friendly packaging methods.

Global Biopolymers for Packagings Market Drivers:

Growing demand for eco-friendly and sustainable packaging materials is fuelling biopolymers’ demand.

There is an increasing need for sustainable packaging materials as more people become aware of environmental issues like pollution, climate change, and waste management. Biopolymers, or natural polymers derived from renewable resources, are an environmentally friendly substitute for plastic and other conventional packaging materials because they can frequently be composted and biodegraded. Customers are increasingly seeking out and willing to pay more for Eco-friendly and sustainable products as they become more conscious of the impact their choices have on the environment. This is anticipated to continue driving market growth in the coming years as it is boosting demand for biopolymers for packaging materials.

Regulatory policies promoting the use of biodegradable and compostable materials are propelling market demand.

Governments all over the world are putting regulations into place to lessen the use of conventional packaging materials and promote the use of compostable and biodegradable materials. For instance, the Single-Use Plastics Directive adopted by the European Union limits the use of specific single-use plastic products and encourages the use of compostable and biodegradable materials. Similar to other countries, India's government has outlawed some single-use plastic products and encourages the use of compostable and biodegradable materials. As more governments implement regulations along these lines, the demand for biopolymers as packaging materials is anticipated to increase.

Global Biopolymers for Packagings Market Challenges:

One of the greatest difficulties with biopolymers right now is their cost in packaging. Biopolymers are exposed to severe market competition as they are usually more expensive than standard packaging materials like plastic. This is brought on by a number of elements, such as expensive raw materials, technological improvements, and limited production capacity. A further factor that may reduce the commercial viability of biopolymers is the increased expenses that are transferred to the consumer. For biopolymers to be widely employed as packaging materials, the cost issue needs to be fixed. Progress in processing technology and the application of economies of scale to reduce production costs can help achieve this.

COVID-19 Impact on Global Biopolymers for Packagings Market:

The COVID-19 pandemic has disrupted the supply chain and reduced demand for many different products, including biopolymers for packaging. Due to transportation disruptions and manufacturing facility closures, the production and distribution of biopolymers have been hindered, causing delays and rising costs. The economic downturn has also reduced consumer spending power, which has caused a drop in demand for high-end sustainable packaging materials like biopolymers. The pandemic has increased people's awareness of the importance of sustainability and waste minimization, though. One of the sustainable packaging solutions that consumers and businesses are increasingly seeking for is biopolymers, which are renewable and biodegradable. The pandemic has increased the market demand for biopolymers by quickening the movement toward sustainable and environmentally friendly packaging materials. In the years to come, the increased government regulations and incentives to improve sustainability brought about by the pandemic are anticipated to further raise demand for biopolymers.

Global Biopolymers for Packagings Market Recent Developments:

- In January 2020, Fraunhofer Institute for Microstructure of Materials and Systems IMWS and POLIFILM Extrusion are collaborating on a research project to develop biopolymer-based films for food packaging.

- In January 2023, Mondi plc completed the acquisition of Duino mill near Trieste, Italy. The acquisition was made from Burgo Group for a total consideration of €40 million.

BIOPOLYMERS FOR PACKAGINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

12.6% |

|

Segments Covered |

By Material Type, End User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mondi Group, Taghleef Industries Inc., Clondalkin Group Holdings BV, Sonoco Products Company, Berry Plastics Group Inc., Constantia Flexibles Group GmbH, Sealed Air Corporation, Tetra Pak International SA, United Biopolymers SA, Amcor PLC |

Global Biopolymers for Packagings Market Segmentation:

Global Biopolymers for Packagings Market Segmentation: By Material Type

- Non-Biodegradable

- Biodegradable

Non-biodegradable biopolymers are petrochemical-based biopolymers that are resistant to biological decomposition. The opposite is true for biodegradable biopolymers, which are typically made from renewable resources and are compostable as well as biodegradable. Due to the growing demand for ecologically friendly packaging materials, it is anticipated that the biodegradable sector would dominate the market. Since they are environmentally friendly and sustainable, biodegradable biopolymers are a great replacement for plastic and other common packaging materials. Due to its application in high-performance industries like electronics and autos, the non-biodegradable category is anticipated to grow despite having a smaller market. In 2022, the biodegradable segment accounted for a sizeable portion of the market; throughout the forecast period, it is anticipated to expand at a higher CAGR due to regulatory initiatives supporting sustainability and consumer demand for environmentally friendly goods.

