Biomass and Bioenergy Testing & Certification Services Market Size (2024-2030)

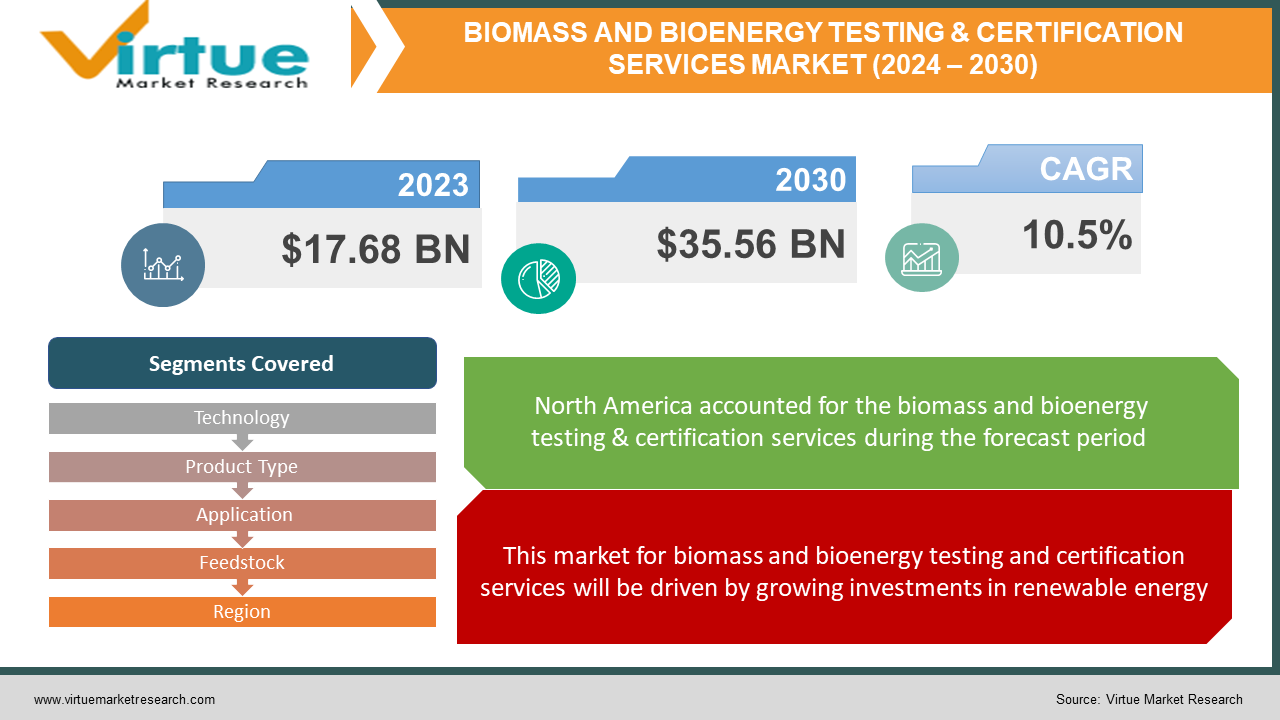

The Global Biomass and Bioenergy Testing & Certification Services Market was valued at USD 17.68 Billion and is projected to reach a market size of USD 35.56 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.5%.

Services for testing and certifying biomass and bioenergy ensure that processes and products linked to these resources satisfy sustainability, quality, and compliance requirements. Many organizations, spanning a variety of products and feedstock-producing sectors, are developing sustainability certification methods for biomass and biofuels. On the other hand, there are a number of obstacles facing sustainability certification at the moment, such as the growth of schemes, rising prices, trade restrictions, and concerns regarding efficacy and efficiency. In order to facilitate the use of sustainable bioenergy, the IEA Bioenergy Strategic Study investigates the function, state, and difficulties of voluntary certification.

Key Market Insights:

Because more people want energy from bio-based fuels for transportation, power, and heating, the global bioenergy market is expanding. Stricter regulations from governments are reducing vehicle emissions from fossil fuels, which is also benefiting the market. On the other hand, the industry's rapid transition away from conventional power sources like coal and toward renewable energy, along with the growing use of biofuels in automobiles, are providing favorable conditions for market participants to continue expanding.

