Biomethane Market Size (2024 – 2030)

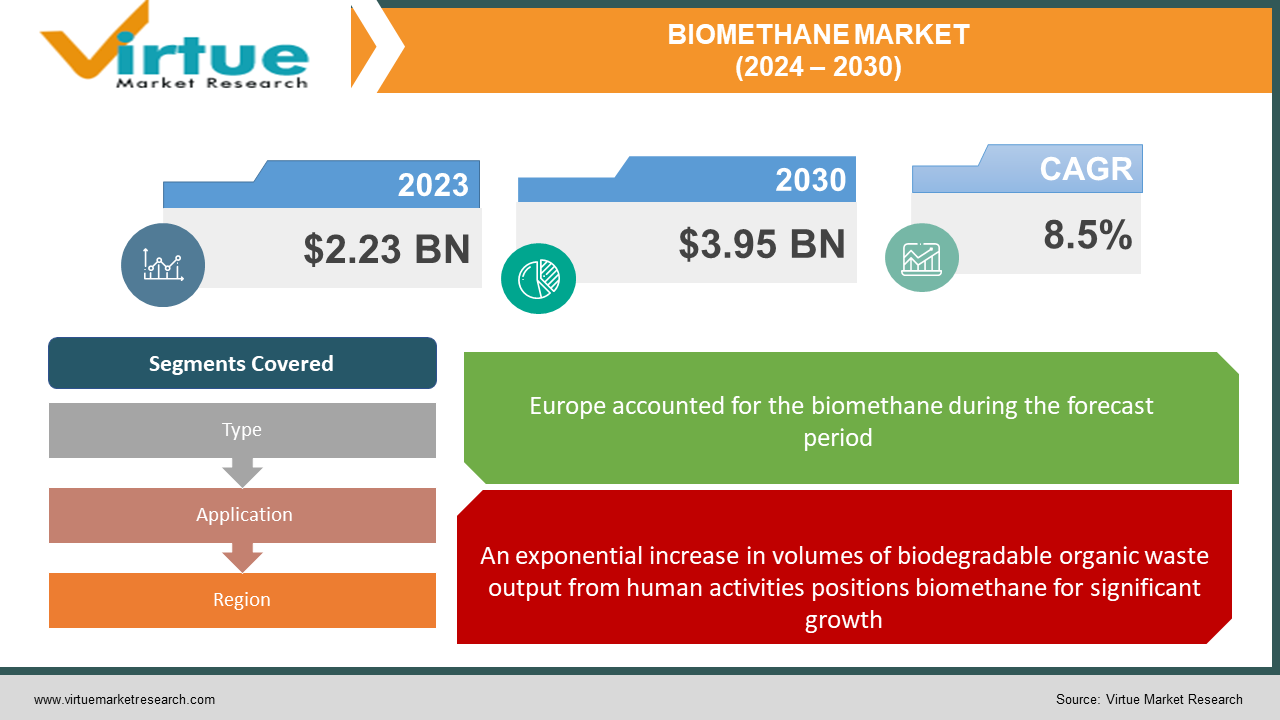

The biomethane market was valued at USD 2.23 billion in 2023 and is projected to reach a market size of USD 3.95 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.5%.

A clean-burning gas known as biomethane is created when organic matter naturally breaks down in the absence of oxygen through anaerobic digestion processes. Biomethane is a nearly pure supply of methane gas, identical to conventional natural gas derived from fossil fuels, and is also referred to as renewable natural gas (RNG). But unlike conventional natural gas, biomethane offers a clean energy source that is environmentally sustainable because it is produced from biodegradable feedstocks like sewage, animal dung, municipal solid waste, and agricultural waste. Power generation, fuel for automobiles, and heating in the residential, commercial, and industrial sectors are the main uses of biomethane. Depending on the waste feedstock used in production, biomethane can help achieve significant lifecycle greenhouse gas emission reductions when used in place of natural gas, diesel, or gasoline. Additionally, it burns very cleanly, with very little particulate matter released. Because it is a renewable energy source, biomethane can be used in jurisdictions across North America and Europe that have emission reduction laws to get green incentives such as renewable natural gas certificates, low-carbon fuel credits, and green gas carbon offsets. Significant growth momentum is provided by these financial advantages, which make investments appealing and allow for the expansion of manufacturing capacity on a worldwide scale.

