Bio-based Water-Soluble Polymers Market Size (2024 – 2030)

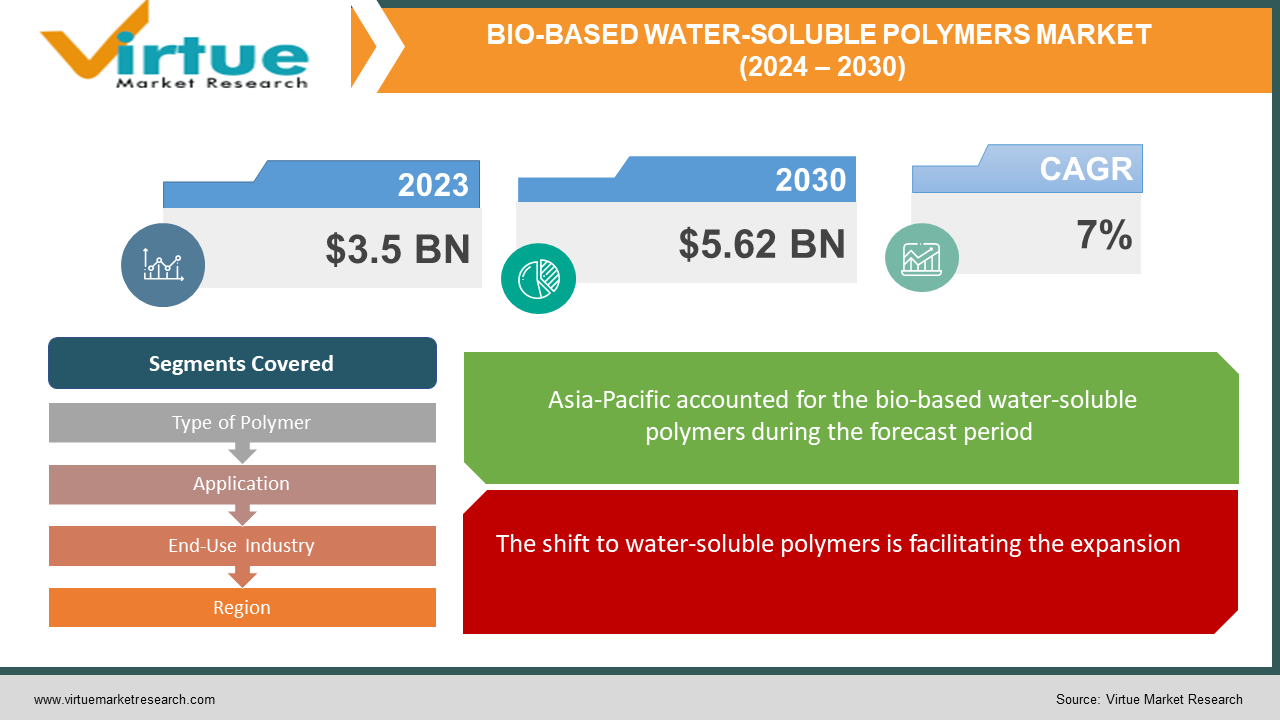

The global bio-based water-soluble polymer market was valued at USD 3.5 billion and is projected to reach a market size of USD 5.62 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7%.

Water-soluble polymers that are bio-based come from renewable resources and can dissolve in water. These polymers support sustainable practices across a range of industries by providing eco-friendly substitutes for their petrochemical counterparts. Examples include chitosan from crab shells, bio-based polyvinyl alcohol, starch and modified starches, cellulose derivatives such as hydroxyethyl and carboxymethyl cellulose, polyacrylamide derived from renewable sources, guar gum from guar beans, alginate extracted from seaweeds, and xanthan gum made by bacterial fermentation. These polymers are used in wastewater treatment, food processing, cosmetics, medicines, and agriculture. Their application promotes the shift to more environmentally friendly and sustainable materials, in line with the worldwide focus on lessening the impact of industrial processes on the environment.