Global Biopolymers for Packagings Market Segmentation: By End-User Industry

- Food and Beverages

- Retail

- Healthcare

- Personal Care/Homecare

- Others

The food and beverage industry is estimated to lead the market because of the huge need for sustainable and eco-friendly packaging choices. Biopolymers are commonly used in food packaging to extend the shelf life of food products because they serve as a barrier to oxygen and moisture. Biopolymers are also commonly used in the healthcare industry due to their biocompatibility and lack of toxicity. The personal care/homecare industry is expected to see substantial growth as a result of the growing need for sustainable and ecologically friendly packaging solutions. Customer demand is projected to drive the market for biopolymers. Following the healthcare and personal care/homecare sectors, the food and beverage sector held a sizeable portion of the market in 2022 and is anticipated to maintain its dominance during the projected period.

Global Biopolymers for Packagings Market Segmentation: By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America, Europe, Asia Pacific, South America, and the Middle East & Africa are the regions into which the global market for biopolymers for packaging may be divided. Due to its strict regulatory rules supporting sustainability and the rising public awareness of the negative environmental effects of conventional packaging materials, Europe is predicted to dominate the market. Because of the rising need for eco-friendly and sustainable packaging solutions brought on by urbanization, population expansion, and rising disposable income, the Asia Pacific region is predicted to experience significant growth. Due to the rising demand for environmentally friendly packaging materials and the presence of important players in the region, North America is also anticipated to experience considerable growth. Due to the political unrest in the Middle East and Africa, it is anticipated that the due to the limited supply of renewable resources and low level of sustainability awareness, the Middle East and Africa region is anticipated to grow more slowly. Following North America and Asia Pacific, Europe had a sizeable portion of the market in 2022 and is anticipated to maintain its dominance during the projected period.

Global Biopolymers for Packagings Market Key Players:

- Mondi Group

- Taghleef Industries Inc.

- Clondalkin Group Holdings BV

- Sonoco Products Company

- Berry Plastics Group Inc.

- Constantia Flexibles Group GmbH

- Sealed Air Corporation

- Tetra Pak International SA

- United Biopolymers SA

- Amcor PLC

Chapter 1. BIOPOLYMERS FOR PACKAGINGS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. BIOPOLYMERS FOR PACKAGINGS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. BIOPOLYMERS FOR PACKAGINGS MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. BIOPOLYMERS FOR PACKAGINGS MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. BIOPOLYMERS FOR PACKAGINGS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. BIOPOLYMERS FOR PACKAGINGS MARKET – By Material Type

6.1. Non-Biodegradable

6.2. Biodegradable

Chapter 7. BIOPOLYMERS FOR PACKAGINGS MARKET –By End-User Industry

7.1. Food and Beverages

7.2. Retail

7.3. Healthcare

7.4. Personal Care/Homecare

7.5. Others

Chapter 8. BIOPOLYMERS FOR PACKAGINGS MARKET – By Region

8.1. North America

8.2. Europe

8.3.The Asia Pacific

8.4.Latin America

8.5. Middle-East and Africa

Chapter 9. BIOPOLYMERS FOR PACKAGINGS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Mondi Group

9.2. Taghleef Industries Inc.

9.3. Clondalkin Group Holdings BV

9.4. Sonoco Products Company

9.5. Berry Plastics Group Inc.

9.6. Constantia Flexibles Group GmbH

9.7. Sealed Air Corporation

9.8. Tetra Pak International SA

9.9. United Biopolymers SA

9.10. Amcor PLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Biopolymers for Packaging Market was estimated to be worth USD 7.07 Billion in 2022 and is projected to reach a value of USD 18.27 Billion by 2030, growing at a CAGR of 12.6% during the forecast period 2023-2030.

The Global Biopolymers for Packagings Market drives the Regulatory policies promoting the use of biodegradable and compostable materials.

The Segments under the Global Biopolymers for Packagings Market by the End-User Industry are Food and Beverages, Retail, Healthcare, Personal Care/Homecare, and Others

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Biopolymers for Packagings Market.

Mondi Group, Amcor PLC, and Sealed Air Corporation are the three major leading players in the Global Biopolymers for Packagings Market.