Key Market Insights:

The global biomethane market’s growth stems from ambitious net-zero emissions targets set by prominent economies in Europe and North America, encompassing carbon reductions from electricity, transportation, and heating. Mandates across federal and state policies like renewable natural gas certificates, low-carbon fuel standards, and clean energy portfolio requirements are further accelerating biomethane's uptick as a renewable fuel of choice across applications like combined heat and power plants, compressed natural gas vehicles, and gas distribution networks. However, industry stakeholders have cautioned that realizing the immense growth opportunity requires meticulous planning and investments around ensuring reliable security of biodegradable feedstock supply chains feeding the production assets, as well as technological developments enabling modular and seasonal flexible capacity expansions. The seasonal variability of agricultural waste availability means production capacities require intelligent management to maximize annual utilization rates. Additionally, competition from other waste-to-energy pathways also remains active, necessitating supply chain contracts and inventory buffer strategies. Centralized digestion facilities with multi-feed intake coupled with distributed upgrading facilities allow aggregation and year-round supply security. Overall, maturing conversion technologies, financial incentives prioritizing environmental sustainability, energy security considerations, and the dictates of energy policies firmly place biomethane adoption on an upward growth trajectory this decade.

Biomethane Market Drivers:

One of the foremost catalysts stimulating biomethane production and adoption worldwide is the implementation of stringent sustainability reforms encompassing the energy and transportation sectors by governments.

Among the foremost stimulants driving biomethane adoption worldwide are aggressive policy reforms spearheaded by governments prioritizing climate change commitments and greener economies. By formalizing sustainability mandates encompassing renewable energy contributions across electricity generation, transportation, and industrial and domestic heating applications, jurisdictions are creating thriving, stable market environments and incentivizing investments in cleaner fuels like biomethane. Several prominent economies have enacted legislation to drastically cut greenhouse gas emissions by over 50% by 2050 from current levels, implying entire system transitions across how energy is produced and consumed. The European Union's Fit for 55 package imposes world-leading reforms like the EU Emissions Trading Scheme pricing carbon and the Renewable Energy Directives (RED) requiring member states to compel energy companies to blend rising percentages of certified renewables like biomethane in pipelines. Overall, by enacting ambitious top-down sustainability transformations encompassing renewable energy quotas across economic sectors reinforced through carbon pricing alongside bottom-up production incentives, legislation worldwide provides biomethane projects with long-term cash flow clarity, supplementing market growth dynamics. The policy momentum promises a thriving investment environment as governments race to meet environmental commitments.

An exponential increase in volumes of biodegradable organic waste output from human activities positions biomethane for significant growth.

Besides policy momentum, the sheer abundance of untreated biogenic waste outputs from expanding human activity also positions biomethane strongly for stratospheric growth this decade. Rapid urbanization and population growth rates have engendered immense organic waste streams from municipal, agricultural, and industrial sectors. However, ineffective management means huge, underutilized energy potential remains untapped within these volumes. Global cities generate over 2 billion tons of municipal solid waste annually, of which organic fractions like food, green cuttings, paper, and wood constitute 50–75% recyclable into green energy formats. However, over 90% of waste in developing countries directly enters landfills, contributing immensely to methane emissions, given anaerobic conditions suitable for natural decomposition. Implementing efficient source segregation of household and commercial food waste coupled with decentralized modular bio methanation units promises a sustainable waste management approach that reduces landfill loads while generating biomethane for local electricity usage. Early examples from cities like San Francisco highlight the immense potential waiting to be unlocked using simple but innovative models. Overall, the untapped reserve energy within the inevitable organic waste bulk from rising human numbers and food production activities presents a gigantic opportunity to sustainably power greener economies through biomethane projects. But unlocking this potential crucially depends on prioritizing waste management reforms that facilitate segregation while incentivizing technology investments tailored for distributed implementation models that benefit communities lacking energy access.

Biomethane Market Restraints and Challenges:

Managing the seasonal fluctuations in the availability of inexpensive biogenic feedstocks required for manufacturing is a significant obstacle impeding the growth of the biomethane sector.

