Biomass-Derived Acrylonitrile Market Size (2023 – 2030)

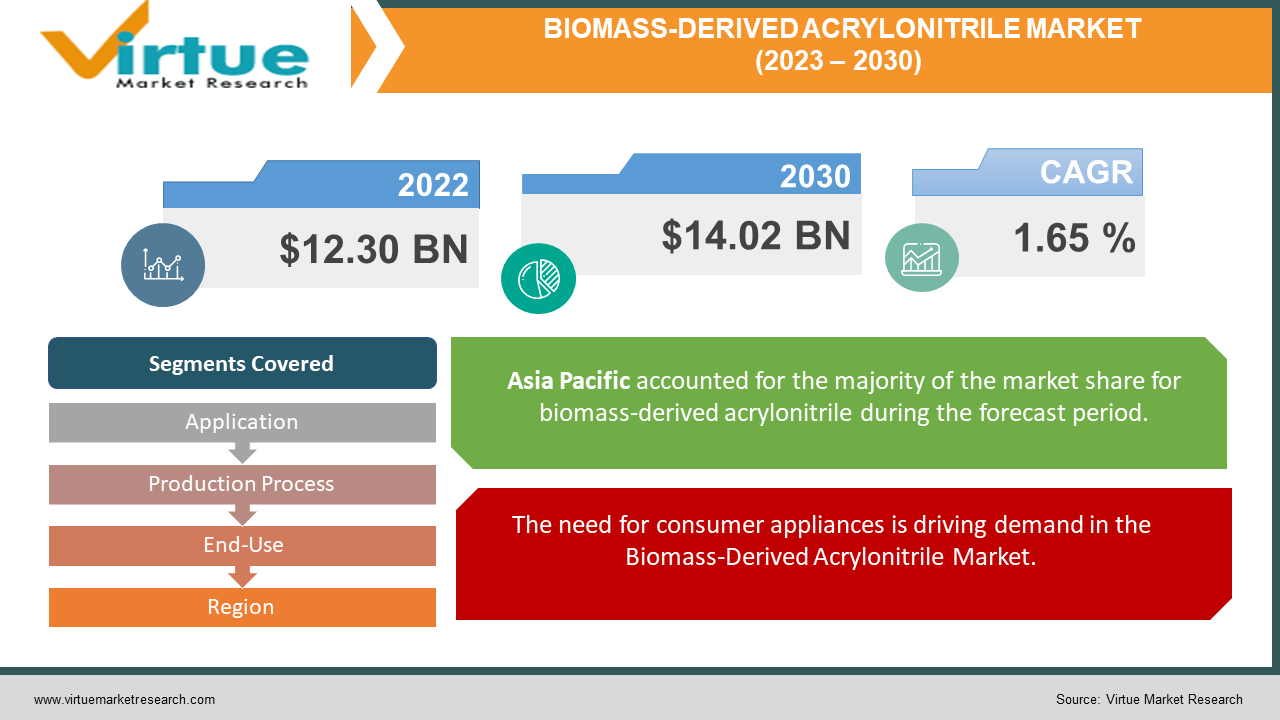

The Global Biomass-Derived Acrylonitrile Market was estimated to be worth USD 12.30 Billion in 2022 and is anticipated to reach a value of USD 14.02 Billion by 2030, growing at a fast CAGR of 1.65 % during the outlook period 2023-2030.

The manufacturing of different materials, including synthetic fibres, plastics, resins, and elastomers, uses the colourless liquid acrylonitrile. It is a crucial ingredient in the production of acrylic fibres, which are widely used in textiles for homes and apparel. The expanding need for these materials across numerous industries, including textile, automotive, and construction, is what is driving the global market. The primary factor driving the market is the rising demand for acrylic fibres, which are frequently used in apparel, home textiles, and industrial applications. The market is expanding because of the rising demand for plastics and resins, which are used in numerous industries such as packaging, automotive parts, and construction materials. The largest acrylonitrile market is in Asia-Pacific, with China serving as both the material's primary production and user. Due to the expanding textile and automotive industries, the region is anticipated to maintain its dominance during the projection period. However, considerations including environmental worries associated with acrylonitrile synthesis and fluctuating prices of raw materials like propylene and ammonia may limit market expansion.

Global Biomass-Derived Acrylonitrile Market Drivers:

The need for consumer appliances is driving demand in the Biomass-Derived Acrylonitrile Market.

As consumer appliances demonstrate qualities like heat resistance and chemical resistance, product demand is rising as well. The need for consumer appliances is anticipated to be driven by evolving lifestyles, expanding consumer tastes, and rising per capita income. This would in turn increase demand for acrylonitrile in the consumer appliances sector. Acrylonitrile use is anticipated to rise along with the automobile sector's expansion. It is frequently employed in the automotive sector due to its low weight and strong strength & durability at low temperatures. High demand for acrylic fibres, particularly in the automotive sector, is predicted to support industrial growth.

