Biomass Blockchain Market Size (2024 – 2030)

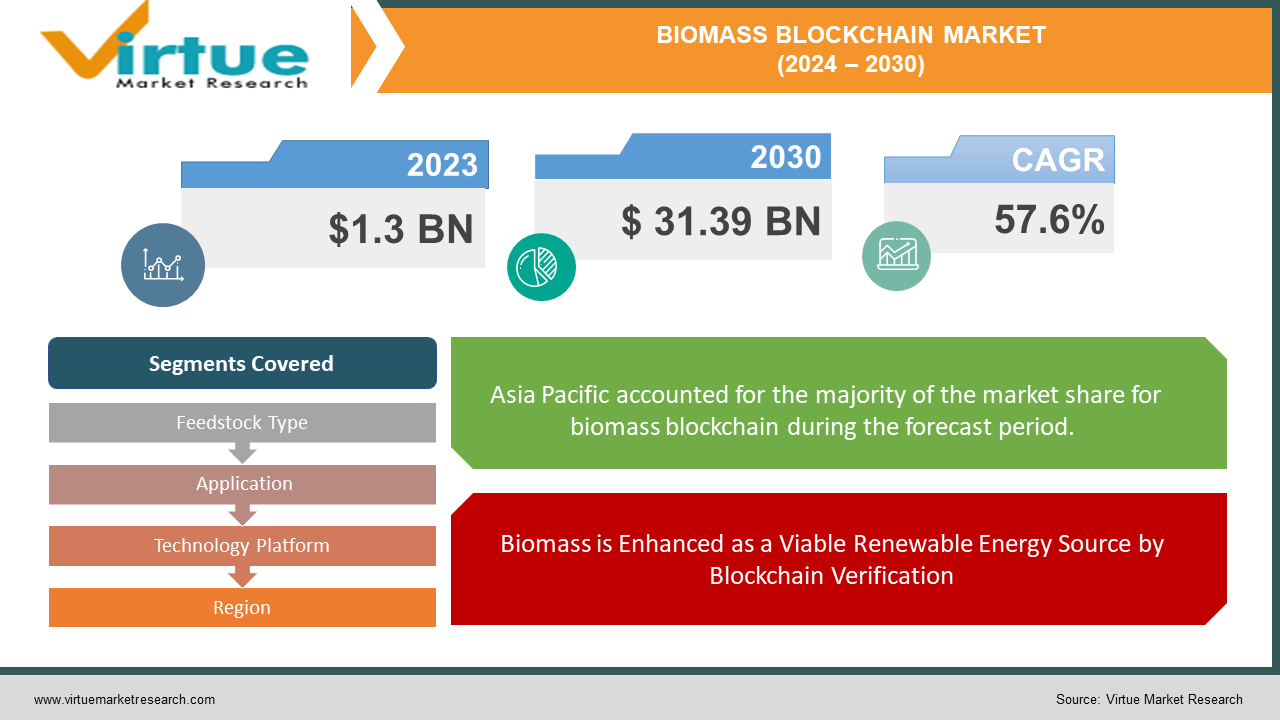

The Global Biomass Blockchain Market was valued at USD 1.3 billion in 2023 and is projected to reach a market size of USD 31.39 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 57.6%.

Biomass blockchain is a technology that follows the flow of biomass feedstock, such as woodchips or algae, from source to biofuel production. It does this by combining renewable biomass energy with blockchain technology. This has three advantages: it verifies sustainable sourcing; it increases supply chain confidence through transparency; and it streamlines commerce with more efficiency.

Key Market Insights:

Given that 72% of people are prepared to pay more for sustainable products, it is possible that sustainable biomass that has been confirmed via blockchain may fetch higher pricing. There are an increasing number of pilot programmes investigating blockchain solutions for biomass. In 2023, there will be more than 15 active pilot programmes worldwide with the goal of monitoring sustainable practices for biomass sources such as algal feedstock and wood pellets. These initiatives are validating the idea and laying the groundwork for broader acceptance.A interesting breakthrough is the fusion of Internet of Things (IoT) sensors with blockchain technology for biomass. When safely stored on the blockchain, real-time data from IoT sensors tracking variables like biomass growth or processing conditions may greatly improve supply chain transparency and traceability. The use of blockchain technology to verify sustainability may allow bioenergy goods to enter new markets. Customers of biofuel are calling for further guarantees on sustainability. Biomass blockchain can assist bioenergy producers in entering new markets with more stringent sustainability regulations by offering this proof.

