Biodegradable Paper & Plastic Packaging Market Size (2024 – 2030)

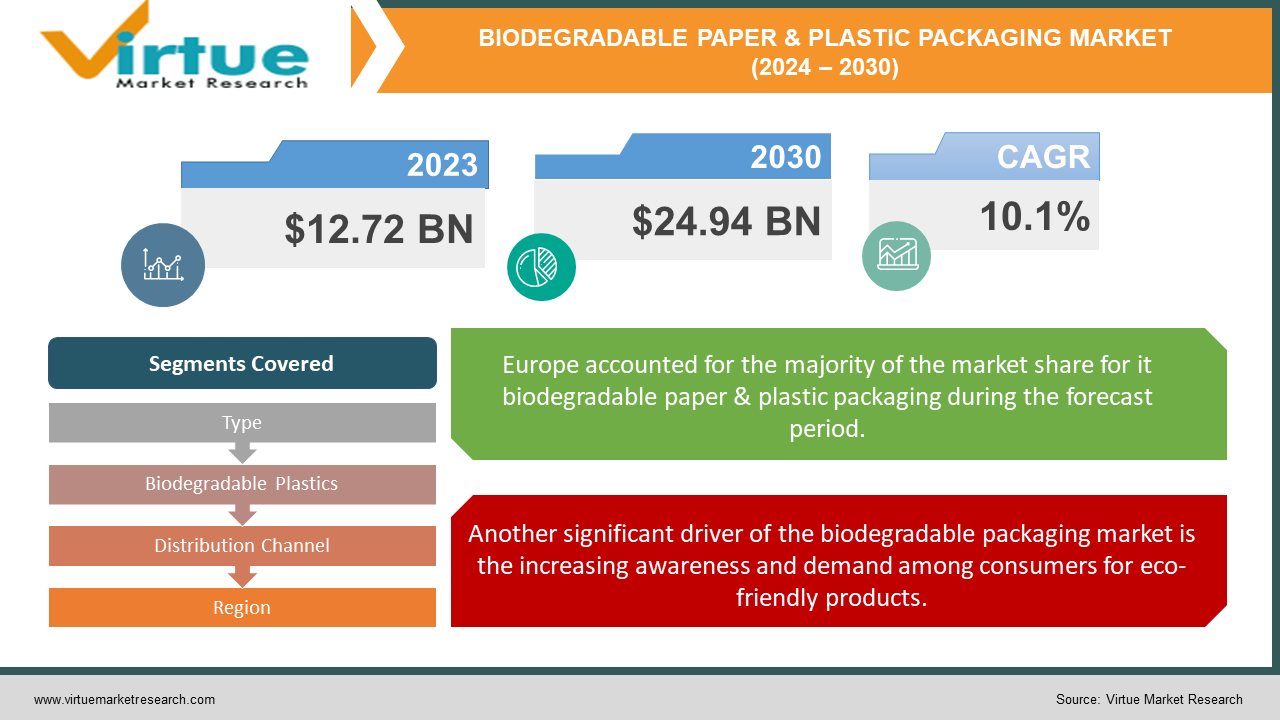

The Biodegradable Paper & Plastic Packaging Market was valued at USD 12.72 Billion in 2023 and is projected to reach a market size of USD 24.94 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.1%.

Growing environmental concerns and a global trend towards sustainable practices have led to a significant increase in the market for biodegradable paper and plastic packaging in recent years. Products in this sector, as opposed to conventional plastic packaging, have a lower environmental effect since they break down organically through the activity of microorganisms. The use of biodegradable substitutes has increased as a result of consumers' and companies' increased awareness of the negative consequences of plastic pollution. Consumer behavior, technical improvements, regulatory frameworks, and economic considerations all have an impact on the biodegradable packaging business. Globally, governments are implementing strict policies aimed at curbing plastic waste, thus promoting the utilization of biodegradable resources. Incentives for businesses who use eco-friendly packaging solutions are frequently included to these rules.

Key Market Insights:

Biodegradable packaging for the healthcare industry is growing at a CAGR of 9.5%.

Investment in R&D for biodegradable materials in Asia-Pacific reached $1 billion in 2023.

The average cost of biodegradable packaging is 25% higher than conventional packaging.

Government subsidies cover 30% of the cost for companies adopting biodegradable packaging in Europe.

90% of plastic waste in the ocean originates from 10 rivers, eight of which are in Asia-Pacific.

The biodegradable packaging market in Japan is expected to grow at a CAGR of 13.5%.

Biodegradable packaging could reduce global plastic waste by 25% by 2030.

The adoption rate of biodegradable packaging in the cosmetics industry is at 15%.

