Bio‑Based Coating Market Size (2025-2030)

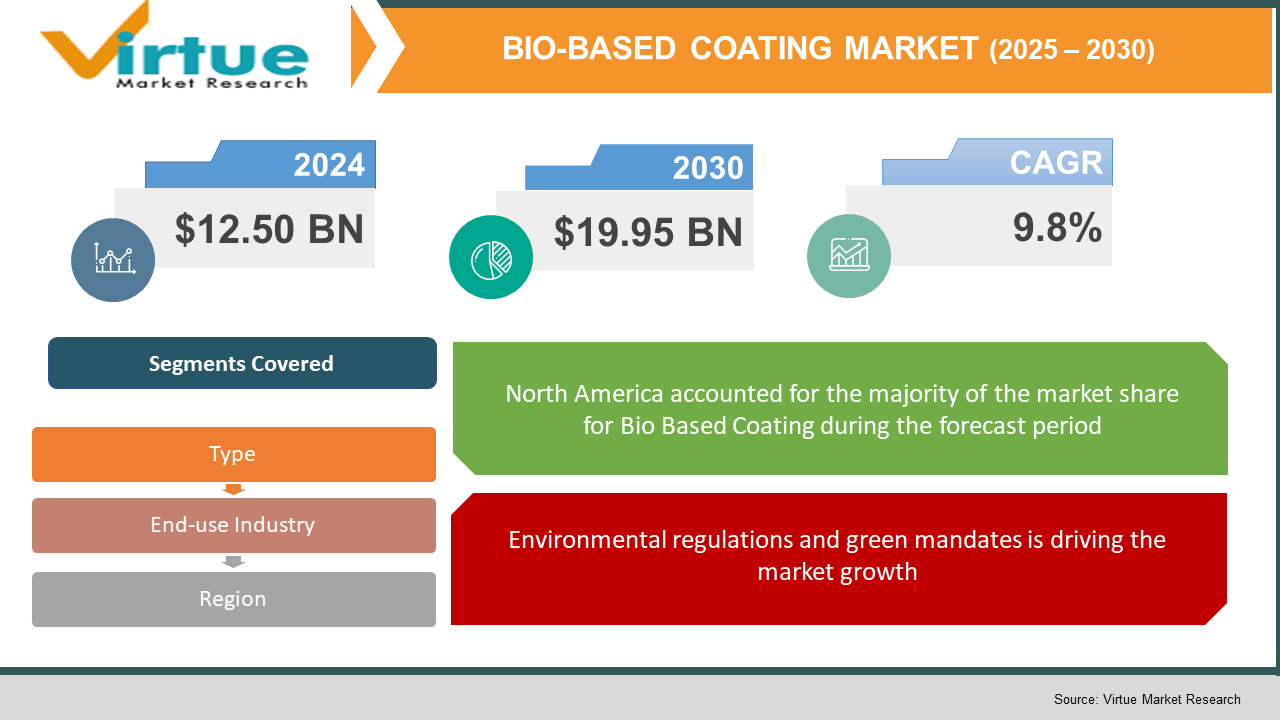

The global bio‑based coating market was valued at approximately USD 12.50 billion in 2024 and is expected to grow to around USD 19.95 billion by 2030, registering a compound annual growth rate (CAGR) of approximately 9.8% over 2025–2030.

The market encompasses environmentally friendly coatings derived from renewable sources such as plant oils, natural resins, biopolymers, and bio‑based alkyds, used in applications like architecture, automotive, industrial, marine, and packaging. Growth is driven by increasing environmental consciousness, tightening regulatory standards aimed at reducing volatile organic compounds (VOCs), advancements in resin technology, and expanding application in end‑use industries. Bio‑based coatings offer a dual benefit of comparable performance to petrochemical coatings while reducing carbon footprint and improving sustainability. With rising adoption in construction and automotive sectors, coupled with robust innovation in binder chemistries like polyurethanes, epoxies, and acrylics, the market is positioned for continued robust growth.

Key market insights:

North America was the leading region in 2024, holding about 35–40% of market share, driven by stringent environmental norms and strong demand across construction, automotive, and furniture.

Asia‑Pacific is the fastest‑growing region, with bio‑based coating sales projected to rise at a CAGR of 10–12% through 2030, fueled by rapid urbanization, industrial expansion, and regulatory incentives.

In 2024, construction end‑use sector commanded around 50–55% of the market share, with demand driven by green building and renovation projects.

Automotive coatings segment is rapidly growing at approximately 9–10% CAGR, with OEMs adopting sustainable materials to meet regulatory and brand commitments.

Global Bio-Based Coating Market Drivers

Environmental regulations and green mandates is driving the market growth

Legislative initiatives aimed at reducing volatile organic compounds (VOCs), carbon emissions, and exposure to hazardous chemicals are powerful stimuli for bio‑based coatings adoption. Governments across North America, the European Union, and Asia are enforcing strict standards through entities such as the US EPA, EU REACH, and China’s GB regulations. Green building certification systems, including LEED and BREEAM, increasingly recognize and incentivize use of low-VOC and sustainable materials, boosting demand in architectural and industrial sectors. Consumers and brands alike are prioritizing eco-friendly product portfolios, especially in packaging, automotive, and consumer goods industries. This regulatory push is prompting industrial coatings manufacturers to reformulate products with renewable resins—even replacing conventional alkyds and polyurethanes—while maintaining performance benchmarks in durability, weather resistance, and opacity. This shift is leading to greater R&D investment and supply chain evolution. By driving compliance with emerging standards, environmental regulation remains a leading force transforming the coating industry.

