Bioinformatics for Genomics Market Size (2024 – 2030)

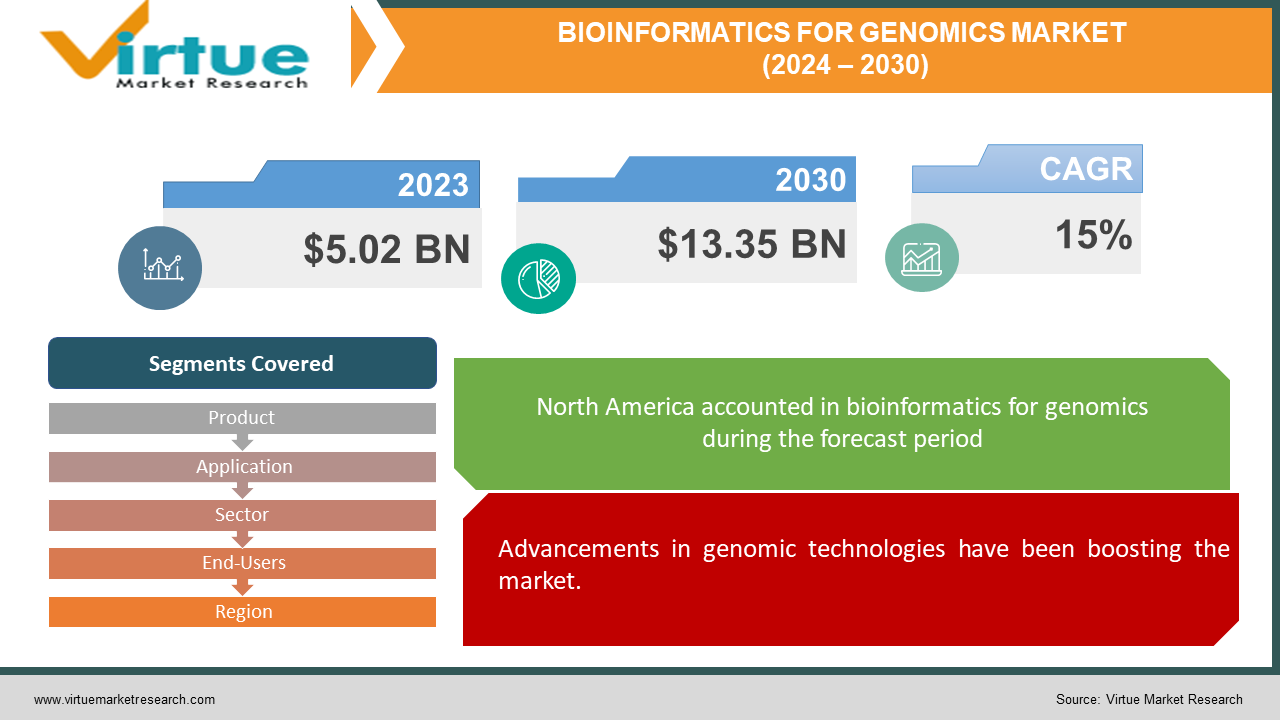

The global bioinformatics for genomics market was valued at USD 5.02 billion and is projected to reach a market size of USD 13.35 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 15%.

A field that combines computer science, statistics, and biology is called bioinformatics for genomics. It entails the analysis and interpretation of biological data, particularly genomic data, using computational approaches. The study of an organism's complete genome, including its DNA sequence, structure, function, and evolution, is known as genomics. The past decade has seen considerable growth in this market due to advancements in next-generation sequencing (NGS) and the opening of many prestigious research institutions. Presently, the market has witnessed a notable expansion owing to skilled expertise and applications. In the future, with a focus on the integration of AI and R&D activities, significant growth is predicted.

Key Market Insights:

Approximately 57% of bioinformatics businesses offer genomics solutions. By 2025, the market for bioinformatics sequencing platforms is projected to grow to $15.98 billion. The Latin American bioinformatics market was estimated by Statista to be valued at $1.31 billion in 2022. The entire market for clinical genomics, informatics, and next-generation sequencing (NGS) was estimated to be worth 836 million USD. By 2028, the market is predicted to reach a value of around 5.9 billion US dollars. The bioinformatics error rate might be a challenge when trying to identify novel variants. For instance, less than 1,000 somatic mutations and 100,000–300,000 previously unknown SNPs are predicted to be present in each freshly sequenced genome. Sources of error can be found and reduced by implementing strict quality control procedures at different phases of the sequencing and analysis process, such as sample preparation, sequencing, and data processing.