By 2030, biodegradable packaging could save 1 million tons of plastic waste annually.

85% of surveyed companies in Europe have sustainability goals that include biodegradable packaging.

Biodegradable Paper & Plastic Packaging Market Drivers:

One of the primary drivers of the biodegradable paper and plastic packaging market is the implementation of stringent environmental regulations by governments across the globe.

Governments are penalizing businesses that violate environmental regulations and outlawing single-use plastics more often. For example, in an effort to lessen the environmental effects of some plastic products, the European Union has put in place a law that forbids the use of single-use plastic items like straws, plates, and cutlery. Regulations like this force producers to look for different ways to package their products, which increases the market for biodegradable materials. Governments are offering incentives and subsidies to businesses that use biodegradable packaging in addition to prohibitions and fines. These incentives may take the form of tax rebates, grants for R&D, or financial assistance for the manufacturing of biodegradable products. Businesses may shift to more environmentally friendly packaging options with greater ease thanks to this financial assistance. The use of biodegradable packaging is also being fueled by the world's dedication to sustainability. Sustainable patterns of consumption and production are emphasized by international accords like the Paris Agreement and the Sustainable Development Goals (SDGs) of the United Nations. It is more probable that nations that have ratified these accords will put biodegradable packaging rules into effect.

Another significant driver of the biodegradable packaging market is the increasing awareness and demand among consumers for eco-friendly products.

Consumer tastes are clearly shifting in favour of goods with biodegradable packaging. Younger customers, who are more environmentally concerned and prepared to pay more for sustainable items, are the demographic group where this movement is most noticeable. This expanding market of environmentally concerned customers is likely to be drawn to brands that use biodegradable packaging. Digital advertisements and social media are essential for raising awareness of the advantages of biodegradable packaging. These platforms are used by organizations, activists, and influencers to inform the public about the benefits of biodegradable products and the harm that plastic waste does to the environment. Customers are demanding more items with ecological packaging as a result of their greater awareness. In response to consumer demand, retailers and e-commerce sites are expanding their selection of items packaged in a biodegradable manner. Many large retailers have made the commitment to lessen the amount of plastic they use, and they are collaborating with suppliers to find environmentally friendly packaging options. In order to satisfy customer demands and legal obligations, e-commerce platforms—whose packaging waste has a substantial environmental impact—are implementing biodegradable materials.

Biodegradable Paper & Plastic Packaging Market Restraints and Challenges:

The greater cost of biodegradable materials than regular plastics is one of the major obstacles facing the biodegradable packaging sector. Many firms, especially small and medium-sized organizations (SMEs), may find it difficult to implement biodegradable packaging solutions due to this pricing discrepancy. Compared to traditional polymers, the manufacture of biodegradable materials sometimes entails more costly and intricate procedures. For instance, bio-based polymers like PLA are made from renewable resources like sugarcane or maize starch, which need a lot of processing and agricultural inputs. The increased cost of biodegradable packaging is a result of the necessity for specialized production facilities and the high cost of raw ingredients. Compared to regular plastics, biodegradable packaging does not have the same extensive or advanced infrastructure for composting and recycling. The efficiency and environmental advantages of biodegradable packaging may be hampered by this restriction.

Biodegradable Paper & Plastic Packaging Market Opportunities:

The market for biodegradable packaging has a lot of prospects because of the continuous advancements in material science. Scientists and businesses are always creating new materials and refining those that already exist to make biodegradable packaging more efficient, long-lasting, and reasonably priced. Technological developments in bio-based polymers, such PLA and PHA, are propelling the industry. These materials may be used in a variety of applications since they are made from renewable resources and have qualities that are comparable to those of traditional plastics. The goal of ongoing research is to make them stronger, more flexible, more biodegradable than conventional polymers. Another exciting field is the application of nanotechnology to biodegradable packaging. Packaging materials' strength, biodegradability, and barrier qualities can all be improved by adding nanomaterials. For example, research is being done on nano-cellulose and nano-clays to enhance performance.

BIODEGRADABLE PAPER & PLASTIC PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.1% |

|

Segments Covered |

By Type, Biodegradable Plastics, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

International Paper (US), Smurfit Kappa (Ireland), Mondi Group (UK), Stora Enso (Finland), WestRock Company (US), BASF SE (Germany), DuPont (US) (owns Danisco), Novamont (Italy), BioPBS (Thailand), Metabolix (US), Amcor PLC (Australia), Sonoco Products (US), Sealed Air Corporation (US), Tetra Pak International SA (Switzerland), Huhtamaki (Finland) |

Biodegradable Paper & Plastic Packaging Market Segmentation: By Types

-

paper bags

-

cardboard boxes

-

paper-based containers

-

compostable paper packaging

Paper bags are the most dominant type within the biodegradable paper segment. Their widespread use across retail, grocery stores, and food delivery services underscores their importance in the market. Many regions have implemented bans or restrictions on single-use plastic bags, driving demand for paper bags as an eco-friendly alternative. Paper bags are adaptable and have many uses, including packing retail goods and transporting groceries. Additionally, they may be personalized with logos and branding, which appeals to businesses.

