Bio-Based Hot Melt Adhesive Market Size (2024 – 2030)

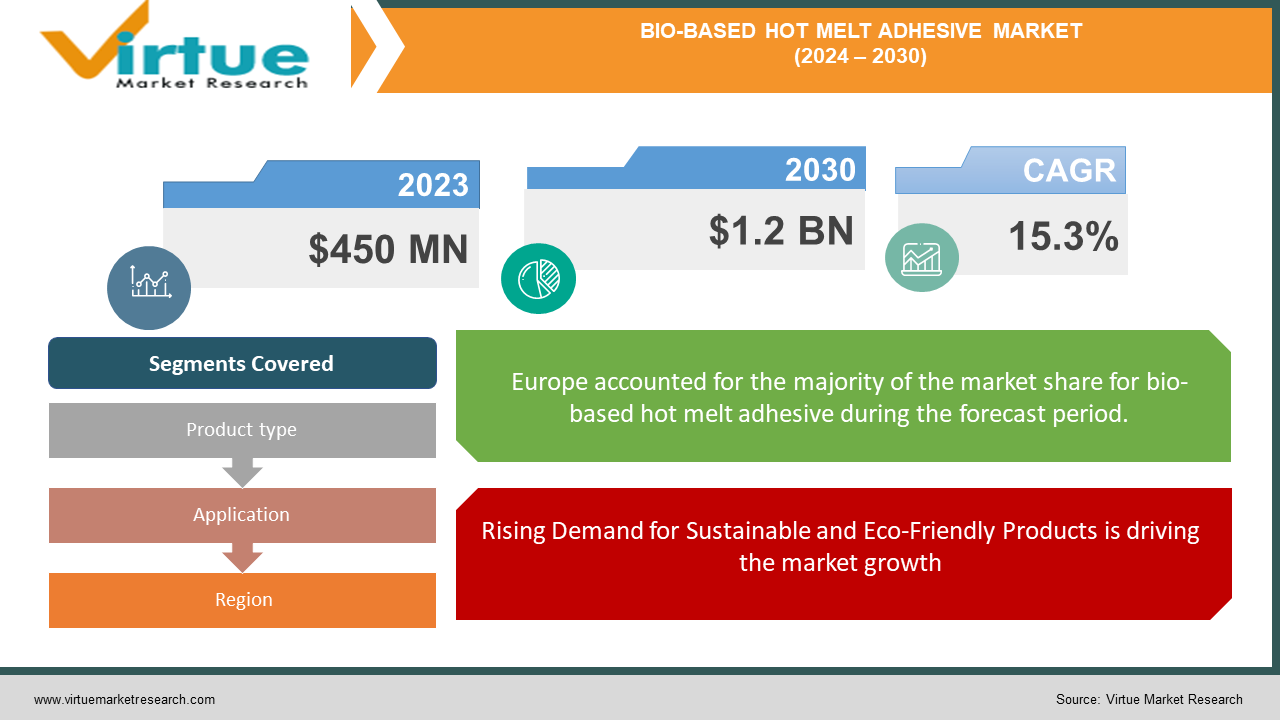

The global Bio-Based Hot Melt Adhesive Market was valued at approximately USD 450 million in 2023 and is projected to reach USD 1.2 billion by 2030, growing at a compound annual growth rate (CAGR) of 15.3% during the forecast period.

Bio-based hot melt adhesives are increasingly gaining traction due to their eco-friendly nature, derived from renewable resources. These adhesives are used across various industries, including packaging, woodworking, textiles, and healthcare, due to their excellent bonding capabilities and reduced environmental impact compared to traditional petroleum-based adhesives.

The market is driven by the increasing demand for sustainable and environmentally friendly products, stringent regulations on volatile organic compounds (VOCs), and the growing awareness among consumers and industries about the environmental impact of conventional adhesives. Additionally, advancements in bio-based polymer technologies are expanding the application scope of bio-based hot melt adhesives, further propelling market growth. As industries seek alternatives to reduce their carbon footprint, the adoption of bio-based hot melt adhesives is expected to rise significantly. The market is characterized by continuous innovation and research in the development of new formulations and applications, ensuring that bio-based adhesives meet the performance standards of traditional adhesives.

Key Market Insights

-

Packaging applications account for over 40% of the market share, driven by the demand for sustainable packaging solutions in the food and beverage, consumer goods, and e-commerce sectors.

-

The polyurethane (PU) segment dominates the market, contributing to 35% of the global revenue, due to its superior performance in bonding and flexibility.

-

Europe leads the market with a 38% share, attributed to strict environmental regulations and high adoption of sustainable materials across industries in the region.

-

The increasing integration of bio-based materials in adhesives is expected to enhance their properties, with projected advancements in adhesive performance by 25% by 2027.

