Bioinformatics Drug Discovery Services Market Size (2024 – 2030)

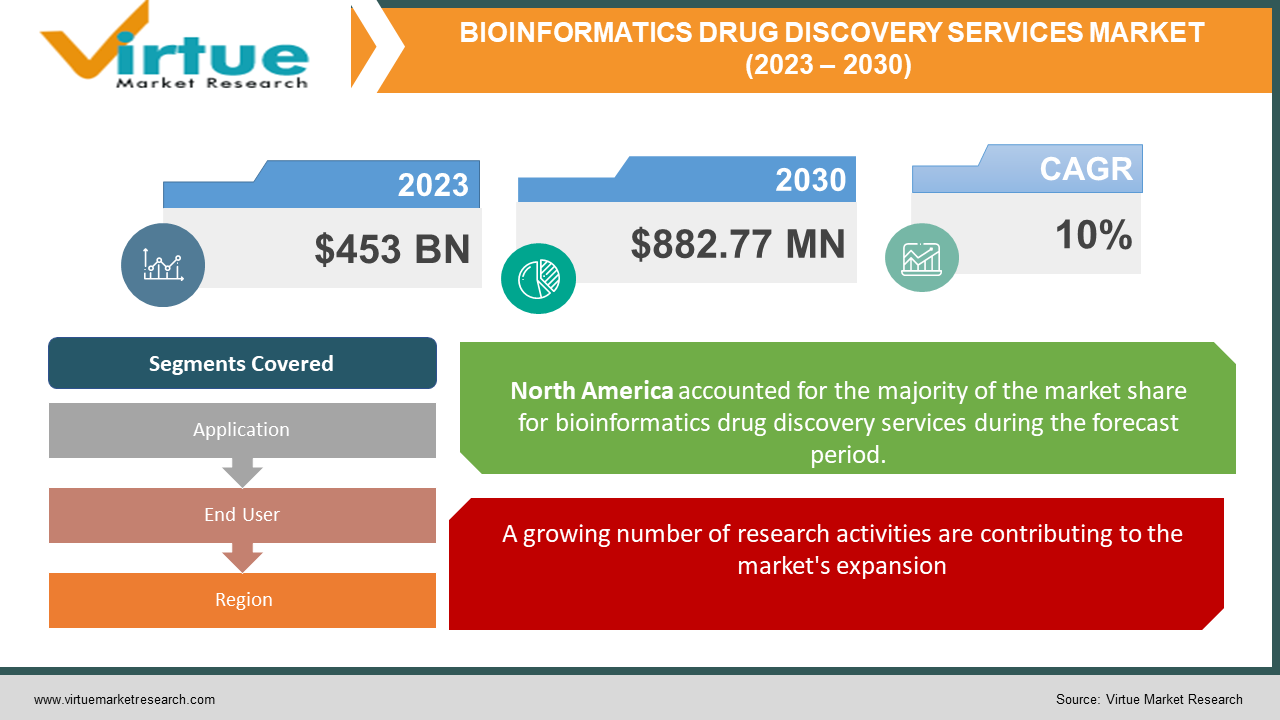

The global bioinformatics drug discovery services market was valued at USD 453 billion and is projected to reach a market size of USD 882.77 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 10%.

Bioinformatics deals with the collection, archiving, analysis, and distribution of biological data and information via computer technology. The field of bioinformatics integrates computer science, statistics, and biological sciences to provide expert software tools and algorithms for the analysis and mining of biological data. In the past, this market had limited scope due to uneasy access and the unavailability of data. However, with funding, R&D activities, and governmental involvement, this market is currently blooming. In the future, with a focus on artificial intelligence, data analytics, and other technologies, this market will see enormous growth. During the forecast period, a considerable growth rate is anticipated.

Key Market Insights:

The Latin American bioinformatics industry was projected to be worth 1.31 billion USD in 2022. According to projections, the amount would rise to 2.06 billion dollars by 2025 and would even reach 2.78 billion dollars by 2027.

R&D expenditures in the German pharmaceutical and biotechnology industries totaled around one million euros in 2022.

The global market for in-silico drug discovery is projected to be worth 6.5 billion dollars by 2031. The market was worth 2.4 billion dollars in 2021.

Global demand for AI-enabled clinical trials and drug discovery is growing. It is anticipated that the compound annual growth rate will be around 25 percent from 2019 to 2030. According to projections, North America will account for roughly 58% of worldwide market sales by 2030, dominating the industry.

Approximately 90% was thought to be the attrition rate during the medication development process. This indicates that the likelihood of a new medication candidate reaching market approval is only around 1 in 10 who go to preclinical research. Therefore, computational tools are being improved to enhance the accuracy in the early stages.

Bioinformatics Drug Discovery Services Market Drivers:

A growing number of research activities are contributing to the market's expansion.

