Biometric Smart Card Market Size (2024-2030)

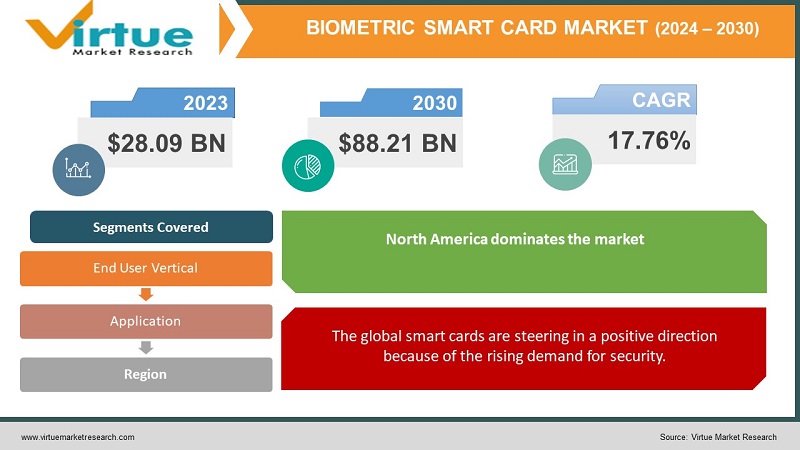

In 2023, the Global Biometric Smart Card Market was valued at $28.09 billion, and is projected to reach a market size of $88.21 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 17.76%.

A biometric smart card is a smart card with a microprocessor that stores biometric information for identification and verification purposes in the smart card chip (Secure Element SE). Encrypted entry keys and complex stored biometric patterns, including fingerprints, irises, facial features, voice and other patterns, inside the chip. The combination of smart cards and biometrics makes it possible to link the identity of the card holder with the identity of the smart card. In addition, it promotes algorithmic digital security compatible with two-factor authentication (also known as MFA) for identity verification. Match-On-PC, Match-On-Terminal or Match-On-Card (MoC) can all be used to verify biometric templates.

In general, biometric smart cards offer more security than traditional cards. A reliable silicon microprocessor chip is tamper-proof and tamper-proof, unlike a central database installed in the cloud. The smart chip in the smart card stores biometric information about the cardholder and is protected by a sophisticated smart card operating system. Many government laws prohibit the use of cloud-based systems to store personal information, such as biometrics, to ensure the privacy and security of sensitive data. In addition, biometric smart cards protect user privacy. Reliable smart card encryption protects the cardholder's information (such as biometric, biographic and other data) to reduce privacy concerns. Personal data is not shared across large central networks, making it less vulnerable to hackers. The chip's advanced security measures prevent unauthorized access to sensitive biometric data.

Key Market Insights:

The biometric smart card market is experiencing significant growth, which raises security concerns and the need for improved authentication. Biometric smart cards combine the security of biometric authentication, such as fingerprints or palm prints, with the convenience of contactless smart card technology. This two-tiered security approach addresses issues related to identity theft and unauthorized access. The adoption of biometric smart cards is important in industries such as finance, healthcare and government, where access control and effective security are critical. Technological advances, including improving the accuracy of biometric sensors and linking biometric features directly to the card, are contributing to the expansion of the market. In addition, the growing trend for contactless payments and the global trend towards efficient and user-friendly authentication methods are key factors driving the biometric market.

Biometric Smart Card Market Drivers:

The expansion of the global smart card market is being driven by the increasing demand among individuals.

Biometric cards are becoming increasingly popular in many industries, including those related to government, banking, telecommunications and healthcare. This is because end users are more comfortable with these types of features. In addition, the latest developments in biometric cards provide additional security to ensure accurate identification and authentication.

The global smart cards are steering in a positive direction because of the rising demand for security.

Businesses and individuals, whose main concern is security, are adopting biometric smart cards. Businesses are increasingly adopting biometric cards for use in highly competitive industries as an added safeguard against counterfeiting and unauthorized theft. Government officials, research institutes and some schools and universities also use biometric cards. This thereby increases the global market for biometric smart cards. Change in customers taste and preference has led to create need for pizza making as business for high extent manufacturing. Special functions like electricity efficiency and smart ovens have been introduced thanks to innovation and technological advancement. The marketplace has seen a call for eco-friendly ovens that reduce power intake and emissions. The upward thrust of on-line food shipping services has positively impacted the market, with eating places requiring inexperienced and dependable ovens which can handle immoderate order volumes together with consistency in flavour.

Biometric Smart Card Market Restraints and Challenges:

The global biometric smart card market is facing challenges, especially in terms of high implementation costs and increasing demand for alternatives.

Biometric authentication and identification cards are more expensive than traditional payment cards, preventing their widespread adoption. Consumers may be willing to pay a little more for a secure card option, but current prices for biometric cards are prohibitive. This is what prevents them from increasing their use. In addition, the rise of digital wallets is hindering the growth of biometric smart cards. While biometric cards offer more security and convenience than contactless cards, digital wallets offer a safer and more convenient way to pay, leading more people to choose digital wallets over traditional wallets. As payments become increasingly digitized in the coming years, digital wallets may overtake contactless cards, slowing down the use of biometric cards.

