Bio-Pharamaceutical Market Size (2022 – 2030)

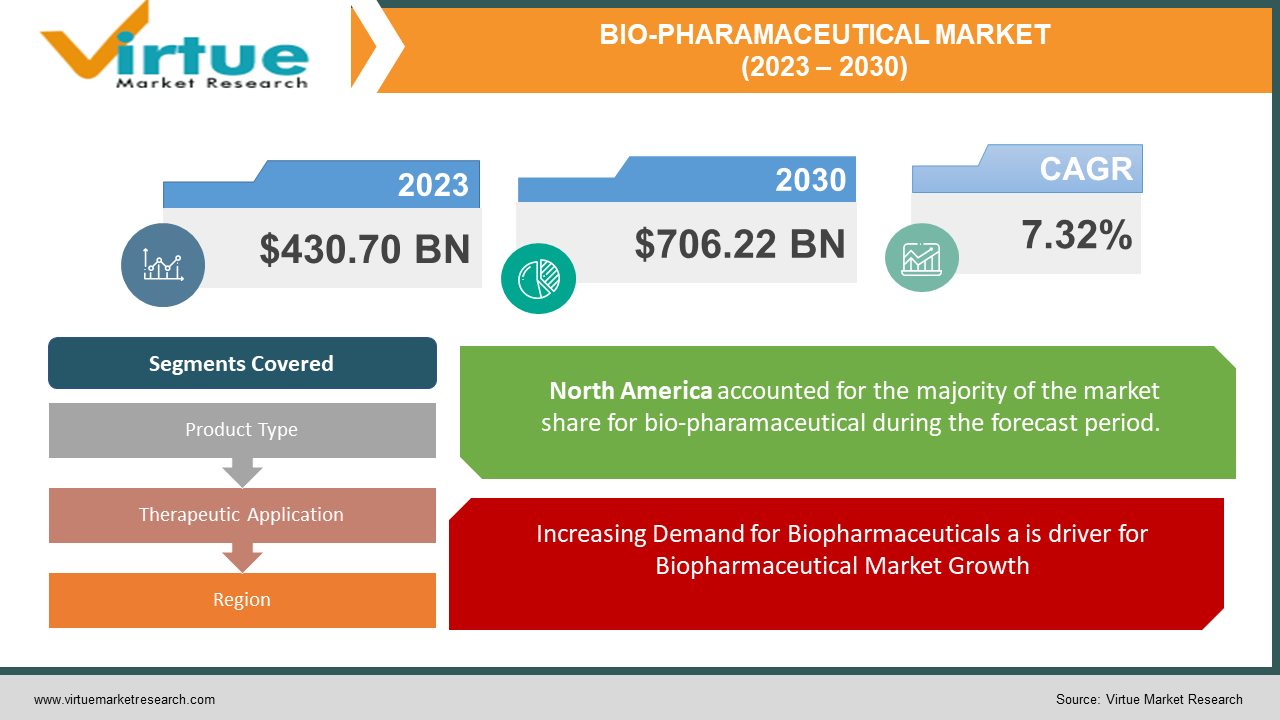

The Global Bio-Pharmaceutical Market was valued at USD 430.70 billion and is projected to reach a market size of USD 706.22 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.32%.

Market Overview

The term Biopharmaceutical was coined in 1982. Since its introduction, it has revolutionized the pharmaceutical industry. Biopharmaceutical products have been able to treat diseases which were not possible to treat with traditional drugs. Over the next years, we can expect the Biopharmaceutical Industry to be shaped by forces which are present inside and outside of the industry. The advent of AI and Machine Learning has made drug manufacturing way easier than in the old days. Now, the drug’s efficacy can be tested by building computer models. The industry is mainly led by Monoclonal Antibodies, and the region where the Biopharmaceutical Industry is most strong is the USA. The USA has been innovating in the Biopharmaceutical industry from the very start, but the COVID-19 pandemic accelerated the rate of innovation in this industry. Even smaller players are coming into this field. The less capital-intensive companies choose the route of manufacturing Biosimilars. Biosimilars have efficacy equivalent to Biopharmaceutical but different chemical structures and prices. They tend to be cheaper than Biopharmaceuticals. Hence, they provide tough competition to Biopharmaceutical companies as they force them to reduce their prices.

Health insurance companies also play a major role in this industry. People in USA and EU are covered under healthcare, where they are able to afford expensive medicines. This helps the industry as it is able to sustain demand in a place where people have good buying power.

