Biomass Power Market size (2025 – 2030)

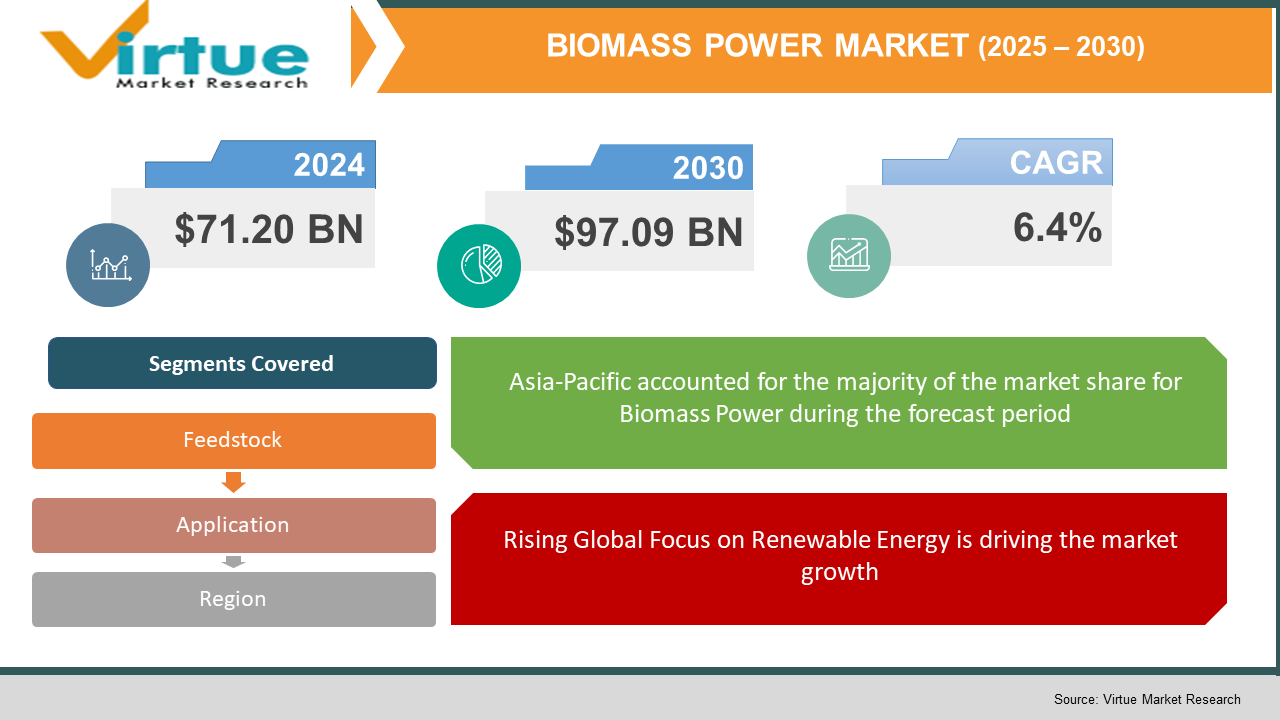

The Global Biomass Power Market was valued at USD 71.20 billion in 2024 and will grow at a CAGR of 6.4% from 2025 to 2030. The market is expected to reach USD 97.09 billion by 2030.

The Biomass Power Market revolves around the use of organic materials such as agricultural residues, wood waste, and other bio-wastes to generate electricity and heat. As governments and industries invest in clean energy infrastructure, biomass offers a versatile and decentralized energy source that can be used across industrial, residential, and commercial sectors. The increasing need for rural electrification, combined with supportive government policies, is expected to drive robust market growth over the coming years.

- Key market insights:

In 2024, the industrial segment accounted for more than 42% of the total biomass power demand due to heavy energy needs and carbon neutrality targets. - Wood chips and forestry residues dominate the feedstock category with a 37% share, driven by established collection networks and high calorific value.

- Asia-Pacific led the global market in 2024, contributing 38% to global revenue owing to aggressive renewable energy investments in China and India.

- Biomass power plants with co-generation capabilities are gaining traction, with over 1,800 installations globally as of 2024.