Global Biomass and Bioenergy Testing & Certification Services Market Drivers:

This market for biomass and bioenergy testing and certification services will be driven by growing investments in renewable energy.

Global environmental laws are driving the power generation industry to transition to more sustainable energy sources. To lessen their dependency on fossil fuels, major economies are concentrating on increasing the capacity of renewable energy sources like solar, wind, and geothermal energy. The amount of money spent on renewable energy is rising, which is causing less money to be spent on coal and other fossil fuels. The majority of renewable energy used worldwide comes from sources like solar, wind, and geothermal energy. It can deal with a number of global problems, such as the depletion of fossil fuels and environmental problems. Many countries find renewable energy attractive because it is flexible and can be used for power, heating, and transportation. The worldwide renewable energy market is being driven by this trend.

The market for testing and certification services for biomass and bioenergy will grow as the transportation sector grows.

In order to combat climate change, improve fuel security, and promote infrastructure development, biofuels are essential. They act as substitutes for conventional fuels derived from petroleum, especially in the transportation industry. In order to achieve the global emission reduction targets set by governments, both traditional and advanced biofuels are necessary. One of the biggest energy consumers in aviation is the production of stable, high-quality biofuels. With the goal of supplying major airlines, a few European companies are producing jet fuel from Jatropha. Airlines and the US military have conducted successful test flights using bio-jet fuel and blends with petroleum-based jet fuel. Biodiesel has the potential to become an environmentally friendly diesel substitute in the rail industry for powering trains.

Biomass and Bioenergy Testing & Certification Services Market Challenges and Restraints:

Significant upfront expenditures are associated with the construction and operation of biofuel plants, and certain nations offer financial support to facilitate their growth. Ongoing funding, however, is necessary for the facility's continued expansion and operation. Feedstock is the primary input used in the production of biofuels, and getting and storing it takes money and time. For different stages, such as gathering, classifying, processing, supplying, and distributing feedstock, as well as operating the plant and marketing biogas and biomethane, financial support and regulations are essential. The plant must have a sizable and consistent output in order to pay for the initial setup and continuing maintenance costs.

Biomass and Bioenergy Testing & Certification Services Market Opportunities:

There is a high demand for bioenergy because more and more people want energy that doesn't harm the environment. Businesses can benefit from this by developing innovative and resourceful methods of producing bioenergy. Investing in cutting-edge technologies can enhance and lower the cost of their solutions, providing them with a competitive advantage. Additionally, there's a good chance that biofuels will be used in automobiles and aircraft as we work to reduce pollution and make transportation cleaner. Companies can investigate novel concepts to produce biofuels that are suitable for automobiles and aircraft.

BIOMASS AND BIOENERGY TESTING & CERTIFICATION SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.5% |

|

Segments Covered |

By Technology, Product Type, Application, Feedstock, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mitsubishi Heavy Industries Ltd, MVV Energie AG, A2A SpA, Hitachi Zosen Corp, BTG Biomass Technology Group, Babcock & Wilcox Volund A/S, Biomass Engineering Ltd, Orsted A/S, Enerkem, Fortum Oyj, Veolia |

Global Biomass and Bioenergy Testing & Certification Services Market Segmentation: By Technology

-

Combustion

-

Gasification

It is anticipated that the market's most dominant category will be combustion technology. Combustion is a well-established technique in the field of bioenergy and biomass production, which entails burning biomass to produce heat or power. It has benefits like low emissions, maximum energy conversion efficiency, and versatility in using different biomass sources. These elements support the combustion technology segment's dominance in the biomass and bioenergy testing and certification services market. Gasification technology is expected to grow at the fastest rate in the market. Gasification is a thermochemical process that turns biomass into syngas, a flexible gas that can be used to produce biofuels, heat, and electricity. Utilizing a variety of biomass feedstocks, gasification technology offers lower emissions, increased energy efficiency, and improved energy efficiency. The market for biomass and bioenergy testing and certification services is seeing growth in the gasification technology segment due to the increasing focus on renewable energy and the need for sustainable and cleaner energy solutions.

