Biomass Feedstock Market Size (2025 –2030)

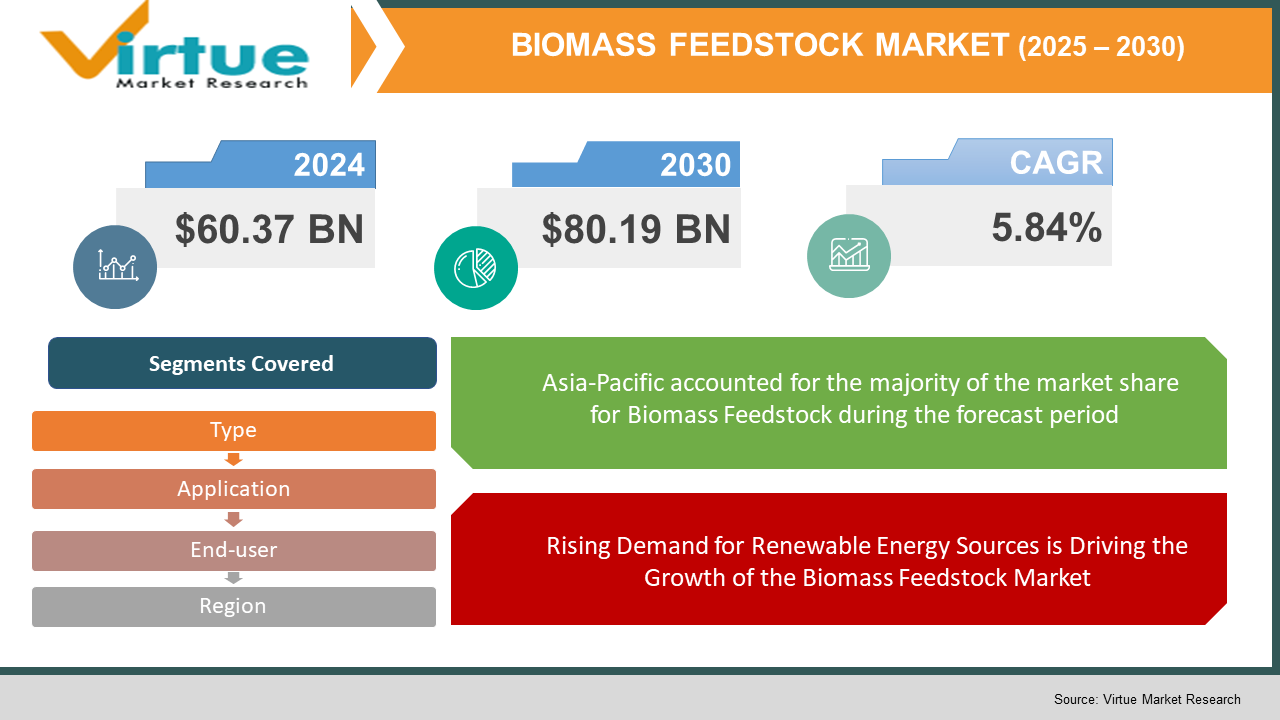

The Global Biomass Feedstock Market was valued at USD 60.37 billion in 2024 and is projected to reach a market size of USD 80.19 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.84%.

The Biomass Feedstock Market is an important component of the global renewable energy sector, providing sustainable raw materials for biofuel production, power generation, and various industrial applications. Biomass feedstock includes organic materials such as agricultural residues, forestry waste, algae, and dedicated energy crops that can be converted into bioenergy and bio-based products. As the world moves towards cleaner energy alternatives, biomass feedstock plays a vital role in reducing carbon emissions, enhancing energy security, and promoting circular economy practices.

With growing government policies supporting bioenergy adoption and technological advancements in biomass processing, the market is witnessing rapid growth. Industries such as power generation, transportation, and bio-based chemicals are significantly investing in biomass solutions to achieve sustainability targets. The rising demand for alternative fuels, coupled with ongoing research into advanced biofuel production, is expected to drive the expansion of the biomass feedstock market in the coming years.

Key Market Insights:

- The biomass feedstock market is witnessing significant growth due to rising environmental concerns and the global shift toward renewable energy sources. According to industry reports, biomass-based energy contributes over 10% of the world’s total energy supply, making it a key player in the global energy transition. The use of biomass for power generation has surged, with over 60% of bioenergy produced globally coming from solid biomass feedstock, including wood pellets, agricultural residues, and forest waste. Governments worldwide are implementing policies to promote biomass utilization, with more than 50 countries integrating bioenergy strategies into their national renewable energy plans.

