Biopesticides Market Size (2024-2030)

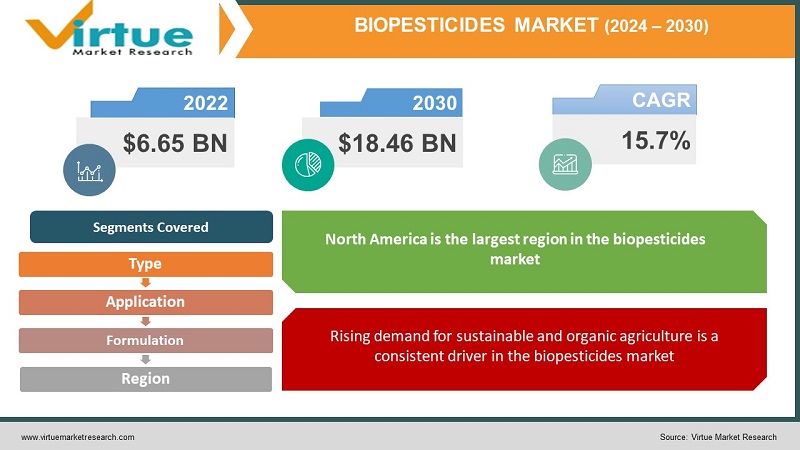

According to the report published by Virtue Market Research in Global Biopesticides Market was valued at USD 6.65 Billion and is projected to reach a market size of USD 18.46 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15.7%.

The Biopesticides market is a significant component of the agricultural industry and has been experiencing continual growth. Negative concerns about chemical pesticides have raised the need for sustainable farming solutions like biopesticides. Demand for organic and sustainable farming has contributed significantly to the biopesticides market. These biopesticides offer many advantages like reduced likelihood of harming beneficial fauna, lower risk of developing pesticide resistance in target pests, and a shorter residual impact on the environment.

Different regions have established regulations, certifications, and guidelines for biopesticides to ensure their safety and efficacy, as they might be less efficient as compared to chemical pesticides, and their effectiveness might be influenced by several environmental factors like humidity and temperature. Regulations imposed by government bodies can affect the sale and use of biopesticides in different markets. Consistent research and innovation are done in the field of biopesticides to introduce more effective and targeted solutions for farming.

Global Biopesticides Market Drivers:

Rising demand for sustainable and organic agriculture is a consistent driver in the biopesticides market

There is an increasing demand for sustainable agricultural practices due to rising concerns about the negative impact of chemical pesticides on the environment. Biopesticides are an eco-friendly solution to reduce the bad environmental effect and toxicity, residue buildup, and less harm to beneficial organisms. Consumers are also increasingly demanding organic and chemical-free products due to the health concerns they pose. More farmers are adopting biopesticides to meet this demand for organic products while adhering to organic farming standards. Many countries have posed strict regulations on the use of chemical pesticides which are harmful to human health, increasing the adoption of biopesticides.

Resistance management and the Emergence of new pest challenges increase the demand for effective biopesticides

Pests develop resistance to pesticides which is a significant concern for the agricultural industry as it could impose a huge loss in yield. Biopesticides assist in managing pest resistance and extend the effectiveness of pest control strategies. Similarly, the emergence of invasive pests and diseases requires more effective and innovative solutions for pest management, where biopesticides can help by offering a specific and targeted approach to control pest challenges.

Global Biopesticides Market Challenges:

The limited spectrum of activity and variable efficacy poses challenges to the adoption of biopesticides

Many biopesticides have a narrow spectrum of activity and are only effective against specific pests, which can limit their adaptability compared to broad-spectrum products like chemical pesticides. The efficacy of biopesticides could also be impacted by environmental conditions like humidity, sunlight, and temperature. These environmental factors can make their performance inconsistent affecting their reliability. These factors decrease the efficiency of biopesticides in general, which could decrease the adoption of biopesticides among farmers.