Global Biomass Blockchain Market Drivers:

Biomass is Enhanced as a Viable Renewable Energy Source by Blockchain Verification

Demand for renewable energy sources is rising because of the battle against climate change. Increasing impetus to shift away from fossil fuels is coming from tighter controls on greenhouse gas emissions in both sectors and nations. Although it has certain environmental drawbacks, biomass provides a carbon-neutral substitute on paper. But it's crucial to make sure that the biomass supply chain uses sustainable techniques. Blockchain technology can help with this. Blockchain can confirm that biomass feedstock satisfies sustainability standards by offering a transparent and unchangeable record of each stage, from harvest to bioenergy production. This becomes particularly appealing in areas with policies that prioritise sustainable practices and high objectives for renewable energy. These areas may use blockchain technology to satisfy environmental targets and take advantage of biomass's potential as a renewable energy source.

Blockchain Simplifies the Biomass Supply Chain, Reducing Costs and Increasing Efficiency

Despite being a potential source of renewable energy, the biomass trade is frequently hampered by labour-intensive manual procedures and paperwork. Inefficiencies and increased costs are a result of these conventional procedures across the whole supply chain. This is where the system can be revolutionised by blockchain technology. Blockchain removes the need for tedious documentation and human verification by automating transactions. This greatly simplifies the entire procedure and lowers the possibility of fraud and human mistake. Imagine that the automated efficiency of blockchain allows a customer to have total transparency into the origin and processing of their biofuel, or a biomass producer to get safe payment promptly upon delivery. All parties concerned stand to gain significantly from this, from manufacturers who may save administrative hassles to consumers who may see a decrease in petrol costs. Blockchain opens the door to a more efficient and economical future for renewable energy by optimising the biomass supply chain.

Global Biomass Blockchain Market Restraints and Challenges:

Despite its promise, the blockchain industry for biomass is experiencing growth challenges. Adoption of this innovative technology is hampered by the complexity and confusing integration of regulations in the energy and biomass industries. Widespread adoption may also be hampered by the scaling problems of blockchain technology, such as expensive and sluggish transaction times. Moreover, obstacles to cooperation and data exchange are brought about by the absence of industry-wide data standards. Smaller players may find it difficult to obtain the technical know-how needed for execution, and data privacy issues add another level of complexity that need attention.

Global Biomass Blockchain Market Opportunities:

The blockchain industry for biomass is full of opportunities. Carbon credit markets may be opened by blockchain certification of sustainable practices, opening up new revenue sources. Additionally, the increasing inclination of customers towards eco-friendly items might lead to higher prices for biomass that can be proven to be sustainably produced. Beyond that, manufacturers and consumers may gain from efficient and cost-effective supply chains that are streamlined by blockchain. Blockchain's capacity to improve traceability and trust might lead to the opening of new markets for bioenergy, especially those that require strong sustainability guarantees.

BIOMASS BLOCKCHAIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

57.6% |

|

Segments Covered |

By Feedstock Type, Application, Technology Platform, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ENGIE, Enviva, Ethereum, Globacap, IBM, Ripple, Xcel Energy |

Global Biomass Blockchain Market Segmentation: By Feedstock Type

-

Solid Biomass

-

Gaseous Biomass

-

Liquid Biomass

Solid biomass (wood chips, pellets, and agricultural leftovers) dominates the worldwide biomass blockchain market as the largest and fastest-growing category. This supremacy is due to the solid biomass industry's established supply networks and infrastructure, which makes blockchain implementation simpler. Furthermore, compared to gaseous or liquid biomass, solid biomass feedstock is positioned for quicker market expansion due to its scalability and the urgent need for sustainability verification in this industry (e.g., reducing deforestation).

Global Biomass Blockchain Market Segmentation: By Application

-

Power Generation

-

Heat Generation

-

Biofuel Production

By application, the biomass blockchain industry is expected to lead the largest and fastest expanding category, with biofuel production likely in the lead. This is a result of the more stringent laws requiring biofuels to have proven sustainability, which blockchain well handles. Furthermore, a favourable atmosphere for the broad use of blockchain technology in the biofuel manufacturing process is created by the anticipated boom in the worldwide biofuel industry.

Global Biomass Blockchain Market Segmentation: By Technology Platform

-

Public Blockchains

-

Private Blockchains

-

Consortium Blockchains

There is still competition to determine which technological platform will rule the biomass blockchain business. Public blockchains provide transparency and open participation, but they are limited by issues with scalability and privacy. Private blockchains provide greater control over these problems, but also reduce transparency for outside audiences. Consortium blockchains achieve a balance between transparency and collaboration. The platform that prevails in the end will rely on the application.