- Technological advancements are playing an important role in enhancing the efficiency and sustainability of biomass feedstock. The development of second-generation biofuels derived from non-food biomass sources has gained momentum, reducing dependency on traditional fossil fuels. Additionally, biochar production from biomass has increased by nearly 40% over the past decade, offering solutions for soil enhancement and carbon sequestration. The expansion of biomass gasification plants, particularly in Europe and North America, is also contributing to a cleaner and more efficient conversion process, with some facilities achieving conversion efficiencies of over 85%.

- The transportation sector is a key consumer of biomass-derived fuels, with bioethanol and biodiesel meeting approximately 5% of the world’s transportation fuel demand. Countries like the United States, Brazil, and Germany are leading the way in biofuel adoption, with mandates requiring a minimum blending of 10-15% biofuels in conventional fuel mixes. Meanwhile, industrial applications of biomass feedstock, including bioplastics and bio-based chemicals, have grown by over 30% in the past five years, reflecting increasing consumer demand for sustainable products.

Biomass Feedstock Market Drivers:

Rising Demand for Renewable Energy Sources is Driving the Growth of the Biomass Feedstock Market

As global energy need increases and concerns over climate change intensify, governments and industries are aggressively seeking alternatives to fossil fuels. Biomass feedstock has emerged as a viable renewable energy source, significantly contributing to bioenergy, biofuels, and bioproducts. Policies promoting sustainable energy, such as the Renewable Energy Directive (RED) in Europe and the Renewable Fuel Standard (RFS) in the U.S., are accelerating the adoption of biomass feedstocks. This rising demand for renewable energy is fostering investments in biomass production, refining, and infrastructure development, propelling market expansion.

Advancements in Biomass Conversion Technologies Are Enhancing Feedstock Utilization and Market Growth

The evolution of biomass conversion technologies, including pyrolysis, gasification, and biochemical processes, has remarkably improved the efficiency and feasibility of biomass feedstock utilization. Advanced bio-refining techniques are enabling the conversion of a wide range of biomass materials, such as agricultural residues, algae, and forestry waste, into high-value biofuels and bioproducts. The development of second-generation and third-generation biofuels is further boosting the market, as these innovations offer higher energy yields and lower carbon footprints compared to traditional biofuels.

Government Incentives and Carbon Reduction Policies Are Boosting Biomass Feedstock Adoption

Many governments worldwide are implementing financial incentives, subsidies, and tax benefits to encourage the use of biomass feedstock as part of their carbon reduction strategies. Programs such as carbon credit trading and subsidies for biofuel production are driving investments in the sector. Additionally, stringent emission regulations and carbon neutrality goals set by organizations like the United Nations and the International Energy Agency (IEA) are compelling industries to integrate biomass feedstocks into their energy portfolios.

Increasing Agricultural and Forestry Waste Utilization is Expanding Biomass Feedstock Supply

The increasing emphasis on waste-to-energy initiatives is transforming agricultural and forestry residues into valuable biomass feedstock sources. Farmers and industries are recognizing the economic potential of converting waste materials such as corn stover, wood chips, and sugarcane bagasse into bioenergy. Circular economy initiatives and sustainability programs are further encouraging industries to repurpose organic waste, reducing environmental pollution while simultaneously creating new revenue streams. This increasing biomass feedstock supply is enhancing market availability and affordability, strengthening its role in the global energy transition.

Biomass Feedstock Market Restraints and Challenges:

High Production Costs and Supply Chain Complexities Pose Significant Challenges in the Biomass Feedstock Market

Despite the increasing demand for biomass feedstock, high production costs, logistical challenges, and supply chain inefficiencies are significant barriers to market growth. The collection, transportation, and storage of biomass materials require substantial investments in infrastructure, making large-scale adoption expensive. Additionally, seasonal availability and inconsistent feedstock quality pose challenges for industries relying on biomass as a primary energy source. Regulatory uncertainties and competition with other renewable energy sources, such as solar and wind, further limit market expansion. Without advancements in cost-effective processing technologies and improved supply chain management, the widespread commercialization of biomass feedstock may face delays.

