Biometric Sensors Market Size (2025 – 2030)

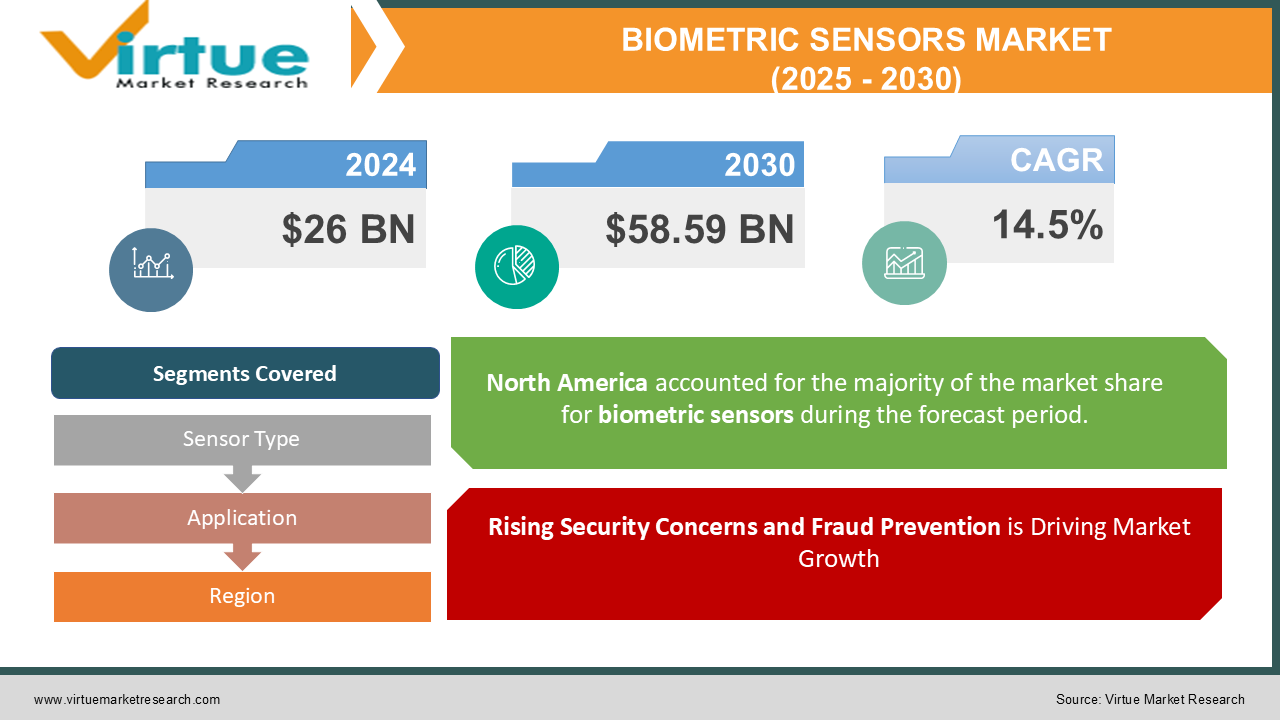

The Global Biometric Sensors Market was valued at USD 26 billion in 2024 and is expected to grow at a CAGR of 14.5% from 2025 to 2030, reaching USD 58.59 billion by 2030.

Biometric sensors, devices that capture and analyze physiological or behavioral traits to confirm identity, have been widely adopted across various sectors, including security, banking, healthcare, and consumer electronics. These sensors use different technologies to identify individuals based on unique characteristics such as fingerprints, iris patterns, facial features, voice, and more. The increasing demand for enhanced security systems, the rise in identity theft and fraud, the growing integration of biometrics into smartphones and other devices, and the need for efficient and contactless identification methods are major factors driving the market growth. The ability of biometric sensors to provide accurate, non-repudiable authentication is enhancing their appeal across numerous industries. Moreover, with the increasing focus on privacy and data protection, the biometric sensors market is expected to continue expanding as organizations seek more secure and reliable identification technologies.

