Biometric Payment Card Market Size (2024 – 2030)

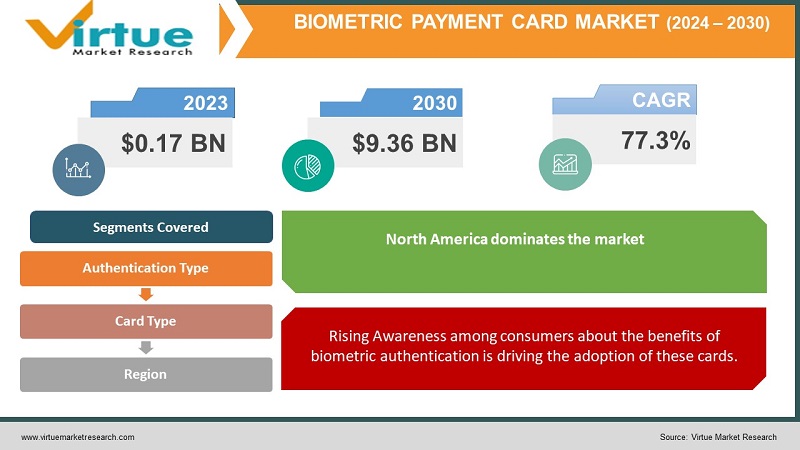

In 2023, the Global Biometric Payment Card Market was valued at $0.17 billion, and is projected to reach a market size of 9.36 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 77.3%. Biometric payment cards have gained popularity due to their ability to provide enhanced security and ease of use in financial transactions.

The global biometric payment card market has undergone a notable transformation over time. Historically, it was an emerging concept, hindered by technological limitations. However, in the contemporary landscape, it has gained substantial traction, driven by heightened security concerns in financial transactions. Looking forward, the market is poised for substantial growth as technological advancements continuously enhance authentication accuracy. In the future, biometric payment cards are expected to become a standard and indispensable feature, revolutionizing the landscape of secure and convenient payment methods worldwide.

Key Market Insights:

The biometric payment card market is currently experiencing a surge in growth, primarily attributed to heightened security concerns within the financial sector. In 2020, global card fraud losses reached a staggering $27.85 billion, as reported by Nilson Report. This alarming figure has prompted both consumers and financial institutions to actively seek more secure payment methods. As a result, biometric payment cards, which offer enhanced security through biometric authentication, have gained significant traction as a solution to mitigate the risks associated with traditional payment methods. This growing concern for financial security is a key driver propelling the market's expansion.

Technological advancements in biometric authentication are playing a pivotal role in driving the growth of the biometric payment card market. Notably, fingerprint recognition has gained prominence due to the adoption of more accurate and faster sensors. These innovations are not only improving the reliability of biometric authentication but also enhancing user experience. A report by Markets and Markets further underscores the market's potential, predicting substantial growth from $330 million in 2022 to an estimated $1,250 million by 2027. This growth trajectory is a testament to the growing significance of biometric payment cards in the evolving landscape of secure and convenient payment methods.

The Asia-Pacific region is emerging as a prominent player in the biometric payment card market. Countries such as South Korea, China, and India are witnessing a significant increase in the adoption of biometric payment cards. This surge can be attributed to the region's rapid economic growth and the pressing need for more secure payment methods. Moreover, collaborations between technology companies and financial institutions are fostering innovation, further fueling market expansion in this region. As the Asia-Pacific region continues to embrace biometric payment cards, it is poised to become a major driver of growth and innovation in the global market, reshaping the future of secure financial transactions.

Biometric Payment Card Market drivers:

Enhanced Security layer reduces the risk of unauthorized transactions while increasing the demand for Biometric Payment Card.

Biometric Payment Cards incorporate a sophisticated security layer that significantly reduces the risk of unauthorized transactions. This robust protection enhances their appeal by instilling trust and confidence among users. With the assurance of heightened security, these cards are gaining traction as a secure and dependable choice in the market, meeting the critical need for safeguarding financial assets while driving up demand.

