Bio-Based Surfactant EOR Market Size (2024 – 2030)

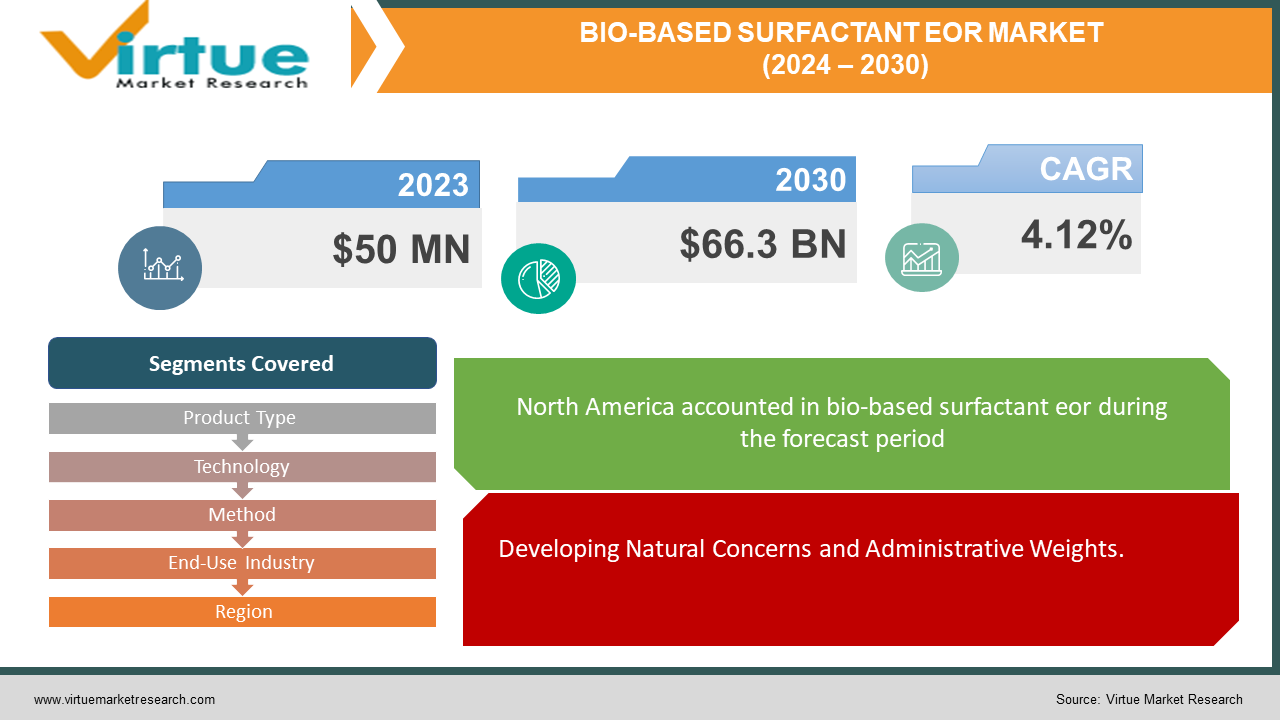

The market for global bio-based surfactant EOR market was estimated to be worth 50 USD million in 2023 and is expected to increase to 66.3 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 4.12% from 2024 to 2030.

The advertisement for bio-based surfactants in Upgraded Oil Recuperation (EOR) presents an energetic scene characterized by development, supportability, and developing requests inside the vitality division. Bio-based surfactants, inferred from renewable sources such as plant oils and microbial sources, have earned considerable consideration due to their eco-friendly nature and adequacy in upgrading oil recuperation forms. With expanding accentuation on decreasing natural effects and transitioning towards economical hones, the bio-based surfactant EOR showcase is encountering relentless development around the world. This showcase is moved by variables counting mechanical headways, steady government directions advancing bio-based items, and developing mindfulness among oil and gas companies concerning the benefits of utilizing ecologically neighborly surfactants. Additionally, the market's direction is advanced complemented by the rising ventures in investigation and improvement pointed at making strides in the productivity and appropriateness of bio-based surfactants in assorted EOR applications. As the industry proceeds to advance, collaborations between key showcase players, progressions in biotechnology, and extending geological reach are expected to shape the long-standing time scene of the bio-based surfactant EOR advertise, advertising promising openings for economic development and advancement.

