Bio Glutamic Acid Market Size (2024 – 2030)

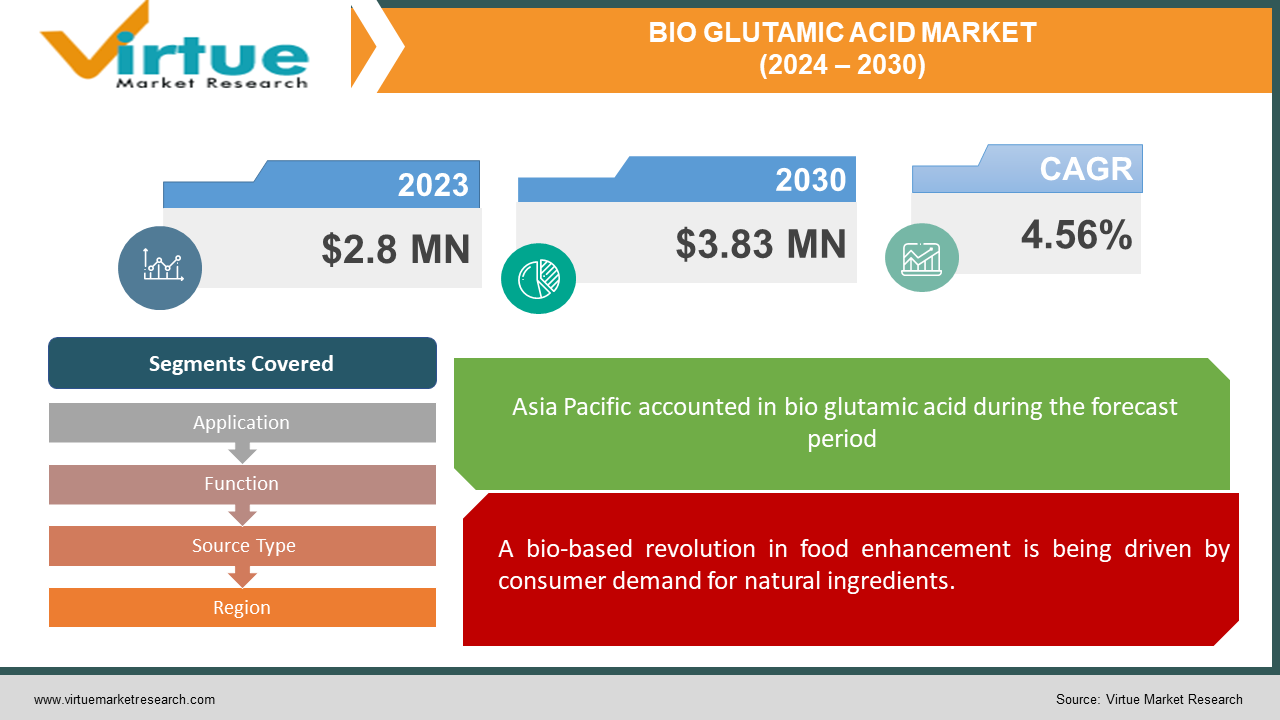

The Global Bio Glutamic Acid Market was valued at USD 2.8 million in 2023 and is projected to reach a market size of USD 3.83 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.56%.

The adaptable amino acid glutamic acid serves two vital roles in your body. It serves as a building block for proteins, the hardworking molecules that maintain the strength of your tissues and the appropriate operation of your hormones and enzymes. Glutamic acid plays a vital role in the brain as a neurotransmitter, serving as the primary messenger molecule that stimulates nerve cells and is necessary for cognitive functions like learning, memory, and sharp thinking. Beyond its internal uses, glutamic acid is a major contributor to the savoury umami taste sensation, which tantalises your taste buds. This wonderful flavour is what entices people to broths, aged cheeses, and meats. Although glutamic acid is produced by your body, it is also widely present in a wide range of foods, including eggs, meats, vegetables, and nuts.

