Biomass Boiler Market Size (2024 – 2030)

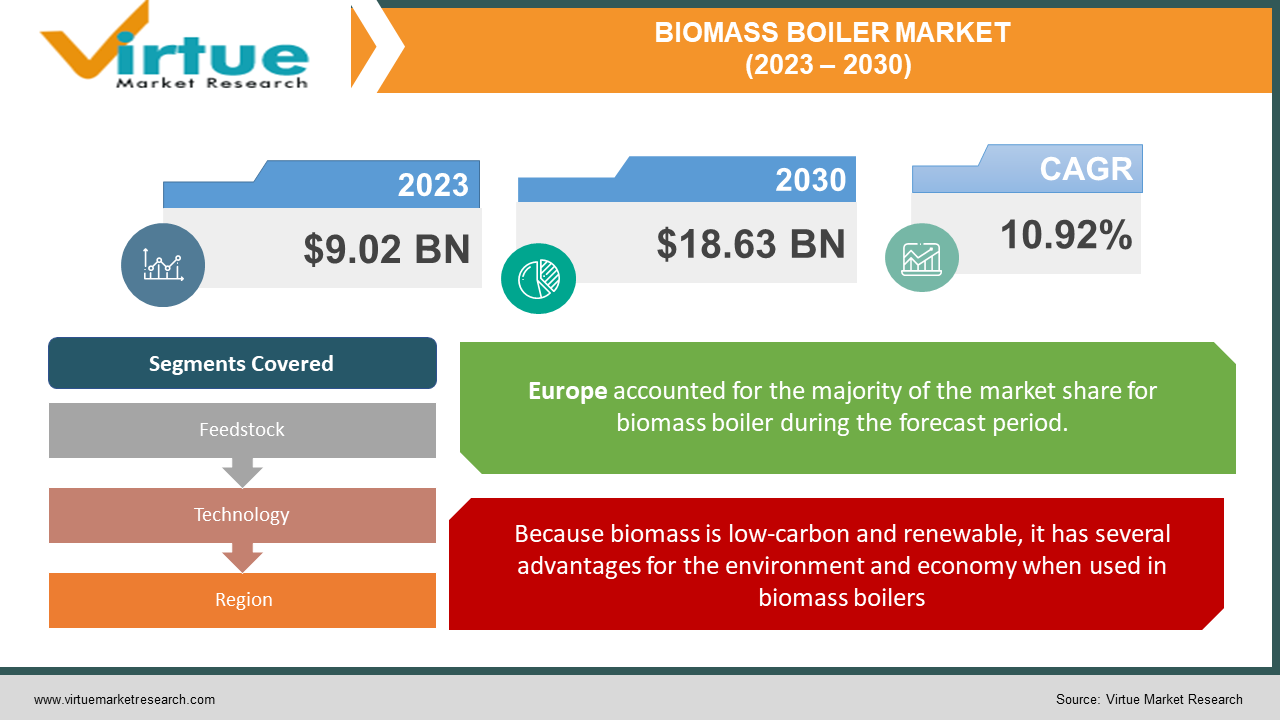

The Global Biomass Boiler Market was valued at USD 9.02 billion in 2023 and is projected to reach a market size of USD 18.63 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.92%.

A biomass boiler refers to a type of heating system that uses sources such, as forestry residues, logs, and wood pellets to generate heat. The primary fuel used is wood and biomass boilers are commonly found in hotels, farms, homes, and other establishments. One of the advantages of biomass boilers is their ability to minimize greenhouse gas emissions due to their carbon footprint. These boilers burn logs, chips, or pellets to produce heat for water heating or electric heating purposes. Installing a biomass boiler is relatively straightforward; however, it requires space for fuel storage and the boiler itself. The popularity of biomass boilers stems from their carbon dioxide emissions. They are installed in locations including buildings, district heating systems, universities, hospitals, hotels, farms community centers, and residential properties. The growth of the biomass boiler market is driven by government regulations concerning impact as well as increasing awareness about environmental risks. Among types of feedstocks used for heat production in 2021, woody biomass holds the market share and is expected to remain dominant until 2026. Additionally, in the 2021 product-wise segment, biomass drivers held the market share.

Key Market Insights:

The Renewable Energy Directive of the EU establishes goals, for Member States to encourage and utilize energy sources like biomass boilers. Additionally, it offers incentives, for households and businesses to adopt heating systems.

The Renewable Heat Incentive (RHI) program, in the United Kingdom has been promoting the adoption of biomass boilers for a decade. It offers assistance, to both businesses and households that choose to install biomass boiler systems.

