Bio-Polyolefins Market Size (2024 –2030)

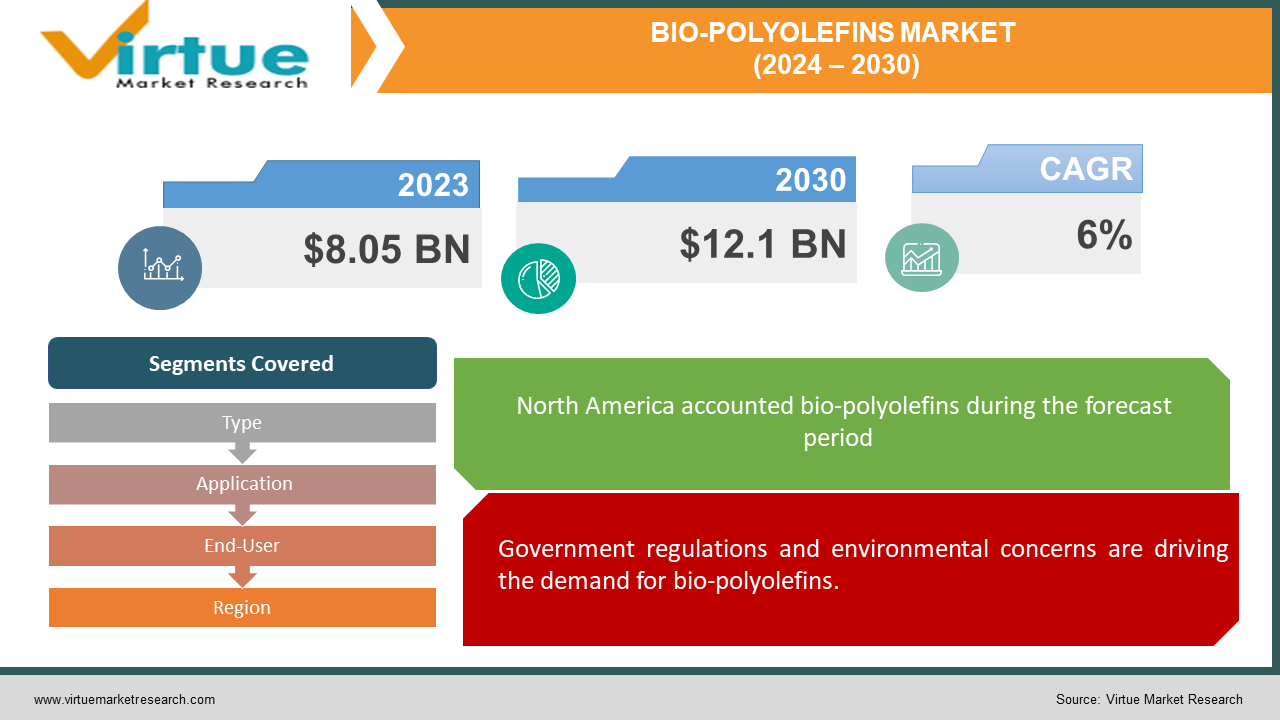

The Global Bio-Polyolefins Market was valued at USD 8.05 billion and is projected to reach a market size of USD 12.1 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

Popular polymers are called polyolefins, and the most prevalent kinds are polypropylene (PP) and polyethylene (PE). Because these polymers have a density of less than 1 gm/cm3, they are less dense than water and can float on it. Rather than using petroleum, some polyolefins can be produced using renewable resources, such as alcohol made from sugarcane. Petroleum-based and bio-based polyolefins can be employed in comparable applications due to their identical chemical characteristics. Companies investing in bio-based polyolefins focus on acquiring new technologies, sourcing raw materials, improving inventory management, expanding product ranges, and enhancing capabilities to support growth during economic challenges. The different economic and social environments in different countries force manufacturers to customize their strategies. Project delays and the accessibility of cheap shale gas, however, could stall or even reverse the growth of bio-based polyolefins, which would have an impact on future projections for bio-plastics.