Key Market Insights:

Notable trends in the market for bio-based water-soluble polymers are being driven by the growing need for sustainable solutions in a variety of industries. These polymers, which come from renewable resources, are becoming more well-known as greener substitutes for their petroleum-based equivalents. The versatility of these materials is shown by their key uses, which span a wide range of industries and include wastewater treatment, pharmaceuticals, food & beverage, and agriculture. Robust environmental legislation across the globe is incentivizing industry to investigate and implement sustainable substitutes, hence endorsing bio-based water-soluble polymers. The goals of ongoing research and development projects are to improve their scalability, performance, and affordability. New bio-based polymers and improvements in production processes are being facilitated by alliances and collaborations among government agencies, academic institutions, and business leaders.

Bio-based Water-Soluble Polymer Market Drivers:

The shift to water-soluble polymers is facilitating the expansion.

The rising need for bio-based water-soluble polymers is mostly due to the growing emphasis on sustainability and environmental concerns. Companies and consumers alike are actively looking for alternatives because of increased awareness of the negative environmental effects of traditional, petroleum-based polymers. There is a notable change in the industry towards bio-based water-soluble polymers due to the desire to adopt eco-friendly activities and lessen the ecological footprint. This driver is indicative of a greater dedication on the part of the polymer industry to reduce environmental issues and encourage more sustainable alternatives.

The increasing need for bio-based polymers is driving the market.

The need for bio-based water-soluble polymers is significantly increasing due to consumer desire for eco-friendly products and growing awareness of environmental issues. Buying decisions in a variety of businesses are changing because of this change in customer behavior. Businesses are under increasing pressure to provide sustainable alternatives that correspond with these changing consumer demands. The increasing market share of bio-based water-soluble polymers indicates a greater commitment to satisfying the demands of an eco-aware customer base. These polymers are vital to helping firms adopt more environmentally friendly practices, as sustainability is becoming a major consideration when making purchases.

Petrochemical price dynamics are boosting the growth.

The relationship between price variations of petrochemical feedstock and the cost competitiveness of bio-based polymers is complex. Bio-based alternatives are becoming more and more viable economically as petrochemical prices climb. This relationship frequently results in a rise in the market for bio-based polymers as businesses look for sustainable and affordable alternatives when petrochemical prices are high. This event highlights the potential strategic benefit of using bio-based polymers to lessen the effects of unstable petrochemical markets. Businesses that are concerned about controlling expenses and lowering their reliance on fossil fuels are more likely to use bio-based substitutes in the event of price volatility, which helps to support the market expansion of these environmentally friendly polymers.

Bio-based Water-Soluble Polymers Market Restraints and Challenges

The market for bio-based water-soluble polymers is confronted with significant obstacles and difficulties. A notable obstacle pertains to its cost-effectiveness when compared with traditional petroleum-derived polymers. Widespread adoption of bio-based polymers may be hampered by the production costs of these materials, which are impacted by several factors, including economies of scale, processing technology, and raw material availability. Large-scale industrial applications are further hampered by problems with the scalability and consistent quality of bio-based polymer synthesis. The competition with well-established synthetic polymers in terms of functionality and performance is another limitation. Moreover, market penetration may be impacted by regional variations in the complexity and quality of bio-based material regulations. To overcome these obstacles and improve the performance and economic feasibility of bio-based water-soluble polymers, industrial collaboration, technological innovation, and ongoing research are needed.

Bio-Based Water-Soluble Polymers Market Opportunities:

The market for water-soluble polymers derived from biotechnology offers numerous encouraging prospects for expansion and advancement. A favorable market environment is created by rising customer awareness of and preferences for sustainable products. Businesses can benefit from this trend by adding more bio-based, water-soluble polymers to their portfolios to satisfy the growing consumer demand for eco-friendly substitutes. Technological and scientific developments provide avenues for innovation, facilitating the creation of novel and superior bio-based polymers with enhanced characteristics. Furthermore, there are opportunities for market growth due to the growing applications of these polymers in a variety of industries, including agriculture, cosmetics, and pharmaceuticals. Furthermore, cooperative efforts among government agencies, academic institutions, and business leaders can promote technological advancements and ease market penetration.