Key Market Insights:

-

The biometric sensors market is experiencing robust growth due to increasing concerns about security and identity theft, leading to widespread adoption of biometric technologies across various sectors.

-

Fingerprint sensors currently dominate the market due to their widespread integration in smartphones, laptops, and access control systems.

-

The Asia-Pacific region is anticipated to witness the highest growth during the forecast period, driven by the rapid adoption of biometrics in countries such as China, India, and Japan, as well as governmental biometric identification initiatives.

-

The healthcare sector is increasingly adopting biometric sensors for patient identification, ensuring secure access to medical records, and improving the accuracy of medical procedures.

-

The growing demand for contactless authentication systems, particularly due to the COVID-19 pandemic, has propelled the adoption of biometric sensors in consumer electronics, security systems, and retail applications.

-

The integration of AI and machine learning with biometric sensors is enhancing their performance, enabling faster and more accurate identification and authentication processes.

-

Advancements in biometric sensor technologies, including the development of multi-modal biometric systems, are expected to further fuel the market, providing more secure and reliable identification methods.

-

With increasing adoption of biometric sensors in financial services, such as biometric ATM access and mobile banking applications, the market for biometric sensors in banking is witnessing substantial growth.

Global Biometric Sensors Market Drivers:

Rising Security Concerns and Fraud Prevention is Driving Market Growth

One of the primary drivers of the biometric sensors market is the increasing need for secure and accurate identity verification systems. The rise in cybercrime, identity theft, and unauthorized access has led businesses and governments to seek advanced solutions that can ensure secure access and protect sensitive information. Traditional authentication methods, such as passwords and PINs, are increasingly vulnerable to hacking, making biometric sensors an ideal alternative. These sensors offer highly secure authentication because biometric data (such as fingerprints, iris patterns, or facial features) is unique to every individual and difficult to replicate or steal. This has made biometric sensors a critical component in applications such as access control, payment systems, and personal identification, thereby driving the market's growth.

Advancements in Biometric Technologies is driving market growth: Continuous advancements in biometric sensor technologies are another key driver of the market. Innovations in sensor accuracy, processing speed, and sensor integration with artificial intelligence (AI) and machine learning algorithms are making biometric systems faster and more reliable. For example, multi-modal biometric systems, which combine different types of biometric sensors (e.g., fingerprint, iris, and facial recognition), are gaining popularity as they offer higher accuracy and improved security. The ability to use sensors in different environmental conditions, such as low-light settings or when the individual is wearing accessories (e.g., glasses, gloves), has increased the versatility of biometric systems. Furthermore, the miniaturization of biometric sensors is enabling their integration into consumer devices like smartphones, wearables, and smart home devices, contributing to the market's growth.

Government Initiatives and Regulatory Support is driving market growth: Governments worldwide are adopting biometric technologies to enhance national security, reduce fraud, and improve public services. Several countries have launched national biometric identification programs that integrate biometric sensors for identity verification, border control, and law enforcement. Examples include the Aadhaar system in India and various e-passport initiatives in Europe and the U.S. Additionally, government regulations around data privacy, such as the General Data Protection Regulation (GDPR) in the European Union, are encouraging organizations to adopt biometric systems that provide secure data protection. The increasing focus on digitalization and smart cities further drives the adoption of biometric systems across the globe. As governments continue to invest in advanced biometric technologies for secure identification, the demand for biometric sensors is expected to rise.

Global Biometric Sensors Market Challenges and Restraints:

Privacy Concerns and Ethical Issues is restricting market growth: Despite the security advantages offered by biometric sensors, privacy concerns remain a significant challenge. The collection and storage of biometric data—such as fingerprints, facial images, and iris patterns—raise concerns about data protection and misuse. Hackers may target biometric databases, making sensitive information susceptible to theft. Additionally, the use of biometric data by governments or private companies for surveillance purposes can be seen as invasive. Some consumers and advocacy groups have raised ethical concerns about the widespread use of biometric systems, questioning whether such systems infringe on personal privacy rights. These concerns could slow the adoption of biometric sensors, particularly in regions where data privacy laws are stringent.