Biometric Smart Card Market Opportunities:

There are growing opportunities in the global smart card market including sensor cost reduction and inorganic expansion plans of companies.

The global biometric card market is expected to expand in the coming years as market leaders are now focusing on reducing the cost and complexity of biometric sensors. With cost being the main factor in marketing, manufacturers are focusing on cost reduction and streamlining the production process.

Also, to capture the huge growth opportunities in the market, key players in the biometric card market are turning to inorganic growth strategies such as partnerships. For example, Linxens Holding SAS recently partnered with IDEX to develop an integrated solution that will reduce smart card manufacturing costs. Through this collaboration, card manufacturers can accelerate the development of fingerprint cards, resulting in savings and faster time to market.

BIOMETRIC SMART CARD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.76% |

|

Segments Covered |

By End User Vertical , Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thales (France), CardLogix (United States), HID Global (United States), SmartMetric Inc. (United States), Zwipe (Norway), Gemalto (Netherlands), Fingerprint Cards AB (Sweden), IDEMIA (France), IDEX Biometrics ASA (Norway), Versasec AB (Sweden) |

Biometric Smart Card Market Segmentation:

Biometric Smart Card Market Segmentation: By Application:

- Payments

- Access Control

- Government ID and Financial Inclusion

- Others

In 2023, based on the application, the payment segment accounted for the largest revenue share. The field of payments is undergoing major changes, and biometric smart cards are emerging as important players in this change. With more focus on improving security and simplifying transactions, biometric smart cards apply short-term biometric technology such as fingerprints, providing a safe and convenient authentication process. The global payment system is seeing a rise in the acceptance of these cards, driven by a growing demand for strong identity verification solutions. Increasing adoption of contactless payments and increasing awareness about data security are the major factors driving the biometric smart card market. As digital payment methods become ubiquitous, these cards are poised to play a critical role in ensuring secure and seamless financial transactions on a global scale. Their influence is not limited to the financial sector, as various applications in healthcare, government services and access control contribute to their growing influence in many industries, shaping the future of secure and friendly payment solutions and friends.

Access control has become a critical part of security infrastructure, with biometric smart cards playing a revolutionary role. The global demand for improved security systems has fueled the growth of access control systems, especially those that incorporate biometrics. Biometric smart cards, with advanced identification technologies such as fingerprints or faces, offer a powerful solution for secure access. The growing need for secure authentication across various industries, including finance, healthcare and government, is a key driver for the adoption of biometric smart cards in access control systems. The move to contactless technology, driven by concerns for hygiene and quality, has increased demand. As access control becomes an integral part of modern security systems, the global biometric smart card market is poised for significant growth, capitalizing on the convergence of security requirements with new technologies and global control solutions.

Biometric Smart Card Market Segmentation: By End-User Vertical:

- BFSI

- Retail

- Government

- Healthcare

- Commercial Entities

- Others

In 2023, the BFSI segment dominated the global market and accounted for the highest market share. The banking, financial services and insurance (BFSI) sector is witnessing a revolution with the introduction of biometric smart cards, which is having a major impact on the global market. Growing concerns about security and fraud in financial transactions are prompting the adoption of biometric authentication within the BFSI sector. Factors such as the digitalization of financial services, the rise of mobile banking, and the need for strong identity verification are driving this change. Biometric smart cards provide a secure and convenient solution, enabling reliable user identification in banking and payment systems. The increase in demand from the BFSI sector is having a major impact on the global biometric smart card market, affecting technological advancements, adoption rates, and market dynamics. As financial institutions worldwide seek flexible and user-friendly security systems, the partnership between BFSI and biometric smart card providers is poised to shape the future of secure and transparent financial transactions.

The healthcare industry is undergoing change, and technological advancements are playing an important role in streamlining patient care and data security. Biometric smart cards are emerging as a key solution in the healthcare sector, providing strong authentication for access control, patient identification and secure data storage. Factors such as the growing need for strong patient identity verification, the protection of electronic health records, and the prevention of health fraud are contributing to the growing demand for biometric smart cards in the healthcare industry. The combination of flawless biometrics improves security and provides a safe and clean way to access. This growing adoption in the healthcare sector not only caters to the needs of the region, but also has a significant impact on the global biometric smart card market. As healthcare embraces advanced technology for efficiency and security, the biometric smart card market is poised for significant growth, providing new opportunities for innovation and mass market expansion.

Biometric Smart Card Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, the North American region dominated the Biometric Smart Card Market. North America plays an important role in the growth of the global biometric smart card market, with many factors shaping its position. The region's strong technological infrastructure, coupled with an increased focus on security and privacy issues, is fueling the appetite for advanced research solutions. The increasing rate of identity theft and the need for secure financial transactions is driving the adoption of biometric smart cards across a variety of industries, including finance, healthcare, and government. The region's strong influence on technological trends has a significant impact on the global market, setting the benchmark for innovation and design standards. In addition, cooperation and collaboration between leading companies contribute to the development of biometric technology. As North America continues to adopt biometric smart cards, its impact is felt globally, shaping the evolution of efficient and effective authentication methods on a large scale.