Key Market Insights:

The demand for bio-polyolefins in the sustainable packaging sector is growing rapidly at a rate of 25% per year. This growth suggests a significant shift towards environmentally friendly packaging solutions, driven by factors such as increasing awareness of environmental issues and stricter regulations regarding single-use plastics.

Packaging is the largest end-use application segment for bio-polyolefins, accounting for over 50% of the market share. Bio-polyolefins are used extensively in flexible and rigid packaging, films, bottles, and other packaging applications due to their excellent barrier properties and environmental benefits.

The 30% increase in automotive bio-polyolefins usage indicates a substantial shift towards sustainable materials in vehicle manufacturing, driven by their lightweight properties.

Governments' 40% increase in bio-based materials adoption underscores a significant global commitment to promoting renewable and environmentally friendly alternatives across industries.

Europe and North America are the leading regions for bio-polyolefins. Strict environmental regulations, consumer awareness of sustainability issues, and initiatives promoting circular economy principles have accelerated the adoption of bio-based materials in these regions.

Global Bio-Polyolefins Market Drivers:

Government regulations and environmental concerns are driving the demand for bio-polyolefins.

As people become more conscious of the damaging effects that traditional plastics have on the environment, more sustainable options are becoming more and more popular. Bio-polyolefins can be broken down naturally or composted because they are derived from renewable resources have smaller carbon footprints and emit fewer greenhouse gases. The use of bio-polyolefins is being driven by the growing consciousness of environmental issues. To combat plastic pollution and encourage environmentally friendly behaviors, governments are enacting stringent laws and regulations. Some of these include prohibitions on single-use plastics, restrictions on plastic disposal, and incentives for the use of bio-based materials. The market is stimulated and demand for bio-polyolefins rises as a result of these regulations.

Because of their capacity to be recycled and biodegraded, bio-polyolefins are helping the world move toward a circular economy and driving market expansion.

Customers are looking for sustainable and eco-friendly products more and more. This need is met by bio-polyolefins, which provide a more environmentally friendly substitute for conventional plastics. The market for bio-polyolefins is being driven by consumer preferences for products made from renewable resources and with little environmental impact. The adoption of bio-polyolefins is also being aided by the transition from a linear economy, in which products are used and then discarded, to a circular economy, in which waste is reduced through recycling and reuse. These materials are crucial to the circular economy because they are easily biodegradable or recyclable. The need for bio-polyolefins is predicted to rise as the idea of a circular economy gains traction.

Bio-Polyolefins Market Challenges and Restraints:

Because renewable materials are more difficult to locate and process, producing bio-polyolefins can be more expensive than producing regular plastics. Producing bio-polyolefins is more expensive than producing traditional plastics, which can be produced using more streamlined and affordable processes. It can be difficult to find sufficient dependable renewable resources, such as corn or sugarcane, for bio-polyolefins. Their supply and production capacity are limited, and growing crops for bio-polyolefins may put food production in jeopardy. In comparison to ordinary plastics, bio-polyolefins might not perform as well in terms of strength, heat resistance, and processing. Scientists are trying to increase the sustainability of bio-polyolefins without compromising their functionality.

Bio-Polyolefins Market Opportunities:

Stricter laws and growing environmental concerns have led to an increase in the demand for eco-friendly packaging. By providing a sustainable substitute for conventional plastics, bio-polyolefins enable the creation of biobased packaging materials that decompose or compost. Increasing the amount of money spent on bio-polyolefin research and development can result in better performance, more advanced manufacturing techniques, and opportunities across a variety of industries. Because of their versatility, bio-polyolefins can be found in consumer goods, consumer goods, automotive, construction, and packaging. The market for these materials is anticipated to expand across multiple industries as technology advances and additional bio-polyolefin options become accessible.