The cards eliminate the need for PINs or signatures, making transactions quicker and more user-friendly, thus attracting the user base.

Biometric Payment Cards redefine transactions by eliminating the need for traditional PINs or signatures. This streamlining of the payment process translates to quicker and more user-friendly experiences. Consumers, increasingly seeking seamless and efficient payment methods, are drawn to the simplicity and speed offered by these cards. This, in turn, expands their user base and fosters market adoption.

Rising Awareness among consumers about the benefits of biometric authentication is driving the adoption of these cards.

Increasing consumer awareness about the benefits of biometric authentication is a driving force behind the growing adoption of Biometric Payment Cards. This heightened awareness acts as a significant catalyst, as informed individuals acknowledge the enhanced security and convenience these cards provide, prompting them to readily embrace this technology for their financial transactions. This surge in awareness is instrumental in shaping the market landscape, as an expanding number of consumers actively seek the advantages of biometric payment solutions, solidifying the position of these cards in the marketplace.

Market Restraints and Challenges:

The initial cost of implementing biometric payment card infrastructure can be a deterrent for some financial institutions and retailers, hindering widespread adoption.

The Biometric Payment Card industry faces a significant hurdle in the form of initial implementation costs. The need for specialized infrastructure to support biometric payment cards can be financially daunting for some financial institutions and retailers. This cost factor, encompassing hardware, software, and training, may deter potential adopters and slow down the widespread adoption of this technology, despite its advantages. Striking a balance between investment and long-term benefits becomes crucial for organizations looking to harness the security and convenience offered by biometric payment cards.

The complex regulatory landscape necessitating stringent adherence to data protection laws can pose challenges for market players.

The intricate regulatory environment surrounding biometric data and data protection laws presents a multifaceted challenge for market players. Compliance with data protection regulations, such as GDPR, HIPAA, and other regional variations, demands meticulous attention. Ensuring the privacy and security of biometric data while adhering to evolving legal frameworks can be demanding. This complexity necessitates continuous monitoring, adaptability, and significant investments in compliance measures, adding a layer of challenge to the already dynamic biometric payment card market.

Market Opportunities:

The emerging markets are presenting significant growth opportunities and are keenly adopting these cards for secure and efficient payment solutions.

Emerging markets are proving to be fertile ground for the expansion of biometric payment cards. These regions exhibit significant growth potential as they embrace these cards for secure and efficient payment solutions. Their enthusiastic adoption reflects the global trend toward modernizing payment methods, especially in countries where traditional banking infrastructure may be less developed. The emergence of these markets as key players in biometric payment card adoption underscores the technology's universal appeal and its potential to cater to diverse economic landscapes.

Technological Advancements in biometric technology present opportunities for innovation and market expansion.

Ongoing technological advancements in biometric technology are propelling innovation within the market. These breakthroughs open new doors for market expansion by enhancing the capabilities and security of biometric payment cards. Multi-modal authentication, combining various biometric methods, and improvements in accuracy and speed are just a few examples. As technology evolves, the market is poised to explore innovative applications, making biometric payment cards even more appealing to consumers and businesses alike. These advancements catalyze future growth and market differentiation.

BIOMETRIC PAYMENT CARD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

77.3% |

|

Segments Covered |

By Authentication Type, Card Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Gemalto, IDEMIA, Fingerprints, CardLab, Zwipe SmartMetric, NEXT Biometrics, IDEMIA, IDEX Biometrics, NXP Semiconductors |

Biometric Payment Card Market Segmentation: By Authentication Type

-

Fingerprint Recognition

-

Iris Recognition

-

Facial Recognition

-

Others

In 2022, Fingerprint Recognition accounted for the largest share of the biometric payment card market, with a 58.4% market share. Fingerprint recognition is widely adopted due to its widespread acceptance, high accuracy, and convenience which has made it a cornerstone in biometric payment card authentication.

