Bioethanol for Automotive Market Size (2024 - 2030)

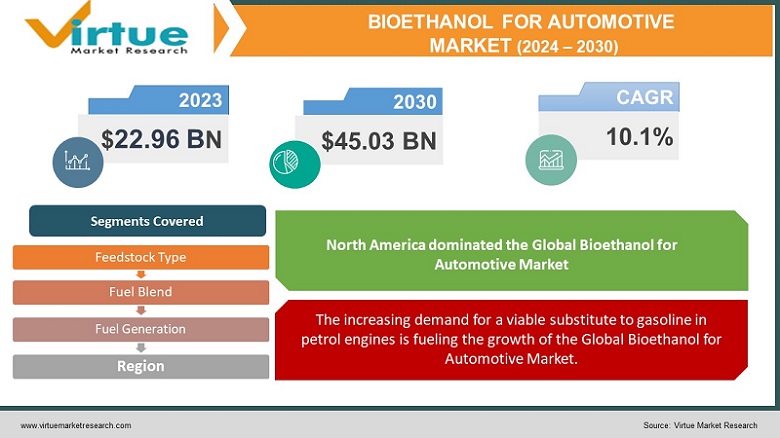

The Global Bioethanol for Automotive Market was valued at USD 22.96 Billion and is projected to reach a market size of USD 45.03 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.1%.

Biofuels are obtained from organic materials that can naturally break down and can exist in either liquid or gaseous states. These materials include agricultural and forestry byproducts, as well as biodegradable portions of industrial and municipal waste. Among the various biofuels, ethanol produced from renewable energy sources demonstrates promising prospects for the future. It is chiefly sourced through the fermentation of sugars found in starch-rich crops like corn and sugar cane. Bioethanol is extensively utilized as an additive in the fuel industry, blended with gasoline to elevate octane levels. The most common blend comprises 90% gasoline and 10% ethanol. Notably, bioethanol's organic composition leads to cleaner emissions when burned, releasing carbon dioxide, water vapor, and heat. The carbon dioxide emitted during combustion is absorbed by plants via photosynthesis, which creates a cycle that implies bioethanol could be a carbon-neutral fuel source.

Bioethanol possesses multiple advantages over traditional fuels. It is generally sourced from renewable crops, which results in minimal or no additional carbon dioxide emissions. This makes bioethanol environmentally friendly. Its utilization in transportation markedly curtails greenhouse gas emissions, and it is biodegradable and less toxic than fossil fuels. Blending bioethanol with gasoline helps address diminishing global oil supplies, which ensures fuel security and reduces reliance on foreign sources. This benefits rural communities through elevated crop cultivation. Bioethanol also diminishes carbon monoxide emissions from older vehicle engines, which aids in improving air quality. Its seamless integration with existing fuel systems allows for easy blending without engine modifications.

Global Bioethanol for Automotive Market Drivers:

The increasing demand for a viable substitute to gasoline in petrol engines is fueling the growth of the Global Bioethanol for Automotive Market.

Bioethanol serves as a viable alternative to gasoline in petrol engines, given that it can be blended with gasoline in varying ratios. Most petrol engines can operate frictionlessly with blends of up to 15% bioethanol and petroleum. The higher-octane rating of bioethanol, in contrast to ethanol-free gasoline, offers an advantage by enabling engines to attain higher compression ratios. This leads to amplified thermal efficiency and performance. Therefore, this factor propels the demand for bioethanol for automotive applications.

The rising demand for enhanced air quality and sustainable automotive applications is another factor contributing to the growth of the Global Bioethanol for Automotive Market.

Bioethanol plays an imperative role in ameliorating air quality by reducing harmful compounds found in gasoline and mitigating emissions of particulates, soot, and greenhouse gases. Ethanol plants prioritize water conservation and implement designs to save water while ensuring strict regulation of water discharge to avert negative environmental impact. Additionally, effective management and recycling of wastewater generated during ethanol production contribute to positive ecological effects. Overall, the utilization of bioethanol leads to diminished exhaust gas emissions, improved energy efficiency, and amplified safety in transportation infrastructure. Therefore, this factor also propels the demand for bioethanol for automotive applications.