Biomass Feedstock Market Opportunities:

The rising emphasis on renewable energy and advancements in biomass conversion technologies present significant opportunities for the biomass feedstock market. Innovations in bio-refining, torrefaction, and gasification are enhancing the efficiency of biomass processing, making it a more viable alternative to fossil fuels. Additionally, government incentives and carbon credit programs are encouraging industries to adopt biomass as a sustainable energy source. The increasing demand for bio-based chemicals, sustainable aviation fuels, and biomass-based hydrogen further expands market potential. With the rising focus on circular economy practices and waste-to-energy initiatives, the biomass feedstock market is poised for long-term growth and investment opportunities.

BIOMASS FEEDSTOCK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.84% |

|

Segments Covered |

By Type, application, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Enviva Partners, LP, Drax Group plc, and New Energy Blue |

Biomass Feedstock Market Segmentation:

Biomass Feedstock Market Segmentation: By Type:

- Agricultural Residues

- Wood & Forestry Residues

- Energy Crops

- Algae

- Municipal & Industrial Waste

Wood and forestry residues hold the dominant position in the biomass feedstock market because of their widespread availability, high energy content, and established use in power generation, heating, and biofuel production. These residues, including sawdust, wood chips, and bark, are by-products of the timber and paper industries, reducing dependency on fossil fuels while supporting waste-to-energy initiatives. The growing demand for pelletized biomass in industrial and residential applications further solidifies this segment’s leadership in the market.

Algae is the fastest-growing biomass feedstock segment, fueled by its rapid growth rate, high lipid content for biofuel production, and minimal land requirements compared to traditional energy crops. With ongoing research in algae-based biofuels and carbon sequestration, this segment is gaining traction as a promising solution for sustainable energy generation. Advancements in biotechnology and large-scale algae cultivation are further accelerating its adoption in renewable energy, bioplastics, and pharmaceutical applications.

Biomass Feedstock Market Segmentation: By Application:

- Biofuels

- Biopower

- Bioproducts

Biofuels dominate the biomass feedstock market, driven by growing global demand for sustainable energy alternatives and stringent environmental regulations limiting fossil fuel consumption. Ethanol and biodiesel, derived from biomass sources like agricultural residues, energy crops, and algae, are widely used in transportation and industrial applications. Government policies promoting biofuel blending and subsidies for renewable energy projects further reinforce the dominance of this segment.

Bioproducts are the fastest-growing segment as industries shift towards eco-friendly and biodegradable alternatives for plastics, chemicals, and pharmaceuticals. Derived from biomass sources such as agricultural waste and algae, bioproducts include bio-based plastics, chemicals, and specialty materials used in various consumer and industrial applications. Increasing consumer preference for sustainable products and advancements in biotechnology are accelerating the adoption of bioproducts worldwide.

Biomass Feedstock Market Segmentation: By End-user:

- Energy & Power

- Transportation

- Chemical Industry

- Agriculture

The Energy & Power sector dominates the biomass feedstock market, as biomass is widely used for electricity generation and heat production. Power plants and industrial facilities use agricultural residues, wood, and forestry waste to produce bioenergy, reducing dependence on coal and natural gas. Governments worldwide are incentivizing biomass-based energy projects through renewable energy policies and subsidies, reinforcing the leadership of this segment.

The Transportation sector is the fastest-growing segment, fueled by the rapid expansion of biofuels such as ethanol and biodiesel as alternatives to conventional gasoline and diesel. Increasing mandates for biofuel blending, carbon reduction targets, and advancements in biofuel production technologies are accelerating the adoption of biomass-derived fuels in aviation, marine, and automotive industries, making transportation the most rapidly expanding market segment.

Biomass Feedstock Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The Asia-Pacific region is the dominant market for biomass feedstock, accounting for approximately 45% of the global share. This dominance is fueled by high agricultural residue availability, government incentives for bioenergy projects, and the rapid expansion of biomass-based power plants in countries like China and India. Additionally, strong demand for renewable energy and biofuels has solidified the region's leading position.

The fastest-growing region is Europe, with a growing adoption rate of biomass feedstock due to stringent carbon reduction policies and aggressive renewable energy targets. Countries such as Germany, Sweden, and the Netherlands are heavily investing in biomass-based power generation, biofuels, and bio-based chemicals. The European Union’s push for circular economy initiatives and sustainability goals is further accelerating the growth of this market segment.

COVID-19 Impact Analysis on the Global Biomass Feedstock Market:

The COVID-19 pandemic had a mixed impact on the global biomass feedstock market. During the initial phases, supply chain disruptions, labor shortages, and restrictions on transportation severely affected biomass collection and processing. Industries relying on biomass for bioenergy and biofuels faced delays in production, and decreased industrial activity resulting to lower demand for biomass-based energy. Additionally, the decline in global transportation significantly reduced the consumption of biofuels, leading to a temporary slowdown in the market.