Key Market Insights:

78% of people worldwide are willing to pay extra for goods that contain natural components. This is an excellent possibility for the fermentation process of bio-glutamic acid. By 2027, the clean-label ingredient market will be worth more than USD 60 billion worldwide. Manufacturers are moving towards bio glutamic acid as a natural flavour enhancer due to worries about MSG, a derivative of glutamic acid, and a desire for transparency. Customers are 60% more inclined to select environmentally friendly packaging. This trend is supported by the possible uses of bio glutamic acid in biodegradable plastics, which opens new market opportunities. Regulations about MSG, a glutamic acid derivative, are driving innovation in applications for bio-glutamic acid. Producers are investigating its possibilities as a natural flavour enhancer without the drawbacks of MSG.

Global Bio Glutamic Acid Market Drivers:

A bio-based revolution in food enhancement is being driven by consumer demand for natural ingredients.

Natural and healthful components are becoming more and more sought after by consumers in the products they select. Increased transparency and the belief that natural products are safer and more helpful are the driving forces behind this trend. Fermentation produces bio glutamic acid, which is in perfect harmony with this shift in preferences. Microorganisms are used in the natural process of fermentation to transform simple sugars into a variety of compounds, including bio glutamic acid. Customers who are leery of chemicals and artificial additives will find resonance in this. Because of this, there is an increasing need for bio-based substitutes for glutamic acid, which is typically produced through chemical synthesis. Due to producers' increased focus on health, this change offers the bio glutamic acid industry a sizable window of opportunity.

An Organic Remedy Emerging from the Debris of MSG Laws

Food regulations—especially those about additives like monosodium glutamate, or MSG—are driving innovation in the market for bio-glutamic acid. Due to possible negative health effects, MSG, a well-known flavour enhancer made from glutamic acid, has generated some debate. Stricter limitations on its usage have been implemented by regulatory organisations in response to these concerns. Manufacturers are then compelled to investigate different ways to improve flavour profiles. Because of its natural source and capacity to impart the savoury umami flavour, bio glutamic acid appears to be a suitable alternative. Producers are currently investigating and creating uses for bio glutamic acid as an all-natural flavour enhancer. By addressing the regulatory environment and meeting consumer desire for natural ingredients and transparency, this focus on bio glutamic acid has the potential to completely change how we perceive savoury flavours in food items.

Global Bio Glutamic Acid Market Restraints and Challenges:

There are obstacles to be faced even with the positive prognosis for the global bio glutamic acid industry. The comparatively elevated expense of fermentation-produced bio glutamic acid in contrast to its chemically synthesised counterpart may constrain its extensive application. Manufacturers may also find it difficult to navigate the intricate web of laws about bio glutamic acid, particularly as it relates to food and drink. Furthermore, some customers may be hesitant to purchase bio-based items since they don't fully comprehend them. Ultimately, further developments in the fermentation process are required to raise productivity and lower costs, making bio glutamic acid a more competitive alternative to conventional chemical synthesis techniques.

Global Bio Glutamic Acid Market Opportunities:

The bio glutamic acid industry offers a plethora of fascinating prospects. The growing market for functional foods especially those that target athletic performance and cognitive function offers a great chance to take advantage of the potential health advantages of bio glutamic acid. The inclination of consumers towards natural ingredients presents an opportunity for bio glutamic acid to emerge as a novel natural flavour enhancer, displacing artificial alternatives such as MSG. Because of its environmentally benign production technique, the sustainability movement is another tailwind that is opening potential for bio glutamic acid in biodegradable polymers and other eco-friendly applications. With a sizable and health-conscious populace, the Asia Pacific area is expected to experience rapid expansion. Businesses will be well-positioned to benefit from this booming industry if they take advantage of this geographical development and invest in innovations to enhance fermentation processes, making bio glutamic acid more cost-competitive.

BIO GLUTAMIC ACID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.56% |

|

Segments Covered |

By Application, Function, Source Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ajinomoto Co., Inc. (Japan), Akzo Nobel N.V. (Netherlands), Evonik Industries AG (Germany), Global Bio-chem Technology Group Company Limited (China), Hefei TNJ Chemical Industry Co., Ltd. (China), KYOWA HAKKO BIO CO., LTD. (Japan), Ningxia Yipin Biological Technology Co., Ltd. (China), Sichuan Tongsheng Amino Acid Co., Ltd. (China), Suzhou Yuanfang Chemical Co., Ltd. (China) |

Global Bio Glutamic Acid Market Segmentation: By Application

-

Food & Beverages (largest segment)

-

Pharmaceuticals

-

Animal Feed

-

Others (cosmetics, personal care, etc.)