High Implementation Costs is restricting market growth: Another challenge faced by the biometric sensors market is the high initial cost of implementing biometric systems, including both hardware and software components. The cost of biometric sensors can be prohibitively expensive, particularly for small and medium-sized businesses or organizations in developing countries. Additionally, organizations need to invest in infrastructure to support biometric data storage and processing, as well as ongoing maintenance costs. While the cost of biometric sensors has decreased over time, the total cost of implementing a biometric system remains a barrier for many potential users. This could limit the adoption of biometric sensors in certain regions or industries, particularly those with budget constraints.

Market Opportunities

The biometric sensors market is expected to see substantial growth driven by the increasing demand for contactless biometric solutions, technological advancements, and expanding applications across different industries. The healthcare sector presents a significant opportunity for biometric sensors, with their ability to improve patient identification, streamline medical records access, and enhance security in medical facilities. As healthcare systems around the world seek ways to reduce fraud and enhance patient safety, biometric sensors will play a crucial role. In addition, the financial services industry is a major growth driver, as biometric sensors are being integrated into mobile banking apps, ATMs, and payment systems to ensure secure and seamless transactions. With the rise of mobile and wearable technologies, biometric sensors are being embedded into consumer devices such as smartphones, smartwatches, and fitness trackers. This is creating new revenue streams for the biometric sensor market and expanding its reach. Furthermore, the growing trend of smart homes, where security and automation are central, presents an opportunity for biometric sensors to be integrated into home security systems, enabling users to unlock doors, control appliances, and monitor their homes through biometric authentication. Overall, the convergence of biometric sensors with AI, IoT, and cloud computing presents vast opportunities for innovation and market expansion.

BIOMETRIC SENSORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

14.5% |

|

Segments Covered |

By Sensor Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M, NEC Corporation, IDEMIA, Fingerprint Cards AB, HID Global Corporation, Qualcomm Incorporated, ZKTeco, Crossmatch Technologies, Suprema Inc., Cognitec Systems GmbH |

Biometric Sensors Market Segmentation: By Sensor Type

-

Fingerprint Sensors

-

Facial Recognition Sensors

-

Iris Recognition Sensors

-

Voice Recognition Sensors

-

Hand Geometry Sensors

-

Others (Behavioral Biometrics, etc.)

The fingerprint sensors segment currently dominates the biometric sensors market. This is primarily due to the widespread integration of fingerprint sensors in smartphones, laptops, and security systems, making them the most commonly used biometric technology worldwide. Fingerprint sensors are relatively cost-effective, easy to implement, and offer a high level of security, making them a popular choice for both consumers and enterprises. Furthermore, the increasing demand for mobile payments and secure transactions is expected to continue driving the growth of the fingerprint sensors segment in the coming years.

Biometric Sensors Market Segmentation: By Application

-

Consumer Electronics

-

Government & Law Enforcement

-

Healthcare

-

Financial Services

-

Military & Defense

-

Automotive

-

Others

The consumer electronics segment is the most dominant application segment in the biometric sensors market. With the increasing use of biometric authentication methods in smartphones, laptops, and wearables, the demand for biometric sensors in consumer electronics is surging. Biometric authentication offers a more secure and convenient alternative to passwords and PINs, contributing to the widespread adoption of biometric sensors in personal devices. The growing trend of mobile payments, online banking, and e-commerce further propels the demand for biometric sensors in consumer electronics.

Biometric Sensors Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America remains the dominant region in the biometric sensors market, primarily due to the strong demand for advanced security systems in various sectors such as government, healthcare, banking, and defense. The presence of leading biometric sensor manufacturers and the rapid adoption of biometric solutions in consumer electronics contribute to the region's market leadership. Additionally, North America has a robust infrastructure for technological development and innovation, which supports the continued growth of the biometric sensors market. The U.S., in particular, has made significant investments in biometric identification systems for border security, law enforcement, and financial services, further driving the demand for biometric sensors.