Global Bio-Based Hot Melt Adhesive Market Drivers

Rising Demand for Sustainable and Eco-Friendly Products is driving the market growth

The growing awareness of environmental sustainability and the need to reduce carbon emissions are key drivers of the Bio-Based Hot Melt Adhesive Market. Consumers and industries are increasingly shifting towards eco-friendly products, and bio-based adhesives fit perfectly into this trend. Unlike conventional adhesives derived from fossil fuels, bio-based hot melt adhesives are produced from renewable resources such as vegetable oils and natural resins, significantly reducing their environmental impact.

The demand for sustainable packaging, in particular, is a major contributor to the growth of the bio-based hot melt adhesive market. Companies in the food and beverage, consumer goods, and e-commerce sectors are increasingly adopting bio-based adhesives to meet consumer preferences for environmentally responsible products. This trend is expected to continue, driving market expansion.

Stringent Regulations on VOC Emissions is driving the market growth

Governments and regulatory bodies worldwide are implementing stringent regulations to control the emission of volatile organic compounds (VOCs), which are harmful to both human health and the environment. Traditional hot melt adhesives often contain VOCs, leading to increased scrutiny and restrictions on their use. This regulatory environment is pushing industries to adopt bio-based alternatives that are low in VOC emissions.

The bio-based hot melt adhesive market is benefiting from these regulations, as bio-based adhesives typically have low or no VOC content, making them a safer and more compliant choice for manufacturers. The need to adhere to environmental regulations is expected to drive the adoption of bio-based hot melt adhesives across various industries.

Advancements in Bio-Based Polymer Technologies is driving the market growth

Technological advancements in bio-based polymers are enhancing the performance characteristics of bio-based hot melt adhesives. Innovations in formulation and processing are improving the adhesion properties, thermal stability, and durability of bio-based adhesives, making them competitive with traditional petroleum-based adhesives. The development of new bio-based raw materials and the refinement of production processes are expanding the application range of bio-based hot melt adhesives. These advancements are enabling bio-based adhesives to meet the demanding requirements of industries such as automotive, electronics, and healthcare, thereby driving market growth.

Global Bio-Based Hot Melt Adhesive Market Challenges and Restraints

High Cost of Bio-Based Raw Materials is restricting the market growth

One of the significant challenges facing the Bio-Based Hot Melt Adhesive Market is the high cost of bio-based raw materials compared to conventional petroleum-based materials. The production of bio-based adhesives involves sourcing renewable raw materials, which can be more expensive due to factors such as limited availability, agricultural production costs, and supply chain complexities. This cost disparity can affect the pricing of bio-based adhesives, making them less competitive in price-sensitive markets. Manufacturers need to balance the cost of raw materials with the need to offer affordable products, which can be challenging in regions with less demand for premium eco-friendly products.

Limited Awareness and Adoption in Emerging Markets is restricting the market growth

While the adoption of bio-based hot melt adhesives is growing in developed regions, there is still limited awareness and acceptance in emerging markets. Factors such as lack of awareness about the benefits of bio-based adhesives, cost sensitivity, and the availability of cheaper alternatives can hinder market penetration in these regions. Additionally, industries in emerging markets may prioritize cost and performance over environmental considerations, leading to slower adoption of bio-based adhesives. Overcoming this challenge requires targeted marketing, education, and demonstrating the long-term benefits of bio-based adhesives in terms of sustainability and regulatory compliance.

Market Opportunities

The Bio-Based Hot Melt Adhesive Market presents several opportunities for growth and innovation. The increasing consumer demand for eco-friendly products and the global shift towards sustainability offer significant market potential. Companies that invest in research and development to improve the performance and cost-effectiveness of bio-based adhesives can gain a competitive edge. There is also an opportunity to expand the application of bio-based hot melt adhesives into new industries and regions. As awareness of environmental issues grows and regulations tighten, industries such as automotive, electronics, and healthcare may increasingly adopt bio-based adhesives. Furthermore, emerging markets represent an untapped potential, where increased awareness and availability of bio-based adhesives could lead to substantial market growth.

BIO-BASED HOT MELT ADHESIVE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15.3% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Arkema S.A., Henkel AG & Co. KGaA, Jowat SE, Toyobo Co., Ltd., Avery Dennison Corporation, 3M Company, Beardow Adams Ltd., Evans Adhesive Corporation, Ltd., Paramelt BV, LioChem, Inc. |

Bio-Based Hot Melt Adhesive Market Segmentation - By Product Type

-

Ethylene Vinyl Acetate (EVA)

-

Polyurethane (PU)

-

Polyamide (PA)

-

Others

The polyurethane (PU) segment is the dominant product type in the Bio-Based Hot Melt Adhesive Market, contributing to 35% of the global revenue. PU-based adhesives are preferred for their superior bonding capabilities, flexibility, and resistance to various environmental factors. They are widely used in industries such as automotive, electronics, and healthcare, where high performance is essential.

