Biocide-free Coatings Market Size (2023 – 2030)

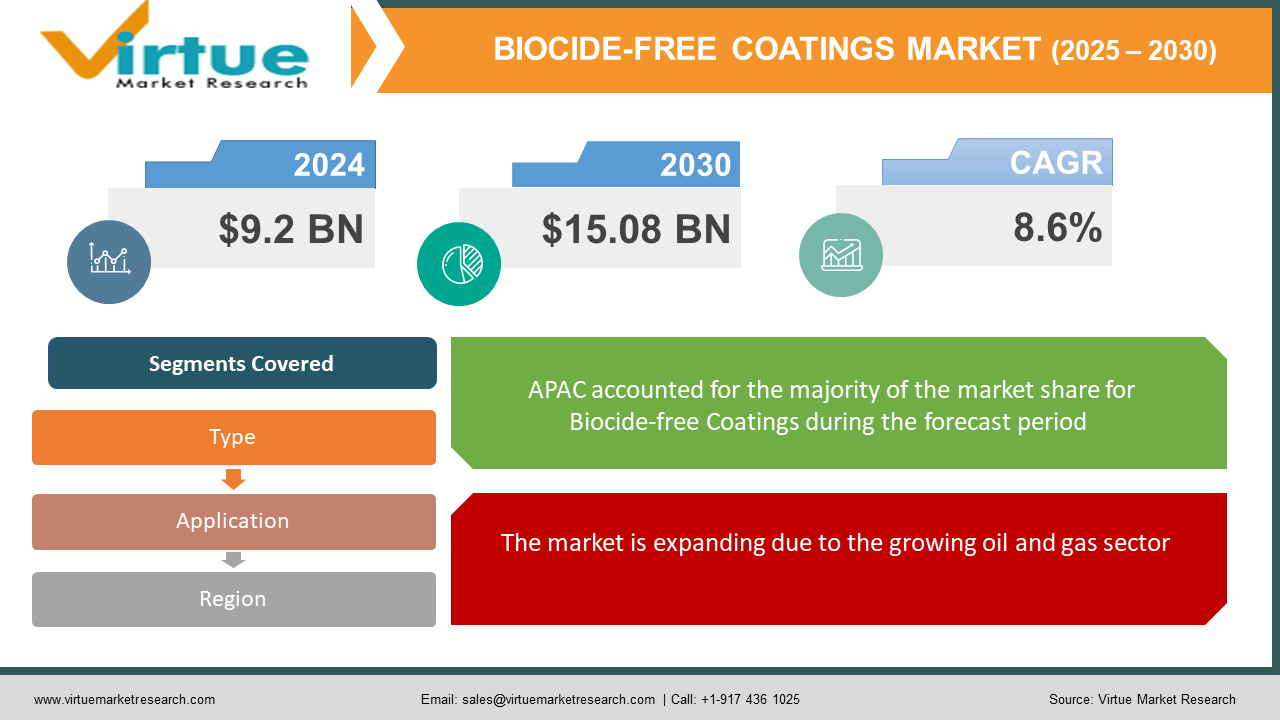

The Biocide-free coatings market was worth USD 9.2 billion in 2021 and is estimated to reach USD 15.08 billion by 2030. The market is anticipated to expand at a CAGR of 8.6% over the forecast period. The need for smoother hulls and underwater surfaces on cargo boats is the main factor propelling the market.

INDUSTRY OVERVIEW

Biocide-free coatings are used to guard metals and alloys against deterioration brought on by various corrosive substances, including moisture, chemicals, salt, and others. They provide the ships they are painted on with several advantages, including an increase in look, weather resistance, resistance to chemical solvents like water and oils, and resistance to damage while in transit. The market demand for marine anti-fouling coatings will be driven by expanding ship repairs & maintenance operations, growing demand from the oil and gas industry, and rising production of recreational boats, commercial vessels, and cruise ships. Biocide-free coatings are unique paints that are applied to a ship's hull to stop the development of aquatic organisms and increase the performance and durability of the vessel. Increased demand for traditional offshore drilling rigs, commercial vessels, passenger ships, yachts, cargo, and FPSOs are anticipated to further boost the market growth. The significance of the product is anticipated to rise significantly as condition-based monitoring becomes more and more preferred in the shipping industry over breakdown maintenance. Additionally, its exceptional qualities, such as resistance to fouling, corrosion, and external contamination, are projected to stimulate expansion.

As more integrated compact systems are used in deepwater offshore reserves under severe weather circumstances, there will be an increase in demand for FPSO vessels in the upstream oil and gas industry, which will propel market expansion. Additionally, the U.S.'s increasing production of alternative fuels like shale gas and tight oil is anticipated to expand the use of FPSO, which will eventually lead to the rise of the biocide-free coating market. Manufacturers and distributors of antifouling are now obliged to sell their products through online portals due to the rise of e-commerce platforms. As a result, organisations like Alibaba and Made-In-China are anticipated to play a significant role in helping consumers acquire biocide-free coating goods. The high demand from developing nations like Vietnam, the Philippines, India, South Korea, Saudi Arabia, and Mexico, among a few others, is anticipated to fuel the market for biocide-free coatings. The demand for products from these nations is predicted to increase as shipbuilding operations increase.