The growing use of acrylic fibres is driving growth in the Biomass-Derived Acrylonitrile Market.

The growing use of acrylic fibres is driving up the demand for acrylonitrile. Additionally, the expansion of the textile and apparel sectors in Asia Pacific will be aided by the region's quick urbanisation. Strong resistance against microbiological attack, UV deterioration, and laundry bleach exists in acrylic fibres. Because they are lightweight, these fibres make great choices for clothing. It serves as the primary raw ingredient for the production of acrylic fibres. The textile and apparel industries employ acrylic fibre because of its lightweight characteristics. However, the availability of new, less expensive polyester fibres may cause the demand to decline. Additionally, it is predicted that the market for acrylic fibres will be hampered by the desire for bio-based polymers, particularly in developed nations.

Increasing demand for acrylic fibres in the healthcare industry is driving growth in the market.

Numerous medical products, such as bed linens, surgical gowns, and wound dressings, employ acrylic fibres. The need for acrylonitrile, a crucial ingredient in the creation of acrylic fibres utilised in various applications, is rising along with the demand for healthcare products.

Global Biomass-Derived Acrylonitrile Market Challenges:

The price of acrylonitrile's raw ingredients, including propylene, ammonia, and natural gas, has a significant impact on the market. It is anticipated that the price volatility of these raw materials will have an impact on the profitability of acrylonitrile producers and could cause changes in the price of acrylonitrile.

To increase fuel efficiency and lower emissions, the automotive and aerospace sectors are increasingly putting a priority on the development of lightweight materials. Carbon fibres, which are strong and lightweight and are frequently employed in various industries, are produced using acrylonitrile.

Global Biomass-Derived Acrylonitrile Market Opportunities:

Carbon fibres are widely employed in a variety of industries, including aerospace, automotive, and construction, and acrylonitrile is a crucial raw ingredient for their manufacturing. In the upcoming years, it's anticipated that the demand for carbon fibres will increase quickly, opening up a sizable window of opportunity for the acrylonitrile market.

A variety of high-performance polymers, including polyacrylonitrile (PAN) and acrylonitrile-butadiene-styrene (ABS), are made using acrylonitrile as a monomer. The acrylonitrile market is anticipated to expand as a result of the rising demand for high-performance polymers in several sectors, including electronics and the automotive industry.

A crucial chemical intermediary that is produced from acrylonitrile is acrylamide. It is extensively employed in the creation of chemicals for papermaking, water treatment, and a variety of other products. It is anticipated that the rising demand for these goods will increase demand for acrylamide and open up opportunities for the acrylonitrile market.

COVID-19 Impact on Global Biomass-Derived Acrylonitrile Market:

COVID-19 hurt the market in 2020. However, when industrial activity increased and acrylonitrile was used more frequently in a variety of applications, including the manufacturing of acrylonitrile butadiene styrene and acrylic fibre, the market had a major recovery in the years 2021–2022.

The market is expected to increase over the next few years as a result of rising demand for acrylonitrile butadiene styrene (ABS) in the construction and automotive industries as well as growing uses in consumer electronics and appliances.

Global Biomass-Derived Acrylonitrile Market Recent Developments:

-

Asahi Kasei announced in January 2022 that it would start producing acrylonitrile using raw materials produced from biomass. Asahi Kasei's wholly-owned South Korean subsidiary, Tongsuh Petrochemical Corp., Ltd. (TSPC), received the international ISCC PLUS1 certification for its acrylonitrile as a sustainable product. In February 2022, the business planned to start producing acrylonitrile utilising biomass propylene.

-

The Sinopec subsidiary SECCO Petrochemical Co. Ltd. manufactures 4.2 million tonnes of olefins, polymers, and other derivatives per year, including ethylene, propylene, acrylonitrile, and other substances. In July 2022, INEOS purchased 50% of this company. The plant is located inside the Shanghai Chemical Industry Park, a 200-hectare area.

-

In July 2022, Sinopec subsidiary SECCO Petrochemical Co. Ltd. was acquired by INEOS for a 50% share. SECCO Petrochemical generates 4.2 million tonnes of derivatives each year, including olefins, polymers, ethylene, propylene, and acrylonitrile. The 200-hectare complex is housed in the Shanghai Chemical Industry Park.

-

In October 2021, INEOS Nitriles said that the €190 million ($230 million) capacity expansion project at its Green Lake plant in Texas had been completed, resulting in a 50% increase in production capacity.