Bioinformatics for Genomics Market Drivers:

Advancements in genomic technologies have been boosting the market.

The need for bioinformatics systems that can handle large data and complicated analysis has increased as next-generation sequencing (NGS) technology advances and makes sequencing faster, more accurate, and more affordable. This has helped in generating vast amounts of data. Besides, methods like long-read sequencing and single-cell sequencing have helped in identifying diseases and in early diagnosis as well. Furthermore, to extract useful insights and understand the intricacies of biological systems, the integration of multi-omics data, including genomes, transcriptomics, proteomics, and metabolomics, requires sophisticated bioinformatics techniques. This presents new opportunities for bioinformatics to build specialized tools for data analysis and interpretation.

Precision medicine has been accelerating the growth rate.

Genomic data plays a major role in the increasingly important field of precision medicine, which attempts to customize medical care to each patient's unique traits. When analyzing genomic data to find genetic changes linked to diseases, forecast medication responses, and create individualized treatment regimens, bioinformatics is a critical tool. The increasing demand for precision medicine activities in global healthcare systems will be driven by the bioinformatics tools and services that facilitate genomic analysis for precision medicine applications.

Bioinformatics for Genomics Market Restraints and Challenges:

Integration challenges, data privacy, computational complexities, and a shortage of personnel are the main issues that the market is currently facing.

There are a lot of obstacles to integrating and harmonizing different genomic datasets from different sources. Variations in data formats, quality, and annotation standards might hinder interoperability and complicate data analysis and interpretation. Secondly, the privacy of data is another major challenge. Sensitive information about the patient is often stored in databases. Misuse and leakage of this information can lead to significant losses. Thirdly, computationally demanding operations, including alignment, variant calling, and functional annotation, are frequently part of the processing of genomic data. Large-scale genomic dataset handling calls for effective algorithms, and high-performance computer infrastructure is required for processing this data. This can be both expensive and resource-intensive. Moreover, since this is an emerging field, there is a lack of skilled expertise. Providing sufficient education and training about the working of bioinformatics tools and genetic methods is vital.

Bioinformatics for Genomics Market Opportunities:

Through the identification of new therapeutic targets, the clarification of disease mechanisms, and the prediction of medication responses, genomic data analysis is essential to the process of drug discovery and development. The pharmaceutical sector can benefit greatly from bioinformatics tools that make it easier to analyze genomic and multi-omics data to prioritize therapeutic targets, optimize drug candidates, and stratify patient populations. Secondly, genomic data integration opens up new possibilities for bioinformatics solutions that provide seamless data interchange, interoperability, and point-of-care decision assistance within electronic health records (EHRs) and healthcare informatics systems. In healthcare settings, integrating genetic data with clinical data can improve patient outcomes, therapy selection, and disease risk assessment. Apart from this, clinical diagnostics using genomic technology are being used more and more to identify, diagnose, and track infectious illnesses, cancer, and genetic disorders. Bioinformatics tools that enable variant interpretation and reporting, as well as the interpretation of genetic data in a clinical context, provide many possibilities.

BIOINFORMATICS FOR GENOMICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Product, Application, Sector, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Illumina, Inc., Thermo Fisher Scientific, Inc., Qiagen N.V., Agilent Technologies, Inc., PerkinElmer, Inc., BGI Group, GENEWIZ (Brooks Automation Company), Eurofins Scientific, DNAnexus, Inc., Oxford Nanopore Technologies Ltd. |

Bioinformatics for Genomics Market Segmentation: By Product

-

Bioinformatics Platforms

-

Bioinformatics Services

-

Knowledge Management Tools

Bioinformatics platforms are the largest growing segment. Because bioinformatics platforms give researchers the tools and software they need to analyze and interpret genomic data, they are essential to genomic research. Numerous applications are supported by these platforms, such as structure prediction, variant calling, functional annotation, and sequence alignment. As genetic data grows exponentially and sequencing technology progresses, bioinformatics platforms adapt to accommodate the varied needs of researchers in academia, biopharmaceuticals, healthcare, and other fields. These platforms offer a growing range of sophisticated features and capabilities. Bioinformatics services are the fastest-growing category. As a vital part of the genomics landscape, bioinformatics services provide specialized knowledge and assistance for the analysis, interpretation, and application of genetic data. These services cover a wide range of products and services, such as data analysis, training, consulting, and solutions that are specially designed to meet the requirements of laboratories, institutions, and researchers. The demand for bioinformatics services is rising quickly due to the increasing complexity of genomic analyses and the growing applications of genomics in various fields like environmental science, agriculture, and personalized medicine.