BIO-BASED WATER-SOLUBLE POLYMERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Type of Polymer, Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Arkema SA (Colombes, France), Ashland (Delaware, U.S.), BASF SE (Ludwigshafen, Germany), DuPont (Delaware, U.S.), Kemira (Helsinki, Finland), Kuraray Co., Ltd. (Tokyo, Japan), LG Chem (Seoul, South Korea), Nitta Gelatin, NA Inc. (Osaka, Japan), SNF (Andrézieux-Bouthéon, France), Dow Chemical (Michigan, U.S.) |

Bio-based Water-Soluble Polymer Market Segmentation: By Type of Polymer

-

Starch and Modified Starches

-

Cellulose Derivatives

-

Chitosan

-

Polyvinyl Alcohol (PVA)

-

Polyacrylamide (PAM)

-

Guar Gum

-

Alginate

-

Xanthan Gum

Guar gum has the largest market share by polymer type. It is a naturally occurring polysaccharide obtained from guar beans and valued for its high thickening, gelling ability, shear-thinning behavior, and environmentally benign qualities. It presently leads the market for bio-based water-soluble polymers. Guar gum is widely used in a variety of industries to provide biodegradable solutions, stabilize emulsions, and thicken culinary items. Simultaneously, the market's fastest-growing section is cellulose derivatives, a broad category of polymers made by altering cellulose. The uses of these compounds in film formation, thickening, gelling, water retention in agriculture, and biocompatible applications in medical devices are becoming more and more common. The market for bio-based water-soluble polymers is dynamic and meets the needs of both traditional and innovative industries because of the combination of guar gum's proven adaptability and the growing applications of cellulose derivatives.

Bio-based Water-Soluble Polymer Market Segmentation: By Application

-

Water Treatment

-

Food and Beverages

-

Pharmaceuticals

-

Cosmetics

-

Agriculture

-

Wastewater Treatment

The bio-based water-soluble polymer market is characterized by a dynamic landscape, with the largest segment presently being water treatment. This segment is driven by the increasing global need for clean water due to urbanization and population expansion. Because of their ability to effectively treat water and provide features like flocculation, improved filtration, disinfection, and heavy metal removal, bio-based polymers are now considered essential for adhering to strict environmental standards. The food and beverage business is the fastest-growing sector, driven by trends in health and wellness that emphasize natural products. With a variety of functions, including thickening, gelling, emulsification, stabilization, encapsulation, and delivery, bio-based polymers meet customer expectations for natural and environmentally friendly components while also meeting the need for clean and sustainable labels.

Bio-based Water-Soluble Polymer Market Segmentation: By End-Use Industry

-

Food and Beverage Industry

-

Pharmaceutical Industry

-

Cosmetics and Personal Care Industry

-

Agriculture Industry

-

Water Treatment Industry

-

Textile Industry

The largest sector is the food and beverage business, whereas the fastest-growing sector is the water treatment industry. Bio-based polymers are becoming more and more popular in the food and beverage industry due to the growing desire for natural and healthful goods. These polymers satisfy the industry's need for adaptable and sustainable ingredients while also appealing to consumers who want clean labels. They have a variety of functions, including thickening, gelling, stabilizing, and encapsulating. On the other hand, the global need for clean water in the face of urbanization and population growth is propelling the water treatment industry's explosive expansion. The use of bio-based polymers has increased due to strict environmental rules on wastewater disposal, which have demonstrated their efficacy in vital processes such as flocculation, filtration, disinfection, and heavy metal removal.

Bio-based Water-Soluble Polymers Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is the largest and fastest-growing segment in the bio-based water-soluble polymer market. Demand has increased across a range of industries due to rapid population growth and rising disposable incomes. The increasing industry and urbanization of the area also add to the popularity of bio-based polymers. A significant role has also been played by government programs that support sustainable practices, particularly considering the growing interest in these polymers from the food processing and agriculture industries. This is linked to expanding demand for natural and healthful products, increased awareness of environmental sustainability, and rising investments in water treatment infrastructure, all at the same time. This twofold trend highlights the Asia-Pacific region's strategic significance for the bio-based water-soluble polymer market's current dominance and future growth trajectory.

COVID-19 Impact Analysis on the Global Bio-Based Water-Soluble Polymers Market:

Numerous effects of the COVID-19 pandemic have been seen in the global market for bio-based, water-soluble polymers. Lockdowns and other restrictions caused supply chain disruptions that hindered raw material transit, which delayed production and delivery. Concurrently, the market for bio-based water-soluble polymers may have been impacted by changes in consumer behavior brought on by the pandemic, which included a greater emphasis on environmental sustainability, especially in applications that supported environmentally beneficial activities. Besides, jobs a lot of people lost their jobs due to economic uncertainty. Most of the funds were shifted towards healthcare applications that caused losses. Certain industry sectors, like textiles and cosmetics, may have seen variations in demand due to economic uncertainty. M, while others, like medicines and water treatment, may have seen prolonged or increased demand. New bio-based polymer advancements may have been hampered by the pandemic's impact on research and development efforts due to obstacles like lab closures and limited collaboration.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are

spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Key Players:

-

Arkema SA (Colombes, France)

-

Ashland (Delaware, U.S.)