One major bottleneck restraining biomethane industry growth is managing seasonal variability in the availability of low-cost biogenic feedstocks needed for production. Agricultural residues and animal waste volumes fluctuate based on crop cycles and farming activities concentrated during harvest seasons. Ensuring consistent supply security to keep digestion and upgrading facilities functioning at high annual utilization rates requires intelligent handling of variability using inventory buffering and demand-supply balancing strategies. This necessitates capital-intensive interventions like storage infrastructure for peak-season preservation. Alternate blending with other consistent feedstocks also requires incremental processing complexity. Such variability risks remain key considerations in screening project investment decisions, given that low output periods directly impact revenue generation abilities. The added costs also affect production cost competitiveness against conventional natural gas prices. Further supply risks exist from competing waste-to-energy production pathways utilizing similar feedstocks for economic viability. While the market outlook remains bullish in Europe and North America given policy incentives, developing countries face additional challenges around securing reliable long-term biomethane uptake agreements from credible offtakes at stable prices. Grid injection infrastructure also remains inadequate, lacking dedicated pipelines, affecting confidence in supply distribution abilities. This exposes project investments to significant off-take uncertainties despite lower production costs from cheaper feedstock availability and labor. Currency risks due to exchange rate volatility in emerging markets also threaten the bankability of foreign capital allocation. Overall, managing fluctuations in feed availability using inventory buffering while also adopting de-risking strategies and securing consistent demand from creditworthy consumers will be pivotal in addressing key investment impediments holding back faster biomethane growth globally.

Biomethane Market Opportunities:

One major bottleneck restraining biomethane industry growth is managing seasonal variability in the availability of low-cost biogenic feedstocks needed for production. Agricultural residues and animal waste volumes fluctuate based on crop cycles and farming activities concentrated during harvest seasons. Ensuring consistent supply security to keep digestion and upgrading facilities functioning at high annual utilization rates requires intelligent handling of variability using inventory buffering and demand-supply balancing strategies. This necessitates capital-intensive interventions like storage infrastructure for peak-season preservation. Alternate blending with other consistent feedstocks also requires incremental processing complexity. Such variability risks remain key considerations in screening project investment decisions, given that low output periods directly impact revenue generation abilities. The added costs also affect production cost competitiveness against conventional natural gas prices. Further supply risks exist from competing waste-to-energy production pathways utilizing similar feedstocks for economic viability. While the market outlook remains bullish in Europe and North America given policy incentives, developing countries face additional challenges in securing reliable long-term biomethane uptake agreements from credible off-takers at stable prices. Grid injection infrastructure also remains inadequate, lacking dedicated pipelines, affecting confidence in supply distribution abilities. This exposes project investments to significant off-take uncertainties despite lower production costs from cheaper feedstock availability and labor. Currency risks due to exchange rate volatility in emerging markets also threaten the bankability of foreign capital allocation. Such demand-side weaknesses extend beyond feedstock supply seasonality risks and hence require innovative interventions around distributing costs using community-shared investment structures, allowing the aggregation of demand from smaller, dispersed consumers. Ancillary sustainability attributes like organic fertilizer production also help balance revenue profiles beyond just renewable gas sales.

BIOMETHANE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nature Energy, Verbio SE, Archaea Energy , Air Liquide, Envi Tec Biogas AG, PlanET Biogas Global GmbH, ETW Energietechnik , Future Biogas |

Biomethane Market Segmentation: By Type

-

Agricultural Waste

-

Municipal Solid Waste

-

Sewage Sludge

-

Industrial Food Processing Waste

-

Other Feedstocks

Agricultural waste is the largest type and accounts for approximately 40% of the market share in 2023. This includes crop residues and animal manure. Animal manure is the dominant type in this segment, contributing around 60% of the agricultural waste feedstock. However, crop residues are seeing faster growth, driven by increasing availability and favorable government policies. Municipal solid waste, holding around 25% of the market share, is the fastest-growing. Landfill gas produced from municipal solid waste is the main feedstock here. There are issues with garbage management in many areas, such as a shortage of disposal space and rising rates of waste output. By keeping organic waste out of landfills and using it to produce biomethane, MSW generation provides a sustainable answer to these problems.

Biomethane Market Segmentation: By Application

-

Power Generation

-

Automotive Fuel

-

Industrial Fuel

-

Pipeline Injection

-

Heating Fuel

Power generation currently holds the largest market share, at roughly 35% in 2023. Biomethane is increasingly being used for power generation via direct combustion and gas engines to produce renewable electricity. It is dominant due to abundant availability, technological maturity, and support from energy access and climate regulations. Though growth is steady, it is expected to be overshadowed by emerging sectors. Automotive fuel occupies around 25% of the biomethane market share and is the fastest-growing. Using biomethane as a compressed natural gas (CNG) fuel for vehicles is an established market segment. Fleet vehicle adoption is witnessing robust uptake in regions like North America and Europe with an interest in reducing diesel dependence. Progressively strict automotive emission regulations are driving the move towards biomethane as a sustainable biofuel, especially in heavy transport.