Global Biomass Blockchain Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The biomass blockchain market worldwide is divided into three regions: Europe is propelled by stringent sustainability rules, Asia Pacific has the fastest-growing bioenergy sector, and North America has the most established companies. While biomass blockchain technology has promising opportunities for sustainable development, greater infrastructure and investment are needed in South America, the Middle East, and Africa to firmly establish a foothold in this dynamic sector.

COVID-19 Impact Analysis on the Global Biomass Blockchain Market:

The COVID-19 epidemic has a two-pronged effect on the blockchain market for biomass. There is a bright spot even if investment and experimental initiatives may have slowed initially due to lockdowns and the recession. The pandemic's emphasis on sustainability may spur long-term blockchain growth in the biomass industry as transparency and ethical sources become increasingly more important. Additionally, businesses may be more open to implementing blockchain technology given the general acceleration of digitization across all industries. In other words, long-term development propelled by sustainability and digitization trends may outweigh the short-term disadvantages brought about by COVID-19 tendencies.

Recent Trends and Developments in the Global Biomass Blockchain Market:

Innovation is booming in the worldwide biomass blockchain sector. The promise of this technology is being demonstrated by the growing popularity of pilot programmes for tracking sustainable biomass production, such as those using algae and wood pellets. Industry collaboration is promoting standardised formats for biomass data storage on blockchains to overcome data sharing problems. Moreover, real-time monitoring data can now be safely recorded thanks to the fascinating combination of biomass blockchain with IoT sensors, adding a new degree of transparency. Lastly, the emphasis is moving to using blockchain technology to introduce bioenergy goods into previously untapped markets, especially those with stringent environmental regulations.

Key Players:

-

ENGIE

-

Enviva

-

Ethereum

-

Globacap

-

IBM

-

Ripple

-

Xcel Energy

Chapter 1. Biomass Blockchain Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Biomass Blockchain Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Biomass Blockchain Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Biomass Blockchain Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Biomass Blockchain Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Biomass Blockchain Market – By Feedstock Type

6.1 Introduction/Key Findings

6.2 Solid Biomass

6.3 Gaseous Biomass

6.4 Liquid Biomass

6.5 Y-O-Y Growth trend Analysis By Feedstock Type

6.6 Absolute $ Opportunity Analysis By Feedstock Type, 2024-2030

Chapter 7. Biomass Blockchain Market – By Technology Platform

7.1 Introduction/Key Findings

7.2 Public Blockchains

7.3 Private Blockchains

7.4 Consortium Blockchains

7.5 Y-O-Y Growth trend Analysis By Technology Platform

7.6 Absolute $ Opportunity Analysis By Technology Platform, 2024-2030

Chapter 8. Biomass Blockchain Market – By Application

8.1 Introduction/Key Findings

8.2 Power Generation

8.3 Heat Generation

8.4 Biofuel Production

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Biomass Blockchain Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Feedstock Type

9.1.3 By Technology Platform

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Feedstock Type

9.2.3 By Technology Platform

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Feedstock Type

9.3.3 By Technology Platform

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Feedstock Type

9.4.3 By Technology Platform

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Feedstock Type

9.5.3 By Technology Platform

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Biomass Blockchain Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ENGIE

10.2 Enviva

10.3 Ethereum

10.4 Globacap

10.5 IBM

10.6 Ripple

10.7 Xcel Energy

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Biomass Blockchain Market size is valued at USD 1.3 billion in 2023.

The worldwide Global Biomass Blockchain Market growth is estimated to be 57.6% from 2024 to 2030.

The Global Navy Integrated Bridge Systems Market is segmented By Feedstock Type (Solid Biomass, Gaseous Biomass, Liquid Biomass); By Application (Power Generation, Heat Generation, Biofuel Production); By Technology Platform (Public Blockchains, Private Blockchains, Consortium Blockchains) and by region.

The worldwide biomass blockchain market has a bright future ahead of it. As worries about sustainability grow, blockchain verification may be a crucial instrument for guaranteeing traceability and ethical sourcing across the biomass supply chain. Furthermore, the combination of artificial intelligence (AI) with biomass blockchain may spur additional innovation, such as the optimisation of biomass production and logistics using AI.

There are two sides to the COVID-19 pandemic's effects on the worldwide biomass blockchain industry. There is a bright spot even if investment and experimental initiatives may have slowed initially due to lockdowns and the recession. The pandemic's focus on sustainability may foster long-term expansion as the need for transparency and responsible sourcing grows.