Biomimetic Adhesives Market Size (2024 - 2030)

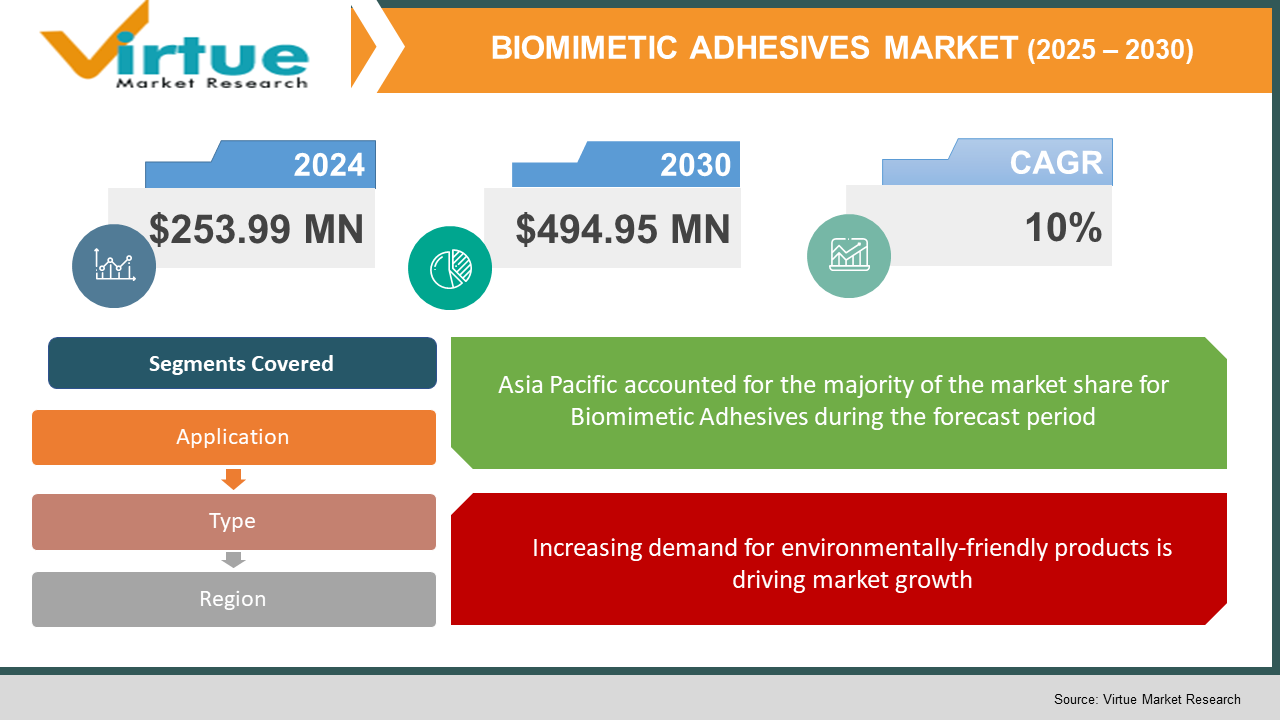

The Global Biomimetic Adhesives Market was valued at USD 253.99 Million in 2023 and is projected to reach a market size of USD 494.95 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10%.

INDUSTRY OVERVIEW

Biomimetic Bio adhesives are polymeric substances that are present in nature and have adhesive capabilities. They also consist of glues produced utilizing biological intermediaries like starch. Bioadhesives are frequently used to cling items together and thwart attempts to separate them. They have a wide range of uses in the paper and packaging industries as sustainable packaging options as well as in the healthcare business as surgical bioadhesives that serve as an adequate replacement for surgical sutures.

The numerous benefits connected with using bioadhesives across various industries are what essentially drives the market for them. For instance, because of their biocompatible qualities, bioadhesives are frequently used in the healthcare sector. Transdermal medication administration, skin-bonded monitoring devices, and wound care dressing are a few of their clinical applications. Additionally, bioadhesives are popular in sectors including paper and packaging, building, and food due to their environmental friendliness. Globally, there is an increasing trend toward the usage of bioadhesives due to increased environmental awareness and a growing understanding of the negative consequences of synthetic adhesives. Furthermore, the usage of bio-based goods is being encouraged by favorable efforts made by both the public and commercial sectors, strict environmental laws by governments of various nations, and other factors that are generating a bright outlook for the industry.

COVID-19 IMPACT ON THE BIOMIMETIC ADHESIVES MARKET

On March 11, 2020, the World Health Organization declared COVID-19 a public health emergency due to its global proliferation to over 213 nations. Germany, France, Italy, Spain, the UK, and Norway are a few of the significant economies experiencing COVID-19 issues. The paper & packaging, construction, woodworking, personal care, and medical industries are the main users of biomimetic bioadhesives. Furthermore, these industries' growth rates were somewhat declining as a result of the effects of the national lockdown. As a result of the suspension of various businesses, particularly transportation and supply chains, the economy has suffered in several nations. Due to the lockout, there has been no development, which has hampered demand for the product. The expansion of the chemical sector during the COVID-19 pandemic is anticipated to be hampered by the demand-supply imbalance, interruptions in the acquisition of raw materials, and price instability. Economists predict that the pandemic's impact on lower worldwide demand for China's goods would have a further negative impact on the country's economy. The growth rate dramatically declines as the coronavirus epidemic spreads against a backdrop of erratic markets and increasing credit stress. China's economy has been impacted far more severely than anticipated, while a hesitant stabilization has started. The first quarter of 2020 saw lower product demand in the U.S. and European nations due to lengthier lockdowns and increased travel and transit restrictions. By the end of 2021, the market is anticipated to rebound.