BIOMASS-DERIVED ACRYLONITRILE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

1.65 % |

|

Segments Covered |

By Application, Production Process, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

INEOS, China Petrochemical Development Corp., Asahi Kasei Advance Corp., Ascend Performance Material, Chemelot, Formosa Plastics Corp., Mitsubishi Chemical Corp., Secco,Taekwang Industrial Co., Ltd., Sumitomo Chemical Co., Ltd. |

Global Biomass-Derived Acrylonitrile Market Segmentation: By Application

-

Acrylic Fiber

-

Adiponitrile

-

Styrene Acrylonitrile

-

Acrylonitrile Butadiene Styrene (ABS)

-

Acrylamide

-

Carbon Fiber

-

Nitrile Rubber

-

Others

In 2021, acrylonitrile butadiene styrene held the largest market share, contributing more than 28.60% of the total revenue. This is a result of the product's expanding application in the construction industry, consumer goods, electronics, automotive, and consumer goods. The product is also more durable than PVC, corrosion-resistant, and has great mechanical strength. Since carbon fibre is strong, light, and incredibly rigid, making it suitable for building materials, it is anticipated to develop at the fastest pace during the projected period.

The aerospace and defence, automotive, alternative energy, and construction industries all use carbon fibre extensively. Because of the significant investments being made in aerospace technology, particularly in nations like China and India, the market for carbon fibre is predicted to expand more quickly in Asian nations. However, it is projected that in the upcoming years, demand for carbon fibre will be substantially constrained by its high price. Butadiene and acrylonitrile are copolymerized to create nitrile rubber, a synthetic rubber. Its resilience to oil and solvents makes it a good candidate for use as a synthetic rubber.

The segment growth is anticipated to be aided by the rising demand for nitrile rubber, which is used to manufacture non-latex gloves, auto gearbox belts, adhesives and binders. Acrylic fibre is created by combining monomers with chemicals derived from petroleum. Its low weight, high performance, high insulin, and good moisture control capabilities make it useful in the textile industry. Polyester fibre has essentially replaced acrylic fibre in the textile business since it is reasonably inexpensive. The textile sector is likely to be the main market for acrylic fibre.

Global Biomass-Derived Acrylonitrile Market Segmentation: By Production Process

-

Propylene ammoxidation

-

Propane ammoxidation

-

Others

Propylene ammoxidation makes up the greatest portion of the global acrylonitrile market's production process segment. With over 90% of the market share, this procedure is the most popular way to produce acrylonitrile. To create acrylonitrile, the propylene ammoxidation method comprises the interaction of propylene, ammonia, and air over a catalyst. The procedure is very effective and economical, making it the method of choice for the majority of producers.

The propane ammoxidation process is the area of the production process segment that is expanding the fastest. Using this process, acrylonitrile is created by the reaction of propane, ammonia, and air over a catalyst. Since propane ammoxidation is a more recent technological advancement, it has several benefits over propylene ammoxidation. It requires less energy, emits less CO2 emissions, and yields more acrylonitrile. As a result, firms seeking to lower their carbon footprint and enhance their environmental performance are increasingly turning to the propane ammoxidation process.

Global Biomass-Derived Acrylonitrile Market Segmentation: By End-Use

-

Automotive

-

Construction

-

Electrical and Electronics

-

Textile

-

Packaging

-

Others

The market for acrylic fibre is expected to be driven by the expanding textile and clothing industries in emerging nations of the Asia-Pacific region over the projected period due to increased urbanisation and rising affordability.

Acrylic fibres are widely employed in the packaging and textile sectors. In addition to having strong resistance to microbiological attack, UV deterioration, and laundry bleach, they also have a pleasing appearance.

These fibres are excellent for clothing since they are soft, lightweight, and have a comforting feel. Rapid urbanisation has had a significant impact on people's way of life. The need for transit rises along with urbanisation.

Numerous automakers have established manufacturing facilities around the world to accommodate this expanding demand. The demand for spare parts, accessories, and raw materials has increased along with the demand for automotive components, add-ons, and materials.

Automobile bumpers, dashboards, seats, lighting fixtures, centre consoles, and headliners are all made of the chemical compound acrylonitrile. Such widespread uses in recent years have greatly increased the market potential for this drug.

Global Biomass-Derived Acrylonitrile Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

Middle East and Africa

-

South America

In 2021, the Asia Pacific area had the biggest revenue share in the worldwide market, exceeding 55.70%. This can be linked to the rising demand for building supplies brought on by the expanding construction industry. The market is also anticipated to benefit from growing demand from the textile and home furnishings industries. Building new commercial and residential structures is a priority for the emerging nations of the Asia-Pacific region, including China and India, and this trend is anticipated to continue. The regional market is additionally driven by factors including the rising demand for energy-efficient building materials and developments in civil construction.