Bioinformatics for Genomics Market Segmentation: By Application

-

Genome Sequencing

-

Functional Genomics

-

Comparative Genomics

-

Structural Genomics

-

Disease Genomics

-

Pharmacogenomics

Genomic sequencing is the largest growing application. The core use of genomics is genome sequencing, which involves figuring out an organism's genome's whole DNA sequence. Genome sequencing can forecast the emergence of diseases before symptoms appear by identifying abnormalities throughout the genome. This helps scientists understand and treat disease processes at the DNA level. Whole-genome, exome, and targeted sequencing are all included, which creates a large need for bioinformatics services and tools for data interpretation and analysis. Pharmacogenomics is the fastest-growing segment. This field is gaining popularity quickly because it may be used to tailor medication regimens according to a patient's genetic composition. It entails researching the effects of genetic variants on safety profiles, efficacy, and therapeutic responsiveness. The need for bioinformatics tools and services in pharmacogenomics research and clinical applications is being driven by the growing acceptance of precision medicine techniques and the growing focus on individualized healthcare solutions.

Bioinformatics for Genomics Market Segmentation: By Sector

-

Medical Biotechnology

-

Forensic Biotechnology

-

Plant Biotechnology

-

Environmental Biotechnology

-

Others

Medical biotechnology is the largest growing category. Numerous fields are covered by medical biotechnology, such as gene therapy, personalized medicine, regenerative medicine, drug research and development, and diagnostics. The requirement for therapeutic target identification, biomarker discovery, and genomic data analysis, among other things, is what drives the demand for bioinformatics tools and services in the medical biotechnology industry. The fastest-growing segment is environmental biotechnology, which uses biotechnological concepts and methods to solve environmental problems such as waste management, pollution, the creation of renewable energy, and environmental preservation. The demand for bioinformatics solutions in environmental biotechnology research and applications is being driven by the increased emphasis on sustainability, mitigating climate change, and environmental protection.

Bioinformatics for Genomics Market Segmentation: By End-Users

-

Academic and Research Institutions

-

Biotechnology and Pharmaceutical Companies

-

Hospitals and Clinics

-

Contract Research Organizations

Due to their strong involvement in drug discovery, development, and clinical research, all of which significantly rely on bioinformatics for genomic tools and services, biotechnology and pharmaceutical companies are the largest growing end users. Businesses seek to find molecular signatures, genetic variations, and biomarkers linked to treatment response, illness development, and susceptibility by evaluating genomic data. Hospitals and clinics are the fastest-growing end-users. This is especially true given the growing popularity of personalized medicine, genomic diagnostics, and genomics-driven healthcare initiatives. The development of genomic technologies, growing recognition of the therapeutic utility of genomics, and the incorporation of genetic data into patient care pathways are the main drivers of this expansion.

Bioinformatics for Genomics Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest growing market. Due to the region's strong concentration of prestigious research organizations, educational institutions, and bioinformatics companies, the U.S. and Canada account for the majority of revenue generation. The regional market is anticipated to grow as a result of increased investments in the research and development of novel and advanced technologies linked to genome sequencing. Besides this, the economy in this region is stable, contributing to greater investments in research and developmental activities. Asia-Pacific is the fastest-growing market. Countries like China, India, and Japan are at the forefront. Growing government financing and initiatives for genomics research, the growing use of precision medicine and tailored healthcare solutions, the expansion of the biotechnology and pharmaceutical industries, and the development of partnerships with foreign partners are some of the factors propelling this rise. In addition, there is a big need for genomic research and healthcare applications in the Asia-Pacific area due to the region's vast population base and increased prevalence of chronic diseases.

COVID-19 Impact Analysis on the Global Bioinformatics for Genomics Market:

The outbreak of the virus had a positive impact on the market. The pandemic brought to light the significance of genetics in comprehending biology and viral dissemination. As a result, there was a demand for bioinformatics platforms and tools designed specifically for genomic study, including those for variant detection, evolutionary analysis, and viral genome sequencing. The need to create COVID-19 treatments, vaccinations, and diagnostics quickly spurred advances in genomics and bioinformatics. Globally, businesses and academic organizations have started to use bioinformatics techniques to study viral genomes, find genetic variants, and create efficient vaccinations and diagnostic tests. There was a general trend toward remote work. Despite physical barriers to collaboration, bioinformatics businesses were able to adapt by providing cloud-based platforms and remotely accessible tools that allowed researchers to examine genomic data and work together efficiently. According to the Future Science Group, 83% of researchers stated the pandemic caused a delay in their work, and many of them started conducting research remotely with a strong emphasis on computational work. Most of the funding was allotted to the pharmaceutical sector. This made research and developmental activities easier. Post-pandemic, the market has continued to grow owing to demand and efforts.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this. Opportunities for bioinformatics solutions that assist crop improvement, livestock breeding, and sustainable agricultural practices are presented by the use of genomics in agriculture. Global food security and agricultural sustainability can be improved by using bioinformatics techniques for genomic selection, trait mapping, and marker-assisted breeding. These techniques can also increase crop output, disease resistance, and nutritional quality.