The Ecodesign Directive of the European Union establishes energy efficiency standards, for appliances, like biomass boilers. This ensures that only products meeting the criteria can be legally sold in the market.

In England and Wales, new buildings must comply with the energy efficiency standards outlined in the U.K. Building Regulations. This includes the incorporation of heating systems, like biomass boilers when deemed suitable.

The U.S. Department of Energy program, for Appliance and Equipment Standards has set energy efficiency requirements for biomass boilers, in the United States. This ensures that these boilers are both effective and economical when used as heating systems.

Biomass Boiler Market Drivers:

Because biomass is low-carbon and renewable, it has several advantages for the environment and economy when used in biomass boilers.

Due, to the properties of biomass there is a growing need to install biomass boilers in both developed and developing nations. Moreover, government policies focused on promoting energy and reducing carbon emissions are playing a role, in expanding the market. Additionally, regulatory frameworks and government subsidies offer investment incentives and tax advantages to industries adopting energy sources. These measures encourage biomass heating companies to transition to biomass on a scale resulting in the expansion of the biomass boiler market.

Biomass Boiler Market Restraints and Challenges:

Wood biomass is widely used as a fuel, in biomass power plants because it is easily accessible. However, its transportation costs to the site are high due to its energy value.

The decrease in efficiency of biomass over time along with increased emissions and ash buildup are some of the challenges that may impede market growth. Despite the benefits of using biomass systems, there are concerns about their impact on the environment. Emissions from biomass systems can have an effect, on air quality and human health which could hinder market expansion. Additionally controlling biomass boilers is more complex compared to controlling gas or oil heating systems, which also limits market growth.

Biomass Boiler Market Opportunities:

The growth of this market is largely driven by the increased capacity, in sectors such as sugar, rice, biorefinery, and pulp and paper. These industries produce an amount of waste and wood biomass, which can be utilized as fuel in biomass plants. The demand for ethanol further emphasizes the necessity for agricultural waste biomass boilers and biomass wood. Consequently, the expansion of these industries will contribute to the growth of the biomass boiler market, in the future.

BIOMASS BOILER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.92% |

|

Segments Covered |

By Feedstock, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thermax Limited, Babcock & Wilcox Enterprises, Forbes Marshall, Hurst Boiler & Welding Co., John Cockerill, John Wood Group PLC, Sofinter S.p.a, Walchandnagar Industries, VIESSMANN, HARGASSNER, Fröling Heizkessel- und Behälterbau Ges.m.b.H., DP CleanTech, Thermodyne Boiler, ANDRITZ |

Biomass Boiler Market Segmentation: By Feedstock

-

Woody Biomass

-

Agricultural Biomass

-

Urban Residue

According to estimates, the woody biomass category is expected to account for, over 52% of the market share by 2026. The increased adoption of short-rotation woody crops, which promote recycling and contribute to water and soil conservation plays a role in driving the growth potential of this market segment, in the foreseeable future.

Biomass Boiler Market Segmentation: By Technology

-

Stoker Boiler

-

Fluidized Bed Boiler

According to the market study experts have determined that the heating boiler industry emerged as the leading market segment, in the projected timeframe. One of the reasons behind its adoption is its capability to generate heat by burning a specific type of fuel. Additionally, its high efficiency and affordability contribute significantly to its dominance, in this sector with a projected market share exceeding 79% by 2026.

Biomass Boiler Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe is expected to be the leading market, for biomass boilers in terms of geography in the future. Europe accounted for a market share of 36% in the biomass boiler market in 2023. This dominance can be attributed to the government’s regulations on greenhouse gas emissions, which has led to an increased demand for biomass boilers in countries like the United Kingdom and France. Additionally, government initiatives such as Heating Incentives (RHI) are also planned to support the expansion of this market by reducing reliance on fuels. North America is another market for biomass boilers due to growing awareness among people about energy-saving solutions and their efforts to reduce greenhouse gas emissions. The United States stands out as a player, in this region.

The Asia Pacific region is expected to experience growth, in the biomass boiler market in the future. This growth can be attributed to the development and increasing acceptance of renewable heating solutions among consumers. China and Japan are leading the way in this region thanks to their investments, in infrastructure development.