COVID-19 Impact:

COVID-19 played a major driving force in order to stimulate the growth of the Biopharmaceutical industry. The advent of the increased number of COVID-19 cases worldwide compelled pharmaceutical companies to build vaccines at an unprecedented rate. In contrast, there are Biopharmaceutical products which are produced from the inactivation and attenuation of live viruses. But majorly, new vaccine manufacturers are using techniques which make use of the advanced DNA, RNA and protein subunits to manufacture new vaccines. While the outbreak of COVID-19 increased the research on vaccines, the other areas of treatment remain slow-paced. The big pharma companies are trying to ride the wave and generate maximum revenues, and hence they’re putting the majority of their efforts into the development of COVID-19 vaccines. But in the long run, Biopharmaceuticals for other diseases also have to be taken more seriously.

MARKET DRIVERS:

Increasing Demand for Biopharmaceuticals a is driver for Biopharmaceutical Market Growth

There has been a surge in demand for Biopharmaceuticals recently. It is because for a number of reasons. Firstly, the rise in chronic diseases such as Cancer and diabetes has increased the dependence of people on Biopharmaceuticals. Secondly, the geriatric population is increasing worldwide. Older people are more susceptible to adverse drug reactions (ADRs). As biopharmaceuticals have little to no side effects, they are perfect for the geriatric population. Thirdly, Biopharmaceuticals have to be able to meet the unmet demand of curing diseases which were incurable before. The increasing awareness among people for the use of Biopharmaceuticals and the availability of new drugs has aggravated its demand in the populous.

Biopharmaceutical CMO is a driver for Biopharmaceutical Market Growth

Biopharmaceutical CMO are contract manufacturing companies in the biopharmaceutical sector. They manufacture biopharmaceuticals on a contract basis and provide various services such as manufacturing and packaging. CMOs help biopharmaceutical companies to expand and scale up quickly. Plus, the ultimate product is lower in price as the cost incurred during shipping or transportation has been avoided. The growth of Biopharmaceutical CMOs has helped meet the growing demand for biopharmaceuticals.

Increasing R&D investments are drivers for Biopharmaceutical Market Growth

Significant efforts are being put into the innovation and development of new Biopharmaceuticals by big and small companies worldwide. These companies are supported by their local government through various subsidies and Production Linked Incentives. The result of this has been an increasing number of Biopharmaceutical products in the market. Due to the innovations in Biopharmaceuticals, the cure rates for hepatitis C have increased to 95%. The mortality rates of Cancer have also come down by 27%. The recent COVID-19 vaccines were effective up to 95% in preventing symptomatic infections. The Research and Development expenditure of companies worldwide doubled in 2019 to USD 80 bn compared to 2001.

MARKET RESTRAINTS:

High Investments cost in production is restraining Biopharmaceutical Market Growth

There is a high amount of capital investment required for the production of Biopharmaceutical products. The capital-intensive model acts as an entry barrier for small pharmaceutical companies. This success rate of clinical trials for biopharmaceuticals has also remained flat over the years. Hence, a company has to do a large amount of expenditure with an unpredictable outcome.

Commercial Pricing Pressures is restraining Biopharmaceutical Market Growth

The pricing pressures put up by the Government and Health insurance companies lead to a reduction in prices which directly affects the revenues of the companies. This is aggravated by competition from Biosimilars. Biosimilars are products which are equivalent in the efficacy of a Biopharmaceutical, which is produced by a company with less R&D expenditure. The combined cost to produce a Biosimilar is less than that of a Biopharmaceutical. Hence, it acts as a major barrier to growth when introduced at a lower price in the market.

BIO-PHARMACEUTICAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.32% |

|

Segments Covered |

By Product Type, Therapeutic Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

|

This research report on the global Biopharmaceutical Market has been segmented and sub-segmented based on type, therapeutic application, and region.

Biopharmaceutical Market - By Product Type

- Monoclonal Antibodies

- Recombinant Growth Factors

- Purified Proteins

- Recombinant Proteins

- Recombinant Hormones

- Vaccines

- Recombinant Enzymes

- Cell and Gene therapies

- Synthetic Immunomodulators

- Other Product types

In terms of product type, Monoclonal Antibodies are the largest contributors to Biopharmaceuticals. They treat a lot of diseases, ranging from Cancer, diabetes, rheumatoid arthritis etc. As the COVID-19 pandemic hit the world, it put an enormous burden on healthcare institutions. There were not enough hospital beds for the treatment of the virus; due to this, research on monoclonal antibodies which would directly target the COVID-19 virus greatly increased. We have seen such examples as pharmaceutical companies coming up with new molecules to cater the patients suffering from various diseases. In 2020, Itolizumab was launched, which is an Anti-CD6IgG1 monoclonal antibody. It would be used for the treatment of Cytokine release syndrome. Another FDA approval of a biopharmaceutical called MARGENZATM happened in the same year. It got approval to be used to treat HER2-positive breast cancer. GSK also got FDA approval in 2020 for its belantamab mafodotin-blmf to treat multiple refractory myeloma.

