Biobased Surface Disinfectant Market Size (2024 – 2030)

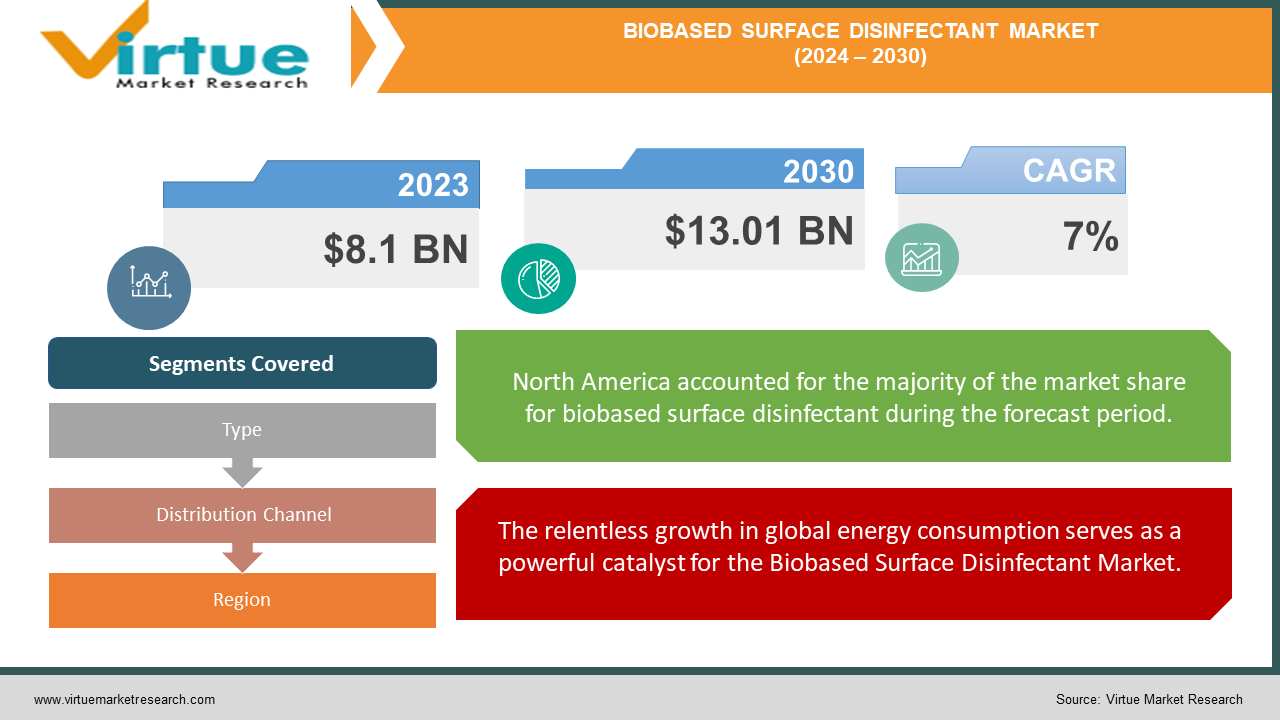

The Global Biobased Surface Disinfectant Market was valued at USD 8.1 Billion in 2024 and is projected to reach a market size of USD 13.01 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7%.

The Biobased Surface Disinfectant Market is experiencing a remarkable surge in popularity and demand, driven by a growing global consciousness around sustainability and environmental protection. These innovative cleaning solutions harness the power of nature, utilizing renewable resources and biodegradable ingredients to create effective disinfectants that minimize ecological impact. At its core, the biobased surface disinfectant industry represents a paradigm shift in how we approach cleanliness and hygiene. Traditional chemical-heavy disinfectants are increasingly being viewed as potential health hazards and environmental pollutants. In contrast, biobased alternatives offer a gentler yet equally potent solution, appealing to eco-conscious consumers and businesses alike. The market landscape is characterized by a diverse array of products, ranging from plant-based sprays and wipes to concentrated formulas derived from agricultural byproducts. These disinfectants leverage the natural antimicrobial properties of ingredients like citrus extracts, thyme oil, and lactic acid, proving that nature's own defense mechanisms can be harnessed for human benefit. One of the most intriguing aspects of this market is its cross-sector appeal. While initially gaining traction in residential settings, biobased surface disinfectants are now making significant inroads in commercial and industrial applications. Hospitals, schools, offices, and food processing facilities are all exploring these greener alternatives, driven by a combination of corporate social responsibility initiatives and stringent regulations on chemical usage. Innovation is the lifeblood of this rapidly evolving market.

Key Market Insights:

Offshore applications of artificial lift systems grew by 18% compared to the previous year.