Global Biomass and Bioenergy Testing & Certification Services Market Segmentation: By Product Type

-

Solid Biomass

-

Liquid Biofuel

-

Biogas

-

Others

The market is anticipated to grow at the fastest rate in the liquid biofuel category. The growing need for clean, renewable energy sources and the goal of lowering carbon emissions are what are driving this expansion. In place of conventional fossil fuels, liquid biofuels such as biodiesel and bioethanol are generated from biomass sources like crops, animal fats, and vegetable oils. These biofuels are used in transportation and industry. The market for liquid biofuel is growing as a result of government policies that are supportive of the industry and technological developments in biofuel production.

Solid biomass is the most important subsegment of the Testing & Certification Services for the Biomass and Bioenergy category. This comprises energy crops used to produce heat and electricity, wood pellets, and agricultural byproducts. Solid biomass is the predominant fuel source because of its plentiful feedstock, established combustion infrastructure, and advanced technologies. Solid biomass is a dependable and reasonably priced renewable energy source that is especially valued for biomass-based heating and power plants.

Global Biomass and Bioenergy Testing & Certification Services Market Segmentation: By Application

-

Power Generation

-

Heat Generation

-

Transportation

-

Others

The power generation segment is anticipated to be the most dominant category in the market. This is a result of the growing need for renewable energy sources as well as the generation of electricity through the use of biomass and bioenergy. For the production of electricity, biomass, and bioenergy are appealing because of their sustainability and environmental friendliness. This market is growing because of government programs that promote renewable energy.

The transportation sector is expected to grow at the fastest rate. In an effort to cut carbon emissions and switch to more environmentally friendly energy sources, the transportation sector is using biomass and bioenergy as biofuels more and more. In order to guarantee the quality and compliance of biomass and bioenergy used in transportation, this shift has resulted in an increase in demand for testing and certification services.

Global Biomass and Bioenergy Testing & Certification Services Market Segmentation: By Feedstock

-

Agricultural Waste

-

Wood and Woody

-

Biomass

-

Solid Waste

-

Others

Crop leftovers and animal dung are examples of agricultural waste that can be processed into solid biomass, liquid biofuel, or biogas, among other forms of bioenergy. One can burn, gasify, or pyrolyze wood and woody biomass, such as sawdust and forest waste. The use of solid waste management techniques, such as gasification, anaerobic digestion, and incineration, is anticipated to rise quickly as a result of growing environmental awareness and government backing. The market is expected to be dominated by agricultural waste because of its abundance and versatility in producing different types of bioenergy products.

Global Biomass and Bioenergy Testing & Certification Services Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America dominated the world bioenergy market in 2023, accounting for more than 35% of installed capacity. With rising biofuel consumption and encouraging government policies, the United States in particular is spearheading market expansion. Numerous initiatives have been launched by the US Department of Energy and NREL to improve bioenergy technologies and increase their efficiency and cost-effectiveness. It is anticipated that technology will continue to advance, propelling the bioenergy market even higher. Asia-Pacific is expected to grow at the fastest rate, accounting for nearly 33% of installed capacity in 2023. With their sizable populations and rising energy demands, China and India are positioned to have a big impact on the renewable energy landscape in the area. China is at the forefront of global efforts to deploy renewable energy, and its participation in the IEA Bioenergy Technology Programme suggests that the country is placing an increasing emphasis on bioenergy as part of its overall renewable energy portfolio.

COVID-19 Impact on the Global Biomass and Bioenergy Testing & Certification Services Market:

The COVID-19 pandemic has had a negative effect on the global bioenergy market. Import, export, and transportation restrictions have thrown off the supply chain, which has affected the demand for electricity and biofuels in sectors like construction, manufacturing, transportation, and oil and gas. These industries use biofuels extensively for a variety of purposes. Global energy consumption has significantly decreased as a result of the pandemic; by 2020, it is anticipated that trillions of cubic meters of gasoline and millions of barrels of oil will be removed from the energy grid. The pandemic's effects on employment, travel, and industry are expected to result in a decline in biomass energy production in the United States, according to the Energy Information Administration (EIA). Sales of electricity are predicted to decline as a result of the move to remote work and business closures, especially in the commercial and industrial sectors.