MARKET DRIVERS:

Increasing regulations & policies against the use of petrochemical-based adhesives

For a variety of industrial applications, synthetic adhesives are currently most commonly utilized commercially. Various nations have used bio-based goods in a variety of applications throughout the years as a result of rising environmental concerns and regulatory restrictions. Furthermore, to assure safety and prevent health problems and risks brought on by VOC emissions from synthetic or petro-based adhesives, the world's adhesive makers are concentrating on bio-products.

Environmental regulations have a strong regulatory impact on areas in Europe and North America. Some organizations, like the Food and Drug Administration (FDA) and the US Environmental Protection Agency (EPA), favor the use of bio-based materials in adhesives. Consequently, encouraging R&D efforts and investments to promote the manufacture of sustainable goods with a bio-based foundation.

Increasing demand for environmentally-friendly products is driving market growth

Many reasons, including growing customer desire for ecologically friendly products and growing awareness of sustainability and greener products, are propelling the growth of the worldwide biomimetic bioadhesives market. The development of novel bio-based chemicals is being funded by the global chemical market, which is also pressuring producers to provide VOC-free goods. As a result, there is plenty of room for the development of environmentally friendly goods in the global chemicals and materials market given the present market demand. A chance for the development of environmentally friendly and sustainable adhesive solutions is presented by the rising demand for green or environmentally friendly constructions. Green adhesives are produced from bio-based, renewable, recycled, remanufactured, or biodegradable ingredients; they are healthy for the environment and the people who use them.

MARKET RESTRAINTS:

Competition from substitutes is stifling market growth

Adhesives based on petroleum feedstock may be replaced by bio adhesives since they are made from renewable resources. The cheaper and simpler produce adhesives made from synthetic materials are a significant threat to biomimetic bioadhesives. Bio adhesives firms must concentrate on offering bio-based solutions at a competitive price to penetrate sizable markets and get beyond resistance to change. The major market segments are seizing this chance to create technology that will enable the manufacturing of bioadhesives with higher performance at competitive prices. The use of bio and green adhesives in diverse applications has been constrained by the bio adhesives' limited capabilities. The performance capabilities of bioadhesives continue to be questioned, which has limited the market's growth.

The high cost of technology and R&D impede the market growth

Innovative technology and sophisticated formulation are needed for the creation of bioadhesives. Compared to conventional adhesive formulations, producing bio-based adhesives involves considerable R&D costs. Therefore, only the top global firms can commit significant resources to such product innovation. Henkel AG, EcoSynthetix Inc., 3M Company, Arkema SA, and Cryolife Inc. are among the top companies funding R&D initiatives. Though it is extremely difficult for them to advertise their products in the cutthroat international market, smaller firms are nonetheless capable of strategizing and developing unique items. Leading businesses already provide their client’s-quality adhesive goods and specialist technical services. The cutting-edge technology used in the creation of bioadhesives offers customers and adhesive producers’ long-term benefits.

This research report on the Biomimetic Adhesives Market has been segmented and sub-segmented based on Type, Application and By Region.

BIOMIMETIC ADHESIVES MARKET – BY TYPE

- Plant-based

- Animal-based

Based on the type, the biomimetic adhesive market is s segmented into Plant-based and Animal-based. It is anticipated that throughout the projected period, the biomimetic bioadhesives market share would be dominated by the plant-based segment. For the production of adhesives, biodegradable and biological plant-based renewable resources are being employed in place of petro-based raw materials. Future technical advancements from the producers of bio-based ingredients are anticipated to meet the growing demand for adhesives across a range of vertical sectors. Manufacturers are under pressure to generate bio-based goods due to rising environmental restrictions and customer demand for ecologically friendly items. The main industries where plant-based adhesives are used are paper & packaging, woodworking, personal care, and medicine.

