Biopharmaceutical Cold Chain Market Size (2025-2030)

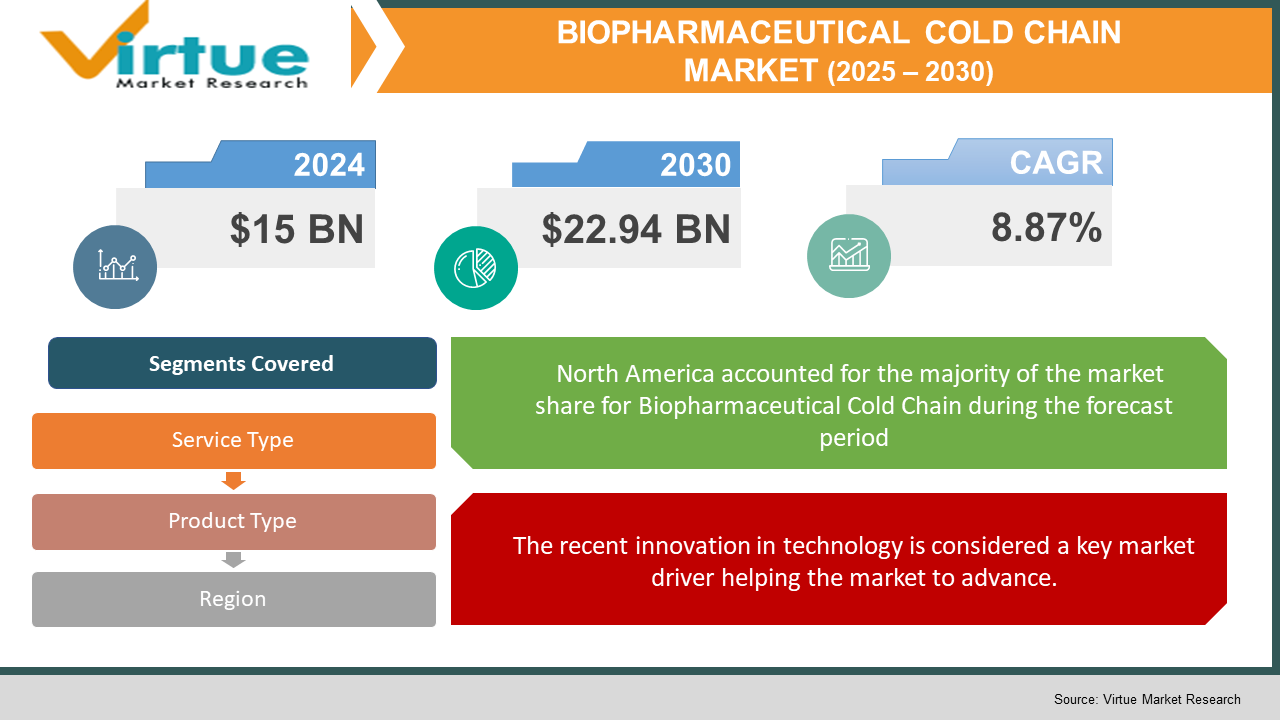

The Global Biopharmaceutical Cold Chain Market was valued at USD 15 billion in 2024 and is projected to reach a market size of USD 22.94 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.87%.

The rising need for temperature-sensitive biologics, vaccines, and specialty medicines will drive notable expansion in the biopharmaceutical cold chain industry from 2025 to 2030. Essentially required to preserve the efficiency of these goods throughout handling and storage are innovations in cold chain logistics and packaging technologies. Focusing on the transportation and storage of temperature-sensitive biopharmaceutical products, the biopharmaceutical cold chain market is a vital sector within the pharmaceutical logistics business. This market guarantees the safety and effectiveness of sensitive medicines, including vaccines, biologics, and others, from production to delivery. The biopharmaceutical cold chain market is booming thanks to the rising need for temperature-sensitive biopharmaceuticals and technological innovations improving logistics efficiency. Sustaining this trajectory of growth will depend much on how we solve current problems using creative solutions and wise investments.

Key Market Insights:

- Temperature-sensitive products, including vaccines, biologics, and gene therapies, are becoming more common in the biopharmaceutical sector.

- Efforts to fight contagious diseases, including large COVID-19 vaccination campaigns, have raised the demand for effective cold chain systems to guarantee vaccines' safe worldwide distribution. The worldwide coverage of key vaccines rose to 84 percent in 2022, up from 72 percent in 2000, pinpointing the need for strong cold chain systems to preserve vaccine effectiveness throughout transit and storage.