Latest Trend/Development:

The National Accreditation Board for Testing and Calibration Laboratories (NABL) accredited SGS India for its biomass testing laboratory located in Chennai. This indicates that the laboratory's capacity to test various characteristics of biomass, such as moisture, ash, volatile matter, fixed carbon, calorific value, and more, has received official recognition.

Businesses in the bioenergy industry engage in more than just product certification and testing. They are growing the scope of what they offer to include counseling, instruction, and assistance with adhering to rules. Their comprehensive approach sets them apart as providers of end-to-end solutions, catering to the evolving demands of their clientele in the bioenergy sector. Businesses can differentiate themselves and draw in a wider clientele by providing a variety of services, which aids in their expansion within the industry.

Key Players:

-

Mitsubishi Heavy Industries Ltd

-

MVV Energie AG

-

A2A SpA

-

Hitachi Zosen Corp

-

BTG Biomass Technology Group

-

Babcock & Wilcox Volund A/S, Biomass Engineering Ltd

-

Orsted A/S

-

Enerkem

-

Fortum Oyj

-

Veolia

Chapter 1. Biomass and Bioenergy Testing & Certification Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Biomass and Bioenergy Testing & Certification Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Biomass and Bioenergy Testing & Certification Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Biomass and Bioenergy Testing & Certification Services Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Biomass and Bioenergy Testing & Certification Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Biomass and Bioenergy Testing & Certification Services Market – By Technology

6.1 Introduction/Key Findings

6.2 Combustion

6.3 Gasification

6.4 Y-O-Y Growth trend Analysis By Technology

6.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Biomass and Bioenergy Testing & Certification Services Market – By Product Type

7.1 Introduction/Key Findings

7.2 Solid Biomass

7.3 Liquid Biofuel

7.4 Biogas

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Product Type

7.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 8. Biomass and Bioenergy Testing & Certification Services Market – By Application

8.1 Introduction/Key Findings

8.2 Power Generation

8.3 Heat Generation,

8.4 Transportation

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Biomass and Bioenergy Testing & Certification Services Market – By Feedstock

9.1 Introduction/Key Findings

9.2 Agricultural Waste

9.3 Wood and Woody

9.4 Biomass

9.5 Solid Waste

9.6 Others

9.7 Y-O-Y Growth trend Analysis By Feedstock

9.8 Absolute $ Opportunity Analysis By Feedstock, 2024-2030

Chapter 10. Biomass and Bioenergy Testing & Certification Services Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Technology

10.1.2.1 By Product Type

10.1.3 By Application

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Technology

10.2.3 By Product Type

10.2.4 By Application

10.2.5 By Feedstock

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Technology

10.3.3 By Product Type

10.3.4 By Application

10.3.5 By Feedstock

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Technology

10.4.3 By Product Type

10.4.4 By Application

10.4.5 By Feedstock

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Technology

10.5.3 By Product Type

10.5.4 By Application

10.5.5 By Feedstock

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Biomass and Bioenergy Testing & Certification Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Mitsubishi Heavy Industries Ltd

11.2 MVV Energie AG

11.3 A2A SpA

11.4 Hitachi Zosen Corp

11.5 BTG Biomass Technology Group

11.6 Babcock & Wilcox Volund A/S, Biomass Engineering Ltd

11.7 Orsted A/S

11.8 Enerkem

11.9 Fortum Oyj

11.10 Veolia

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Biomass and Bioenergy Testing & Certification Services Market was valued at USD 17.68 Billion and is projected to reach a market size of USD 35.56 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.5%.

The quality, sustainability, and compliance of biomass and bioenergy products and processes are verified and certified by biomass and bioenergy testing and certification services.

Rising Investments in Renewable Energy and Growth in the Transportation Sector are the drivers of the Biomass and Bioenergy Testing & Certification Services Market.

High Initial Investment for Establishing Plants May Hinder the Biomass and Bioenergy Testing & Certification Services Market Growth.

SGS India announced that it has received accreditation from the National Accreditation Board for Testing and Calibration Laboratories (NABL) for its biomass testing laboratory in Chennai. The laboratory can test various parameters of biomass such as moisture, ash, volatile matter, fixed carbon, calorific value, etc.