Latest Trends/ Developments:

The biomass feedstock market is experiencing significant advancements driven by technological innovation and increasing sustainability initiatives. One of the major trends is the growing adoption of second-generation and third-generation biofuels derived from non-food biomass sources, such as agricultural residues, algae, and municipal waste. These advanced biofuels offer higher energy efficiency and lower carbon emissions, making them a preferred choice for the transportation and energy sectors. Additionally, the development of torrefaction and pyrolysis technologies is enhancing biomass processing efficiency, enabling higher energy yields and expanding applications in biochar, biogas, and renewable chemicals. Governments worldwide are also introducing stricter renewable energy mandates, boosting investments in biomass conversion technologies and infrastructure.

Another key development is the rising role of biomass in carbon capture and utilization (CCU) projects. With industries focusing on achieving net-zero emissions, biomass is being integrated with carbon capture systems to produce negative-emission bioenergy (BECCS). Moreover, the shift toward decentralized energy systems has led to a rise in small-scale biomass power plants, particularly in rural and off-grid areas. The expansion of circular economy initiatives is also driving the use of biomass-derived products, such as biodegradable plastics and sustainable aviation fuels. These trends indicate a strong push toward bio-based solutions as industries and governments seek alternatives to fossil fuels and aim for long-term energy security and sustainability.

Key Players:

- Archer Daniels Midland Company

- Enviva Partners, LP

- Drax Group plc

- New Energy Blue

- Neste Corporation

- Babcock & Wilcox Enterprises, Inc.

- Vattenfall AB

- UPM-Kymmene Corporation

- Pacific BioEnergy Corporation

- Lignetics, Inc.

- Biomass Secure Power Inc.

- Ameresco, Inc.

- Enerkem Inc.

- Green Plains Inc.

- Georgia Biomass, LLC (Enviva Biomass)

Chapter 1. Biomass Feedstock Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Biomass Feedstock Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Biomass Feedstock Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & End-user Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Biomass Feedstock Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Biomass Feedstock Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Biomass Feedstock Market – By Type

6.1 Introduction/Key Findings

6.2 Agricultural Residues

6.3 Wood & Forestry Residues

6.4 Energy Crops

6.5 Algae

6.6 Municipal & Industrial Waste

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. Biomass Feedstock Market – By End-user

7.1 Introduction/Key Findings

7.2 Energy & Power

7.3 Transportation

7.4 Chemical Industry

7.5 Agriculture

7.6 Y-O-Y Growth trend Analysis By End-user

7.7 Absolute $ Opportunity Analysis By End-user , 2025-2030

Chapter 8. Biomass Feedstock Market – By Application

8.1 Introduction/Key Findings

8.2 Biofuels

8.3 Biopower

8.4 Bioproducts

8.5 Y-O-Y Growth trend Analysis Application

8.6 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 9. Biomass Feedstock Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By End-user

9.1.3. By Application

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By End-user

9.2.3. By Application

9.2.4. By Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By End-user

9.3.3. By Application

9.3.4. By Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By End-user

9.4.4. By Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By End-user

9.5.4. By Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Biomass Feedstock Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Archer Daniels Midland Company

10.2 Enviva Partners, LP

10.3 Drax Group plc

10.4 New Energy Blue

10.5 Neste Corporation

10.6 Babcock & Wilcox Enterprises, Inc.

10.7 Vattenfall AB

10.8 UPM-Kymmene Corporation

10.9 Pacific BioEnergy Corporation

10.10 Lignetics, Inc.

10.11 Biomass Secure Power Inc.

10.12 Ameresco, Inc.

10.13 Enerkem Inc.

10.14 Green Plains Inc.

10.15 Georgia Biomass, LLC (Enviva Biomass)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Biomass Feedstock Market was valued at USD 60.37 billion in 2024 and is projected to reach a market size of USD 80.19 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.84%.

There is a growing demand for renewable energy, biofuels, and sustainable waste management solutions.

Based on Application, the Global Biomass Feedstock Market is segmented into Biofuels, Biopower, and Bioproducts.

Asia-Pacific is the most dominant region for the Global Biomass Feedstock Market.

Archer Daniels Midland Company, Enviva Partners, LP, Drax Group plc, and New Energy Blue are the leading players in the Global Biomass Feedstock Market