In this market, compostable paper packaging is the kind that is expanding the fastest. Packaging materials of this subtype are made to decompose in composting conditions, providing a sustainable alternative for applications such as food packaging. Compostable paper packaging is being used more and more by the food sector for products including meal wraps, coffee cups, and takeout containers. Regulations and customer demand for environmentally friendly packaging are what are causing this change. Compostable paper packaging has been developed with better barrier qualities and durability because of advances in material science, opening up new possibilities for the material.

Biodegradable Paper & Plastic Packaging Market Segmentation: By Biodegradable Plastics

-

polylactic acid (PLA)

-

polyhydroxyalkanoates (PHA)

-

starch blends

-

other compostable plastics

PLA is the most dominant type within the biodegradable plastics segment. Derived from renewable resources such as corn starch and sugarcane, PLA is widely used in various applications, including food packaging, disposable cutlery, and agricultural films. PLA is one of the more cost-effective biodegradable plastics available, making it an attractive option for manufacturers and consumers. PLA has a broad range of uses, including 3D printing materials, disposable cutlery, and packaging sheets and containers.

In this category, PHA is the kind that is expanding the fastest. PHAs have good biodegradability and are created by microbial fermentation of renewable materials. Because PHAs are completely biodegradable in a variety of settings, including as soil, the ocean, and compost, they are the perfect way to cut down on plastic pollution. PHAs have a wide range of uses, including consumer items, medical devices, packaging, and agriculture.

Biodegradable Paper & Plastic Packaging Market Segmentation: By Distribution Channel

-

Direct Sales

-

Online Platforms

-

Direct-to-Consumer (DTC) Channels

The direct sales channel is dominated by business-to-business (B2B) sales. Sales to big-box stores, food and beverage producers, and other industries in need of bulk packaging solutions fall under this category. B2B transactions sometimes entail specialized packaging options made to meet the unique requirements of companies. Specifications for material, size, and branding may be part of this personalization. Packaging for products in regulated sectors like food and medicine must adhere to strict guidelines. Manufacturers may guarantee compliance by providing customized solutions through direct sales.

Online channels, such as marketplaces and e-commerce websites, are quickly taking the lead in biodegradable packaging product distribution. This channel appeals to both customers and companies because it provides ease, a large selection of products, and reasonable cost. Due to the worldwide accessibility of e-commerce platforms, manufacturers may reach a larger audience and grow their consumer base. Price-conscious consumers may now more easily purchase biodegradable packaging materials because to the competitive pricing and discounts found on e-commerce platforms.

Biodegradable Paper & Plastic Packaging Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

Europe’s dominance in the biodegradable paper and plastic packaging market is underpinned by several critical factors. The European Union has been at the forefront of environmental legislation aimed at reducing plastic waste. Directives such as the Single-Use Plastics Directive, which bans certain single-use plastic products and mandates the use of biodegradable alternatives, have significantly influenced market dynamics. European consumers are highly aware of environmental issues and actively seek out sustainable products. This consumer behaviour has pushed businesses to adopt biodegradable packaging to meet market demands and align with green branding strategies.

Asia-Pacific’s rapid growth in the biodegradable packaging market is driven by several factors. The region faces severe plastic pollution problems, with many countries contributing significantly to global plastic waste. Growing awareness of these issues among governments, businesses, and consumers is fueling demand for biodegradable packaging. The rapid expansion of e-commerce in Asia-Pacific has led to increased demand for packaging solutions. E-commerce companies are adopting biodegradable packaging to appeal to eco-conscious consumers and comply with sustainability standards.

COVID-19 Impact Analysis on the Biodegradable Paper & Plastic Packaging Market:

The epidemic caused interruptions in the world's supply chains, which affected the raw materials available for the creation of biodegradable packaging. Travel restrictions and lockdowns made it more difficult for commodities to move, which resulted in shortages and price swings. The early phases of the pandemic caused panic purchasing and hoarding, which raised the demand for packaged items and strained the ability of producers of biodegradable packaging to meet demand. In order to address customer concerns and guarantee product safety, producers of biodegradable packaging adopted more stringent hygiene regulations and sanitation techniques throughout the production process. The pandemic spurred innovation in developing more robust and virus-resistant biodegradable materials, potentially enhancing their appeal in a hygiene-conscious market.