The number of research activities has significantly increased over the past decade. A lot of people are interested in pursuing a career in this field. The software available helps in understanding the mechanism, finding suitable treatments, and preventing diseases. Certain diseases like diabetes, cancer, and Alzheimer's have no cure. Therefore, this software is very important for understanding different sequences and genes. To discover a treatment, they aid in identifying sequence abnormalities along with possible mutations. To support this, many governmental organizations, multinational companies, and investors have been funding various research projects and institutes. There have been major milestones in analyzing patterns. This data is helping mankind to further broaden human understanding and discover additional drugs that are necessary.

The rising demand for personalized medicine is boosting growth.

Personalized medicine adjusts procedures, treatments, medications, and products to the specific needs of each patient. Based on the patient's expected response or illness risk, the drugs are made. This concept, which involves finding drug targets and suitable drugs for them, is rapidly emerging. More and more youngsters are keen on pursuing research activities in these areas, which is helping this market progress. For this, various biomarkers are being discovered. They provide information about all the activities that take place in a human cell. Biomarkers are being looked upon for diseases like cancer, neurological diseases, and other cardiovascular diseases. There are various software programs assigned for each biomarker and disease. They help in diagnosing, classifying, and curating specialized plans for an individual. This need for developing effective solutions will be a breakthrough for the market.

Technological advancements are fueling the development.

Fields like artificial intelligence, quantum computing, data analytics, cloud solutions, structural biology, and molecular modeling have undergone tremendous progress. They help improve the efficiency and accuracy of drug discovery and development. Due to these technologies, predictive analysis, handling vast data, simulation, integration, analyzing complex patterns, modeling, and understanding of structural systems have been made possible. To further improve the existing technologies, measures are being taken through R&D activities. Furthermore, bioinformatics is being coupled with genomics and proteomics to get a clear comprehension of the genes and other involved mechanisms.

Bioinformatics Drug Discovery Services Market Restraints and Challenges:

Limited understanding, associated costs, and data security are the main issues that the market is currently experiencing.

Since this is a relatively new field, there is a lot that is undiscovered. It can be difficult for scientists to understand the data and locate appropriate tools for it. Secondly, there are significant expenses linked to the software. Furthermore, upgrading, maintaining, and installing require ongoing care, which can drain businesses. Thirdly, privacy and data security may also be jeopardized. Maintaining the confidentiality of all the data is highly challenging and might result in misuse.

Bioinformatics Drug Discovery Services Market Opportunities:

Priority is being given to R&D projects that focus on biological responses, medication sites, and other indicators. Workshops and training sessions are being facilitated to find out relevant remedies. The concept of personalized medicine is being prioritized, leading to a larger workforce. Prominence is being given to discovering computational tools. Additionally, investments and funding have increased for fields like AI and ML. Studies are being conducted in the metabolic and molecular biology fields.

BIOINFORMATICS DRUG DISCOVERY SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Schrödinger, Genedata, Certara, Collaborative Drug Discovery (CDD), Atomwise, Insilico Medicine, Numerate, Acellera, Biovista, ChemAxon |

Bioinformatics Drug Discovery Services Market Segmentation: By Application

-

Oncology

-

Cardiovascular Diseases

-

Neurology

-

Infectious Diseases

-

Others

Oncology is the largest application segment holding the majority of the shares in the global bioinformatics drug discovery services market. A lot of young minds are interested in finding a cure for cancer. Even though there are treatments like chemotherapy, the chances of relapse cannot be neglected. Besides, the growing incidence of cancer calls for the development of a permanent solution. Globally, cancer was the cause of around 10 million deaths in 2020; by 2040, that figure is predicted to rise to over 16 million, as per Statista. Therefore, it is very necessary to find an effective drug for the same, contributing to the success of this category. Neurology is also among the leading segments owing to rising prevalence, interest, and breakthroughs in research activities. The infectious diseases category is the fastest-growing segment because there have been several emerging diseases over time. Additionally, certain bacteria and other microorganisms have developed resistance to the existing drugs. Furthermore, advancements in bioinformatics are aiding the growth.

Bioinformatics Drug Discovery Services Market Segmentation: By End User

-

Research Laboratories and Academic Institutes

-

Pharmaceutical and Biotechnology Companies

-

Contract Research Organizations (CROs)

-

Hospitals and Diagnostic Centers

Based on end users, pharmaceutical and biotechnology firms are the largest segment. They hold a total share of around 37% of the market. The necessity and desire to create novel medicine formulations for illnesses for which there is no treatment have led to supremacy. Furthermore, research is conducted in a highly sophisticated manner and is supported by substantial funding. These businesses will find it simpler to obtain research articles and a variety of technologies. The rise of several companies that concentrate on medicinal and molecular research is also a factor in its success. However, academic institutions and research labs are expanding at the fastest rate due to government funding, emerging startups, research projects, and an increasing interest of youngsters in pursuing research careers. During the forecast period, this segment is predicted to further expand.