Bio-Based Hot Melt Adhesive Market Segmentation - By Application

-

Packaging

-

Woodworking

-

Textiles

-

Healthcare

-

Others

The packaging application segment is the dominant segment in the market, accounting for over 40% of the market share. The demand for sustainable packaging solutions, particularly in the food and beverage, consumer goods, and e-commerce sectors, drives the significant usage of bio-based hot melt adhesives. These adhesives offer strong bonding properties, are easy to apply, and reduce environmental impact, making them ideal for packaging applications.

Bio-Based Hot Melt Adhesive Market Segmentation - Regional Segmentation

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Europe is the dominant region in the Bio-Based Hot Melt Adhesive Market, contributing to 38% of global revenue. The region's dominance is attributed to the stringent environmental regulations, high consumer awareness, and widespread adoption of sustainable materials across various industries. Countries such as Germany, France, and the UK are leading in the use of bio-based adhesives, driven by strong regulatory frameworks and a commitment to reducing carbon emissions.

COVID-19 Impact Analysis on the Bio-Based Hot Melt Adhesive Market

The COVID-19 pandemic has had a mixed impact on the Bio-Based Hot Melt Adhesive Market. On one hand, disruptions in supply chains and manufacturing activities led to a temporary decline in demand for adhesives across various industries. Lockdowns and restrictions impacted the production and distribution of goods, affecting the packaging, automotive, and construction sectors, which are major consumers of adhesives. On the other hand, the pandemic also accelerated the trend towards sustainability and eco-friendly products, as consumers and industries became more conscious of environmental and health impacts. The increased demand for sustainable packaging in the food and e-commerce sectors during the pandemic supported the growth of the bio-based hot melt adhesive market. As economies recover and industries resume operations, the market is expected to regain momentum, with a stronger focus on sustainability driving future growth.

Latest Trends/Developments

Several trends are shaping the Bio-Based Hot Melt Adhesive Market. The integration of advanced bio-based materials is enhancing the performance and application range of adhesives, making them suitable for more demanding industrial applications. Innovations in bio-based polymer technology are leading to the development of new adhesive formulations with improved bonding strength, thermal stability, and environmental resistance. There is also a growing trend towards the use of bio-based adhesives in the automotive and electronics industries, where the demand for lightweight, durable, and eco-friendly materials is rising. Additionally, the packaging industry continues to be a major driver of the market, with increasing demand for sustainable packaging solutions. The focus on reducing carbon footprints and adhering to environmental regulations is expected to drive further adoption of bio-based hot melt adhesives in the coming years.

Key Players

-

Arkema S.A.

-

Henkel AG & Co. KGaA

-

Jowat SE

-

Toyobo Co., Ltd.

-

Avery Dennison Corporation

-

3M Company

-

Beardow Adams Ltd.

-

Evans Adhesive Corporation, Ltd.

-

Paramelt BV

-

LioChem, Inc.

Chapter 1. Bio-Based Hot Melt Adhesive Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bio-Based Hot Melt Adhesive Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bio-Based Hot Melt Adhesive Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bio-Based Hot Melt Adhesive Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bio-Based Hot Melt Adhesive Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bio-Based Hot Melt Adhesive Market – By Product Type

6.1 Introduction/Key Findings

6.2 Ethylene Vinyl Acetate (EVA)

6.3 Polyurethane (PU)

6.4 Polyamide (PA)

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Bio-Based Hot Melt Adhesive Market – By Application

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Woodworking

7.4 Textiles

7.5 Healthcare

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Bio-Based Hot Melt Adhesive Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Bio-Based Hot Melt Adhesive Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Arkema S.A.

9.2 Henkel AG & Co. KGaA

9.3 Jowat SE

9.4 Toyobo Co., Ltd.

9.5 Avery Dennison Corporation

9.6 3M Company

9.7 Beardow Adams Ltd.

9.8 Evans Adhesive Corporation, Ltd.

9.9 Paramelt BV

9.10 LioChem, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global Bio-Based Hot Melt Adhesive Market was valued at approximately USD 450 million in 2023 and is projected to reach USD 1.2 billion by 2030, growing at a compound annual growth rate (CAGR) of 15.3% during the forecast period.

Key drivers include rising demand for sustainable products, stringent VOC regulations, and advancements in bio-based polymer technologies.

The market is segmented by product type into Ethylene Vinyl Acetate (EVA), Polyurethane (PU), Polyamide (PA), and Others; and by application into Packaging, Woodworking, Textiles, Healthcare, and Others.

Europe is the most dominant region, contributing to 38% of global revenue, driven by strict environmental regulations and high adoption of sustainable materials.

Leading players include Arkema S.A., Henkel AG & Co. KGaA, Jowat SE, Toyobo Co., Ltd., Avery Dennison Corporation, 3M Company, Beardow Adams Ltd., Evans Adhesive Corporation, Ltd., Paramelt BV, and LioChem, Inc.