- Cold chain logistics are being transformed by the combination of technologies, including blockchain, artificial intelligence (AI), and the Internet of Things (IoT). Real-time monitoring, increased traceability, and improved supply chain visibility are made possible by these tools.

- Singapore, particularly regional centers, is building cold chain infrastructure together with India and China's big metropolitans.

- To improve their cold chain processes, biopharmaceutical firms are turning more and more to specialized logistics providers.

Biopharmaceutical Cold Chain Market Drivers:

The increased cases of chronic diseases have led to an increased demand for Biopharmaceuticals.

The worldwide increase in chronic illnesses, including cancer, diabetes, and cardiovascular conditions, has driven the increased need for biopharmaceuticals, many of which are temperature-sensitive and, therefore, require careful cold chain management. The International Diabetes Federation, for example, announced in 2021 that around 537 million adults were suffering from diabetes; this figure is estimated to grow to 643 million by 2030. The incorporation of medicines like insulin highlights the need for sophisticated cold chain systems and precise temperature regulation.

The recent innovation in technology is considered a key market driver helping the market to advance.

By improving the efficiency and dependability of biopharmaceutical logistics, cold chain advances like Internet of Things (IoT) devices and real-time monitoring systems are helping to act as translations from research to reality. Continuous temperature and environmental monitoring made possible by these technologies enhances risk control and lowers product waste.

Strict rules have compelled companies to adopt cold chain solutions, hence driving market growth.

Strict rules on the handling and transportation of biopharmaceuticals are driving businesses to use sophisticated cold chain solutions to satisfy standards and guarantee product integrity. In the United States, for instance, strict temperature monitoring criteria for biologic and vaccinations are enforced by organizations such the FDA, therefore, reliable cold chain logistics are needed to preserve product safety and integrity.

Biopharmaceutical Cold Chain Market Restraints and Challenges:

The high levels of operational costs are acting as a major challenge for the market, hampering its growth.

Implementing and maintaining sophisticated cold chain logistics methods need significant financial resources, especially for small businesses, therefore challenging. Strict rules, constant temperature checking, and the need for specialized machinery all add to these high costs. For example, the worldwide biopharmaceutical cold chain logistics industry was worth USD 15.6 billion in 2019 and is forecast to expand at a 7.1 percent compounded annual rate of growth from 2020 to 2027, therefore showing major continued investments in this sphere.

The infrastructure limitations seen in developing nations pose a great market challenge.

Insufficient cold chain systems in developing areas can cause goods to spoil and lead to loss, therefore impeding market expansion. For instance, in Ghana's isolated New Tafo Akyem village, drones carry vaccinations in insulated cold bags to keep the necessary temperatures for efficacy, a technique very important for vaccine distribution, especially for sub-zero mRNA vaccinations. These developments tackle vaccine degradation caused by temperature, which is especially important in regions with little refrigeration.

Complex rules and regulations lead to confusion and potential delays in supply, which is a great market challenge.

Dealing with different worldwide rules for biopharmaceutical transportation introduces complexity and possibly slows the supply chain. Every nation may have particular guidelines for packaging, document preparation, and temperature control, thus demanding careful preparation and compliance actions. Transitioning from air freight to sea shipping to meet regulatory requirements, the changing cold chain demands of the pharmaceutical sector call for companies to give priority to dependability, visibility, and cost-effectiveness.

The risk of temperature excursions would result in the compromise of product efficiency, posing a great challenge to the market.

Deviation from the necessary temperature range during transport may compromise product performance, hence damaging reputation and causing monetary loss. Since they can make vaccinations and biologics useless, temperature excursions still need much attention. In the supply of vaccines to remote facilities in hot regions supported by weak transportation systems, the cold chain is utilized. Cold chain management failure can compromise the efficiency of vaccines.

Biopharmaceutical Cold Chain Market Opportunities:

The developing regions present a great opportunity for the market to expand its operations.

Rising demand for biopharmaceuticals and growing healthcare spending in developing areas, especially in the Asia-Pacific, offer great possibilities for cold chain logistics. During the forecast period, the Asia-Pacific market for biopharmaceutical logistics is projected to have the fastest growth rate of more than 10.3 percent Compound Annual Growth Rate (CAGR). The fast-developing biopharmaceutical sector and the increasing demand for cold chain logistics in developing countries, including China and India, are driving forces behind this development.

The recent adoption of IoT and AI technologies allows the market to grow.