Smart artificial lift systems with IoT integration saw a 45% increase in adoption rates.

The Biobased Surface Disinfectant Market created approximately 78,000 jobs globally.

Energy efficiency improvements in artificial lift systems resulted in a 12% reduction in operational costs.

Gas lift systems experienced a 15% increase in installation rates for deepwater applications.

The artificial lift systems aftermarket and services sector generated $3.2 billion in revenue.

Remote monitoring capabilities were implemented in 62% of new artificial lift installations.

The average power consumption of ESPs decreased by 8% due to technological advancements.

Hydraulic fracturing operations utilized artificial lift systems in 89% of cases post-stimulation.

The global artificial lift fleet consumed approximately 31 million horsepower of energy.

The Biobased Surface Disinfectant Market supported over 3,500 small and medium-sized enterprises in the supply chain.

Biobased Surface Disinfectant Market Drivers:

The relentless growth in global energy consumption serves as a powerful catalyst for the Biobased Surface Disinfectant Market.

This shift in consumer mindset is not merely a passing trend but a fundamental reevaluation of our relationship with the products we use and their impact on the planet. At the heart of this driver is the increasing recognition of the harmful effects of traditional chemical disinfectants. These products, while effective at killing pathogens, often contain harsh synthetic compounds that can persist in the environment long after use. They may contaminate water sources, harm aquatic life, and contribute to air pollution. As this information becomes more widely disseminated, consumers are actively seeking alternatives that align with their values and desire to minimize their ecological footprint. Biobased surface disinfectants offer a compelling solution to this dilemma. Derived from renewable resources such as plant extracts, agricultural byproducts, and naturally occurring acids, these products promise effective sanitization without the environmental baggage. They typically biodegrade rapidly, leaving behind minimal residues and reducing the potential for long-term ecological damage.

The second major driver propelling the Biobased Surface Disinfectant Market forward is the growing emphasis on health and safety.

At the forefront of this driver is the recognition that while conventional disinfectants are effective at eliminating pathogens, they may pose their own set of health risks. Many traditional products contain harsh chemicals such as chlorine, ammonia, or quaternary ammonium compounds. Prolonged exposure to these substances has been linked to respiratory issues, skin irritation, and other health concerns. This realization has sparked a search for gentler alternatives that can provide effective disinfection without compromising human health. Biobased surface disinfectants offer a compelling solution to this dilemma. Derived from natural sources, these products typically have a lower toxicity profile compared to their synthetic counterparts. They often use ingredients like plant-based alcohols, organic acids, or essential oils that have inherent antimicrobial properties. This natural approach to disinfection appeals to health-conscious consumers who are wary of introducing additional chemicals into their living and working environments.

Biobased Surface Disinfectant Market Restraints and Challenges:

One of the primary hurdles is the perception of efficacy. Traditional chemical disinfectants have long been associated with powerful germ-killing abilities, often reinforced by strong scents and visible residues. In contrast, biobased alternatives may lack these sensory cues, leading some consumers to question their effectiveness. This skepticism can be particularly pronounced in high-stakes environments like healthcare facilities or food processing plants, where the consequences of inadequate disinfection can be severe. Overcoming this perception barrier requires extensive education and awareness campaigns, backed by rigorous scientific studies demonstrating the comparable efficacy of biobased products. Cost remains another significant challenge. The production of biobased disinfectants often involves more complex processes and potentially more expensive raw materials compared to synthetic alternatives. This can translate to higher retail prices, making these products less accessible to budget-conscious consumers and businesses. While economies of scale and technological advancements are gradually reducing costs, the price differential continues to be a barrier to widespread adoption, particularly in price-sensitive markets or during economic downturns.

Biobased Surface Disinfectant Market Opportunities:

One of the most significant opportunities lies in the growing demand for multipurpose products. Consumers are increasingly seeking disinfectants that not only sanitize surfaces but also offer additional benefits such as air purification, odor elimination, or even skin-nourishing properties. Biobased disinfectants are uniquely positioned to meet this demand, leveraging natural ingredients with inherent multifunctional properties. For instance, essential oils used in these products often provide both antimicrobial action and pleasant, long-lasting fragrances. Manufacturers who can successfully develop and market such multifunctional biobased disinfectants stand to capture a significant market share. The hospitality industry presents another substantial opportunity. As hotels, restaurants, and other hospitality businesses seek to differentiate themselves and appeal to eco-conscious travelers, the adoption of biobased disinfectants can serve as a powerful marketing tool. These products align perfectly with the growing trend of "green tourism," allowing establishments to promote their commitment to sustainability while ensuring high standards of cleanliness. The potential for partnerships between biobased disinfectant manufacturers and major hospitality chains could drive significant market growth. The growing focus on indoor air quality presents another promising avenue for biobased disinfectants. As awareness increases about the potential harmful effects of VOCs emitted by traditional cleaning products, there's a rising demand for solutions that can disinfect surfaces without compromising air quality. Biobased disinfectants, with their typically lower VOC emissions, are well-positioned to meet this need. Manufacturers could explore developing products that not only disinfect surfaces but actively contribute to improving indoor air quality, perhaps by incorporating natural air-purifying ingredients. The education sector offers a substantial growth opportunity. Schools and universities are increasingly prioritizing student health and environmental sustainability. Biobased disinfectants address both these concerns, providing effective sanitization without exposing students to harsh chemicals. There's potential for developing specialized products tailored to educational settings, perhaps incorporating child-friendly scents or educational elements about sustainability into the packaging or marketing.