COVID-19 Impact Analysis on the Global Biomass Boiler Market:

The increasing recognition of the importance of livestock nutrition, along with the modernization of the livestock industry and the high demand for meat and other livestock products has led to a growth in the feed industry. However, due to COVID-19, animal feed manufacturers and producers are well aware of the strategies required to navigate through this challenging situation. As a result, there is an increase in the demand for food additives once market stability is achieved. Food plant genetics encompass a range of substances such as oils, flavonoids, saponins, and oleoresins that enhance intestinal health and support livestock growth. With growing concerns about COVID-19 transmission among animals and increased consumer awareness regarding farm product consumption feed industry manufacturers are opting for organic alternatives, like phylogenies.

Latest Trends/ Developments:

The global biomass boiler market is expected to experience investments, in the future primarily due to the widespread adoption of boiler standards worldwide. Additionally, the regulatory framework and government support in the form of subsidies and tax rebates for power generation projects using energy sources are anticipated to drive growth in this market. The increasing demand for heating systems driven by improving living standards and colder climates is a factor contributing to market expansion. Consequently governments, in both developing countries are actively promoting the installation of energy production facilities that utilize resources through various incentives, subsidies, and regulations.

Key Players:

-

Thermax Limited

-

Babcock & Wilcox Enterprises

-

Forbes Marshall

-

Hurst Boiler & Welding Co.

-

John Cockerill

-

John Wood Group PLC

-

Sofinter S.p.a

-

Walchandnagar Industries

-

VIESSMANN

-

HARGASSNER

-

Fröling Heizkessel- und Behälterbau Ges.m.b.H.

-

DP CleanTech

-

Thermodyne Boiler

-

ANDRITZ

•In June 2022 Babcock & Wilcox subsidiary company, B&W Renewable Service completed the installation of biomass-fired boilers, as part of an energy initiative in Europe. These boilers have been designed to provide district heating to a range of businesses in Denmark. The main objective of this project is to generate heat by using renewable fuel sources thereby significantly reducing harmful emissions. In addition to the boiler itself, B&W will also supply components such as economizers, valves, instrumentation, and related equipment. The plant is expected to start operating in the quarter of 2023 contributing, towards achieving the region’s sustainable energy targets.

In April 2021 the Viessmann Group purchased a 34.3% interest, in Value Added Engineering Group (VAE) a provider of HVAC solutions based in Australia. This move allowed Viessmann to expand its reach, in the Asia Pacific region and establish a foothold in the market. Additionally, the acquisition contributed to Viessmann’s growth and market presence worldwide.

Chapter 1. Biomass Boiler Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Biomass Boiler Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Biomass Boiler Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Biomass Boiler Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Biomass Boiler Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Biomass Boiler Market – By Feedstock

6.1 Introduction/Key Findings

6.2 Woody Biomass

6.3 Agricultural Biomass

6.4 Urban Residue

6.5 Y-O-Y Growth trend Analysis By Feedstock

6.6 Absolute $ Opportunity Analysis By Feedstock, 2024-2030

Chapter 7. Biomass Boiler Market – By Technology

7.1 Introduction/Key Findings

7.2 Stoker Boiler

7.3 Fluidized Bed Boiler

7.4 Y-O-Y Growth trend Analysis By Technology

7.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Biomass Boiler Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Feedstock

8.1.3 By Technology

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Feedstock

8.2.3 By Technology

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Feedstock

8.3.3 By Technology

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Feedstock

8.4.3 By Technology

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Feedstock

8.5.3 By Technology

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Biomass Boiler Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Thermax Limited

9.2 Babcock & Wilcox Enterprises

9.3 Forbes Marshall

9.4 Hurst Boiler & Welding Co.

9.5 John Cockerill

9.6 John Wood Group PLC

9.7 Sofinter S.p.a

9.8 Walchandnagar Industries

9.9 VIESSMANN

9.10 HARGASSNER

9.11 Fröling Heizkessel- und Behälterbau Ges.m.b.H.

9.12 DP CleanTech

9.13 Thermodyne Boiler

9.14 ANDRITZ

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Biomass Boiler Market was valued at USD 9.02 billion in 2023 and is projected to reach a market size of USD 18.63 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.92%.

Because biomass is low-carbon and renewable, it has several advantages for the environment and economy when used in biomass boilers.

Based on Technology, the Global Biomass Boiler Market is segmented into • Stoker Boiler and Fluidized Bed Boiler.

Europe is the most dominant region for the Global Biomass Boiler Market.

Thermax Limited, Babcock & Wilcox Enterprises, Forbes Marshall, Hurst Boiler & Welding Co., John Cockerill, John Wood Group PLC, and Sofinter S.p.a are the key players operating in the Global Biomass Boiler Market.