- The U.S. biomass power generation capacity surpassed 7.5 GW in 2024, supported by federal tax credits and state-level renewable portfolio standards.

- The EU’s Renewable Energy Directive mandates member states to source at least 32% of energy from renewables by 2030, increasing biomass usage in countries like Germany and Sweden.

- Liquid biomass fuels such as bio-oil and syngas are emerging fast, with a CAGR of 8.2% projected between 2025 and 2030.

- Technological innovations in biomass gasification and pelletization have reduced operational costs by up to 15% over the last five years.

Global Biomass Power Market Drivers

Rising Global Focus on Renewable Energy is driving the market growth

One of the primary growth drivers for the biomass power market is the rising global emphasis on renewable and sustainable energy sources. As nations face mounting pressure to reduce carbon emissions and meet international climate agreements, including the Paris Agreement, the shift toward clean energy is accelerating. Biomass power provides a unique advantage among renewables, as it is dispatchable and can generate power consistently unlike solar or wind, which are weather-dependent. Governments around the world are offering subsidies, tax benefits, and grants to biomass energy projects, encouraging infrastructure development and innovation. Additionally, biomass helps utilize organic waste that would otherwise end up in landfills or release methane, a potent greenhouse gas. Countries like India and China are integrating biomass into their rural electrification strategies to expand access to power in remote areas. This strong policy backing and environmental imperative are driving steady growth in biomass power adoption worldwide.

Technological Advancements and Efficiency Gains is driving the market growth

Technological innovation is another significant factor propelling the biomass power market forward. Developments in biomass gasification, anaerobic digestion, and combustion technologies have significantly improved energy efficiency and system reliability. Modern biomass power plants are now equipped with automated control systems, emissions reduction technologies, and integrated waste management capabilities, making them more cost-effective and environmentally friendly. The use of combined heat and power (CHP) systems in biomass facilities has also improved energy output, reducing fuel consumption and operational costs. Moreover, advancements in pelletizing and torrefaction techniques have enhanced the fuel quality of biomass, allowing easier transportation and longer storage. These innovations have helped reduce the Levelized Cost of Electricity (LCOE) from biomass, making it more competitive with fossil fuels and other renewable energy sources. The combination of improved performance, reliability, and economic viability is a major catalyst for the market’s growth.

Circular Economy and Waste-to-Energy Initiatives is driving the market growth

Biomass power plays a pivotal role in the circular economy by converting agricultural, municipal, and industrial waste into a valuable energy resource. Governments and environmental organizations are increasingly advocating for sustainable waste management practices that minimize landfill use and promote energy recovery. In this context, biomass power plants are being established near industrial clusters and urban centers to process large volumes of biodegradable waste efficiently. These waste-to-energy plants help solve dual problems—waste disposal and energy generation—making them highly attractive investments. Moreover, many agro-based economies are promoting the use of crop residues, such as rice husks and bagasse, to produce biomass power. This not only provides an additional income stream for farmers but also reduces the incidence of open-field burning, which contributes to air pollution. With a growing emphasis on zero-waste strategies and sustainable development, biomass power is becoming a cornerstone of integrated environmental solutions.

Global Biomass Power Market Challenges and Restraints

Feedstock Supply Chain Complexity is restricting the market growth

One of the key challenges facing the biomass power market is the complexity of securing a consistent and reliable feedstock supply chain. Unlike fossil fuels that can be easily transported and stored, biomass feedstock such as wood chips, agricultural residues, and organic waste are bulky, perishable, and geographically dispersed. Seasonal availability and competing uses of agricultural waste—such as for fodder or bio-fertilizer—can affect biomass supply for power generation. Additionally, improper storage can lead to feedstock degradation, loss of energy content, and the risk of microbial contamination. Logistics costs associated with biomass transport can also be prohibitively high, especially in regions lacking infrastructure. These supply chain inefficiencies can hinder the scalability and economic feasibility of biomass power projects. Addressing this challenge requires investment in regional feedstock aggregation systems, better warehousing, and transportation networks, along with government incentives to build local biomass supply chains.