Global Bioethanol for Automotive Market Challenges:

The Global Bioethanol for Automotive Market is encountering challenges, primarily in terms of the growing preference for electric vehicles. EVs offer several advantages, including diminished carbon emissions, budget-friendly operation and maintenance, and favorable tax incentives. The sales of electric vehicles have been consistently augmenting, suggesting a sustained trend. Consequently, the demand for bioethanol is projected to decline due to the rising popularity and advantages of electric vehicles. Thus, these challenges inhibit the growth of the Global Bioethanol Automotive Market.

Global Bioethanol for Automotive Market Opportunities:

Market expansion strategies present a lucrative opportunity in the Global Bioethanol for Automotive Market. The demand for bioethanol for automotive applications is augmenting owing to its advantages, including declined greenhouse gas emissions, cleaner exhaust gases, high octane number, comparable energy content, and reduced utilization of cancer-causing gasoline compounds. Businesses specializing in the production of bioethanol can attain considerable benefits from this opportunity by broadening their production facilities in emerging markets, encompassing Italy, Finland, Slovenia, and the Czech Republic. By pursuing this expansion, companies can broaden their customer base and drive a notable increase in their overall revenue.

COVID-19 Impact on the Global Bioethanol for Automotive Market:

The Global Bioethanol for Automotive Market has been considerably influenced by the COVID-19 outbreak. As a result of rigorous lockdowns, travel restrictions, and social distancing measures, the demand for bioethanol for automotive applications waned. Delays in the expedient production and distribution of goods and services have also been caused by the pandemic's influence on the market's supply chain. The manufacturing facilities' cessation and limited production capacity declined the demand for bioethanol in the automotive sector. Volatility in crude oil prices during the pandemic curtailed bioethanol's market competitiveness, as subdued oil prices made gasoline a more economically appealing option, which led to dwindled demand for bioethanol as a blending agent. These factors negatively impacted the market's growth. Despite these challenges, the market is likely to rebound alongside the global recovery from the pandemic.

Global Bioethanol for Automotive Market Recent Developments:

- In August 2022, GS E&C, a Korean EPC contractor, and St1, a Finnish bioenergy company, unveiled a collaboration to produce next-generation bioethanol from cassava waste in Thailand. Cassava is a tropical tuber root plant that resembles a sweet potato.

- In October 2021, The Archer-Daniels-Midland Company reached an agreement with BioUrja Group to sell its ethanol manufacturing plant in Peoria, Illinois, United States. The sale of the Peoria facility was a vital part of ADM's strategic evaluation of their dry mill ethanol assets.

- In December 2020, Bionex, a Serbia-based firm, unveiled its intentions to establish a bioethanol plant in Apatin. The project, set to commence in March 2021, will involve a significant investment of USD 6.1 billion.

BIOETHANOL FOR AUTOMOTIVE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.1% |

|

Segments Covered |

By Feedstock Type, Fuel Blend, Fuel Generation and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Alto Ingredients, Inc. (United States), POET, LLC (United States), The Andersons, Inc. (United States), Valero Energy Corporation (United States), Abengoa Bioenergía S.A. (Spain), Tereos SCA (France), CropEnergies AG (Germany), Green Plains Inc. (United States), Flint Hills Resources LLC (United States), Raízen SA (Brazil) |

Global Bioethanol for Automotive Market Segmentation:

Global Bioethanol for Automotive Market Segmentation: By Feedstock Type

-

Cellulose-Based

-

Starch-Based

-

Sugar-Based

-

Others

The starch-based segment held the highest market share in the year 2022. The growth can be ascribed to the copious availability of starch feedstocks in crops like corn, wheat, and barley. This accessibility guarantees a steady supply, which contributes to the dominance of starch-based bioethanol. The existing infrastructure and expertise in ethanol production and distribution further benefit the starch-based bioethanol market. Numerous countries already have established facilities, transportation networks, and blending facilities for starch-based bioethanol production.

Global Bioethanol for Automotive Market Segmentation: By Fuel Blend

-

E5

-

E10

-

E15 to E70

-

E75 to E85

-

Others

The E10 segment held the highest market share in the year 2022. The growth can be ascribed to the extensive blending of E10 bioethanol with conventional fuels which enhances their renewable properties. E10 refers to a gasoline blend that consists of 90% regular unleaded fuel and 10% ethanol. The consumption of bioethanol in the E10 sector is anticipated to augment owing to its growing utilization in the automotive industry. To diminish global greenhouse gas emissions, multiple governments in Europe and other regions have mandated the utilization of E-10 fuel blends in vehicles.