Biomethane Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe has the largest market, driven by supportive renewable energy and emissions policies like the EU Renewable Energy Directive. Countries such as the UK, Germany, Italy, and France account for a major chunk owing to incentive programs and national biomethane targets, along with extensive gas infrastructure availability. Well-established animal husbandry and an emphasis on circular economies further propel uptake. Asia-Pacific is the fastest-growing market. China is witnessing surging biomethane development integrated with waste management requirements and sustainability goals. South Korea, Japan, and Australia also demonstrate considerable potential owing to increasing renewable transitions. Emerging economies are expected to drive new market development. The Asia-Pacific market is fueled by high waste generation densities across emerging economies combined with substantial infrastructure investment and supportive decarbonization policy frameworks.

COVID-19 Impact Analysis on the Biomethane Market:

The outbreak of COVID-19 caused widespread disruptions across economies, impacting the biomethane market significantly. Mandatory lockdowns resulted in a slowdown of manufacturing activity and the temporary suspension of proposed plant construction. Movement restrictions also caused biomass feedstock supply chain and logistics disruptions during the initial months. This affected scheduled biomethane production across operational plants. However, the demand dynamics for biomethane varied across end-use sectors. While demand from the automotive sector declined temporarily in line with the overall transport activity slowdown, industrial consumption remained largely stable. The power sector also witnessed sustained biomethane energy demand owing to steady base electricity requirements during the lockdowns as well. The market demonstrated resilience, registering a smaller 6% decline in biomethane output as compared to projections as per the pre-COVID estimates. Developers focused on plant maintenance planning and enhancing storage capabilities. Government economic stimulus packages with green recovery measures also provided an impetus. The market is expected to bounce back strongly, with most delayed projects expected to resume. Monitoring policy support realignment with net zero priorities across jurisdictions during these years remains vital for the biomethane energy market.

Latest Trends/ Developments:

Biomethane is garnering strong policy momentum across mature and emerging economies, driven by renewable natural gas development goals, emission reduction commitments, and waste management regulations. Countries like Germany, France, the UK, the US, China, and Australia have recently enhanced market incentives like carbon credits, production quotas, subsidies for project investments, RNG blending targets, and green public procurement programs. Innovations in gas purification, scrubbing, enrichment, and methanation techniques are enabling more efficient and cost-effective upgrading of biogas into pipeline-grade green gas. This allows tapping unconventional dispersed feedstocks. Novel membrane materials, dynamic pressurized reactors, and microbial electrolysis processes are also being developed. Using biomethane as a renewable biofuel for long-haul heavy vehicles, ships, and ferries is witnessing substantial momentum derived from carbon-neutral mobility goals laid out by corporations and governments. Investments in liquefied biomethane production and distribution logistics have increased sharply.

Key Players:

-

Nature Energy

-

Verbio SE

-

Archaea Energy

-

Air Liquide

-

Envi Tec Biogas AG

-

PlanET Biogas Global GmbH

-

ETW Energietechnik

-

Future Biogas

Chapter 1. Biomethane Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Biomethane Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Biomethane Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Biomethane Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Biomethane Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Biomethane Market – By Type

6.1 Introduction/Key Findings

6.2 Agricultural Waste

6.3 Municipal Solid Waste

6.4 Sewage Sludge

6.5 Industrial Food Processing Waste

6.6 Other Feedstocks

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Biomethane Market – By Application

7.1 Introduction/Key Findings

7.2 Power Generation

7.3 Automotive Fuel

7.4 Industrial Fuel

7.5 Pipeline Injection

7.6 Heating Fuel

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Biomethane Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Biomethane Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Nature Energy

9.2 Verbio SE

9.3 Archaea Energy

9.4 Air Liquide

9.5 Envi Tec Biogas AG

9.6 PlanET Biogas Global GmbH

9.7 ETW Energietechnik

9.8 Future Biogas

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Biomethane offers a sustainable alternative to fossil fuels, significantly reducing greenhouse gas emissions. Governments and industries are increasingly committed to combating climate change, making biomethane a valuable solution.

While technological advancements continue to drive down costs, producing biomethane can still be more expensive than conventional natural gas in some scenarios.

Nature Energy, Verbio SE, Archaea Energy, Air Liquide, Envi Tec Biogas AG, and PlanET Biogas Global GmbH are the key players.

Europe currently holds the largest market share, estimated at around 40%.

Asia-Pacific exhibits the fastest growth, driven by its increasing population and expanding economy.