Biofuel Market Size (2025 – 2030)

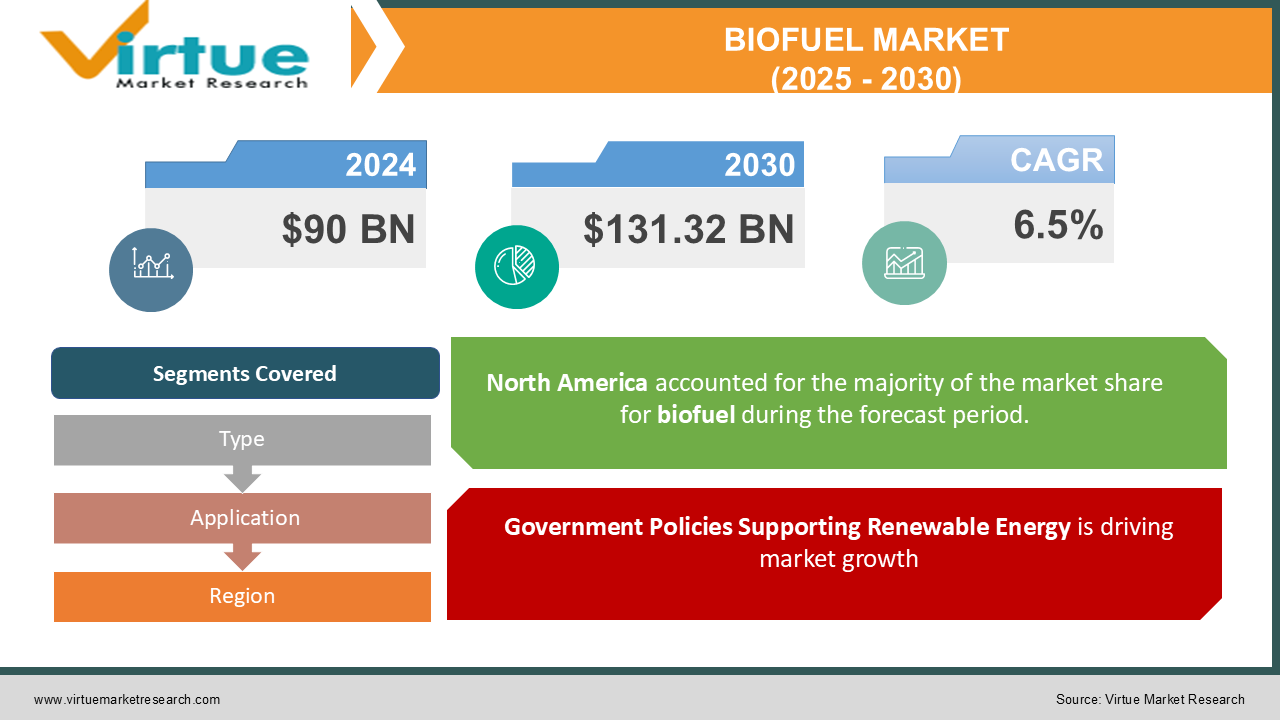

The Global Biofuel Market was valued at USD 90 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. By 2030, the market is expected to reach USD 131.32 billion.

Biofuels, derived from biomass, include biodiesel, ethanol, and other renewable sources used as alternatives to fossil fuels in transportation, power generation, and heating applications. Growing concerns over environmental sustainability, rising fossil fuel prices, and government initiatives promoting renewable energy sources are driving the global biofuel market's expansion.

Key Market Insights:

-

Bioethanol accounts for the largest share in the biofuel market, contributing approximately 60% to global revenue in 2024, due to its widespread use in blending with gasoline.

-

Biodiesel is growing rapidly, with an expected CAGR of 7.2% between 2025 and 2030, fueled by mandates from the European Union for low-emission fuels.

-

The transportation sector represents nearly 80% of the biofuel consumption globally, as governments enforce stricter emission reduction policies.

-

The Asia-Pacific region experienced the fastest growth in the biofuel market, with an annual increase of 8% in 2024, owing to significant investments in biofuel plants in India and China.

-

Government subsidies and tax benefits for biofuel producers in North America have bolstered the market, with the region accounting for 30% of the global market share in 2024.

-

Technological advancements, such as second-generation biofuels from agricultural residues and algae-based biofuels, are expected to reshape the market dynamics. Increasing focus on achieving net-zero emissions by 2050 is pushing investments in research and development for advanced biofuel technologies.

-

Limited availability of feedstock remains a constraint, with nearly 60% of biofuel manufacturers reporting challenges in sourcing raw materials in 2024.