Latest Trends/ Developments:

The global plastic pollution crisis, with its devastating impact on marine ecosystems and wildlife, is a major driving force behind the market growth. Public awareness campaigns and shocking visuals of plastic waste highlight the urgency for alternative packaging solutions. Growing scientific evidence linking microplastics to potential health risks is further fueling the demand for biodegradable options. Consumers are seeking packaging materials that decompose naturally, minimizing the risk of microplastic contamination in the environment and food chain. Paper derived from sustainably managed forests, particularly with certifications like FSC (Forest Stewardship Council), offers a readily available and biodegradable alternative for packaging applications. Advancements in paper coatings and treatments are enhancing its moisture resistance and durability. Bioplastics derived from renewable resources like corn starch, sugarcane, or cellulose offer a promising alternative. These materials can be designed to decompose in industrial composting facilities or even home composting bins under specific conditions.

Key Players:

-

International Paper (US)

-

Smurfit Kappa (Ireland)

-

Mondi Group (UK)

-

Stora Enso (Finland)

-

WestRock Company (US)

-

BASF SE (Germany)

-

DuPont (US) (owns Danisco)

-

Novamont (Italy)

-

BioPBS (Thailand)

-

Metabolix (US)

-

Amcor PLC (Australia)

-

Sonoco Products (US)

-

Sealed Air Corporation (US)

-

Tetra Pak International SA (Switzerland)

-

Huhtamaki (Finland)

Chapter 1. Biodegradable Paper & Plastic Packaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Biodegradable Paper & Plastic Packaging Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Biodegradable Paper & Plastic Packaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Biodegradable Paper & Plastic Packaging Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Biodegradable Paper & Plastic Packaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Biodegradable Paper & Plastic Packaging Market – By Types

6.1 Introduction/Key Findings

6.2 paper bags

6.3 cardboard boxes

6.4 paper-based containers

6.5 compostable paper packaging

6.6 Y-O-Y Growth trend Analysis By Types

6.7 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Biodegradable Paper & Plastic Packaging Market – By Biodegradable Plastics

7.1 Introduction/Key Findings

7.2 polylactic acid (PLA)

7.3 polyhydroxyalkanoates (PHA)

7.4 starch blends

7.5 other compostable plastics

7.6 Y-O-Y Growth trend Analysis By Biodegradable Plastics

7.7 Absolute $ Opportunity Analysis By Biodegradable Plastics, 2024-2030

Chapter 8. Biodegradable Paper & Plastic Packaging Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Online Platforms

8.4 Direct-to-Consumer (DTC) Channels

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Biodegradable Paper & Plastic Packaging Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Types

9.1.3 By Biodegradable Plastics

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Types

9.2.3 By Biodegradable Plastics

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Types

9.3.3 By Biodegradable Plastics

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Types

9.4.3 By Biodegradable Plastics

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Types

9.5.3 By Biodegradable Plastics

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Biodegradable Paper & Plastic Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 International Paper (US)

10.2 Smurfit Kappa (Ireland)

10.3 Mondi Group (UK)

10.4 Stora Enso (Finland)

10.5 WestRock Company (US)

10.6 BASF SE (Germany)

10.7 DuPont (US) (owns Danisco)

10.8 Novamont (Italy)

10.9 BioPBS (Thailand)

10.10 Metabolix (US)

10.11 Amcor PLC (Australia)

10.12 Sonoco Products (US)

10.13 Sealed Air Corporation (US)

10.14 Tetra Pak International SA (Switzerland)

10.15 Huhtamaki (Finland)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Public awareness about the detrimental effects of plastic pollution on ecosystems and human health is a major driving force. Images of plastic-laden oceans and the threat of microplastics are prompting a shift towards sustainable alternatives.

The limited availability of industrial composting facilities, especially in developing regions, can hinder the widespread adoption of biodegradable packaging. Educating consumers about proper disposal methods for these materials is equally crucial, as mistakenly putting them in landfills can negate their environmental benefits.

International Paper (US), Smurfit Kappa (Ireland), Mondi Group (UK), Stora Enso (Finland), WestRock Company (US), BASF SE (Germany), DuPont (US) (owns Danisco), Novamont (Italy), BioPBS (Thailand), Metabolix (US), Amcor PLC (Australia), Sonoco Products (US).

As the largest market worldwide, with a significant 35% share, is Europe.

Asia-Pacific’s rapid growth in the biodegradable packaging market is driven by several factors. The region faces severe plastic pollution problems, with many countries contributing significantly to global plastic waste.