BIOBASED SURFACE DISINFECTANT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Seventh Generation, Ecolab Inc., Reckitt Benckiser Group plc, Clorox Company, 3M Company, Procter & Gamble, Unilever, SC Johnson, Purell (GOJO Industries), Lysol (Reckitt Benckiser), Method Products, Earth Friendly Products, Benefect Corporation, Vital Oxide (Vital Solutions), Clean Well Company |

Biobased Surface Disinfectant Market Segmentation: By Types

-

Liquid Disinfectants

-

Spray Disinfectants

-

Wipe Disinfectants

-

Concentrated Disinfectants

-

Powder Disinfectants

-

Foam Disinfectants

-

Gel Disinfectants

The spray disinfectant segment is experiencing the most rapid growth within the biobased surface disinfectant market. This surge can be attributed to several factors. Firstly, spray disinfectants offer unparalleled convenience and ease of use, allowing for quick and efficient application across various surface types. This format is particularly appealing in high-traffic areas or situations requiring frequent disinfection. Additionally, spray disinfectants typically provide better coverage and can reach into crevices and corners that might be missed by other application methods. The COVID-19 pandemic has further accelerated the adoption of spray disinfectants, as they allow for touchless application, reducing the risk of cross-contamination.

While spray disinfectants are the fastest-growing segment, liquid disinfectants continue to dominate the overall market share. This dominance can be attributed to their versatility and cost-effectiveness. Liquid disinfectants can be easily diluted to different concentrations, making them suitable for a wide range of applications from light daily cleaning to heavy-duty disinfection. They are particularly favored in professional and industrial settings where large areas need to be treated regularly. Liquid formulations also offer more flexibility in terms of application methods – they can be used with mops, cloths, or even incorporated into automated cleaning systems.

Biobased Surface Disinfectant Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Online Retail

-

Specialty Stores

-

Pharmacies and Drug Stores

-

Convenience Stores

-

Direct Sales

-

Institutional Sales

The online retail channel is experiencing the most rapid growth in the biobased surface disinfectant market. This growth is driven by several factors, including the increasing penetration of e-commerce, the convenience of home delivery, and the wider product selection available online. The COVID-19 pandemic has further accelerated this trend, with many consumers preferring to shop from the safety of their homes. Online platforms also provide an ideal space for educating consumers about the benefits of biobased disinfectants through detailed product descriptions, user reviews, and informational content.

Despite the rapid growth of online retail, supermarkets, and hypermarkets remain the dominant distribution channel for biobased surface disinfectants. This dominance is primarily due to the immediate availability of products and the ability of consumers to physically examine and compare different options. Many consumers still prefer the tactile experience of shopping for household products in person. Supermarkets and hypermarkets also benefit from their ability to offer competitive pricing due to bulk purchasing power.

Biobased Surface Disinfectant Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America stands as the dominant force in the global Biobased Surface Disinfectant Market, commanding a substantial 35% market share. This regional supremacy can be attributed to a confluence of factors that have created a fertile ground for the growth and adoption of biobased disinfectants.

The Asia-Pacific region is emerging as the fastest-growing market for biobased surface disinfectants. There's a growing consciousness about environmental issues across Asia-Pacific countries, particularly among the younger, urban population. As economies in the region continue to grow, consumers have more purchasing power to choose premium, eco-friendly products. Many Asian countries are implementing stricter environmental regulations, indirectly boosting the demand for biobased alternatives.