Key Insights:

The global bio-based surfactant EOR market is projected to grow at a CAGR of approximately 5% from 2021 to 2026.North America dominates the bio-based surfactant EOR market with a market share of over 40% due to increased investment in shale gas exploration and production.Plant-based surfactants segment accounts for the largest share in the market, owing to their biodegradable nature and low environmental impact.The Asia Pacific region is anticipated to witness significant growth in the bio-based surfactant EOR market, driven by rising oil exploration activities in countries like China and India.

Global Bio-Based Surfactant EOR Market Drivers:

Developing Natural Concerns and Administrative Weights.

The expanding mindfulness of natural issues coupled with exacting controls on routine chemical utilization within the oil and gas industry are driving the request for bio-based surfactants in Improved Oil Recuperation (EOR) forms. Natural controls are pushing oil and gas companies to receive economical hones, in this manner quickening the appropriation of bio-based surfactants. Also, the biodegradable nature of bio-based surfactants adjusts with the industry's supportability objectives, assist fueling their take-up in EOR applications. As a result, the advertisement for bio-based surfactant EOR is seeing noteworthy development driven by the basics to play down natural effects while keeping up proficient oil recuperation operations.

Innovative Progressions in Surfactant Definitions.

Continuous inquiry about advancement endeavors centered on moving forward the performance and viability of bio-based surfactants are driving advancement within the showcase. Progresses in surfactant definitions, counting the advancement of novel compounds and optimization of generation forms, are improving the adequacy of bio-based surfactants in EOR applications. These mechanical headways are empowering oil and gas administrators to realize higher oil recuperation rates while diminishing the natural impression of their operations. In addition, advancements such as custom-fitted surfactant mixes and responsive definitions are increasing the appropriateness of bio-based surfactants over differing supply conditions, encouraging driving showcase development.

Rising Speculations in Oil Investigation and Generation Exercises.

The increasing investments in oil investigation and generation exercises, especially in districts with undiscovered saves and developing oil areas, are driving the request for improved oil recuperation arrangements, counting bio-based surfactants. As ordinary oil saves end up exhausted and the requirement for auxiliary and tertiary recuperation strategies rises, there's a developing dependence on EOR procedures to maximize oil generation from existing stores. Bio-based surfactants offer a feasible elective to conventional surfactants, making them an attractive choice for oil and gas companies looking to optimize generation while following natural controls. The surge in speculations in oil investigation and generation exercises around the world is hence moving the development of the worldwide bio-based surfactant EOR advertise.

Global Bio-Based Surfactant EOR Market Restraints and Challenges:

Fetched Limitations and Cost Affectability.

One of the essential challenges ruining the broad appropriation of bio-based surfactants in Improved Oil Recuperation (EOR) applications is their moderately higher generation costs compared to customary surfactants. The starting venture required for investigation, advancement, and generation framework for bio-based surfactants can be considerable, making them less financially reasonable for a few oil and gas administrators, particularly in cost-sensitive situations. Also, the cost affectability of the oil and gas industry, especially in periods of showcase downturns or cost instability, assists compounds in the challenge of taking a toll on competitiveness for bio-based surfactants.

Restricted Versatility and Generation Capacity.

Another limitation confronting the bio-based surfactant EOR advertise is the restricted adaptability and generation capacity of bio-based surfactant fabricating offices. Scaling up a generation to meet the developing request for bio-based surfactants requires noteworthy speculations in framework, innovation, and workforce preparation. Be that as it may, the complex nature of bio-based surfactant generation forms, coupled with administrative compliance prerequisites and showcase instabilities, poses challenges to fast development. As a result, supply chain disturbances and generation bottlenecks can compel showcase development and obstruct the accessibility of bio-based surfactants for EOR applications.

Execution and Compatibility Issues.

Despite progressions in bio-based surfactant details, challenges related to execution and compatibility with existing EOR innovations and supply conditions stay critical obstructions to showcase entrance. Accomplishing ideal oil recuperation rates while keeping up cost-effectiveness requires bio-based surfactants to illustrate comparable or prevalent execution to routine surfactants over a wide run of store characteristics. Additionally, guaranteeing compatibility with other EOR chemicals, supply liquids, and generation hardware is fundamental for consistent integration into existing oilfield operations. Tending to these execution and compatibility challenges through proceeded investigation, advancement, and field testing endeavors is basic to overcoming boundaries to selection and driving advertise acknowledgment of bio-based surfactants in EOR applications.