Bioinformatics Drug Discovery Services Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, North America has the largest market. This is due to technological advancements, the presence of key companies, the increasing number of patients with various disorders and diseases, research activities, funds, and economic developments. The United States and Canada are the leading countries. This region is estimated to hold a share of around 36%. Asia-Pacific is the fastest-growing, holding a share of around 22%. This is because of rising investments, growing research focus, improving economies, emerging startups, and other bigger firms, an increasing number of biotechnological establishments, and demand for personalized medicine concepts. Countries like Japan, Australia, and Singapore are at the forefront. Europe is also among the leading countries due to advancements in AI, pharmaceutical companies, collaborations, and research institutes. Countries like Germany, the United Kingdom, and Sweden have shown immense growth.

COVID-19 Impact Analysis on the Global Bioinformatics Drug Discovery Services Market:

There was an urgent need to find an effective vaccine to prevent the spreading of the virus. Most of the governmental funding was shifted towards healthcare applications. This involved the development of vaccines and other therapeutics for the coronavirus. R&D activities saw an upsurge as a result. Bioinformatics and other tools were vital for identifying patterns and understanding genome sequences. These software tools helped in analyzing the data and finding suitable targets. Drug repurposing effects, suitable biomarkers, and other potential treatments were studied with the aid of different software. Various research institutes presented their findings through online conferences during the pandemic. Prestigious journals published all the data to widen human knowledge. According to a poll carried out by the Careers Research and Advisory Center between February and March 2021, 27% of respondents said that COVID-19 had given them unanticipated research prospects. Post-pandemic, the market has continued to rise.

Latest Trends/ Developments:

Companies in this industry are driven to increase their market share using a variety of tactics, including alliances, investments, and acquisitions. Along with maintaining competitive pricing, businesses are paying much to advance their existing technology and find better ones.

Artificial intelligence (AI) has drawn a lot of interest lately because it can drastically reduce the time and expense associated with discovering new pharmaceuticals. As deep learning (DL) technology develops and the amount of drug-related data increases, DL-based techniques are being employed more and more in all phases of drug development. By combining knowledge graphs, structure-based computational techniques, and drug target interaction (DTI) prediction, various deep learning models may be used to evaluate the data.

Key Players:

-

Schrödinger

-

Genedata

-

Certara

-

Collaborative Drug Discovery (CDD)

-

Atomwise

-

Insilico Medicine

-

Numerate

-

Acellera

-

Biovista

-

ChemAxon

In September 2023, leading scientific and technology business Merck announced the formation of two new strategic partnerships for drug development. These partnerships are intended to help the company expand its research endeavors by utilizing AI-driven design and discovery skills. The collaborations with Exscientia in Oxford, UK, and BenevolentAI in London, UK, are anticipated to provide several innovative clinical development medication candidates with best- and first-in-class potential in the important therapeutic domains of immunology, neurology, and cancer

In September 2022, to use CytoReason's artificial intelligence technology for Pfizer's drug research initiatives, the two companies announced the extension of their multi-year partnership.

In January 2020, the top artificial intelligence (AI) drug discovery startup, Exscientia, announced that it has partnered with Bayer AG to speed up the search for small-molecule treatments targeted at cancer and cardiovascular disease.

Chapter 1. Bioinformatics Drug Discovery Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bioinformatics Drug Discovery Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bioinformatics Drug Discovery Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bioinformatics Drug Discovery Services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bioinformatics Drug Discovery Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bioinformatics Drug Discovery Services Market – By Application

6.1 Introduction/Key Findings

6.2 Oncology

6.3 Cardiovascular Diseases

6.4 Neurology

6.5 Infectious Diseases

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Bioinformatics Drug Discovery Services Market – By End User

7.1 Introduction/Key Findings

7.2 Research Laboratories and Academic Institutes

7.3 Pharmaceutical and Biotechnology Companies

7.4 Contract Research Organizations (CROs)

7.5 Hospitals and Diagnostic Centers

7.6 Y-O-Y Growth trend Analysis By End User

7.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Bioinformatics Drug Discovery Services Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Bioinformatics Drug Discovery Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Schrödinger

9.2 Genedata

9.3 Certara

9.4 Collaborative Drug Discovery (CDD)

9.5 Atomwise

9.6 Insilico Medicine

9.7 Numerate

9.8 Acellera

9.9 Biovista

9.10 ChemAxon

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bioinformatics Drug Discovery Services Market was valued at USD 453 million and is projected to reach a market size of USD 882.77 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10%.

A growing number of research activities, rising demand for personalized medicine, and technological advancements are propelling the Global Bioinformatics Drug Discovery Services Market.

Based on End User, the Global Bioinformatics Drug Discovery Services Market is segmented into Research Laboratories and Academic Institutes, Pharmaceutical and Biotechnology Companies, Contract Research Organizations (CROs), and Hospitals and Diagnostic Centers.

North America is the most dominant region for the Global Bioinformatics Drug Discovery Services Market.

Schrödinger, Genedata, and Certara are the key players operating in the Global Bioinformatics Drug Discovery Services Market.