Bio-Based Crop Protection Chemicals Market Size (2024 – 2030)

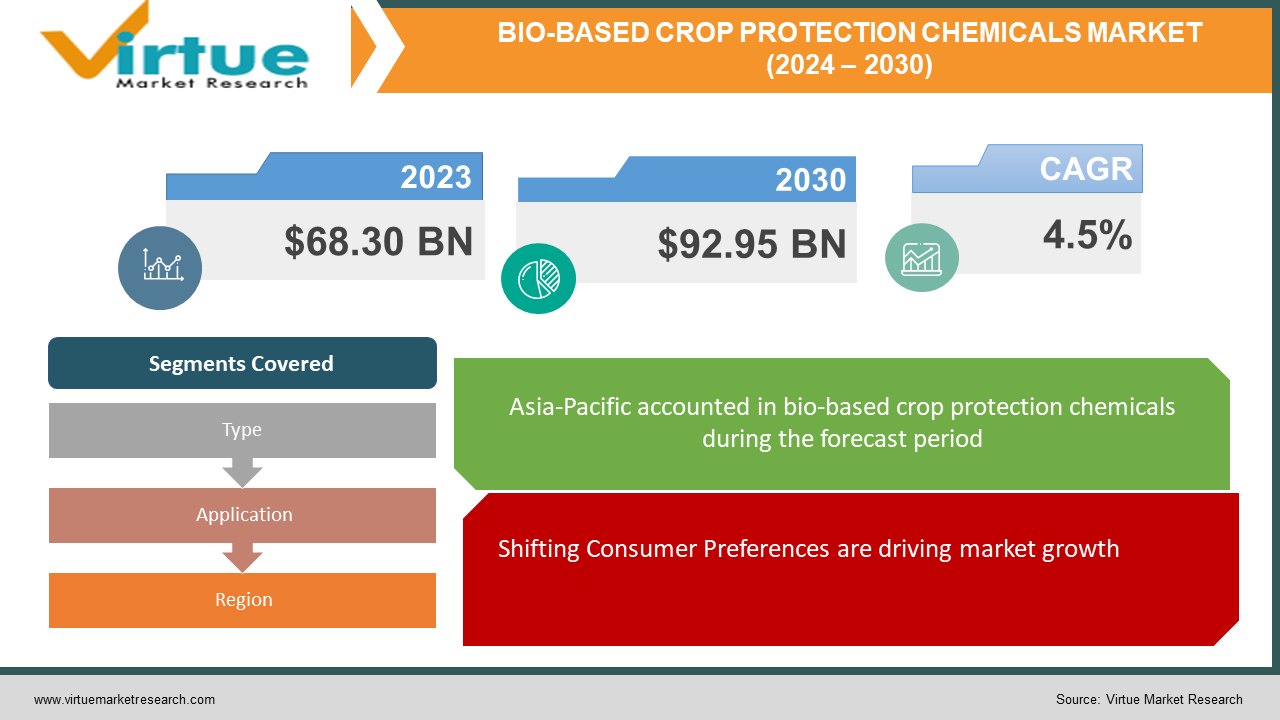

The Global Bio-Based Crop Protection Chemicals Market was valued at USD 68.30 billion in 2023 and will grow at a CAGR of 4.5% from 2024 to 2030. The market is expected to reach USD 92.95 billion by 2030.

The Bio-Based Crop Protection Chemicals Market caters to farmers seeking a safer and more eco-friendly alternative to synthetic pesticides. These naturally derived solutions, like bio-insecticides and bio-fungicides, are gaining traction due to rising organic food demand, environmental concerns, and stricter regulations on synthetic chemicals. Though still a niche compared to synthetics, this market is expected to grow significantly as research improves the effectiveness of bio-pesticides and brings down their cost.

Key Market Insights:

Consumers are increasingly seeking organic produce, driving the need for natural pest control solutions. Bio-based chemicals fit the bill perfectly.Synthetic pesticides raise worries about environmental damage and potential health risks. Bio-based options offer a perceived safer alternative.Stricter regulations on synthetic chemicals in some regions are pushing farmers towards bio-based options.Though bio-based crop protection chemicals are a niche right now, with continued research, rising consumer demand, and supportive regulations, this market segment is poised for significant growth in the global crop protection industry.