Global Bio-Based Surfactant EOR Market Opportunities:

Developing Center on Maintainable Hones.

With expanding worldwide mindfulness of natural maintainability, there's a critical opportunity for bio-based surfactants in Upgraded Oil Recuperation (EOR) applications. Oil and gas companies are beneath weight to decrease their natural impression and move towards greener hones. Bio-based surfactants offer a feasible elective to routine chemicals, adjusting with the industry's maintainability objectives. Capitalizing on this drift presents an opportunity for bio-based surfactant producers to position themselves as key accomplices within the industry's endeavors toward natural stewardship.

Progressions in Biotechnology and Detailing Procedures.

Continuous progressions in biotechnology and detailing strategies are growing the capabilities and versatility of bio-based surfactants, opening unused openings within the EOR showcase. Developments such as hereditarily designed microbial surfactants and custom-made details are upgrading the execution and productivity of bio-based surfactants in challenging reservoir conditions. These innovative headways empower oil and gas administrators to realize higher oil recuperation rates while minimizing natural effects, driving requests for bio-based surfactants in assorted EOR applications.

Vital Collaborations and Associations.

Key collaborations and organizations between bio-based surfactant producers, oil and gas companies, investigate education, and government organizations display noteworthy openings for advertising extension. Collaborative endeavors can quicken investigation and advancement activities, encourage innovation exchange, and drive advancement in bio-based surfactant formulations and generation forms. Additionally, organizations with industry partners can upgrade showcase permeability, make synergies, and cultivate the selection of bio-based surfactants over the esteem chain. Leveraging key collaborations can offer assistance to bio-based surfactant producers to capitalize on developing openings and enter modern markets, driving development and competitiveness within the worldwide EOR advertise.

BIO-BASED SURFACTANT EOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.12% |

|

Segments Covered |

By Product Type, Technology, Method, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Solvay S.A., Stepan Company, BASF SE, Clariant AG, Croda International Plc, The Dow Chemical Company, Akzo Nobel N.V., Evonik Industries AG, Innospec Inc., Nouryon, Huntsman Corporation, Sasol Limited |

Bio-Based Surfactant EOR Market Segmentation: By Product Type

-

Anionic Surfactants

-

Cationic Surfactants

-

Non-ionic Surfactants

-

Amphoteric Surfactants

Among the different sorts of surfactants utilized in Upgraded Oil Recuperation (EOR) applications, anionic surfactants stand out as one of the foremost successful choices. Anionic surfactants are characterized by their capacity to viably decrease interfacial pressure between oil and water, encouraging the relocation of caught oil from store rocks and progressing oil recuperation rates. Their solid negative charge permits them to connect with emphatically charged oil particles, driving to improved oil mobilization and uprooting. Besides, anionic surfactants display great compatibility with store liquids and other EOR chemicals, making them flexible and appropriate for a wide run of store conditions. Their demonstrated adequacy, flexibility, and compatibility make anionic surfactants a favored choice for oil and gas administrators looking to optimize oil recuperation productivity and maximize generation yields in EOR applications.

Bio-Based Surfactant EOR Market Segmentation: By Technology

-

Microbial Surfactants

-

Plant-based Surfactants

-

Synthetic Biology-based Surfactants

Among the different advances utilized within the generation of surfactants for Improved Oil Recuperation (EOR) applications, microbial surfactants emerge as one of the foremost successful alternatives. Microbial surfactants are delivered by microorganisms through maturation forms, coming about in common, biodegradable compounds with amazing surface-active properties. These surfactants display one-of-a-kind structures and functionalities that make them exceedingly viable in decreasing interfacial pressure between oil and water, subsequently improving oil recuperation effectiveness. Microbial surfactants offer a few points of interest, including tall biocompatibility, warm solidness, and versatility to a wide extent of natural conditions. Furthermore, their generation forms frequently utilize renewable feedstocks and produce minimal natural effects, adjusting with maintainability objectives within the oil and gas industry. The common root, prevalent execution, and eco-friendly characteristics of microbial surfactants position them as promising and compelling innovations for optimizing oil recuperation forms in EOR applications.