Global Biofuel Market Drivers:

Government Policies Supporting Renewable Energy is driving market growth:

Governments worldwide are implementing policies to reduce greenhouse gas emissions and dependency on fossil fuels. For instance, the Renewable Fuel Standard (RFS) in the United States mandates a certain volume of biofuel to be blended with petroleum-based fuels. Similarly, the European Union’s Renewable Energy Directive II (RED II) aims to achieve 14% renewable energy usage in transportation by 2030. These regulations significantly contribute to the biofuel market's growth by creating a stable demand. Additionally, subsidies and tax benefits are encouraging private players to enter the market. The increasing awareness of climate change impacts further strengthens these government initiatives.

Rising Fossil Fuel Prices and Energy Security Concerns is driving market growth:

With the volatility of crude oil prices, countries are exploring biofuels as a cost-effective and stable alternative. Biofuels reduce dependency on oil imports, enhancing energy security. Emerging economies like India and Brazil are investing heavily in biofuel production to reduce their reliance on fossil fuel imports, which account for a significant portion of their trade deficits. Furthermore, the transport sector, which contributes nearly 25% of global CO2 emissions, is turning to biofuels for achieving emission reduction targets, spurring market demand.

Technological Advancements in Biofuel Production is driving market growth:

Innovations in biofuel technologies, such as the development of second and third-generation biofuels, are overcoming traditional limitations of feedstock availability and efficiency. For example, algae-based biofuels offer a high yield per hectare compared to traditional crops, reducing the need for arable land. Similarly, second-generation biofuels, derived from agricultural residues, minimize the impact on food supply chains. These advancements are attracting investments from both governments and private entities, creating growth opportunities for the biofuel industry.

Global Biofuel Market Challenges and Restraints:

Feedstock Availability and Competition with Food Production is restricting market growth:

The biofuel industry heavily relies on feedstock such as sugarcane, corn, and soybean. However, the increasing demand for these raw materials in the food industry creates competition, raising concerns about food security. For instance, the global corn price surged by 15% in 2024, significantly impacting bioethanol production costs. Additionally, climate change and erratic weather patterns are affecting crop yields, leading to feedstock shortages. These challenges necessitate the exploration of alternative raw materials, such as non-edible crops or waste biomass, to ensure sustainable growth of the biofuel sector.

High Initial Investment Costs is restricting market growth:

Establishing biofuel production facilities requires significant capital investment, particularly for advanced biofuels. For example, second-generation biofuel plants cost approximately 50% more than traditional ethanol plants due to the complexity of technologies involved. Furthermore, small and medium-sized enterprises face challenges in securing funding for such projects. While government subsidies and public-private partnerships help mitigate some costs, the high initial investment remains a barrier for market entry and expansion. This constraint is particularly significant in developing regions where capital resources are limited.

Market Opportunities:

The transition toward cleaner energy sources presents immense opportunities for the biofuel market. Developing economies, such as India and Brazil, are investing in large-scale biofuel production to reduce their dependency on imported crude oil. Brazil’s Proálcool Program and India’s National Policy on Biofuels are prime examples of such initiatives. The aviation industry is also emerging as a potential market for biofuels, with companies like Boeing and Airbus testing biofuel blends to reduce carbon footprints. Furthermore, the development of bio-refineries capable of producing biofuels along with bioplastics and chemicals can diversify revenue streams for producers. Technological advancements in waste-to-biofuel conversion are opening new avenues for biofuel production, particularly in urban areas where waste management is a growing concern.

BIOFUEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland (ADM), POET LLC, Green Plains Inc., Neste Corporation, Renewable Energy Group, Inc., Abengoa Bioenergy, Novozymes A/S, BP Biofuels |

Biofuel Market Segmentation: By Type

-

Bioethanol

-

Biodiesel

-

Biogas

-

Others

In the type category, bioethanol is the most dominant segment, accounting for 60% of the market share in 2024. Its widespread application as a fuel additive in gasoline blends, particularly in North America and Brazil, contributes to its dominance.

Biofuel Market Segmentation: By Application

-

Transportation

-

Power Generation

-

Heating

In the application category, transportation leads with an 80% market share in 2024, driven by strict emission norms and the push for alternative fuels in the automotive sector.

Biofuel Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the leading region in the biofuel market, contributing 30% of the global revenue in 2024. The region's dominance is attributed to favorable government policies, such as the Renewable Fuel Standard (RFS) in the U.S., which mandates the blending of biofuels in gasoline. Additionally, technological advancements in feedstock utilization and the presence of leading market players enhance North America's market position. The U.S. and Canada are also witnessing increased investments in second-generation biofuels, reducing dependency on imported crude oil and aligning with carbon neutrality goals.