The greatest market for bio-glutamic acid is the food and beverage industry. Bio glutamic acid has several uses in this industry. It intensifies the savoury umami flavour that accentuates the allure of aged cheeses, meats, and broths. Moreover, it serves as a dietary supplement by offering glutamic acid, an amino acid that is necessary for brain and protein synthesis. Beyond nutrition and flavour, bio glutamic acid can be used in a variety of culinary applications as an acidity regulator or bulking agent. Nonetheless, the medicines segment is expected to increase at the greatest rate. The intriguing potential of bio glutamic acid in drugs for ulcers, epilepsy, and even cognitive impairments is what's driving this increase.

Global Bio Glutamic Acid Market Segmentation: By Function

-

Flavour enhancer (Umami taste)

-

Nutritional supplement

-

Pharmaceutical ingredient

-

Biodegradable material precursor

In terms of functionality, flavour enhancer is the market leader for bio glutamic acid right now. The food and beverage industry has relied on bioglutamic acid's proven strength—unlocking the savoury umami taste—for many years. Because of its ingrained use, it is by far the most important function. But there's a new rival in town: the market for medicinal ingredients. The potential uses of bioglutamic acid as a treatment for a range of ailments are being intensively investigated, and this fascinating new field is propelling the substance's rapid expansion. The pharmaceutical segment's development trajectory points to a potential future shift, with pharmaceuticals potentially becoming a greater participant in the bio glutamic acid industry, even though flavour enhancers currently control much of the market share.

Global Bio Glutamic Acid Market Segmentation: By Source Type

-

Plant-based (soy, corn, etc.)

-

Animal-based (eggs, dairy, etc.)

Plant-based alternatives like soy and maize are the top sources of bio glutamic acid. Several variables come together to cause this domination. First off, since plant-based fermentation is generally regarded as a more environmentally benign manufacturing process than animal-based sources, it fits in perfectly with the increased emphasis on sustainability. Second, compared to their animal equivalents, plant-based ingredients are frequently more affordable and easier to obtain, which could reduce the cost of producing bio glutamic acid. Not to mention, plant-based fermentation techniques have excellent scalability, making it simple to increase their production to satisfy the growing need for bio glutamic acid. These benefits bolster the leading position of plant-based bio glutamic acid by source type.

Global Bio Glutamic Acid Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The largest and fastest-growing market for bio glutamic acid is the Asia Pacific area. This dominance is the result of several interrelated variables. First off, there is a sizable and growingly health-conscious populace in the area. This results in an increased need for nutritional supplements and functional foods, which frequently include bio glutamic acid due to its alleged health advantages. Second, rising disposable incomes are being driven by the economic progress of Asia Pacific's developing nations. This results in a rise in the consumption of packaged goods and processed foods, which are two categories where bio glutamic acid is commonly used. Lastly, the region's governments are aggressively encouraging the use of bio-based products, which is fostering the manufacture and usage of bio-glutamic acid.

COVID-19 Impact Analysis on the Global Bio Glutamic Acid Market:

The COVID-19 pandemic had a mixed effect on the world market for bio glutamic acid. The first lockdowns had a knock-on effect, upsetting supply networks and making it more difficult to get necessities. Short-term market growth was limited by this and a drop in demand from industries that significantly rely on bio glutamic acid, such as food service. But the pandemic also brought with it unanticipated opportunities. The increased emphasis on wellbeing and health led to a surge in the market for medications and foods high in nutrients, both of which can contain bio glutamic acid. This unanticipated change created opportunities for long-term market expansion and a more optimistic perspective.

Recent Trends and Developments in the Global Bio Glutamic Acid Market:

There are a tonne of innovative advancements in the bio glutamic acid industry worldwide. Natural components are becoming more and more popular, and fermentation produces bio glutamic acid, which is ideal for this trend. The development of bio-based substitutes for their chemically synthesised counterparts is being fuelled by this. Additionally, bio glutamic acid is getting opportunities thanks to the environmental movement. When compared to conventional processes, its manufacture can be more environmentally friendly, which makes it possible to employ it in biodegradable plastics and other bio-based applications. Another positive trend is the rise in health and well-being, which is driving up demand for functional foods with healthy components. Given its ability to enhance both mental and physical performance, bio glutamic acid may be a good fit for this expanding category. Lastly, new laws about food additives—most notably MSG—are encouraging creativity. Producers are investigating the possibility of bio glutamic acid as a natural flavour enhancer, providing an alternative to MSG without the drawbacks.