Through joint ventures and licencing agreements, the major firms, who are well-represented in the Asia Pacific area, continue to engage in organic expansion. The ABS market in these nations is being driven by the relocation of end-use sectors including automotive, marine, and furniture to cost-competitive nations. Due to the considerable presence of important companies, like Ascend Performance Material in the United States, North America is predicted to have tremendous growth. Over the projected period, it is anticipated that the aforementioned companies' primary focus on new product advancements in construction and automotive items will foster industry growth.

Global Biomass-Derived Acrylonitrile Market Key Players:

-

INEOS

-

China Petrochemical Development Corp.

-

Asahi Kasei Advance Corp.

-

Ascend Performance Material

-

Chemelot

-

Formosa Plastics Corp.

-

Mitsubishi Chemical Corp.

-

Secco

-

Taekwang Industrial Co., Ltd.

-

Sumitomo Chemical Co., Ltd.

Chapter 1. Biomass-Derived Acrylonitrile Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Biomass-Derived Acrylonitrile Market– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Biomass-Derived Acrylonitrile Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Biomass-Derived Acrylonitrile Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Biomass-Derived Acrylonitrile Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Biomass-Derived Acrylonitrile Market– By Application

6.1. Introduction/Key Findings

6.2 Acrylic Fiber

6.3 Adiponitrile

6.4 Styrene Acrylonitrile

6.5 Acrylonitrile Butadiene Styrene (ABS)

6.6 Acrylamide

6.7 Carbon Fiber

6.8 Nitrile Rubber

6.9 Others

6.10 Y-O-Y Growth trend Analysis By Application

6.11 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 7. Biomass-Derived Acrylonitrile Market– By Production Process

7.1. Introduction/Key Findings

7.2 Propylene ammoxidation

7.3 Propane ammoxidation

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Production Process

7.6 Absolute $ Opportunity Analysis By Production Process, 2023-2030

Chapter 8. Biomass-Derived Acrylonitrile Market - By End-Use

8.1. Introduction/Key Findings

8.2 Automotive

8.3 Construction

8.4 Electrical and Electronics

8.5 Textile

8.6 Packaging

8.7 Others

8.8 Y-O-Y Growth trend Analysis By Production Process

8.9 Absolute $ Opportunity Analysis By Production Process, 2023-2030

Chapter 9. Biomass-Derived Acrylonitrile Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2 By Application

9.1.3 By Production Process

9.1.4. By End-Use

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1. U.K.

9.2.2. Germany

9.2.3. France

9.2.4. Italy

9.2.5. Spain

9.2.6. Rest of Europe

9.2.2 By Application

9.2.3 By Production Process

9.2.4. By End-Use

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. Rest of Asia-Pacific

9.3.2 By Application

9.3.3. By Production Process

9.3.4. By End-Use

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Colombia

9.4.4. Chile

9.4.5. Rest of South America

9.4.2 By Application

9.4.3. By Production Process

9.4.4. By End-Use

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1. United Arab Emirates (UAE)

9.5.2. Saudi Arabia

9.5.3. Qatar

9.5.4. Israel

9.5.5. South Africa

9.5.6. Nigeria

9.5.7. Kenya

9.5.8. Egypt

9.5.9. Rest of MEA

9.5.2. By Application

9.5.3. By Production Process

9.5.4. By End-Use

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Biomass-Derived Acrylonitrile Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 INEOS

10.2 China Petrochemical Development Corp.

10.3 Asahi Kasei Advance Corp.

10.4 Ascend Performance Material

10.5 Chemelot

10.6 Formosa Plastics Corp.

10.7 Mitsubishi Chemical Corp.

10.8 Secco

10.9 Taekwang Industrial Co., Ltd.

10.10 Sumitomo Chemical Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Biomass-Derived Acrylonitrile Market was estimated to be worth USD 12.30 Billion in 2022 and is anticipated to reach a value of USD 14.02 Billion by 2030, growing at a fast CAGR of 1.65 % during the outlook period 2023-2030.

The Segments under the Global Biomass-Derived Acrylonitrile Market by End-Use are Automotive, Construction, Electrical and Electronics, Textile, Packaging, and others.

Some of the top industry players in the Biomass-Derived Acrylonitrile Market are INEOS, China Petrochemical Development Corp., Asahi Kasei Advance Corp., Ascend Performance Material, Chemelot Etc.

The Global Biomass-Derived Acrylonitrile market is segmented based on Application, Production Process, End-Use and Region.

Asia-Pacific region held the highest share in the Global Biomass-Derived Acrylonitrile market.