Higher costs and short shelf life could affect the growth of the biopesticides market

Biopesticides could involve higher costs associated with production, formulation, and application as compared to chemical pesticides. This could be a hindrance for some farmers, especially small farmers, and regions with tight profit margins. Biopesticides also have shorter shelf life compared to conventional chemical pesticides, which could lead to product shortage and distribution, affecting the growth of biopesticides.

COVID-19 Impact on Global Biopesticides Market:

Lockdowns, restrictions, and limitations in transportation affected the supply chain for raw materials used for biopesticides manufacturing, which in turn delayed the production and distribution of biopesticides. Labor shortages due to health concerns, and lockdowns affected field operations, manufacturing, and farming activities as well. Disrupted markets and financial challenges indirectly affected the demand for biopesticides. Economic uncertainty caused some farmers to reconsider the adoption of new pest management strategies including biopesticides. Regulatory delays by government bodies impacted the introduction and distribution of biopesticides. Logistic challenges affected the transportation routes and posed challenges for the distribution of pesticides to farmers.

Latest Developments in Global Biopesticides Market:

- In July 2023, Kynetec, an agriculture and animal health specialist, launched a set of online dashboards, BioLogica, which will provide farmer-driven data around biopesticide use, aiming to provide useful insights for crop protection, marketing, and R&D, to make significant decisions.

- In May 2023, a liquid biopesticide and biofertilizer production unit along with a micronutrient mixture production unit was inaugurated in Eriodu, Tamil Nadu, India, on behalf of Tamil Nadu Cooperative Marketing Federation Limited (TANFED). This move was taken to help increase yield and soil quality.

- In May 2023, Biobest acquired Bioworks, a New York-based manufacturer and marketer of biopesticides. This acquisition will accelerate Biobest's expansion into biopesticides and reduce the reliance on synthetic and chemical pesticides.

BIOPESTICIDES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15.7% |

|

Segments Covered |

By Type, Application, Formulation, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bayer CropScience, Syngenta, BASF SE, Marrone Bio Innovations, Certis USA, Koppert Biological Systems, Valent BioSciences, Isagro S.p.A., Andermatt Biocontrol, FMC Corporation |

Global Biopesticides Market Segmentation: By Type

-

Microbial Pesticides

-

Biochemical Pesticides

Microbial pesticides are one of the most used biopesticides, which are based on living organisms such as bacteria, viruses, and fungi, like Bacillus thuringiensis (Bt), Beauveria bassiana, and Trichoderma spp. Microbial pesticides produce toxins that are harmful to specific pests and insects. Biochemical pesticides are produced from natural compounds/chemicals that are derived from either plants or insects. These chemicals interfere with the growth and development of insects. Microbial pesticides are the largest as well as the fastest growing segment due to their wide range of applications and effectiveness.

Global Biopesticides Market Segmentation: By Application

-

Foliar Spray

-

Seed Treatment

-

Soil Treatment

-

Post-Harvest Treatment

In Foliar spray, biopesticides are sprayed directly onto the foliage and stems of plants, which provides quick and targeted pest control. Seed treatment involves the application of biopesticides to seeds before planting to protect the germinating seeds and seedlings, which ensures that biopesticide is acting from the beginning of the growth cycle. Soil treatment is the application of biopesticides to soil targeting soil-borne pests and pathogens, providing long-lasting protection. Post-harvest treatment is done to protect harvested crops to prevent spoilage, decay, and infestation in stored produce. Foliar spray is the largest segment because main crops like fruits, and vegetables rely on foliar sprays. The seed treatment segment is the fastest-growing segment, due to the benefits of protecting germinating seeds and younglings from pests while minimizing the need for foliar spray.