BIO-POLYOLEFINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Braskem, Dow Inc., LyondellBasell Industries N.V., TotalEnergies SE, Arkema SA, Mitsubishi Chemical Corporation, BASF SE, SABIC (Saudi Basic Industries Corporation), NatureWorks LLC, Biome Bioplastics Limited |

Global Bio-Polyolefins Market Segmentation: By Type

-

Bio-based polyethylene

-

Bio-based polypropylene

One of the most prevalent and fundamental forms of plastic, polyethylene is produced in about 80,000 kilotons annually worldwide. The process of creating polymers, or plastics, from renewable resources has drawn increasing attention recently. Brazil has long used fermentation to produce bio-ethanol from sugarcane. Now, ethylene is being produced from this bio-ethanol, and ethylene is used to create bio-based polyethylene. Making bio-based polypropylene is more difficult, though. Bio-ethanol can also be used to make bio-based polypropylene, though the procedure is more involved. Compared to polyethylene, polypropylene is a more recent plastic type that finds use in a variety of technical applications. Propylene monomer (C3H6) must be extracted using a variety of techniques from diverse renewable resources to create bio-based polypropylene.

Global Bio-Polyolefins Market Segmentation: By Application

-

Films

-

Bottles

-

Barrels

-

Tubes

-

Others

Because bio-based polyolefins have superior barrier, clarity, and sealability qualities, they are frequently used in film applications, particularly in food packaging. Shrink, industrial, and agricultural films are also made from these materials. Bio-based polyolefins are gradually taking the place of conventional plastics in bottle applications, where they are used to package household cleaners, beverages, cosmetics, and other goods. They provide good impact resistance, chemical resistance, and clarity. Barrels and drums for the storage and transportation of chemicals, oils, lubricants, and hazardous materials are also made from bio-based polyolefins.

Global Bio-Polyolefins Market Segmentation: By End-User

-

Packaging

-

Automotive

-

Consumer Good

-

Agriculture

-

Building & Construction

-

Others

Bio-polyolefins are widely used in many different industries, with packaging being one of the main ones. They serve as environmentally friendly substitutes for conventional plastics in bottles, films, and flexible and rigid packaging. Bio-polyolefins are used in the automotive industry to create textiles, door panels, dashboards, bumpers, and other interior and exterior components. Additionally, they are employed in the production of consumer goods like appliances, electronics, furniture, and personal hygiene items. Bio-polyolefins are used in agriculture to make agricultural films, mulch films, irrigation pipes, and greenhouse films that protect and retain moisture for crops. These resources support sustainable farming methods.

Global Bio-Polyolefins Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

Middle East and Africa

-

Latin America

There is a sizable market for bio-polyolefins in North America, which comprises the US and Canada. This is due to the region's stringent environmental regulations, rising consumer interest in sustainability, and the presence of numerous large businesses in this sector. The market for bio-polyolefins is expanding in Europe as a result of stringent laws and initiatives to advance the circular economy. The growing population, rising disposable income, and growing environmental consciousness are all driving up demand for sustainable materials. More environmentally friendly materials are also beginning to be used in Latin American nations like Argentina, Brazil, and Mexico. Because consumers in these areas are growing more conscious of environmental issues and prefer to use more sustainable products, there is a growing market for bio-polyolefins.

COVID-19 Impact on the Global Bio-Polyolefins Market:

The pandemic has highlighted the significance of sustainability and raised awareness of the negative environmental effects of ordinary plastics. As a result, demand for bio-polyolefins as environmentally friendly substitutes has increased. Recognizing the importance of sustainable resources, numerous nations have put laws and incentives in place to encourage the use of bio-based products. A favorable market environment for bio-polyolefins has been established by these actions. However, lockdowns, travel restrictions, and trade barriers during the pandemic caused supply chain disruptions in the global bio-polyolefins market, just like they did in other industries. Market expansion has been impacted by delays in the sourcing, manufacturing, and distribution of raw materials. The pandemic's effects on the world economy have also decreased consumer and investment spending, which has affected the demand for bio-polyolefins generally and in particular in the building and automotive industries.

