Bio-based Epoxy Resin Market Size (2025-2030)

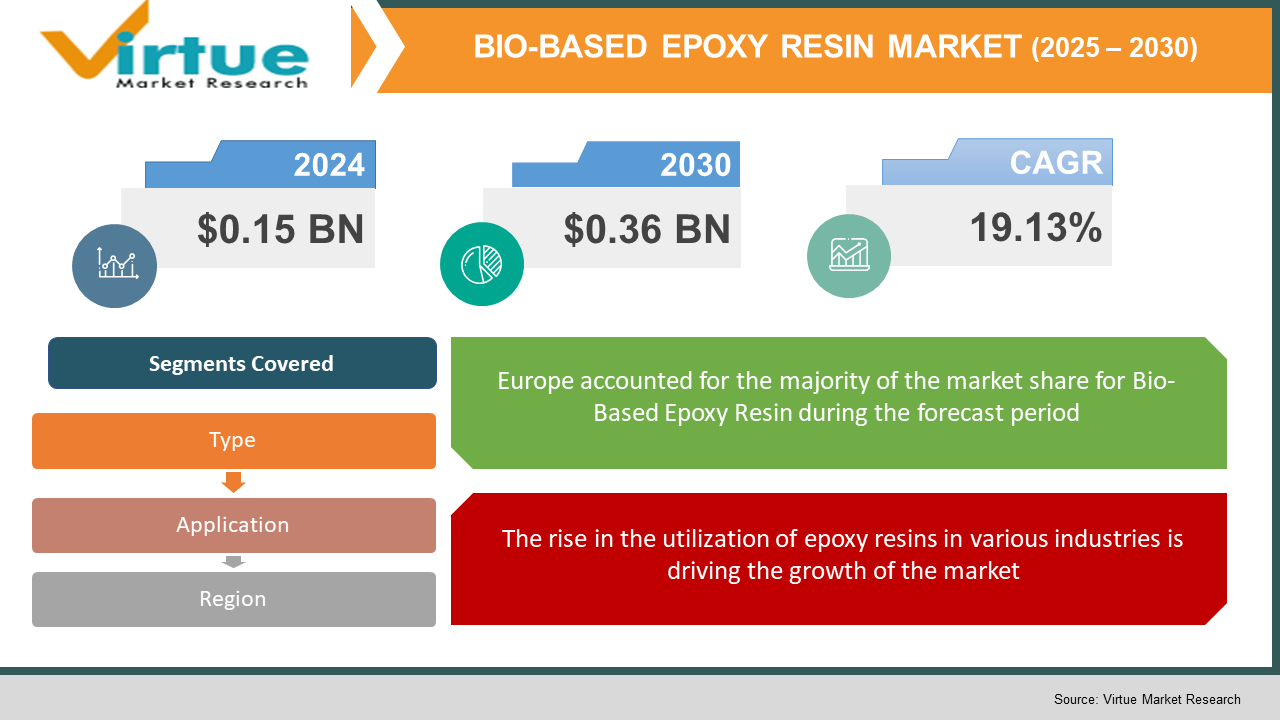

The Global Bio-based Epoxy Resin Market was valued at USD 0.15 billion in 2024 and is projected to reach USD 0.36 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 19.13%.

Epoxy resins are a class of super-advanced thermosetting resins comprising a wide array of crosslinking polymers, unsaturated polyester resins, phenol-formaldehyde resins, and amino resins. Bio-based epoxy resins are produced from plant-based carbon in the context of petroleum-based carbon. A curing agent is a chemical that takes part in the cross-reaction of oligomers and monomers to carry out polymerization reactions to yield the final product in the form of resins. Curing agents depend on the two vital parameters of viscosity and glass transition temperature (Tg). With the help of binders and catalyst agents, curing sellers form 3D structures. Bio-based epoxy resins use environmentally friendly green chemistry techniques, which are much lower in power consumption and have fewer toxic bi-products, hence decreasing the greenhouse fuel emission during resin manufacturing by 50%. Tough epoxy resins are used for the production of adhesives, coatings, sealants, composites, and ground products, which are extensive materials within the construction and building sector. Epoxy resin-based adhesives find application in the introduction of laminated woods for roofs, walls, decks, and various construction purposes. Increasing use and demand prices boost the boom rate of the market.

Key Market Insights:

Europe led the natural (bio-based) resin market, holding a market share of 45.94% in 2022, indicating a strong regional demand for sustainable resin solutions. The coatings segment emerged as the largest application area in 2022, valued at approximately USD 40.4 million, and is expected to reach USD 62.1 million by 2031.

Recent developments include the synthesis of bio-based epoxy resins from renewable resources such as plant oils, saccharides, lignin, and polyphenols. These innovations enhance the environmental profile of epoxy resins while maintaining performance standards.

Plant oils, particularly soybean oil, are the primary raw materials used in bio-based epoxy resin production, owing to their wide availability and cost-effectiveness. Liquid and solution forms of bio-based epoxy resins dominate the market due to their versatility and ease of application across various industries.