COVID-19 Impact Analysis on the Biofuel Market:

The COVID-19 pandemic had a profound impact on the global biofuel market, leading to a 10% decline in production in 2020. This downturn was primarily due to lockdown measures and a sharp reduction in transportation demand, which affected bioethanol producers the most, as gasoline consumption plummeted. With travel restrictions and reduced fuel needs, the market faced significant challenges. However, the pandemic also underscored the critical need for energy security, prompting governments worldwide to prioritize renewable energy projects as part of their economic recovery strategies. This shift in focus helped the biofuel sector recover more swiftly than anticipated. By 2021, biofuel production rebounded by 8%, driven by a rise in demand for sustainable aviation fuel (SAF) and renewable diesel, which became key components in the effort to decarbonize the transportation sector. The pandemic also accelerated the adoption of digital technologies in biofuel production facilities. With the urgency to streamline operations and manage costs more efficiently, biofuel plants increasingly turned to automation, data analytics, and other technological innovations. These digital tools helped optimize production processes, reduce waste, and improve overall operational efficiency. As a result, the biofuel industry emerged from the pandemic more resilient and better equipped to meet future energy demands. In conclusion, while the COVID-19 pandemic initially caused significant disruptions to the biofuel market, it ultimately spurred investments in renewable energy and technological advancements. These developments have paved the way for a more sustainable and secure biofuel industry, highlighting its importance in global energy strategies.

Latest Trends/Developments:

The biofuel market is undergoing a significant transformation, with a growing emphasis on advanced biofuels such as algae-based and cellulosic biofuels. These next-generation fuels offer higher yields and greater sustainability, positioning them as key players in the future of renewable energy. In the aviation sector, sustainable aviation fuels (SAFs) are becoming increasingly adopted, with airlines setting ambitious goals to reduce carbon emissions by 50% by 2050. This shift is part of a broader effort to decarbonize air travel and make it more sustainable. Governments worldwide are also enhancing their support for biofuels, particularly through biofuel blending mandates. For example, India has set an ambitious target of achieving a 20% ethanol blend in its fuel supply by 2025. This move aligns with global trends towards increasing the use of renewable fuels and reducing reliance on fossil-based energy sources. Moreover, the rise of integrated bio-refineries is a key development in the biofuel industry. These facilities are designed to produce a wide range of bio-based products, including fuels, chemicals, and bioplastics, contributing to a circular economy and enhancing the versatility of biofuel production. This approach not only maximizes the use of renewable resources but also helps reduce waste by producing multiple valuable products from the same feedstocks. To address one of the major challenges in biofuel production—the supply of feedstock—partnerships between energy companies and agricultural producers are becoming more common. These collaborations help strengthen feedstock supply chains, ensuring a steady and sustainable flow of raw materials needed for biofuel production. As these trends continue to evolve, the biofuel market is set for sustained growth and increased innovation in the coming years.

Key Players:

-

Archer Daniels Midland (ADM)

-

POET LLC

-

Green Plains Inc.

-

Neste Corporation

-

Renewable Energy Group, Inc.

-

Abengoa Bioenergy

-

Novozymes A/S

-

BP Biofuels

Chapter 1. Biofuel Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Biofuel Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Biofuel Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Biofuel Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Biofuel Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Biofuel Market – By Type

6.1 Introduction/Key Findings

6.2 Bioethanol

6.3 Biodiesel

6.4 Biogas

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Biofuel Market – By Application

7.1 Introduction/Key Findings

7.2 Transportation

7.3 Power Generation

7.4 Heating

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Biofuel Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Biofuel Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland (ADM)

9.2 POET LLC

9.3 Green Plains Inc.

9.4 Neste Corporation

9.5 Renewable Energy Group, Inc.

9.6 Abengoa Bioenergy

9.7 Novozymes A/S

9.8 BP Biofuels

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Biofuel Market was valued at USD 90 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. By 2030, the market is expected to reach USD 131.32 billion.

Key drivers include government policies supporting renewable energy, rising fossil fuel prices, and advancements in biofuel production technologies.

The market is segmented by type (bioethanol, biodiesel, biogas, others) and application (transportation, power generation, heating).

North America leads the market with a 30% share, driven by government mandates and technological advancements.

Leading players include Archer Daniels Midland, POET LLC, Neste Corporation, Green Plains Inc., and Renewable Energy Group, Inc.