Soybean, lignin, and starch are just a few of the several materials used to make plant-based adhesives. Furthermore, the development of alternate sources for raw materials has been facilitated by the shortage of natural resources. In comparison to petroleum and natural gas, starch is a more affordable raw ingredient for the production of adhesives. In-depth research has been done in recent years to increase the starch-based adhesives' ability to connect surfaces. The roots, seeds, and stalks of common crops including corn, rice, tapioca, wheat, and potatoes are used to make starch-based adhesives. Adhesives made of starch are mostly used in wood and furniture application

BIOMIMETIC ADHESIVES MARKET - BY APPLICATION

- Paper & Packaging

- Construction

- Woodworking

- Personal Care

- Medical

- Others

Based on the type, the biomimetic adhesive market is s segmented into Paper & Packaging, Construction, Woodworking, Personal Care, Medical and Others. During the anticipated period, the bioadhesives market's medical application sector is anticipated to have the quickest growth. High end-user demand, environmental legislation focusing on renewable or bio-based goods, and increased volatility in the price of petrochemical feedstock, among other considerations, are driving the adoption of bioadhesives compared to traditional competitor products. Due to the production and usage of bio-based materials in the manufacture of adhesives, bioadhesives are attracting interest on a global scale. This is a good substitute for synthetic adhesives in fields including paper and packaging, building, carpentry, personal care, and medicine. Due to rising knowledge of health-related concerns, developing nations in the APAC area including China and India are predicted to increase demand for healthcare products. Recent years have seen substantial growth in R&D in the medical sector, and it is anticipated that growing awareness of the usage of these adhesives in medical applications would enhance the demand for bioadhesives in these areas.

BIOMIMETIC ADHESIVES MARKET - BY REGION

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East

- Africa

By region, the Biomimetic Adhesives Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. Since fewer regulations and laws are surrounding the usage of petrochemical-based adhesives from environmental authorities and governments, APAC is one of the most potential markets for biomimetic bioadhesives. The area is anticipated to experience a rise in the production and demand for bioadhesives if strict restrictions are adopted by regulatory organizations. In the majority of APAC nations, strict government laws are still not in place to limit VOC emissions. The number of adhesive businesses making bioadhesives in APAC is quite low when compared to North America and Europe. For those in the sector, this market is the most alluring due to the accessibility of inexpensive labor and raw materials as well as the high domestic demand. The German company Henkel Corporation imports bio-based goods to advance biotechnology and meet the region's growing need for bio-products. Global vendors are delivering bioadhesives to these end customers to satisfy the need in this region as international firms increase their desire for bio-based goods. In APAC, there is a rising need for bioadhesives in industries including wood, paper & packaging, construction, and medicine. Bioadhesives are mostly imported into this region from nations in Europe and North America. In several end-use applications, bioadhesives are supplying biocompatibility, biodegradability, and adhesion requirements. Government support is also growing as a result of growing environmental worries about VOC emissions and the usage of synthetic adhesives.

BIOMIMETIC ADHESIVES MARKET - BY COMPANIES

Some of the major players operating in the Biomimetic Adhesives Market include:

- ADHESIVES RESEARCH, INC.

- ARKEMA

- ASHLAND GLOBAL HOLDINGS INC.

- BEARDOW ADAMS

- CAMURUS

- DUPONT DE NEMOURS, INC.

- HENKEL AG

- JOWAT SE

- PARAMELT BV

- U.S. ADHESIVES

NOTABLE HAPPENING IN THE BIOMIMETIC ADHESIVES MARKET

- EXPANSION- Henkel AG opened its new production site in Kurkumbh, India, close to Pune, in February 2020. The business unit, which has invested a total of around USD 57 million, intends to meet the expanding need of Indian industries for high-performance adhesives, sealants, and surface treatment products. The new facility, which was created as a smart factory, supports a variety of Industry 4.0 processes and satisfies the highest criteria for sustainability.

- EXPANSION- Henkel established its brand-new "Henkel Adhesives Technical Center" in the Vietnamese capital of Hanoi in December 2019. The high-tech facility's proximity to top consumer electronics and semiconductor firms will facilitate close and exciting partnerships with top clients and hasten the creation of high-impact solutions for a variety of applications for regional markets.

- ACQUISITION- Arkema revealed its intentions to purchase Nitta-Gelatin Inc.'s industrial adhesives division in May 2019. The purchase will be carried out through the joint venture between Bostik and Nitta, in which Bostik has the majority of the shares. In Japan's adhesives market, the acquisition helped Bostik gain market share. On August first, 2018, the purchase was finalized.

Chapter 1.BIOMIMETIC ADHESIVES MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.BIOMIMETIC ADHESIVES MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.BIOMIMETIC ADHESIVES MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.BIOMIMETIC ADHESIVES MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. BIOMIMETIC ADHESIVES MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.BIOMIMETIC ADHESIVES MARKET – BY TYPE:

6.1. Plant-based

6.2. Animal-based

Chapter 7.BIOMIMETIC ADHESIVES MARKET – By Application

7.1. Paper & Packaging

7.2. Construction

7.3. Woodworking

7.4. Personal Care

7.5. Medical

7.6. Others

Chapter 8.BIOMIMETIC ADHESIVES MARKET – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9.BIOMIMETIC ADHESIVES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. ADHESIVES RESEARCH, INC.

9.2. ARKEMA

9.3. ASHLAND GLOBAL HOLDINGS INC.

9.4. BEARDOW ADAMS

9.5. CAMURUS

9.6. DUPONT DE NEMOURS, INC.

9.7. HENKEL AG

9.8. JOWAT SE

9.9. PARAMELT BV

9.10. U.S. ADHESIVES

Download Sample

Choose License Type

2500

4250

5250

6900