Latest Trend/Development:

The bio-polyolefins market is being shaped by several noteworthy trends and advancements. First, a lot of attention is being paid to technology developments that will enhance the capabilities and characteristics of bio-polyolefins and increase their competitiveness against conventional plastics. Furthermore, the uses of bio-polyolefins are not limited to packaging; they are also finding their way into consumer goods, agriculture, construction materials, and automotive components. Innovation and market expansion are being propelled by strategic partnerships and collaborations among pivotal stakeholders. With an emphasis on utilizing renewable feedstocks, cutting carbon emissions, and advancing circular economy principles, sustainability continues to be a top priority. The bio-polyolefins industry is experiencing growth in the market due to government regulations that support the use of bio-based materials and growing consumer demand for eco-friendly products. These factors are also encouraging further investment in sustainable solutions within the industry. Together, these patterns demonstrate the market's dynamic character and the continued dedication to developing environmentally friendly substitutes for traditional plastics.

Key Players:

-

Braskem

-

Dow Inc.

-

LyondellBasell Industries N.V.

-

TotalEnergies SE

-

Arkema SA

-

Mitsubishi Chemical Corporation

-

BASF SE

-

SABIC (Saudi Basic Industries Corporation)

-

NatureWorks LLC

-

Biome Bioplastics Limited

Market News:

-

The Total Corbion PLA joint venture unveiled Luminy PLA, a novel bioplastic derived from PLA (polylactic acid), in November 2022. This product is intended to take the place of conventional plastics in a variety of applications, such as consumer goods, automotive packaging, and consumer goods.

-

Braskem, a company renowned for producing superior bio-polyolefins, introduced the Braskem PP H5610 range of biobased polypropylene (PP) grades in August 2022. The goal of this product is to satisfy the growing demand in sectors like packaging and automotive for environmentally friendly plastics.

Chapter 1. BIO-POLYOLEFINS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. BIO-POLYOLEFINS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. BIO-POLYOLEFINS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. BIO-POLYOLEFINS MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. BIO-POLYOLEFINS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. BIO-POLYOLEFINS MARKET – By Type

6.1 Introduction/Key Findings

6.2 Bio-based polyethylene

6.3 Bio-based polypropylene

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. BIO-POLYOLEFINS MARKET – By End-User

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Automotive

7.4 Consumer Good

7.5 Agriculture

7.6 Building & Construction

7.7 Others

7.8 Y-O-Y Growth trend Analysis By End-User

7.9 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. BIO-POLYOLEFINS MARKET – By Application

8.1 Introduction/Key Findings

8.2 Films

8.3 Bottles

8.4 Barrels

8.5 Tubes

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. BIO-POLYOLEFINS MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End-User

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End-User

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End-User

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End-User

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End-User

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. BIO-POLYOLEFINS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Braskem

10.2 Dow Inc.

10.3 LyondellBasell Industries N.V.

10.4 TotalEnergies SE

10.5 Arkema SA

10.6 Mitsubishi Chemical Corporation

10.7 BASF SE

10.8 SABIC (Saudi Basic Industries Corporation)

10.9 NatureWorks LLC

10.10 Biome Bioplastics Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bio-Polyolefins Market was valued at USD 8.05 billion and is projected to reach a market size of USD 12.1 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

The Global Bio-Polyolefins Market is driven by Environmental Concerns, Government Regulations and Policies, a Shift towards Circular Economy, and Rising Consumer Demand for Sustainable Products.

The Segments under the Global Bio-Polyolefins Market by application are films, bottles, barrels, and tubes.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Bio-Polyolefins Market.

Braskem, Dow Inc., and LyondellBasell Industries N.V. are the three major leading players in the Global Bio-Polyolefins Market.