Biopharmaceutical Market - By Therapeutic Application

- Oncology

- Inflammatory and Infectious diseases

- Autoimmune Disorders

- Metabolic Disorders

- Hormonal Disorders

- Cardiovascular Diseases

- Neurological Diseases

- Other Diseases

Biopharmaceuticals have been used since the 1980s to treat various diseases. The key difference between a biopharmaceutical and a pharmaceutical is that a biopharmaceutical has a lesser number of side effects. Additionally, its ability to target the right molecule is much better than its pharmaceutical counterpart. Apart from this, it opened avenues to provide treatment for diseases against which traditional synthetic drugs were ineffective.

Biopharmaceutical Market - By Region

- North America

- Europe

- Asia-Pacific

- The Middle East and Africa

- South America

North America (NA) is a dominant player in Biopharmaceutical for a number of reasons. The number of chronic diseases in NA has increased a lot. With this, the innovation in Biopharmaceutical has also increased. So, both increase in supply and demand has led to overall growth in the market. Today, biopharmaceuticals contribute 20% of the total revenue generated from pharmaceuticals. NA was the torchbearer in the innovation involved in biopharmaceuticals from the very start. When the COVID-19 cases were increasing rapidly in the NA, it put a lot of pressure on NA Pharmaceutical companies to innovate and invest in their Research and Development. Major investments and Joint Ventures and taking place to build vaccines and meet the unmet demand.

RECENT HAPPENINGS

- Changes in manufacturing: In 2022, Biopharmaceutical manufacturing has changed a lot, especially after the post-pandemic era. The pandemic helped the companies to believe that they don’t need years of Research and Development to manufacture vaccines. It has been realized by removing a number of redundant steps in the manufacturing process.

- Quality standards: Improvement in the GMP has helped companies build quality products at lesser timelines.

- Acquisitions: In 2022, Novo Nordisk is going to acquire Forma, a biopharmaceutical firm, for USD 1.1 bn. This acquisition will help Novo Nordisk to build a pipeline of biopharmaceutical products. The other route in which companies engage is in-licensing. A company will cover the R&D costs and share the marketing costs of the company to gain royalties from its future sales.

- Microbial Fermentation: Mammalian cell culture and microbial fermentation outsourced services by Biopharmaceutical CMOs have seen an ongoing demand since 2020. The growing demand has been due to the increased focus of companies on recombinant proteins and monoclonal antibodies, which require microbial fermentation and mammalian cell culture. Additionally, companies have a large number of biologics in their pipeline, which has also helped in the increasing demand for mammalian cell culture. A report from Contact Pharma showed an increase in demand for mammalian cell culture outsourced services by 10% from 2019. The capacity needed for mammalian cell culture has also gone up by 20-30% in recent years.

Chapter 1.BIOPHARMACEUTICAL MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.BIOPHARMACEUTICAL MARKET – Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3.BIOPHARMACEUTICAL MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.BIOPHARMACEUTICAL MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. BIOPHARMACEUTICAL MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.BIOPHARMACEUTICAL MARKET – By Product:

6.1. Monoclonal Antibodies

6.2. Recombinant Growth Factors

6.3. Purified Proteins

6.4. Recombinant Proteins

6.5. Recombinant Hormones

6.6. Vaccines

6.7. Recombinant Enzymes

6.8. Cell and Gene therapies

6.9. Synthetic Immunomodulators

6.10. Other Product types

Chapter 7.BIOPHARMACEUTICAL MARKET – By Therapeutic Application

7.1.Oncology

7.2. Inflammatory and Infectious diseases

7.3. Autoimmune Disorders

7.4. Metabolic Disorders

7.5. Hormonal Disorders

7.6. Cardiovascular Diseases

7.7. Neurological Diseases

7.8. Other Diseases

Chapter 8.BIOPHARMACEUTICAL MARKET – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Download Sample

Choose License Type

2500

4250

5250

6900