Global Bio-based Epoxy Resin Market Drivers:

The rise in the utilization of epoxy resins in various industries is driving the growth of the market.

Bio-based epoxy resin is being used in the construction & development industry. Bio epoxy resin as a coating protects the floor of many objects against wear, corrosion, and other environmental conditions. It can also be employed for improving the appearance or functionality of an object. Bio epoxy is employed in adhesives as it acts as a curing agent. It provides the adhesive substance with more bonding and further water protection. Bio-based epoxies are said to be a more environmentally friendly option compared to petroleum-based ones, making them the best choice for favorable activities like boat building and insulation. Bio-based epoxy resins offer more benefits compared to resins that are derived from fossil fuels, thanks to their lower VOC emissions, lack of an unpleasant odor, and lower fossil fuel reliance in processing the resin.

Strong government regulations are driving the growth of the market.

Resilient authorities act worldwide to include carbon emissions and positive vibes nearer the environmental issues, surfacing on market demand for bio-based epoxy resins throughout end-use sectors. The environmental-friendliness, biodegradability, and minimal manufacturing fee enable manufacturers to focus on renewable sources like raw material, comprising starch and other plant oils.

Global Bio-based Epoxy Resin Market Restraints and Challenges:

The high risk of respiratory diseases is restraining the growth of the market.

The elevated risk of respiratory diseases presents a huge challenge to market expansion, as expanding health issues and regulatory limitations confine the usage of specific products and strategies. Long-term exposure to toxic airborne particles, chemicals, or contaminants has been associated with respiratory conditions, including asthma, chronic bronchitis, and lung infections, providing reasons for concern among consumers and industry participants. Consequently, strict safety rules and workplace health regulations are being implemented, forcing companies to invest in alternative options or innovative protective measures. Not only does this raise operational costs but also delays market growth, as firms need to go through compliance issues while dealing with health hazards linked to their products or services.

Global Bio-based Epoxy Resin Market Opportunities:

The worldwide bio-based epoxy resin market offers tremendous opportunities for growth due to the rising demand for environment-friendly and sustainable products versus traditional petroleum-based resins. Rising environmental issues, regulation on carbon emissions by governments, and the drive for green materials used in construction, automotive, and electronic industries are driving the market growth. Bio-based feedstock advancements, including plant oils and lignin, are improving resin performance, making them suitable for high-performance applications. Furthermore, increasing consumer awareness and corporate sustainability initiatives are prompting the acceptance of bio-based epoxy resins. Research and development investments aimed at product durability, heat resistance, and cost savings will continue to propel market penetration. Growing economies in Asia-Pacific and Latin America present promising growth opportunities with rising industrialization and sustainable infrastructure development. As businesses prioritize circular economy strategies, bio-based epoxy resins are poised to become increasingly popular as a major feature in conserving the environment and pushing green manufacturing.

BIO-BASED EPOXY RESIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

19.13% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Pond ApS, Kukdo Chemical, Bitrez Ltd, Sicomin Epoxy Systems, Huntsman Corporation, Entropy Resins and ALPAS |

Global Bio-based Epoxy Resin Market Segmentation:

Bio-based Epoxy Resin Market Segmentation: By Type

- Vegetable Oil-based

- Soybean Oil-based

- Cardanol-based

- Furan-based

- Lignin-based

- Others

By type, the soybean oil-based segment led the global bio-based epoxy resin market in 2021. This is particularly attributed to an intensification in demand for soybean oil-based epoxy resin in composites, laminates, adhesives, and various other uses. The soybean oil-based epoxy resin segment was traditionally one of the largest consumed compounds for the manufacturing of bio-based epoxy resin. Its production cost is extremely low compared to other epoxy resins. Soybean oil-based resin is extensively utilized in many industries like adhesives & sealants, food & beverages, and fitness care & pharmaceuticals. Furan-based epoxy resin type of bio-based epoxy resin is utilized in limited applications. Thus, the Furan-based epoxy resin segment is likely to grow at a steady pace during the forecast period.

Bio-based Epoxy Resin Market Segmentation: By Application

- Paints & Coatings

- Adhesives

- Composites

- Laminates

- Others

According to the Application, in housing structures, bio-based epoxy resins are used as paint & coating, adhesives, and composites. Bio-based epoxy resin is widely used as a principal binder in paints and coatings due to its excessive adhesion. It can be applied on wood surfaces to form a protective seal that avoids moisture damage. Furthermore, bio-based epoxy coatings are consistently decorative and may add color and texture to a surface. Bio-based epoxy resin is a versatile fabric with the highest bodily and electrical properties, for example, stability, the highest chemical resistance, no foul odor, low VOC and odor, excessive durability, UV resistance heat resistance, and non-toxic. The adhesive phase is likely to grow at a consistent rate during the forecast period.