COVD-19 IMPACT ON THE BIOCIDE-FREE COATINGS MARKET

Due to the COVID-19 outbreak, operations in several industries, including oil & gas, automotive, and aerospace, are being severely impacted. As a result, the majority of nations issued "stay at home instructions," or a lockdown. Additionally, the COVID-19 pandemic is predicted to have a long-term effect. This is preventing the market for biocide-free coatings from expanding. Global markets have been significantly impacted by the coronavirus' quick spread since key economies throughout the world are currently under total lockdown as a result of the epidemic. Due to this severe lockout, the consumer market has all of a sudden begun to exhibit zero interest in buying biocide-free coatings. The closure of various businesses is one of the biggest issues the industry is dealing with. Market growth for biocide-free coatings was slowed by the global crisis, which affected many industries, including the coatings industry.

MARKET DRIVERS:

Implementation of Stringent Environment Regulations is likely to fuel the market for biocide-free coating:

The need for green solution coatings is driven by rising environmental consciousness and strict environmental regulations from established and emerging nations. However, the rules are increasing the value-added that comes with higher levels of performance. Globally, governments are putting more emphasis on green practices to lessen the effects of chemicals on the environment, human health, and marine life. For instance, the US state of Washington banned copper's usage in hull coating in 2018. The major companies in the worldwide market, however, are more likely to provide coatings that adhere to environmental rules and industry norms.

Escalating the need for environmentally safe and sustainable coatings is driving the market expansion:

The early 1990s saw the introduction of foul release coatings for use on ships, but despite early optimism for the product, they have only had a tiny market share because of their high cost and subpar effectiveness when compared to biocidal marine coatings. Biocide-free coatings are now in vogue. The production of eco-friendly coatings with increased foul release performance and antifouling capabilities has been made possible by accelerated advances based on nano chemistry; this will lead to a rise in the market demand for biocide-free coatings over the forecast period.

The market is expanding due to the growing oil and gas sector:

To boost the effectiveness of antifouling coatings, businesses are heavily spending on research and development, which is likely to raise end-user demand. One of the factors anticipated to contribute to the expansion of the global antifouling coatings market is the progress of technology on a global scale. The market for antifouling coatings is expanding as a result of rising population, urbanisation, and oil and gas demand. These are also frequently utilised to safeguard rig machinery and structural elements.

MARKET RESTRAINTS:

Unstable economic conditions and volatile prices of raw material:

The main causes of the current unstable economic conditions include the escalating trade conflict between the world's two largest economies, the US and China, as well as geopolitical unrest, international trade conflicts, and general macroeconomic performance. In 2020, the continued COVID-19 epidemic will also have a negative impact on people's lives, companies, and industries. Due to the lockdown and low demand for goods from wealthy and developing countries, the pandemic's quick growth has had a significant influence on international shipping markets. Additionally, the price of crude oil falls in 2020 as a result of the geopolitical tensions between the US, Iraq, Iran, and Saudi Arabia. Since the majority of coatings are made from ingredients derived from crude oil, the variation in crude oil prices throughout the world will provide a challenge to this market's expansion throughout the projected period.

Stringent regulations to reduce carbon footprint and VOC emissions:

To lessen the carbon footprint and VOC emissions from coatings, several agencies, including the California Air Resources Board and the US Environmental Protection Agency, have established different rules and guidelines. For example, the EPA's control technique recommendations (CTGs) place restrictions on VOC emissions from coatings for a variety of businesses, especially in regions with higher than average levels of lower atmospheric ozone. VOC emission from coatings is subject to regulations. Additionally, in the eastern United States, the Ozone Transport Committee (OTC) establishes environmental regulations for thirteen states, including New England, New York, Pennsylvania, Delaware, New Jersey, Maryland, and Washington, D.C., to reduce VOC emissions from coatings. More rigorous rules regulating VOC emission from coatings are the consequence of growing environmental concerns, which might impede industry expansion.

BIOCIDE-FREE COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

8.6% |

|

Segments Covered |

By Type, Application, and Region

|

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Hempel A/S, PPG Industries, Kansai Paint Co., Ltd., Jotun, Axalta Coating Systems, AkzoNobel N.V., The Sherwin-Williams Company, RPM International Inc., Nippon Paint Holdings Co., Ltd.

|

This research report on the Biocide-free coatings market has been segmented and sub-segmented based on Type, Application and By Region.

BIOCIDE-FREE COATINGS MARKET – BY TYPE

-

Copper-based

-

Self-Polishing Copolymer

-

Hybrid

-

Others.

Based on application, the biocide-free coating market is segmented into copper-based, Self-Polishing Copolymer, Hybrid and others. Due to its widespread application in marine ship coating, self-polishing coatings (SPCs) commanded a market share of more than 80% of the global market in 2021. The usage of SPCs offers several advantages, including the ability to regulate the polishing rate, achieve optimal biocide release, and utilise their built-in self-smoothing to reduce hull roughness and increase fuel economy. It is appropriate for hull coating applications due to the advantages of SPCs. While the demand for SPC anti-fouling release coating is driven by the strict environmental regulations in the US and Europe and the presence of volatile organic compounds (VOCs) in the coating, this segment is anticipated to grow at the fastest rate in the global biocide-free coatings market during the forecast period.