Key Players:

-

Ajinomoto Co., Inc. (Japan)

-

Akzo Nobel N.V. (Netherlands)

-

Evonik Industries AG (Germany)

-

Global Bio-chem Technology Group Company Limited (China)

-

Hefei TNJ Chemical Industry Co., Ltd. (China)

-

KYOWA HAKKO BIO CO., LTD. (Japan)

-

Ningxia Yipin Biological Technology Co., Ltd. (China)

-

Sichuan Tongsheng Amino Acid Co., Ltd. (China)

-

Suzhou Yuanfang Chemical Co., Ltd. (China)

Chapter 1. Bio Glutamic Acid Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bio Glutamic Acid Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bio Glutamic Acid Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bio Glutamic Acid Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bio Glutamic Acid Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bio Glutamic Acid Market – By Function

6.1 Introduction/Key Findings

6.2 Flavour enhancer (Umami taste)

6.3 Nutritional supplement

6.4 Pharmaceutical ingredient

6.5 Biodegradable material precursor

6.6 Y-O-Y Growth trend Analysis By Function

6.7 Absolute $ Opportunity Analysis By Function, 2024-2030

Chapter 7. Bio Glutamic Acid Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverages (largest segment)

7.3 Pharmaceuticals

7.4 Animal Feed

7.5 Others (cosmetics, personal care, etc.)

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Bio Glutamic Acid Market – By Source Type

8.1 Introduction/Key Findings

8.2 Plant-based (soy, corn, etc.)

8.3 Animal-based (eggs, dairy, etc.)

8.4 Y-O-Y Growth trend Analysis By Source Type

8.5 Absolute $ Opportunity Analysis By Source Type, 2024-2030

Chapter 9. Bio Glutamic Acid Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Function

9.1.3 By Application

9.1.4 By Source Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Function

9.2.3 By Application

9.2.4 By Source Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Function

9.3.3 By Application

9.3.4 By Source Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Function

9.4.3 By Application

9.4.4 By Source Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Function

9.5.3 By Application

9.5.4 By Source Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Bio Glutamic Acid Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Ajinomoto Co., Inc. (Japan)

10.2 Akzo Nobel N.V. (Netherlands)

10.3 Evonik Industries AG (Germany)

10.4 Global Bio-chem Technology Group Company Limited (China)

10.5 Hefei TNJ Chemical Industry Co., Ltd. (China)

10.6 KYOWA HAKKO BIO CO., LTD. (Japan)

10.7 Ningxia Yipin Biological Technology Co., Ltd. (China)

10.8 Sichuan Tongsheng Amino Acid Co., Ltd. (China)

10.9 Suzhou Yuanfang Chemical Co., Ltd. (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bio Glutamic Acid Market size is valued at USD 2.8 million in 2023.

The worldwide Global Bio Glutamic Acid Market growth is estimated to be 4.56% from 2024 to 2030.

The Global Bio Glutamic Acid Market is segmented By Application (Food & Beverages (largest segment), Pharmaceuticals, Animal Feed, Others (cosmetics, personal care, etc.)); By Function (Flavour enhancer (Umami taste), Nutritional supplement, pharmaceutical ingredient, Biodegradable material precursor); By Source Type (Plant-based (soy, corn, etc.), Animal-based (eggs, dairy, etc.)) and by region.

Several trends indicate that the demand for bio glutamic acid is projected to rise in the global market. The increased interest in functional foods—which frequently contain bio glutamic acid—among consumers is a result of the burgeoning health and wellness trend. Furthermore, prospects for bio glutamic acid in industrial applications are being created by the desire for bio-based and biodegradable products.

The global bio glutamic acid market was impacted by the COVID-19 pandemic in two ways. The initial lockdowns affected supply chains and reduced demand for bio glutamic acid in all industries. On the other hand, there was potential for the industry due to an increase in demand for medications and foods that support health and include bio glutamic acid.