The Asia-Pacific region is emerging as a force at the center of the evolution of the global biometric smart card market, with many factors driving both demand and innovation. Growing economies in the region, especially in countries such as China, India and Japan, are seeing an increase in technology adoption and infrastructure development, increasing the need for secure and cost-effective research solutions. Growing concerns about data security and identity theft are driving the adoption of biometric smart cards across a variety of industries, including finance, healthcare, and government. This increasing demand not only affects regional market dynamics but also has a significant impact on the global biometric smart card market. Partnerships between regional and international players, along with government initiatives to promote digital security, are increasing market growth in the Asia-Pacific region, positioning it as a key driving factor.

COVID-19 Impact Analysis on the Biometric Smart Card Market:

The COVID-19 pandemic has had a major impact on the global smart card market. The COVID-19 pandemic has led to the proliferation of contactless technologies, such as biometric smart cards, as individuals seek to avoid physical contact with each other to prevent the spread of the virus. This has led to the adoption of biometric smart cards in many industries, such as banking, retail and healthcare. However, the pandemic has caused major problems in the global supply and distribution chain, which has affected the production and delivery of many products and services. This not only reduced the production of biometric cards, but also reduced consumer spending. This has affected the growth of the global biometric smart card market. Despite these challenges, it is expected that the biometric smart card market will recover and grow in the coming years.

Latest Trends/ Developments:

The biometric smart card market is witnessing a dynamic trend, driven by continuous technological advancements with a focus on secure and efficient authentication solutions. The integration of advanced biometric sensor technology, such as improved fingerprint recognition and multi-sensor authentication, improves the accuracy and efficiency of biometric smart cards. With the growing popularity of contactless payments, these cards are becoming an increasingly popular option for secure transactions. Partnerships between biometric technology providers, smart card manufacturers and payment system integrators are driving innovation and market expansion. Across the financial, consumer and health sectors, government and access control are changing market share. Efforts to reduce and improve the design of biometric smart cards are strongly warranted to improve user experience and acceptance.

Key Players:

- Thales (France)

- CardLogix (United States)

- HID Global (United States)

- SmartMetric Inc. (United States)

- Zwipe (Norway)

- Gemalto (Netherlands)

- Fingerprint Cards AB (Sweden)

- IDEMIA (France)

- IDEX Biometrics ASA (Norway)

- Versasec AB (Sweden)

- In February 2023, Infineon Technologies AG and TrustSEC joined forces to launch BIO-SLCOS, a smart card operating system using Infineon's latest SLC38 storage. They say that this open and secure platform offers greater security, greater hardware independence and greater flexibility for a variety of applications, including government identification, payment processing, and ticketing and data management.

- In January 2023, CardLab and WiBioCard combined their proprietary technologies to create a fully integrated card and background check solution that aims to usher in a new era of unique user identification and privacy protection.

Chapter 1. GLOBAL BIOMETRIC SMART CARD MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL BIOMETRIC SMART CARD MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL BIOMETRIC SMART CARD MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL BIOMETRIC SMART CARD MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL BIOMETRIC SMART CARD MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL BIOMETRIC SMART CARD MARKET – By End-User Vertical

6.1. Introduction/Key Findings

6.2 BFSI

6.3. Retail

6.4. Government

6.5. Healthcare

6.6. Commercial Entities

6.7. Others

6.6. Y-O-Y Growth trend Analysis By End-User Vertical

6.7. Absolute $ Opportunity Analysis By End-User Vertical , 2024-2030

Chapter 7. GLOBAL BIOMETRIC SMART CARD MARKET – By Application

7.1. Introduction/Key Findings

7.2 Payments

7.3. Access Control

7.4. Government ID and Financial Inclusion

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. GLOBAL BIOMETRIC SMART CARD MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By End-User Vertical

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By End-User Vertical

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By End-User Vertical

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By End-User Vertical

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By End-User Vertical

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL BIOMETRIC SMART CARD MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Thales (France)

9.2. CardLogix (United States)

9.3. HID Global (United States)

9.4. SmartMetric Inc. (United States)

9.5. Zwipe (Norway)

9.6. Gemalto (Netherlands)

9.7. Fingerprint Cards AB (Sweden)

9.8. IDEMIA (France)

9.9. IDEX Biometrics ASA (Norway)

9.10. Versasec AB (Sweden)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2023, the Global Biometric Smart Card Market was valued at $28.09 billion, and is projected to reach a market size of $88.21 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 17.76%.

The increasing demand for biometric cards among individuals is driving the expansion of the global biometric smart card market.

Based on Application, the Biometric Smart Card Market is segmented into Payments

Access Control, Government ID and Financial Inclusion, Others.

North America is the most dominant region for the Biometric Smart Card Market.

. Thales (France), CardLogix (United States), HID Global (United States), SmartMetric Inc. (United States), Zwipe (Norway), Gemalto (Netherlands), Fingerprint Cards AB (Sweden), IDEMIA (France), IDEX Biometrics ASA (Norway), Versasec AB (Sweden) in the Biometric Smart Card Market.