Global Bioethanol for Automotive Market Segmentation: By Fuel Generation

-

First Generation

-

Second Generation

-

Third Generation

The first-generation segment held the highest market share in the year 2022. The growth can be ascribed to the extensive utilization of edible food crops like rice, wheat, barley, potato, corn, sugarcane, and various vegetable oils (e.g., soybean oil, sunflower oil, olive oil, canola oil, mustard oil) as feedstock for bioethanol production. While first-generation bioethanol has gained traction in several nations, its viability is still uncertain due to concerns over competition with the food supply and land usage, resulting in higher food costs.

Global Bioethanol for Automotive Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The region of North America dominated the Global Bioethanol for Automotive Market in the year 2022. The extensive utilization of bioethanol as an alternative to standard gasoline owing to stringent environmental regulations imposed by the governments and the increasing investments in research and development activities are some of the pivotal factors propelling the region's growth. The U.S. is the top producer of bioethanol worldwide. Furthermore, North America is home to several prominent market players, including Alto Ingredients, Inc., POET, LLC, The Andersons, Inc., Valero Energy Corporation, and Flint Hills Resources LLC.

The region of Asia-Pacific is anticipated to expand at the quickest rate over the forecast period 2023-2030 owing to the increasing setting up of bioethanol plants across the nations of China, India, and Thailand, the national policy on biofuels introduced by the Indian government, which envisioned an indicative target of 20% of bioethanol blending in gasoline by 2030, and the strong presence of key market players, including TruAlt Bioenergy, PetroChina Company Ltd., and Indian Oil Corporation.

Global Bioethanol for Automotive Market Key Players:

-

Alto Ingredients, Inc. (United States)

-

POET, LLC (United States)

-

The Andersons, Inc. (United States)

-

Valero Energy Corporation (United States)

-

Abengoa Bioenergía S.A. (Spain)

-

Tereos SCA (France)

-

CropEnergies AG (Germany)

-

Green Plains Inc. (United States)

-

Flint Hills Resources LLC (United States)

-

Raízen SA (Brazil)

Chapter 1. GLOBAL BIOETHANOL FOR AUTOMOTIVE MARKET - Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. GLOBAL BIOETHANOL FOR AUTOMOTIVE MARKET - Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2024 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. GLOBAL BIOETHANOL FOR AUTOMOTIVE MARKET - Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. GLOBAL BIOETHANOL FOR AUTOMOTIVE MARKET - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. GLOBAL BIOETHANOL FOR AUTOMOTIVE MARKET - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. GLOBAL BIOETHANOL FOR AUTOMOTIVE MARKET - By Feedstock Type

6.1 Cellulose-Based

6.2 Starch-Based

6.3 Sugar-Based

6.4 Others

Chapter 7. GLOBAL BIOETHANOL FOR AUTOMOTIVE MARKET - By Fuel Blend

7.1 E5

7.2 E10

7.3 E15 to E70

7.4 E75 to E85

7.5 Others

Chapter 8. GLOBAL BIOETHANOL FOR AUTOMOTIVE MARKET - By Fuel Generation

8.1 First Generation

8.2 Second Generation

8.3 Third Generation

Chapter 9. GLOBAL BIOETHANOL FOR AUTOMOTIVE MARKET – By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. GLOBAL BIOETHANOL FOR AUTOMOTIVE MARKET – Key players

10.1 Alto Ingredients, Inc. (United States)

10.2 POET, LLC (United States)

10.3 The Andersons, Inc. (United States)

10.4 Valero Energy Corporation (United States)

10.5 Abengoa Bioenergía S.A. (Spain)

10.6 Tereos SCA (France)

10.7 CropEnergies AG (Germany)

10.8 Green Plains Inc. (United States)

10.9 Flint Hills Resources LLC (United States)

10.10 Raízen SA (Brazil)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bioethanol for Automotive Market was valued at USD 22.96 Billion and is projected to reach a market size of USD 45.03 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.1%.

The Global Bioethanol for Automotive Market Drivers is the Increasing Demand for a Viable Substitute to Gasoline in Petrol Engines and the Rising Demand for Enhanced Air Quality and Sustainable Automotive Applications.

Based on the Feedstock Type, the Global Bioethanol for Automotive Market is segmented into Cellulose-Based, Starch-Based, Sugar-Based, and Others.

The United States is the most dominating country in the region of North America for the Global Bioethanol for Automotive Market.

Alto Ingredients, Inc., POET, LLC, and The Andersons, Inc. are the leading players in the Global Bioethanol for Automotive Market.