Including Internet of Things (IoT) devices and Artificial Intelligence (AI) in cold chain logistics can help to boost efficiency using improved real-time monitoring and predictive maintenance. These technologies guarantee that time- and temperature-sensitive biopharmaceuticals are moved without event, provide enhanced visibility throughout all stages of processing, transportation, and distribution, and keep expenses down and dependability high.

The development of sustainable packaging solutions helps the market to decrease its costs and grow further.

By addressing ecological worries and saving long-term operational expenditures, developing reusable, environmentally friendly packaging materials helps. The growing need for temperature-sensitive medicines, vaccines, and biologies is driving the notable growth of the pharmaceutical cold chain logistics packaging sector. Preventing product degradation depends on this turn to controlled logistics packaging, therefore, the pharmaceutical sector needs cold chain packaging.

The partnership among the companies and logistics providers helps the market to expand its global reach.

Strategic partnerships between logistics firms and biopharmaceutical businesses may result in better supply chains and increased worldwide coverage. For example, the changing cold chain requirements of the pharmaceutical sector have driven businesses to give priority to dependability, visibility, and cost efficiency, hence creating changes from air cargo to sea transportation. To satisfy the growing need of cold chain networks and storage buildings, such partnerships are necessary.

BIOPHARMACEUTICAL COLD CHAIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.87% |

|

Segments Covered |

By Product Type, service type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DHL International GmbH, FedEx Corporation, United Parcel Service, Inc. (UPS), Kuehne + Nagel International AG, DB Schenker, AmerisourceBergen Corporation, SF Express, C.H. Robinson Worldwide, Inc., Panalpina World Transport (Holding) Ltd., Agility Logistics |

Biopharmaceutical Cold Chain Market Segmentation:

Biopharmaceutical Cold Chain Market Segmentation: By Service Type

- Storage

- Transportation

- Packaging

The transportation segment is both the dominant segment and the fastest-growing one. Particularly in the biopharmaceutical cold chain logistics industry, transportation is currently the most important sector. This dominance is claimed to be related to the rising use of safe, temperature-controlled transportation tools vital for distributing temperature-sensitive goods. The complexity and importance of moving biopharmaceuticals call for strong logistical solutions to uphold product effectiveness. The increased need for dependable transportation services that could guarantee product integrity during transit results from the increased need for biopharmaceuticals, including vaccines and biologics.

Biopharmaceutical products' integrity is maintained using storage, which includes warehousing sites with temperature-controlled surroundings. Packaging refers to special containers and materials meant to shield products from physical harm during storage and transport, as well as from temperature changes.

Biopharmaceutical Cold Chain Market Segmentation: By Product Type

- Vaccines

- Biologics

- Clinical Trial Materials

Vaccines hold dominance in the market, and biologics is the fastest-growing segment. Vaccines hold the bulk of the market revenue in the healthcare cold chain logistics industry, supplying about 32% to 35 %. Their prominence is further stressed by the worldwide demand for vaccines and their vital necessity for temperature-controlled conditions. The rising need for temperature-controlled logistics services and the development of distribution networks by biopharmaceutical firms to carry biologics across many regions drive this growth.

Biological preparations offering immunity against particular diseases utilizing vaccines, their potency must be kept constant via strict temperature control. Living organism-based products, including monoclonal antibodies, recombinant proteins, and cell therapies, are very temperature sensitive and derived from living organisms. Clinical Trial Materials investigational medicines and biologics used in clinical trials, therefore demanding exact temperature control to preserve compliance and integrity.

Biopharmaceutical Cold Chain Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the dominant region in the market, and the Asia-Pacific region is the fastest-growing one. The most relevant shareholder in the biopharmaceutical logistics sector is North America, which therefore covers a very sizable portion of worldwide revenue. The advanced healthcare infrastructure and substantial biopharmaceutical activity in the region contribute to this domination. Over the forecast times (2025–2030), the most rapid CAGR is projected to be that of the Asia-Pacific region. Rising healthcare spending, growing pharmaceutical sectors, and better cold chain infrastructure in nations like India and China all help to explain this fast rise.

Europe is the second largest region in this market. Whereas the South America and the MEA regions are the emerging markets.