Global Bio-Based Crop Protection Chemicals Market Drivers:

Shifting Consumer Preferences are driving market growth:

The surge in organic food consumption is a key driver propelling the bio-based crop protection chemicals market. As health-conscious consumers prioritize food free from synthetic pesticides, bio-based solutions rise to the occasion. These natural alternatives, derived from plant or animal sources, perfectly align with the organic philosophy. Bio-based pesticides offer a sense of security to consumers concerned about potential health risks from synthetic residues on their food. Additionally, the perceived environmental benefits of bio-based options resonate with eco-conscious consumers, as these chemicals often have lower toxicity levels and degrade more readily in the environment compared to their synthetic counterparts. This growing consumer demand for safe, sustainable food production methods creates a fertile ground for the bio-based crop protection chemicals market to flourish.

Environmental Concerns are driving market growth:

The surge in organic food consumption is a key driver propelling the bio-based crop protection chemicals market. As health-conscious consumers prioritize food free from synthetic pesticides, bio-based solutions rise to the occasion. These natural alternatives, derived from plant or animal sources, perfectly align with the organic philosophy. Bio-based pesticides offer a sense of security to consumers concerned about potential health risks from synthetic residues on their food. Additionally, the perceived environmental benefits of bio-based options resonate with eco-conscious consumers, as these chemicals often have lower toxicity levels and degrade more readily in the environment compared to their synthetic counterparts. This growing consumer demand for safe, sustainable food production methods creates a fertile ground for the bio-based crop protection chemicals market to flourish.

Regulatory Landscape is driving market growth:

The regulatory landscape is tightening around synthetic pesticides, acting as a significant accelerant for the bio-based crop protection chemicals market. Governments, increasingly focused on sustainable agricultural practices, are enacting stricter regulations on the use of synthetic chemicals. These regulations aim to minimize environmental damage and potential health risks associated with synthetic pesticides. This changing regulatory landscape presents a challenge for farmers who must adapt their practices to comply. Bio-based alternatives emerge as a viable solution in this scenario. As they are derived from natural sources and often boast lower toxicity levels, bio-based pesticides are viewed more favorably by regulatory bodies. By adopting these alternatives, farmers can ensure their practices align with evolving regulations and avoid potential penalties. This regulatory push, coupled with government incentives for sustainable farming methods, is creating a strong impetus for farmers to transition towards bio-based crop protection solutions, shaping the future of the market.

Global Bio-Based Crop Protection Chemicals Market challenges and restraints:

Efficacy Concerns are a significant hurdle for Bio-Based Crop Protection Chemicals:

Efficacy remains a major hurdle for bio-based pesticides. While the environmental and health benefits are attractive, farmers prioritize protecting their crops and livelihoods. Bio-based options may not always offer the same level of pest control as synthetic chemicals, particularly against stubborn or highly destructive insects. This can lead to crop damage and economic losses, discouraging widespread adoption. However, the bio-based market is actively addressing this challenge. Research and development are focused on enhancing the potency of bio-pesticides through various means, like exploring new natural sources with stronger pest-control properties or improving the delivery methods to maximize effectiveness. As these advancements progress, bio-based solutions will be able to compete more effectively with synthetics in terms of pest control, making them a more viable choice for farmers who prioritize both crop yield and environmental responsibility.

Higher Costs is throwing a curveball at the Bio-Based Crop Protection Chemicals market:

The cost factor is a significant roadblock for bio-based pesticides. Currently, their price tag often outweighs that of synthetic alternatives. This is a major hurdle, especially for cost-conscious farmers in developing economies where profit margins are tight. The higher cost can be attributed to several factors, including the relatively new and evolving nature of bio-pesticides, leading to smaller production volumes. This limits economies of scale, which typically bring down production costs. Additionally, research and development for bio-based solutions is ongoing, and these initial investments are reflected in the price. However, there's optimism for the future. As the bio-based market matures, production scales up, and technological advancements occur, the cost of bio-pesticides is expected to decrease. Furthermore, with growing consumer demand for organic produce, there's a potential for increased market share and profitability for bio-based solutions. This, in turn, could incentivize further investment and innovation, ultimately leading to a more cost-competitive bio-pesticide market that is accessible to a wider range of farmers.