BIOCIDE-FREE COATINGS MARKET – BY APPLICATION

-

Shipping Vessels

-

Drilling Rigs & Production Platforms

-

Fishing Boats

-

Yachts & Other Boats

-

Inland Waterways Transport

-

Mooring Lines

Based on application, the biocide-free coating market is segmented into Shipping Vessels, Drilling Rigs & Production Platforms, Fishing Boats, Yachts & Other Boats, Inland Waterways Transport and Mooring Lines. The shipping vessels sector, which accounted for more than 30% of the market for biocide-free coatings in 2021, is predicted to expand at a CAGR of 3.86 per cent throughout the forecast period. All types and sizes of vessels can use these coatings. The high-performance coating may be used to minimise hull resistance, which is typically recoated on ships every fifth year. For full-bodied ships like bulkers and tankers, the opportunity for reduced frictional force will be higher. By maintaining hulls free of fouling agents, the application of these paints leads to an increase in the dry-docking interval and directly reduces fuel consumption.

From 2023 - 2030, drilling rigs and production platforms are anticipated to grow at a CAGR of 8.0 per cent in terms of revenue. The demand for biocide-free coatings is anticipated to increase shortly as a result of rising capital expenditure on FPSO vessels by businesses engaged in upstream oil and gas production.

BIOCIDE-FREE COATINGS MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Biocide-free coatings market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. The biocide-free coatings market was led by the APAC region in 2021 with over 85% of the overall market share. China, Japan, and South Korea are among the top makers of ships in the Asia-Pacific area, but there are also significant shipyards in several other countries in the region. Ships are typically constructed after projects are acquired and in accordance with customer specifications. The building of a ship takes at least two years to finish. Bulk vessel orders are now being delivered to nations in the Asia-Pacific area. Shipbuilding is a thriving industry in South Korea, China, Japan, Taiwan, and the Philippines. This is anticipated to lead to the Asia Pacific dominating the shipbuilding industry, which would increase demand for antifouling paints. Additionally, it is anticipated that rising spending on the exploration and production of natural gas and crude oil in China, India, and Thailand would increase demand for these biocide-free coatings on drilling rigs and production platforms.

BIOCIDE-FREE COATINGS MARKET - BY COMPANIES

Some of the major players operating in the Biocide-free coatings market include:

-

BASF SE

-

Hempel A/S

-

PPG Industries

-

Kansai Paint Co., Ltd.

-

Jotun

-

Axalta Coating Systems

-

AkzoNobel N.V.

-

The Sherwin-Williams Company

-

RPM International Inc.

-

Nippon Paint Holdings Co., Ltd.,

-

Others

NOTABLE HAPPENING IN THE BIOCIDE-FREE COATINGS MARKET

- INVESTMENT- In January 2020, BASF announced an investment for the development of the production of water-based polyurethane dispersions at its Castellbisbal plant in Spain. BASF's manufacturing capacity will rise by 30% as a result of the development.

- PRODUCT LAUNCH- In February 2019, Hempel introduced Atlantic+, a potent new antifouling coating that offers versatile and dependable performance. Atlantic+ is developed to prevent the hull from fouling throughout service intervals of up to 60 months while providing unmatched protection.

- PRODUCT LAUNCH- In September 2019, Hempel A/S introduced "Hempelguard Max," a novel coating technology with cutting-edge anti-biofouling capabilities. The new coating method helps owners cut their yearly bunker costs by USD 500 million and their CO2 emissions by more than 10 million tonnes.

- PRODUCT LAUNCH- The first biocide-free, low friction self-polishing copolymer antifouling technique is thought to have been introduced by Nippon Paint Marine in 2018.

Chapter 1. Biocide-free Coatings Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Biocide-free Coatings Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Biocide-free Coatings Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Biocide-free Coatings Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Biocide-free Coatings Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Biocide-free Coatings Market – By Application

6.1. Shipping Vessels

6.2. Drilling Rigs & Production Platforms

6.3. Fishing Boats

6.4. Yachts & Other Boats

6.5. Inland Waterways Transport

6.6. Mooring Lines

Chapter 7. Biocide-free Coatings Market – By Type

7.1. Copper-based

7.2. Self-Polishing Copolymer

7.3. Hybrid

7.4. Others.

Chapter 8. Biocide-free Coatings Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. AI for Vaccine Development Market

9.1 BASF SE

9.2 Hempel A/S

9.3 PPG Industries

9.4 Kansai Paint Co., Ltd.

9.5 Jotun

9.6 Axalta Coating Systems

9.7 AkzoNobel N.V.

9.8 The Sherwin-Williams Company

9.9 RPM International Inc.

9.10 Nippon Paint Holdings Co., Ltd.,

9.11 Others

Download Sample

Choose License Type

2500

4250

5250

6900