COVID-19 Impact Analysis on the Global Biopharmaceutical Cold Chain Market:

The biopharmaceutical cold chain market experienced great changes and progress as a result of the COVID-19 epidemic. The never-before-seen worldwide need for vaccines, especially those needing ultracold storage like the Pfizer-BioNTech COVID-19 shot, revealed weaknesses in current cold chain infrastructure. Especially in areas without such facilities, keeping storage temperatures between -80°C and -60°C presented difficulties. This underscored the need for large investments to improve cold chain capabilities. Drones with insulated cold bags guaranteed timely vaccine deliveries in places with restricted infrastructure and kept needed temperatures. Nasal spray vaccines, which are simpler to store and deliver, started to become popular. By providing a needle-free option, these vaccines may help to raise immunization rates. To react fast to demand swings, therefore lowering dependence on foreign supply chains, firms like Reckitt Benckiser invested in improving local manufacturing capabilities. The epidemic brought to light the need for flexible and strong supply chains fit for global health crises. This understanding spurred companies and governments alike to fund projects and technology use for improved future readiness.

Latest Trends/ Developments:

The incorporation of digital tools, including IoT sensors and blockchain, is improving real-time monitoring and openness in the cold chain, therefore guaranteeing product integrity.

To lessen environmental effects and meet worldwide sustainability goals, there is increasing focus on green and reusable packaging materials.

Through mergers, well-known logistics firms are strengthening their healthcare logistics skills. For example, UPS aims to strengthen its temperature-controlled logistics operations across Europe by means of the acquisition of German companies Frigo-Trans and BPL.

Vaccine compositions like those developed by Stablepharma are driving fridge-free vaccines, which could lower dependency on established cold chain logistics.

Key Players:

- DHL International GmbH

- FedEx Corporation

- United Parcel Service, Inc. (UPS)

- Kuehne + Nagel International AG

- DB Schenker

- AmerisourceBergen Corporation

- SF Express

- C.H. Robinson Worldwide, Inc.

- Panalpina World Transport (Holding) Ltd.

- Agility Logistics

Chapter 1. BIOPHARMACEUTICAL COLD CHAIN MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. BIOPHARMACEUTICAL COLD CHAIN MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. BIOPHARMACEUTICAL COLD CHAIN MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. BIOPHARMACEUTICAL COLD CHAIN MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. BIOPHARMACEUTICAL COLD CHAIN MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. BIOPHARMACEUTICAL COLD CHAIN MARKET – By Service Type

6.1 Introduction/Key Findings

6.2 Storage

6.3 Transportation

6.4 Packaging

6.5 Y-O-Y Growth trend Analysis By Service Type

6.6 Absolute $ Opportunity Analysis By Service Type , 2025-2030

Chapter 7. BIOPHARMACEUTICAL COLD CHAIN MARKET – By Product Type

7.1 Introduction/Key Findings

7.2 Vaccines

7.3 Biologics

7.4 Clinical Trial Materials

7.5 Y-O-Y Growth trend Analysis By Product Type

7.6 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 8. BIOPHARMACEUTICAL COLD CHAIN MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Product Type

8.1.3. By Service Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Service Type

8.2.3. By Product Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Service Type

8.3.3. By Product Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Service Type

8.4.3. By Product Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Service Type

8.5.3. By Product Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. BIOPHARMACEUTICAL COLD CHAIN MARKET– Company Profiles – (Overview, Packaging Service Type Portfolio, Financials, Strategies & Developments)

9.1 DHL International GmbH

9.2 FedEx Corporation

9.3 United Parcel Service, Inc. (UPS)

9.4 Kuehne + Nagel International AG

9.5 DB Schenker

9.6 AmerisourceBergen Corporation

9.7 SF Express

9.8 C.H. Robinson Worldwide, Inc.

9.9 Panalpina World Transport (Holding) Ltd.

9.10 Agility Logistics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Maintaining the effectiveness and safety of biopharmaceutical products such as vaccines and biologics requires a temperature-controlled supply chain known as the biopharmaceutical cold chain for their preservation and transit.

It is important to control temperature in biopharmaceutical logistics because many biopharmaceutical compounds are intolerant to temperature changes, which might affect their safety and efficiency; therefore, temperature control is critical.

For particular vaccines and biologics, average temperature ranges include refrigerated conditions (2°C to 8°C), frozen conditions (-20°C), and ultra-low temperatures (-70°C).

The epidemic underlined the need for strong cold chain logistics for world vaccine distribution, which resulted in more funding and a rise in cold chain infrastructure developments.

Real-time monitoring, eco-friendly packaging solutions, and the use of advanced technologies like IoT and AI to improve dependability and effectiveness are the latest trends in the global biopharmaceutical cold chain market.