Limited Spectrum is a growing nightmare for the Bio-Based Crop Protection Chemicals market:

The spectrum of pests controlled by bio-based pesticides presents another challenge for farmers. Unlike their synthetic counterparts, bio-based options often target a narrower range of pests. This specificity, while positive for the environment, can complicate farm management. Broad-spectrum synthetic pesticides can tackle a variety of insects with a single application. Bio-based alternatives might require using multiple products or combining them with other pest control methods, like introducing beneficial insects or crop rotation techniques. This can significantly increase the complexity of a farmer's workflow, requiring more time, effort, and potentially additional training to ensure effective pest control. However, ongoing research is exploring ways to broaden the spectrum of bio-based pesticides. Additionally, advancements in integrated pest management (IPM) strategies can help farmers effectively combine bio-based solutions with other methods to achieve comprehensive pest control without sacrificing efficiency. As both bio-based technology and IPM practices evolve, this challenge has the potential to be mitigated, making bio-based options a more practical choice for farmers.

Market Opportunities:

The bio-based crop protection chemicals market is brimming with exciting opportunities driven by a confluence of consumer trends, environmental concerns, and regulatory shifts. The surging demand for organic food acts as a springboard, as health-conscious consumers seek produce free from synthetic pesticides. Bio-based alternatives, derived from natural sources, perfectly align with this philosophy, offering a safer and more sustainable solution. Furthermore, growing environmental awareness is pushing the industry towards bio-based options. Synthetic pesticides have been linked to water and soil contamination, disrupting ecosystems and potentially harming human health. Bio-based solutions, with their lower toxicity profiles and faster degradation rates, offer a path towards a more environmentally friendly future for agriculture. Regulatory tailwinds are another key driver. Governments worldwide are enacting stricter regulations on synthetic pesticides to minimize environmental damage and potential health risks. This presents a significant opportunity for bio-based alternatives, which are often viewed more favorably by regulatory bodies. By adopting bio-based solutions, farmers can ensure compliance with evolving regulations and maintain sustainable practices. Innovation is another engine of growth. Research and development are continuously improving the efficacy of bio-based pesticides, making them more competitive with synthetics against a wider range of pests. Additionally, advancements are being made to bring down production costs through economies of scale, making bio-based options more accessible to farmers, particularly in developing economies. With its alignment with consumer preferences, environmental consciousness, and regulatory frameworks, this market segment offers a win-win scenario for farmers, consumers, and the environment.

BIO-BASED CROP PROTECTION CHEMICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE (Germany), Bayer Crop Science AG (Germany), Syngenta International AG (Switzerland), Corteva AgriScience (U.S.), UPL Limited (India), FMC Corporation (U.S.), Novozymes A/S (Denmark), Sumitomo Chemical Co., Ltd. (Japan), Bioworks Inc. (U.S.), Verdesian Life Sciences (U.S.) |

Bio-Based Crop Protection Chemicals Market Segmentation - By Type

-

Biofungicides

-

Bioherbicides

Currently, bio fungicides are expected to be a more prominent sector in the Bio-Based Crop Protection Chemicals Market compared to bioherbicides. This is because fungal diseases pose a significant threat to a wide range of crops, and effective bio-based solutions are readily available. Additionally, consumer awareness about the benefits of organic food production often focuses on reducing fungal contaminants. While bioherbicides are a promising segment, research and development for a broader spectrum of weed control using natural solutions is still ongoing.

Bio-Based Crop Protection Chemicals Market Segmentation - By Application

-

Cereals and Grains

-

Fruits and Vegetables

Cereals and Grains reign supreme in the bio-based crop protection market due to vast acreage – think wheat, rice, and corn – requiring significant pest control. Protecting these staple crops, crucial for global food security, makes bio-based options a highly attractive sustainable alternative to synthetic pesticides. While Fruits and Vegetables are a growing segment fueled by organic food demand, their smaller land footprint keeps them behind for now. However, advancements in bio-based solutions have the potential to shift the balance in the future.

Bio-Based Crop Protection Chemicals Market Segmentation - Regional Analysis

-

Asia - Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific currently holds the crown in the Bio-Based Crop Protection Chemicals Market. This dominance stems from a powerful combination of factors: a massive agricultural sector heavily reliant on staple crops like rice, a surging demand for organic food in densely populated countries, and increasing government support for sustainable farming practices. While North America and Europe boast strong regulations and technological advancements in bio-pesticides, Asia's sheer scale and focus on organic food position it as the frontrunner in this evolving market.