-

BASF SE (Ludwigshafen, Germany)

-

DuPont (Delaware, U.S.)

-

Kemira (Helsinki, Finland)

-

Kuraray Co., Ltd. (Tokyo, Japan)

-

LG Chem (Seoul, South Korea)

-

Nitta Gelatin, NA Inc. (Osaka, Japan)

-

SNF (Andrézieux-Bouthéon, France)

-

Dow Chemical (Michigan, U.S.)

Chapter 1. Bio-based Water-Soluble Polymers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bio-based Water-Soluble Polymers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bio-based Water-Soluble Polymers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bio-based Water-Soluble Polymers Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bio-based Water-Soluble Polymers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bio-based Water-Soluble Polymers Market – By Application

6.1 Introduction/Key Findings

6.2 Water Treatment

6.3 Food and Beverages

6.4 Pharmaceuticals

6.5 Cosmetics

6.6 Agriculture

6.7 Wastewater Treatment

6.8 Y-O-Y Growth trend Analysis By Application

6.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Bio-based Water-Soluble Polymers Market – By Type

7.1 Introduction/Key Findings

7.2 Starch and Modified Starches

7.3 Cellulose Derivatives

7.4 Chitosan

7.5 Polyvinyl Alcohol (PVA)

7.6 Polyacrylamide (PAM)

7.7 Guar Gum

7.8 Alginate

7.9 Xanthan Gum

7.10 Y-O-Y Growth trend Analysis By Type

7.11 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Bio-based Water-Soluble Polymers Market – By End-user

8.1 Introduction/Key Findings

8.2 Food and Beverage Industry

8.3 Pharmaceutical Industry

8.4 Cosmetics and Personal Care Industry

8.5 Agriculture Industry

8.6 Water Treatment Industry

8.7 Textile Industry

8.8 Y-O-Y Growth trend Analysis By End-user

8.9 Absolute $ Opportunity Analysis By End-user, 2024-2030

Chapter 9. Bio-based Water-Soluble Polymers Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Type

9.1.4 By By End-user

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Type

9.2.4 By End-user

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Type

9.3.4 By End-user

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Type

9.4.4 By End-user

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Type

9.5.4 By End-user

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Bio-based Water-Soluble Polymers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Arkema SA (Colombes, France)

10.2 Ashland (Delaware, U.S.)

10.3 BASF SE (Ludwigshafen, Germany)

10.4 DuPont (Delaware, U.S.)

10.5 Kemira (Helsinki, Finland)

10.6 Kuraray Co., Ltd. (Tokyo, Japan)

10.7 LG Chem (Seoul, South Korea)

10.8 Nitta Gelatin, NA Inc. (Osaka, Japan)

10.9 SNF (Andrézieux-Bouthéon, France)

10.10 Dow Chemical (Michigan, U.S.)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global bio-based water-soluble polymer market was valued at USD 3.5 billion and is projected to reach a market size of USD 5.62 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7%.

Increasing consumer preference for sustainability, growing environmental awareness, technological developments, and corporate sustainability initiatives are the market drivers of the global bio-based water-soluble polymer market.

Type of polymer, application, end-use industry, and region are the segments under the global bio-based water-soluble polymer market.

Asia-Pacific is the most dominant region for the global bio-based water-soluble polymer market.

Arkema SA (Colombes, France), Ashland (Delaware, U.S.), BASF SE (Ludwigshafen, Germany), DuPont (Delaware, U.S.), Kemira (Helsinki, Finland), Kuraray Co., Ltd. (Tokyo, Japan), LG Chem (Seoul, South Korea), Nitta Gelatin, NA Inc. (Osaka, Japan), SNF (Andrézieux-Bouthéon, France), and Dow Chemical (Michigan, U.S.) are the key players in the global bio-based water-soluble polymer market.