COVID-19 Impact Analysis on the Biometric Sensors Market:

The COVID-19 pandemic has significantly impacted the biometric sensors market, accelerating the adoption of contactless biometric systems while also disrupting the global supply chain. The pandemic underscored the importance of contactless authentication methods, as individuals and organizations sought ways to minimize physical contact to reduce the spread of the virus. This shift led to increased demand for biometric sensors that provide non-contact verification, such as facial recognition and iris scanners. At the same time, the pandemic caused delays in the production and deployment of biometric systems due to global lockdowns, factory closures, and disruptions in the logistics sector. However, as economies begin to recover and the demand for secure and contactless identification grows, the biometric sensors market is expected to bounce back and continue its upward trajectory.

Latest Trends/Developments:

Recent trends in the biometric sensors market include the increasing adoption of AI-powered biometric systems that offer enhanced accuracy and faster processing speeds. AI and machine learning algorithms are being integrated into biometric sensors to improve recognition accuracy, reduce false positives, and enable real-time decision-making. Another key development is the rise of multi-modal biometric systems, which combine multiple biometric modalities (such as fingerprint, facial recognition, and voice recognition) to provide a higher level of security and prevent fraudulent attempts. Moreover, the miniaturization of biometric sensors is enabling their integration into a wide range of consumer devices, from smartphones to smartwatches and wearable health trackers. The increasing focus on digital identity and secure transactions in industries like banking and e-commerce is also contributing to the growth of biometric sensors in these sectors.

Key Players

-

3M

-

NEC Corporation

-

IDEMIA

-

Fingerprint Cards AB

-

HID Global Corporation

-

Qualcomm Incorporated

-

ZKTeco

-

Crossmatch Technologies

-

Suprema Inc.

-

Cognitec Systems GmbH

Chapter 1. Biometric Sensors Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Biometric Sensors Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Biometric Sensors Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Biometric Sensors Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Biometric Sensors Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Biometric Sensors Market – By Sensor Type

6.1 Introduction/Key Findings

6.2 Fingerprint Sensors

6.3 Facial Recognition Sensors

6.4 Iris Recognition Sensors

6.5 Voice Recognition Sensors

6.6 Hand Geometry Sensors

6.7 Others (Behavioral Biometrics, etc.)

6.8 Y-O-Y Growth trend Analysis By Sensor Type

6.9 Absolute $ Opportunity Analysis By Sensor Type, 2025-2030

Chapter 7. Biometric Sensors Market – By Application

7.1 Introduction/Key Findings

7.2 Consumer Electronics

7.3 Government & Law Enforcement

7.4 Healthcare

7.5 Financial Services

7.6 Military & Defense

7.7 Automotive

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Biometric Sensors Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Sensor Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Sensor Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Sensor Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Sensor Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Sensor Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Biometric Sensors Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 3M

9.2 NEC Corporation

9.3 IDEMIA

9.4 Fingerprint Cards AB

9.5 HID Global Corporation

9.6 Qualcomm Incorporated

9.7 ZKTeco

9.8 Crossmatch Technologies

9.9 Suprema Inc.

9.10 Cognitec Systems GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Biometric Sensors Market was valued at USD 26 billion in 2024 and is expected to grow at a CAGR of 14.5% from 2025 to 2030, reaching USD 58.59 billion by 2030.

Drivers include rising security concerns, advancements in biometric technologies, and government initiatives supporting the adoption of biometric systems.

Segments include sensor types (fingerprint, facial recognition, iris recognition, voice recognition, hand geometry, others) and applications (consumer electronics, government & law enforcement, healthcare, financial services, military & defense, automotive, others).

North America is the most dominant region, with high demand in sectors like government, healthcare, and financial services.

Leading players include 3M, NEC Corporation, IDEMIA, Fingerprint Cards AB, HID Global Corporation, and others.