Key Players:

-

Illumina, Inc.

-

Thermo Fisher Scientific, Inc.

-

Qiagen N.V.

-

Agilent Technologies, Inc.

-

PerkinElmer, Inc.

-

BGI Group

-

GENEWIZ (Brooks Automation Company)

-

Eurofins Scientific

-

DNAnexus, Inc.

-

Oxford Nanopore Technologies Ltd.

-

In February 2023, at the Advances in Genome Biology and Technology (AGBT) 2023 General Meeting, BioSkryb Genomics, a leader in complete single-cell multiomic research solutions, announced the commercial launch of its BaseJumperTM Bioinformatics Platform and ResolveOMETM Whole Genome and Transcriptome Amplification system. With ResolveOME, it is possible to accurately and thoroughly examine the whole genome, transcriptome, exomes, or specific gene content of a single cell for the first time in the single-cell analysis market.

-

In January 2023, the bioinformatics company QIAGEN, QIAGEN Digital Insights (QDI), announced the release of their improved QIAGEN CLC Genomics Workbench Premium, which adds revolutionary analysis speed to analyze and interpret large panel sequencing, whole exome sequencing, and whole genome sequencing (WGS) data, thereby eliminating the data-analysis bottleneck of next-generation sequencing (NGS).

-

In March 2022, ARUP introduced Rio, a new bioinformatics platform that was launched to enhance the precision and speed of next-generation sequencing (NGS) test outcomes. Rio leverages cloud computing to transfer data more effectively and precisely, enabling doctors to analyze test findings more quickly and make better patient decisions.

Chapter 1. Bioinformatics for Genomics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bioinformatics for Genomics Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bioinformatics for Genomics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bioinformatics for Genomics Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bioinformatics for Genomics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bioinformatics for Genomics Market – By Product Type

6.1 Introduction/Key Findings

6.2 Bioinformatics Platforms

6.3 Bioinformatics Services

6.4 Knowledge Management Tools

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Bioinformatics for Genomics Market – By Application

7.1 Introduction/Key Findings

7.2 Genome Sequencing

7.3 Functional Genomics

7.4 Comparative Genomics

7.5 Structural Genomics

7.6 Disease Genomics

7.7 Pharmacogenomics

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Bioinformatics for Genomics Market – By Sector

8.1 Introduction/Key Findings

8.2 Medical Biotechnology

8.3 Forensic Biotechnology

8.4 Plant Biotechnology

8.5 Environmental Biotechnology

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Sector

8.8 Absolute $ Opportunity Analysis By Sector, 2024-2030

Chapter 9. Bioinformatics for Genomics Market – By End-User

9.1 Introduction/Key Findings

9.2 Academic and Research Institutions

9.3 Biotechnology and Pharmaceutical Companies

9.4 Hospitals and Clinics

9.5 Contract Research Organizations

9.6 Y-O-Y Growth trend Analysis By End-User

9.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 10.Bioinformatics for Genomics Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.3 By Application

10.1.4 By Sector

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Application

10.2.4 By Sector

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Application

10.3.4 By Sector

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Application

10.4.4 By Sector

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Application

10.5.4 By Sector

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Bioinformatics for Genomics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Illumina, Inc.

11.2 Thermo Fisher Scientific, Inc.

11.3 Qiagen N.V.

11.4 Agilent Technologies, Inc.

11.5 PerkinElmer, Inc.

11.6 BGI Group

11.7 GENEWIZ (Brooks Automation Company)

11.8 Eurofins Scientific

11.9 DNAnexus, Inc.

11.10 Oxford Nanopore Technologies Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global bioinformatics for genomics market was valued at USD 5.02 billion and is projected to reach a market size of USD 13.35 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 15%.

Advancements in genomic technologies and precision medicine are the main factors propelling global bioinformatics for the genomics market.

Based on product, the global bioinformatics for genomics market is segmented into bioinformatics platforms, bioinformatics services, and knowledge management tools.

North America is the most dominant region for global bioinformatics in the genomics market.

Illumina, Inc., Thermo Fisher Scientific, Inc., and Qiagen N.V. are the key players operating in global bioinformatics for the genomics market.