Bio-based Epoxy Resin Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The regional division of the world bio-based epoxy resin market in 2024 showcases Europe's dominance based on robust sustainability programs and a high demand for sustainable products. North America also closely trails, with growing penetration across industries like the automotive, electronics, and construction industries, where policy regulations promote green alternatives. The Asia-Pacific region is undergoing fast expansion as a result of increasing industrialization and infrastructure development, especially in China, India, and Japan. South America is also seeing steady growth based on the rise of environmental policies and increased interest in sustainable materials. The Middle East and Africa are slowly embracing bio-based epoxy resins, mostly in specialty applications, as awareness and investments in sustainable solutions increase.

COVID-19 Impact Analysis on the Global Bio-Based Epoxy Resin Market:

International supply chains are due for a grand revamp, with the COVID-19 pandemic laying bare the vulnerability of nations and firms that are important and close to a limited set of trading partners. Thus, companies in the bio-based epoxy resin industry are establishing an equitable relationship with suppliers and ecosystem partners to capture value-grab opportunities in sectors such as customer goods, transport, and electronics, among others. Aggressive capability ramps are emerging as dominant in the China bio-based epoxy resin market. The bio-based epoxy resin market is set for healthy growth in the coming months as market stakeholders shift to a new post-pandemic normal. The global Bio-based Epoxy Resins market, just like most other industries, has been forced to overcome several barriers introduced by the emergence of COVID-19. Not only have there been unprecedented disruptions concerning the different grant chains of the Bio-based Epoxy resin market, but this pandemic has also caused several corporations to close or operate at sub-par operating capacities, leading to incalculable losses, both economically and in terms of a decreasing workforce. This continued for some time, as long as strict precautionary measures were placed on the movement of individuals and objects by respective governments to limit such contagion.

Latest Trends/ Developments:

The global bio-based epoxy resin market is witnessing several significant trends and developments due to growing sustainability efforts as well as improvements in material science. One of the significant trends is the increasing use of bio-based feedstocks, like plant oils, lignin, and cellulose, to improve the performance of resins while lowering carbon footprints. Advances in polymer chemistry are driving better thermal and mechanical attributes, and so bio-based epoxy resins become ideal for advanced performance applications within automotive, aerospace, and electronic industries. Supporting regulatory policies along with government policies encouraging green products are also further fueling growth in the market. Firms are investing in research and development to provide better biodegradability, recyclability, and manufacturing efficiencies. Strategic associations among industry entities and academic units are also inducing innovation. With the growing need for eco-friendly alternatives, cost-cutting and scalability are also becoming the focus areas for manufacturers to match petroleum-based resins in competing across industries.

Key Players:

- Pond ApS

- Kukdo Chemical

- Bitrez Ltd

- Sicomin Epoxy Systems

- Huntsman Corporation

- Entropy Resins

- ALPAS

- Chang Chun Group

- Nagase ChemteX Corporation

- Change Climate

Chapter 1. BIO-BASED EPOXY RESIN MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. BIO-BASED EPOXY RESIN MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. BIO-BASED EPOXY RESIN MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. BIO-BASED EPOXY RESIN MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. BIO-BASED EPOXY RESIN MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. BIO-BASED EPOXY RESIN MARKET – By Type

6.1 Introduction/Key Findings

6.2 Vegetable Oil-based

6.3 Soybean Oil-based

6.4 Cardanol-based

6.5 Furan-based

6.6 Lignin-based

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. BIO-BASED EPOXY RESIN MARKET – By Application

7.1 Introduction/Key Findings

7.2 Paints & Coatings

7.3 Adhesives

7.4 Composites

7.5 Laminates

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. BIO-BASED EPOXY RESIN MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. BIO-BASED EPOXY RESIN MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Pond ApS

9.2 Kukdo Chemical

9.3 Bitrez Ltd

9.4 Sicomin Epoxy Systems

9.5 Huntsman Corporation

9.6 Entropy Resins

9.7 ALPAS

9.8 Chang Chun Group

9.9 Nagase ChemteX Corporation

9.10 Change Climate

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Bio-based Epoxy Resin Market was valued at USD 0.15 billion in 2024 and is projected to reach a market size of USD 0.36 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 19.13%.

The global bio-based epoxy resin market is driven by increasing environmental regulations promoting sustainable materials and rising demand across industries like automotive, construction, and electronics. Additionally, advancements in bio-based raw materials and growing consumer preference for eco-friendly products further boost market growth.

Based on the Service Provider, the Global Bio-based Epoxy Resin Market is segmented into material manufacturers, Raw Material Suppliers, Distributors & Wholesalers, and End-to-End Solution Providers

Europe is the most dominant region for the Global Bio-based Epoxy Resin Market.

Pond ApS, Kukdo Chemical, Bitrez Ltd, Sicomin Epoxy Systems, Huntsman Corporation, Entropy Resins and ALPAS are the key players in the Global Bio-based Epoxy Resin Market.