COVID-19 Impact Analysis on the Global Bio-Based Crop Protection Chemicals Market

The COVID-19 pandemic's impact on the bio-based crop protection chemicals market was a mixed bag. Initial disruptions in global supply chains and movement restrictions hampered the production and distribution of bio-based pesticides. However, the pandemic also triggered some positive changes. Increased focus on food security and heightened consumer awareness of health and hygiene led to a surge in demand for organic food. This, in turn, bolstered the demand for bio-based pest control solutions as a safer alternative to synthetics. Additionally, government support for sustainable agriculture practices during the pandemic might have indirectly benefitted the bio-based market. Looking ahead, the long-term impact of COVID-19 on the bio-based crop protection chemicals market is expected to be positive. As consumer preferences for organic food and environmentally friendly practices solidify, the demand for bio-based solutions is anticipated to rise, propelling the growth of this market segment in the coming years.

Latest trends/Developments

The bio-based crop protection chemicals market is buzzing with exciting developments. Innovation is a key driver, with research focused on enhancing the efficacy of biopesticides. This includes exploring new natural sources with potent pest-control properties and improving delivery methods for maximum impact. Additionally, advancements in bio-engineering are leading to the creation of novel bio-pesticides with broader target spectrums, making them more competitive with synthetics. To address cost concerns, the industry is looking towards economies of scale as production volumes increase. This, coupled with technological refinements, has the potential to bring down the price of bio-based options, making them more accessible to farmers, particularly in developing economies. Furthermore, the rise of integrated pest management (IPM) strategies presents a synergistic opportunity. Combining bio-based solutions with beneficial insects, crop rotation techniques, and other methods allows for comprehensive pest control while minimizing environmental impact. Regulatory tailwinds are another trend to watch. Stricter limitations on synthetic pesticides are pushing farmers towards bio-based alternatives, which are often viewed more favorably by regulatory bodies. As consumer demand for organic food and sustainable agricultural practices continues to rise, the bio-based crop protection chemicals market is poised for significant growth in the coming years.

Key Players:

-

BASF SE (Germany)

-

Bayer Crop Science AG (Germany)

-

Syngenta International AG (Switzerland)

-

Corteva AgriScience (U.S.)

-

UPL Limited (India)

-

FMC Corporation (U.S.)

-

Novozymes A/S (Denmark)

-

Sumitomo Chemical Co., Ltd. (Japan)

-

Bioworks Inc. (U.S.)

-

Verdesian Life Sciences (U.S.)

Chapter 1. Bio-Based Crop Protection Chemicals Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bio-Based Crop Protection Chemicals Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bio-Based Crop Protection Chemicals Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bio-Based Crop Protection Chemicals Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bio-Based Crop Protection Chemicals Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bio-Based Crop Protection Chemicals Market – By Type

6.1 Introduction/Key Findings

6.2 Biofungicides

6.3 Bioherbicides

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Bio-Based Crop Protection Chemicals Market – By Application

7.1 Introduction/Key Findings

7.2 Cereals and Grains

7.3 Fruits and Vegetables

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Bio-Based Crop Protection Chemicals Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Bio-Based Crop Protection Chemicals Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE (Germany)

9.2 Bayer Crop Science AG (Germany)

9.3 Syngenta International AG (Switzerland)

9.4 Corteva AgriScience (U.S.)

9.5 UPL Limited (India)

9.6 FMC Corporation (U.S.)

9.7 Novozymes A/S (Denmark)

9.8 Sumitomo Chemical Co., Ltd. (Japan)

9.9 Bioworks Inc. (U.S.)

9.10 Verdesian Life Sciences (U.S.)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bio-Based Crop Protection Chemicals Market was valued at USD 68.30 billion in 2023 and will grow at a CAGR of 4.5% from 2024 to 2030. The market is expected to reach USD 92.95 billion by 2030.

Shifting Consumer Preferences, Environmental Concerns, and Regulatory Landscapes These are the reasons that are driving the market.

Based on Application it is divided into two segments – Cereals and Grains, Fruits and Vegetables.

Asia is the most dominant region for the luxury vehicle Market.

BASF SE (Germany), Bayer Crop Science AG (Germany), Syngenta International AG (Switzerland), Corteva AgriScience (U.S.), UPL Limited (India).