Bio-Based Surfactant EOR Market Segmentation: By Method

-

Chemical EOR

-

Thermal EOR

-

Gas EOR

Among the strategies utilized in Upgraded Oil Recuperation (EOR) forms, chemical EOR rises as one of the foremost successful methods for optimizing oil recuperation rates. Chemical EOR includes the infusion of specialized chemicals into the supply to change liquid properties, decrease interfacial pressure, and move forward with clear effectiveness. This strategy is especially compelling in uprooting leftover oil caught in pore spaces, improving oil versatility, and expanding extreme oil recuperation. Chemical EOR strategies incorporate the infusion of surfactants, polymers, and soluble bases, among other chemicals, custom-made to the particular supply conditions and soil characteristics. Compared to warm and gas EOR strategies, chemical EOR offers more noteworthy adaptability and versatility to different store sorts and generation scenarios. Besides, chemical EOR can be actualized with existing foundations and operational hones, minimizing capital speculation and operational disturbances. Its demonstrated viability, flexibility, and compatibility with existing oilfield operations make chemical EOR a favored choice for oil and gas administrators looking to maximize oil recuperation and amplify the beneficial life of developed stores.

Bio-Based Surfactant EOR Market Segmentation: By End-Use Industry

-

Oil & Gas Industry

-

Chemical Industry

-

Others

Among the end-use businesses for surfactants, the oil and gas segment stands out as the foremost critical and powerful showcase portion. Surfactants play a pivotal part in different forms inside the oil and gas industry, including Upgraded Oil Recuperation (EOR), penetrating, generation, and refining. In EOR applications, surfactants are utilized to diminish interfacial pressure between oil and water, encouraging the mobilization and relocation of caught oil from store rocks and, in this way improving oil recuperation rates. Furthermore, surfactants discover broad utilization in boring liquids to move forward grease, diminish contact, and improve wellbore stability during boring operations. Within the generation and refining stages, surfactants are utilized in emulsification, demulsification, and erosion restraint forms, contributing to productive oil and gas extraction, preparation, and transportation. The oil and gas industry's noteworthy dependence on surfactants underscores their basic significance in ensuring operational proficiency, efficiency, and productivity over the whole esteem chain. As such, the oil and gas segment remains the primary driver of requests for surfactants, driving advancement, venture, and advertise development within the worldwide surfactants industry.

Bio-Based Surfactant EOR Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The showcase share by locale shows North America as the prevailing player, commanding 30% of the advertising. This is often taken after by Europe with a 25% share, and Asia-Pacific closely behind at 23%. South America holds a 12% share, whereas the Center East and Africa locale accounts for the remaining 10%. These measurements reflect the dissemination of the bio-based surfactant EOR showcase over distinctive topographical locales, with North America driving the pack, driven by headways in shale gas investigation and generation. Europe and Asia-Pacific moreover play critical parts, fueled by expanding natural controls and developing oil investigation exercises, separately. South America and the Center East and Africa districts speak to developing markets with potential development openings, driven by rising speculations in oil and gas framework and investigation ventures.

COVID-19 Impact Analysis on the Global Bio-Based Surfactant EOR Market:

The COVID-19 widespread has had a noteworthy effect on the worldwide bio-based surfactant Upgraded Oil Recuperation (EOR) showcase, disturbing supply chains, deferring ventures, and hosing speculation estimations. As nations actualized lockdown measures and travel confinements to contain the spread of the infection, oil requests dove, driving to a sharp decrease in oil costs and decreased investigation and generation exercises. Subsequently, numerous oil and gas companies scaled back their EOR ventures or conceded ventures, affecting the request for bio-based surfactants. Also, disturbances in fabricating operations and coordinations encourage exacerbated supply chain challenges, influencing the accessibility of crude materials and wrapped-up items. In any case, amid these challenges, the widespread underscored the significance of maintainability and natural stewardship, driving expanded intrigued in bio-based arrangements among industry partners. As economies continuously recuperate and oil requests bounce back, the bio-based surfactant EOR showcase is balanced for resurgence, backed by progressing endeavors to move towards greener hones and the basic to optimize oil recuperation proficiency within the post-pandemic time.