Regulatory and Environmental Concerns is restricting the market growth

Despite being a renewable energy source, biomass power is not free from regulatory and environmental scrutiny. Combustion-based biomass plants emit particulates, nitrogen oxides, and carbon monoxide, which can impact air quality if not properly managed. There is also growing debate over the carbon neutrality of biomass, especially when it involves logging or unsustainable sourcing of wood. Some environmental groups argue that large-scale biomass use could lead to deforestation and loss of biodiversity. As a result, stringent regulations and certification requirements have been introduced, particularly in the European Union, to ensure sustainable feedstock sourcing and emission control. These evolving regulations can increase compliance costs and extend project approval timelines. Moreover, uncertainty in long-term policy frameworks—such as subsidy reductions or shifting renewable energy priorities—can deter private sector investment. Addressing these regulatory and ecological challenges is crucial for the long-term viability of the biomass power sector.

Market Opportunities

The global biomass power market presents substantial opportunities for growth as governments and industries intensify efforts to decarbonize their energy systems. One of the most promising avenues lies in the expansion of biomass power in developing countries, where energy access is still limited and agricultural waste is abundantly available. By establishing decentralized biomass power plants in rural and peri-urban areas, governments can promote inclusive energy access while creating local employment opportunities. Furthermore, the adoption of biomass co-firing in existing coal power plants offers a low-cost and low-carbon retrofit solution for countries transitioning from fossil fuels. This hybrid approach enables significant reductions in greenhouse gas emissions without requiring full plant replacements. Another opportunity arises in the integration of biomass with emerging carbon capture and storage (CCS) technologies, resulting in negative emissions—a key goal for net-zero targets. Advanced technologies like fluidized bed gasification and high-efficiency CHP systems are gaining interest from investors and utilities due to their scalability and economic returns. In addition, the rising demand for renewable heating in commercial and industrial settings opens new avenues for biomass boilers and district heating systems. As the circular economy gains momentum, partnerships between municipalities and biomass project developers are emerging to convert urban organic waste into clean power. Finally, expanding international funding and green finance initiatives provide a financial lifeline for large-scale biomass infrastructure projects. Collectively, these opportunities set the stage for robust expansion of the biomass power market over the coming decade.

BIOMASS POWER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.4% |

|

Segments Covered |

By feedstock application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Drax Group, Veolia, Ørsted, Babcock & Wilcox, General Electric, Valmet, Ameresco, Mitsubishi Heavy Industries, Suez, Andritz.

|

Biomass Power Market Segmentation

Biomass Power Market Segmentation By Feedstock:

• Agricultural Waste

• Wood Chips

• Animal Manure

• Energy Crops

• Others

Wood Chips dominate the feedstock segment due to their widespread availability, high energy density, and well-established supply networks. Their ease of storage and compatibility with various biomass technologies have made them the preferred choice for power producers. Wood chips accounted for over 37% of the total feedstock demand in 2024, especially in developed markets with extensive forestry resources and infrastructure.

Biomass Power Market Segmentation By Application:

• Industrial

• Commercial

• Residential

• Power Generation

Large-scale manufacturing facilities and processing plants utilize biomass as a primary energy source for steam and power. The sector’s energy-intensive operations align well with biomass’s capacity for steady, base-load power delivery, and environmental compliance targets further accelerate its adoption.

Biomass Power Market Regional Segmentation

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

The region’s leadership stems from aggressive investments in renewable energy infrastructure, especially in China and India. Both countries have set ambitious targets to diversify their energy mix and reduce dependence on coal, with biomass playing a crucial transitional role. In China, the central government supports biomass heating projects in rural areas and promotes co-generation units for industrial zones. India’s National Bio-Energy Mission and surplus availability of agricultural waste provide fertile ground for biomass growth. Moreover, Southeast Asian nations like Thailand, Vietnam, and Indonesia are tapping into abundant palm oil residues and rice husks to generate distributed energy. The availability of inexpensive labor, favorable policies, and international financing for climate initiatives contribute to the region’s robust biomass ecosystem. Collectively, Asia-Pacific is expected to retain its lead through 2030 due to its resource availability and supportive regulatory environment.