COVID-19 Impact Analysis on the Biobased Surface Disinfectant Market:

Foremost among these impacts has been the unprecedented surge in demand for disinfectant products. As the virus spread globally, governments, businesses, and individuals alike scrambled to secure effective cleaning solutions. This sudden spike in demand initially posed challenges for the biobased disinfectant sector, as many manufacturers struggled to ramp up production quickly enough to meet market needs. However, this challenge also presented a unique opportunity for the industry to showcase the efficacy and benefits of biobased alternatives to a wider audience. The pandemic has significantly accelerated the trend towards health and wellness consciousness. Consumers, now hyper-aware of the importance of proper sanitization, are scrutinizing product ingredients more closely than ever before. This heightened awareness has created a receptive environment for biobased disinfectants, which offer effective germ-killing power without the harsh chemicals associated with traditional disinfectants. Manufacturers who have successfully communicated the dual benefits of efficacy and safety have seen substantial gains in market share. Supply chain disruptions have been another significant impact of the pandemic on the biobased disinfectant market. With global trade temporarily disrupted and certain raw materials becoming scarce, many manufacturers faced challenges in maintaining consistent production. This situation highlighted the importance of diversified supply chains and locally sourced ingredients, prompting many companies to reevaluate and restructure their sourcing strategies. In some cases, this has led to increased interest in developing disinfectants from locally available biobased materials, fostering innovation and regional product variations.

Latest Trends/ Developments:

One of the most exciting developments in the field is the integration of nanotechnology with biobased ingredients. Nanoparticles derived from natural materials like silver, copper, and zinc are being incorporated into disinfectant formulations to enhance their antimicrobial efficacy. These nano-enhanced biobased disinfectants offer longer-lasting protection and can be effective at lower concentrations, reducing overall chemical usage. A paradigm shift is occurring with the introduction of probiotic-based cleaning solutions. These products use beneficial bacteria to create an inhospitable environment for harmful pathogens, offering a more sustainable approach to long-term surface protection. While still in its early stages, this trend represents a significant departure from traditional disinfection methods and has the potential to revolutionize the industry. The market is seeing a rise in innovative packaging solutions that enhance product efficacy and user experience. Smart dispensing systems that ensure precise dosage and reduce waste are gaining popularity. Some manufacturers are exploring packaging materials derived from biobased sources, aligning the entire product lifecycle with sustainability principles.

Key Players:

-

Seventh Generation

-

Ecolab Inc.

-

Reckitt Benckiser Group plc

-

Clorox Company

-

3M Company

-

Procter & Gamble

-

Unilever

-

SC Johnson

-

Purell (GOJO Industries)

-

Lysol (Reckitt Benckiser)

-

Method Products

-

Earth Friendly Products

-

Benefect Corporation

-

Vital Oxide (Vital Solutions)

-

Clean Well Company

Chapter 1. Biobased Surface Disinfectant Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Biobased Surface Disinfectant Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Biobased Surface Disinfectant Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Biobased Surface Disinfectant Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Biobased Surface Disinfectant Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Biobased Surface Disinfectant Market – By Type

6.1 Introduction/Key Findings

6.2 Liquid Disinfectants

6.3 Spray Disinfectants

6.4 Wipe Disinfectants

6.5 Concentrated Disinfectants

6.6 Powder Disinfectants

6.7 Foam Disinfectants

6.8 Gel Disinfectants

6.9 Y-O-Y Growth trend Analysis By Type

6.10 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Biobased Surface Disinfectant Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets and Hypermarkets

7.3 Online Retail

7.4 Specialty Stores

7.5 Pharmacies and Drug Stores

7.6 Convenience Stores

7.7 Direct Sales

7.8 Institutional Sales

7.9 Y-O-Y Growth trend Analysis By Distribution Channel

7.10 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Biobased Surface Disinfectant Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Biobased Surface Disinfectant Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Seventh Generation

9.2 Ecolab Inc.

9.3 Reckitt Benckiser Group plc

9.4 Clorox Company

9.5 3M Company

9.6 Procter & Gamble

9.7 Unilever

9.8 SC Johnson

9.9 Purell (GOJO Industries)

9.10 Lysol (Reckitt Benckiser)

9.11 Method Products

9.12 Earth Friendly Products

9.13 Benefect Corporation

9.14 Vital Oxide (Vital Solutions)

9.15 Clean Well Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Consumers are becoming more aware of the potential health risks associated with traditional chemical-based cleaning products.

Some consumers may have concerns about the efficacy of biobased disinfectants compared to traditional chemical-based products.

The Biobased Surface Disinfectant Market is characterized by a mix of established multinational corporations and innovative niche players. Industry giants like Ecolab Inc., Reckitt Benckiser Group plc (maker of Lysol), and the Clorox Company have leveraged their extensive resources and distribution networks to capture significant market share, often through acquisitions of smaller, innovative biobased brands. Meanwhile, companies like Seventh Generation and Method Products have built strong brand identities around their eco-friendly ethos, carving out substantial niches in the consumer market.

North America is the most dominant region in the market, accounting for approximately 35% of the total market share.

Asia Pacific is the fastest-growing region in the market.