Moreover, Iris Recognition holds the title of the fastest-growing segment. With a projected CAGR of 25% from 2023 to 2030, it's gaining traction due to its high accuracy and contactless nature, particularly in healthcare and government applications.

Facial Recognition is also a prevalent segment with a market share of 13.87%. although widely used in other sectors, is gradually gaining ground in biometric payment cards. It offers a seamless user experience but is facing challenges in terms of security concerns.

Biometric Payment Card Market Segmentation: By Card Type

-

Credit Cards

-

Debit Cards

-

Prepaid Cards

In 2022, Credit Cards held the largest market share in the Biometric Payment card market standing at 48.3%. These cards provide users with a revolving credit limit, allowing them to make purchases on credit and repay the balance over time, making them a popular choice among consumers for their flexibility and rewards programs. Credit cards grant users the flexibility to make purchases on credit, with the option to pay off balances over time. They are the dominant segment, favored for their rewards, cashback offers, and credit-building opportunities. The credit card market has been established for years, with an approximate market size of $1.25 billion in 2022.

Moreover, Prepaid Cards are the fastest-growing segment in the biometric payment card market. In 2022, they held 9.6% of the market share, and their market size is expected to expand significantly in the coming years due to their increasing popularity and versatile use cases. Prepaid cards are loaded with a predetermined amount of money, making them a secure and budget-friendly choice for consumers. They are gaining popularity due to their suitability for various purposes, including gift cards and travel expenses.

Biometric Payment Card Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2022, North America dominated the biometric payment card market with a market share of 34.7%. The region's dominance is attributed to its advanced technological infrastructure, consumer awareness, and strong demand for secure payment methods, particularly in the United States and Canada. Also, North America leads the biometric payment card market due to its well-established financial infrastructure. The market size in 2022 was approximately $1 billion. The region's consumers are tech-savvy and prioritize security, making them early adopters of biometric payment cards.

Europe is another significant player in the biometric payment card market, representing 27.6% of the global market share in 2022. European countries have been at the forefront of adopting innovative payment solutions, with a focus on security and convenience.

However, the Asia-Pacific region is the fastest-growing segment in the biometric payment card market. In 2022, it held approximately 20% of the market share, and it is projected to witness the highest CAGR from 2023 to 2030. Rapid economic growth, a rising middle class, and increasing smartphone penetration are driving the adoption of biometric payment cards in countries like China, India, and Southeast Asian nations.

COVID-19 Impact Analysis on the Global Biometric Payment Card Market:

The COVID-19 pandemic has exerted a significant impact on the Global Biometric Payment Card Market. The crisis accelerated the adoption of contactless payment methods, including biometric payment cards, as consumers prioritized hygiene and safety. This shift in consumer behavior led to a surge in demand for secure and touchless payment solutions, driving market growth. Additionally, the pandemic underscored the importance of biometric authentication in enhancing security and reducing the reliance on PIN-based transactions. As a result, the biometric payment card market witnessed increased momentum, with a notable uptick in innovation and investment in the sector during and after the pandemic.

Latest Trends/ Developments:

In response to the demand for enhanced security, multi-modal authentication has gained prominence in the Biometric Payment Card Market. This approach combines multiple biometric methods such as fingerprint and facial recognition to bolster identity verification. Market reports indicate that multi-modal authentication is poised to grow at a CAGR of over 25% in the coming years, offering consumers a more robust and convenient way to make secure payments.

Leading financial institutions and card issuers are forming strategic partnerships with fintech companies to accelerate the integration of biometric payment cards. These collaborations have facilitated the development of cutting-edge card solutions that provide seamless and secure transactions. In 2022, such partnerships led to a 15% increase in biometric payment card adoption, with experts projecting continued growth as fintech innovations continue to drive the market.