Global Biopesticides Market Segmentation: By Formulation

-

Liquid

-

Dry

-

Others

Liquid formulations are mainly solutions and suspensions that either contain concentrated liquid formulations mixed with water or finely dispersed solid particles. Dry formulations are fine or large solid particles that can be either mixed with water or applied directly to plants releasing biopesticides slowly over time. Other formulations consist of wettable powders and encapsulated formulations. Liquid formulations comprise the largest segment in this market due to their ease of use and uniform application. It is also the fastest growing as it provides ease of handling and accurate dosing, making them convenient and attractive to farmers.

Global Biopesticides Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America is the largest region in the biopesticides market due to a strong focus on sustainable agriculture and increasing demand for pesticide-free produce. Europe has a well-established market for biopesticides with strict regulations on chemical pesticides and demand for organic products. Asia-Pacific is projected to show the fastest growth due to the increasing adoption of modern agricultural practices, rising environmental concerns, and growing population as well. South America has a significant market for biopesticides, as it is a major exporter of many crops and has shown a growing interest in sustainable farming. Middle East and Africa are relatively smaller markets for biopesticides due to harsh weather and arid climate. However, these regions are exploring the use of biopesticides to address pest challenges.

Global Biopesticides Market Key Players:

-

Bayer CropScience

-

Syngenta

-

BASF SE

-

Marrone Bio Innovations

-

Certis USA

-

Koppert Biological Systems

-

Valent BioSciences

-

Isagro S.p.A.

-

Andermatt Biocontrol

-

FMC Corporation

Chapter 1. Biopesticides Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Biopesticides Market– Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Biopesticides Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Biopesticides MarketEntry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Biopesticides Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Biopesticides Market– By Type

6.1. Introduction/Key Findings

6.2. Microbial Pesticides

6.3 Biochemical Pesticides

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Biopesticides Market– By Application

7.1. Introduction/Key Findings

7.2 Foliar Spray

7.3 Seed Treatment

7.4 Soil Treatment

7.5 Post-Harvest Treatment

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Biopesticides Market– By Formulation

8.1. Introduction/Key Findings

8.2 Liquid

8.3 Dry

8.4 Others

8.5 Y-O-Y Growth trend Analysis By Formulation

8.6 Absolute $ Opportunity Analysis By Formulation, 2024-2030

Chapter 9. Biopesticides Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Type

9.1.3. By Application

9.1.4. By Formulation

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1. U.K.

9.2.2. Germany

9.2.3. France

9.2.4. Italy

9.2.5. Spain

9.2.6. Rest of Europe

9.2.2. By Type

9.2.3. By Application

9.2.4. By Formulation

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. Rest of Asia-Pacific

9.3.2. By Type

9.3.3. By Application

9.3.4. By Formulation

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Colombia

9.4.4. Chile

9.4.5. Rest of South America

9.4.2. By Type

9.4.3. By Application

9.4.4. By Formulation

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1. United Arab Emirates (UAE)

9.5.2. Saudi Arabia

9.5.3. Qatar

9.5.4. Israel

9.5.5. South Africa

9.5.6. Nigeria

9.5.7. Kenya

9.5.8. Egypt

9.5.9. Rest of MEA

9.5.2. By Type

9.5.3. By Application

9.5.4. By Formulation

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Biopesticides Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Bayer CropScience

10.2 Syngenta

10.3 BASF SE

10.4 Marrone Bio Innovations

10.5 Certis USA

10.6 Koppert Biological Systems

10.7 Valent BioSciences

10.8 Isagro S.p.A.

10.9 Andermatt Biocontrol

10.10 FMC Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

According to the report published by Virtue Market Research in Global Biopesticides Market was valued at USD 6.65 Billion and is projected to reach a market size of USD 18.46 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15.7%.

The Global Biopesticides Market Drivers are rising demand for sustainable and organic agriculture along with Resistance management and Emergence of new pest challenges.

Based on the type, the Global Biopesticides Market is segmented into Microbial biopesticides and Biochemical biopesticides.

North America holds the largest share of the Global Biopesticides Market.

Bayer CropScience, Syngenta, BASF SE, and Marrone Bio Innovations are a few of the leading players in the Global Biopesticides Market.