Latest Trends/ Developments:

Within the quickly advancing scene of the bio-based surfactant, Improved Oil Recuperation (EOR) advertise, a few essential patterns and advancements are shaping industry flow. Firstly, there's a developing accentuation on advancement and mechanical headways pointed at improving the execution and appropriateness of bio-based surfactants in differing EOR applications. Inquire about endeavors are centered on creating novel details, leveraging biotechnology, and investigating synergies with other EOR strategies to optimize oil recovery rates and minimize natural effects. Moreover, there's a rising slant towards vital collaborations and associations among key industry players, inquiries about teachers, and government organizations to drive advancement, quicken showcase infiltration, and address critical challenges confronting the bio-based surfactant EOR showcase. In addition, there's expanding acknowledgment of the significance of supportability and natural obligation, driving the appropriation of bio-based surfactants as a greener elective to ordinary chemicals in oil recuperation operations. Besides, the rise of specialty applications and markets, coupled with advancing administrative scenes and advertise flow, is fueling expansion and development openings for bio-based surfactant manufacturers, making an energetic and dynamic biological system balanced for development and improvement within the coming long time.

Key Players:

-

Solvay S.A.

-

Stepan Company

-

BASF SE

-

Clariant AG

-

Croda International Plc

-

The Dow Chemical Company

-

Akzo Nobel N.V.

-

Evonik Industries AG

-

Innospec Inc.

-

Nouryon

-

Huntsman Corporation

-

Sasol Limited

Chapter 1. Bio-Based Surfactant EOR Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bio-Based Surfactant EOR Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bio-Based Surfactant EOR Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bio-Based Surfactant EOR Market-Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bio-Based Surfactant EOR Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bio-Based Surfactant EOR Market– By Product Type

6.1 Introduction/Key Findings

6.2 Anionic Surfactants

6.3 Cationic Surfactants

6.4 Non-ionic Surfactants

6.5 Amphoteric Surfactants

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Bio-Based Surfactant EOR Market– By Technology

7.1 Introduction/Key Findings

7.2 Microbial Surfactants

7.3 Plant-based Surfactants

7.4 Synthetic Biology-based Surfactants

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Bio-Based Surfactant EOR Market– By Method

8.1 Introduction/Key Findings

8.2 Chemical EOR

8.3 Thermal EOR

8.4 Gas EOR

8.5 Y-O-Y Growth trend Analysis By Method

8.6 Absolute $ Opportunity Analysis By Method, 2024-2030

Chapter 9. Bio-Based Surfactant EOR Market– By End-Use Industry

9.1 Introduction/Key Findings

9.2 Oil & Gas Industry

9.3 Chemical Industry

9.4 Others

9.5 Y-O-Y Growth trend Analysis By End-Use Industry

9.6 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 10. Bio-Based Surfactant EOR Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.3 By Technology

10.1.4 By Method

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Technology

10.2.4 By Method

10.2.5 By End-Use Industry

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Technology

10.3.4 By Method

10.3.5 By End-Use Industry

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Technology

10.4.4 By Method

10.4.5 By End-Use Industry

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Technology

10.5.4 By Method

10.5.5 By End-Use Industry

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Bio-Based Surfactant EOR Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Solvay S.A.

11.2 Stepan Company

11.3 BASF SE

11.4 Clariant AG

11.5 Croda International Plc

11.6 The Dow Chemical Company

11.7 Akzo Nobel N.V.

11.8 Evonik Industries AG

11.9 Innospec Inc.

11.10 Nouryon

11.11 Huntsman Corporation

11.12 Sasol Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for global bio-based surfactant EOR market was estimated to be worth 50 USD million in 2023 and is expected to increase to 66.3 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 4.12% from 2024 to 2030.

The essential drivers of the worldwide bio-based surfactant EOR advertise are expanding natural concerns, rigid controls, and the requirement for economical oil recuperation arrangements.

The key challenges confronting the worldwide bio-based surfactant EOR advertise incorporate high generation costs, restricted versatility, and compatibility issues with existing EOR innovations.

In 2023, North America held the largest share of the global bio-based surfactant EOR market.

Solvay S.A., Stepan Company, BASF SE, Clariant AG, Croda International Plc, The Dow Chemical Company, Akzo Nobel N.V., Evonik Industries AG, Innospec Inc., Nouryon, Huntsman Corporation, Sasol Limited are the main players.