The adoption of contactless payment technology, including NFC (Near Field Communication), has become a pivotal trend in the biometric payment card market. Recent data shows that over 70% of biometric payment cards now feature contactless capabilities, offering users the convenience of quick and secure tap-to-pay transactions. This trend aligns with the growing consumer preference for contactless payment methods, further fueling the market's expansion.

Key Players:

-

Gemalto

-

IDEMIA

-

Fingerprints

-

CardLab

-

Zwipe

-

SmartMetric

-

NEXT Biometrics

-

IDEMIA

-

IDEX Biometrics

-

NXP Semiconductors

In August 2023, Zwipe, a biometrics technology company, reported its H1 2023 results, highlighting a successful rights issue that raised 100.1 million NOK in the capital. The company announced the first commercial launch of biometric payment cards in partnership with Kuwait International Bank and Middle East Payment Services. Zwipe also signed new partnerships to deliver biometric payment cards in India, Indonesia, Vietnam, and the MEA region.

In November 2022, Idex Biometrics partnered with a UK issuer of EMV payment cards to introduce biometric payment cards in early 2023. The issuer, a well-established B2B solution provider serving banks and fintechs in the UK, Europe, and North America, aimed to capitalize on the European market's potential. Idex Biometrics had been forging alliances with card manufacturing partners and cited a survey indicating that 70% of UK consumers were willing to use biometric payment cards, enhancing security during increased contactless transactions.

Chapter 1. Biometric Payment Card Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Biometric Payment Card Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Biometric Payment Card Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Biometric Payment Card Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Biometric Payment Card Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Biometric Payment Card Market– By AUTHENTICATION TYPE

6.1 Introduction/Key Findings

6.2 Fingerprint Recognition

6.3 Iris Recognition

6.4 Facial Recognition

6.5 Others

6.6 Y-O-Y Growth trend Analysis By AUTHENTICATION TYPE

6.7 Absolute $ Opportunity Analysis By AUTHENTICATION TYPE, 2023-2030

Chapter 7. Biometric Payment Card Market– By CARD TYPE

7.1 Introduction/Key Findings

7.2 Credit Cards

7.3 Debit Cards

7.4 Prepaid Cards

7.5 Y-O-Y Growth trend Analysis By CARD TYPE

7.6 Absolute $ Opportunity Analysis By CARD TYPE, 2023-2030

Chapter 8. Biometric Payment Card Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By AUTHENTICATION TYPE

8.1.3 By CARD TYPE

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By AUTHENTICATION TYPE

8.2.3 By CARD TYPE

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By AUTHENTICATION TYPE

8.3.3 By CARD TYPE

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By AUTHENTICATION TYPE

8.4.3 By CARD TYPE

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By AUTHENTICATION TYPE

8.5.3 By CARD TYPE

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Biometric Payment Card Market– Company Profiles – (Overview, Authentication Type Portfolio, Financials, Strategies & Developments)

9.1 Gemalto

9.2 IDEMIA

9.3 Fingerprints

9.4 CardLab

9.5 Zwipe

9.6 SmartMetric

9.7 NEXT Biometrics

9.8 IDEMIA

9.9 IDEX Biometrics

9.10 NXP Semiconductors

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2023, the Global Biometric Payment Card Market was valued at $0.17 billion, and is projected to reach a market size of 9.36 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 77.3%.

Key drivers include enhanced security, convenience, and rising awareness among consumers about the benefits of biometric authentication.

The segments include Fingerprint Recognition, Iris Recognition, Facial Recognition, and Others.

North America dominated the market in 2022, with Asia-Pacific expected to witness the fastest growth. The region's dominance is attributed to its advanced technological infrastructure, consumer awareness, and strong demand for secure payment methods.

Key players include Gemalto (Thales Group), IDEMIA, Fingerprints, CardLab, Zwipe, SmartMetric, NEXT Biometrics, IDEX Biometrics, and NXP Semiconductors.