COVID-19 Impact Analysis on the Biomass Power Market

Initially, lockdowns and supply chain disruptions slowed down the construction of new biomass facilities and interrupted the flow of feedstock materials such as wood chips and agricultural waste. Restrictions on labor movement and transportation increased operational costs and led to temporary shutdowns of several small-scale biomass plants, particularly in Asia and South America. The diversion of government attention and financial resources toward healthcare limited funding for renewable energy projects during the early phases of the crisis. However, the pandemic also accelerated a long-term shift toward green energy. Many governments included clean energy initiatives in their post-COVID economic recovery packages, and biomass power featured prominently due to its job creation potential and role in managing urban and agricultural waste. For instance, the European Union’s Green Recovery Plan channeled funds into bioenergy projects. Similarly, India expanded incentives for biomass pellet production and briquetting. The crisis underscored the importance of energy security, prompting many countries to diversify their energy sources through domestic biomass resources. Despite temporary setbacks, the biomass power market rebounded by late 2021 and has since resumed its growth trajectory, supported by renewed policy commitments and technological advancements.

Latest Trends/Developments

Recent developments in the biomass power market reflect a shift toward efficiency, sustainability, and integration with broader energy systems. One key trend is the rise of biomass co-firing, where existing coal-fired plants are modified to use a blend of biomass and coal. This approach offers a cost-effective pathway for utilities to meet emission reduction targets without decommissioning infrastructure. Another important trend is the growing use of digital technologies for performance monitoring and predictive maintenance in biomass plants, improving reliability and operational efficiency. Biomass gasification and pyrolysis are gaining popularity for their ability to produce not just power, but also biochar and syngas, enhancing revenue streams. There is also increasing adoption of carbon capture and storage (CCS) technologies integrated with biomass plants, especially in Europe and North America, leading to the emergence of negative emission solutions. Furthermore, bioenergy with carbon capture and storage (BECCS) is being explored for climate mitigation in alignment with net-zero commitments. On the supply side, advancements in pellet manufacturing and densification are improving fuel quality and transport economics. Additionally, several new financing models, including green bonds and public-private partnerships, are making biomass investments more attractive. These innovations are transforming biomass power into a more flexible, scalable, and competitive component of the global renewable energy mix.

Key Players

- Drax Group

- Veolia

- Ørsted

- Babcock & Wilcox

- General Electric

- Valmet

- Ameresco

- Mitsubishi Heavy Industries

- Suez

- Andritz

Chapter 1. BIOMASS POWER MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. BIOMASS POWER MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. BIOMASS POWER MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. BIOMASS POWER MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. BIOMASS POWER MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. BIOMASS POWER MARKET – By Feedstock

6.1 Introduction/Key Findings

6.2 Agricultural Waste

6.3 Wood Chips

6.4 Animal Manure

6.5 Energy Crops

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Feedstock

6.8 Absolute $ Opportunity Analysis By Feedstock , 2025-2030

Chapter 7. BIOMASS POWER MARKET – By Application

7.1 Introduction/Key Findings

7.2 Industrial

7.3 Commercial

7.4 Residential

7.5 Power Generation

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. BIOMASS POWER MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Feedstock

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Feedstock

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Feedstock

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Feedstock

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Feedstock

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. BIOMASS POWER MARKET – Company Profiles – (Overview, Packaging Feedstock , Portfolio, Financials, Strategies & Developments)

9.1 Drax Group

9.2 Veolia

9.3 Ørsted

9.4 Babcock & Wilcox

9.5 General Electric

9.6 Valmet

9.7 Ameresco

9.8 Mitsubishi Heavy Industries

9.9 Suez

9.10 Andritz

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Biomass Power Market was valued at USD 71.20 billion in 2024 and will grow at a CAGR of 6.4% from 2025 to 2030. The market is expected to reach USD 97.09 billion by 2030.

Key drivers include renewable energy focus, technology advancements, and circular economy and waste-to-energy initiatives.

Segments include Feedstock (Agricultural Waste, Wood Chips, etc.) and Application (Industrial, Commercial, Residential, Power Generation).

Asia-Pacific dominates the market with a 38% share, led by China, India, and Southeast Asia.

Drax Group, Veolia, Ørsted, Babcock & Wilcox, General Electric, Valmet, Ameresco, Mitsubishi Heavy Industries, Suez, Andritz.