Technological innovation in bio-based binders is driving the market growth

Progress in chemistry, biotechnology, and materials science has elevated bio‑based resin performance, enabling formulations that rival petrochemical counterparts. Producers are leveraging vegetable oils, plant sugars, and bio‑monomers to engineer advanced binders—such as polyurethanes from cashew shell oil or epoxies from soy—to achieve enhanced durability, resistance to weathering, and low emissions. Developments include waterborne acrylics with high solids content, UV-curable bio-resins, and powder coatings that eliminate solvent use altogether. Industrial applications are seeing breakthroughs in crosslinking and adhesion tailored for metal, wood, and composites. Agricultural feedstock innovations are helping stabilize raw material availability and manage costs. Collaborative efforts among universities, start‑ups, and legacy coating firms are accelerating next-generation chemistries. These innovations are increasing the commercial viability of bio-based solutions and helping manufacturers meet both performance and sustainability criteria for broader market penetration.

Growing demand within construction and automotive sectors is driving the market growth

The construction and automotive industries are the largest end‑users of coatings globally, and both sectors are prioritizing sustainability as a core value. In construction, the push for low-VOC paints, biobased primers, and protective architectures align with green architecture initiatives and formal policy incentives. In automotive manufacturing, OEMs are responding to consumer pressure and tighter regulations on lifecycle emissions with plant-derived clear coats, wood interior finishes, and eco-certified primers. These coatings meet subjective criteria—like feel and gloss—while meeting stringent durability and safety requirements. Infrastructure investments in Asia‑Pacific and Latin America offer opportunities for bio‑based coatings through volume adoption in housing renovations and public buildings. In automotive, the rise of EVs offers fresh demand for sustainable materials across body paint systems, interior woodgrain coatings, and trim finishes. Even smaller segments such as furniture and packaging are embracing bio-resins to differentiate in environmentally conscious markets. Thus end‑use demand catalyzes adoption and scale.

Global Bio-Based Coating Market Challenges and Restraints

Cost premium and raw material volatility is restricting the market growth

Bio‑based coatings generally cost more than conventional petrochemical-based alternatives, due to higher costs associated with renewable feedstocks, supply chain complexities, and lower economies of scale. Limited availability of bio‑resins like rapeseed oil, PLA, or castor derivatives leads to fluctuations in availability and price spikes. This price differential often deters cost-sensitive segments, especially in price-competitive industrial coatings or bulk packaging applications. Lower margins in construction or furniture segments also constrain brand willingness to absorb cost premium. Market data indicates many manufacturers offer hybrid formulations combining partial bio content to manage pricing. Investment in production infrastructures and feedstock diversification is underway, but until maturity and scale reach traditional resin levels, price resistance remains a key restraint. Adoption may be limited unless competitive pricing is achieved.

Performance comparability and industrial acceptance is restricting the market growth

Although performance parity is improving, bio-based coatings still face apprehension around durability, scratch resistance, weather tolerance, and adhesion—particularly for specialized industrial or marine use. Some formulations underperform in extreme temperature or high-humidity environments. When compared to decades of proven epoxy or polyurethane systems, bio-based alternatives face perception challenges among architects, engineers, and OEM specifiers. Industrial qualification processes require rigorous testing, validation cycles, and technical certifications, delaying adoption curve and incurring trial costs. In sectors such as aerospace, marine, and infrastructure, product confidence is vital. Manufacturers must invest in empirical testing and standards compliance to accelerate mainstream acceptance. Until universal performance benchmarks are matched, industrial customers may remain reluctant, constraining market reach.

Market Opportunities

The global bio‑based coating market offers compelling opportunities driven by evolving consumer preferences, regulatory momentum, and technological breakthroughs. A primary area of opportunity lies in increased corporate and consumer demand for green products across packaging, furniture, automotive interiors, and architectural finishes. Brands prioritizing circular economy credentials are likely to invest in bio-based coatings for differentiation, potentially leading to portfolio-wide transitions. Strategic partnerships between resin producers, biopolymer manufacturers, and coating formulators can help reduce costs, as co-investment enables supply resilience and economies of scale. Growth in emerging markets across Asia-Pacific, Latin America, and the Middle East presents further scope: government incentives for green buildings and infrastructure development support volume adoption in these high-growth regions. In automotive, the transition to electric vehicles creates fresh demand for sustainable coatings in body panels and interior trims; OEM sustainability pledges can translate into high-value bio-based procurement contracts. On the technology front, bio-based powder coatings and UV-curable solutions offer solvent-free benefits and faster drying times. These attributes align with industrial efficiency goals and can support inroads into metal packaging or electronics applications. Another key opportunity is integrating bio‑based coatings into certification schemes like LEED or Cradle to Cradle, enabling premium pricing and green project participation. Educating architects, engineers, and end-users on lifecycle benefits, carbon footprint analysis, and performance parity will help close trust gaps. Through targeted marketing and standard compliance, bio-based coatings can reach price parity in premium segments. Reinforcement through R&D grants, policy incentives for renewable feedstocks, and joint ventures will support value-chain maturity. Quality control, feedstock competitiveness, and raw material diversification will underpin long-term viability. Taken together, these prospects—from sector expansion to technological integration—position bio-based coatings as foundational components in the future of sustainable materials for construction, mobility, packaging, and consumer goods, poised for mainstream adoption and scale.

BIO-BASED COATING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.8% |

|

Segments Covered |

By Type, end user industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AkzoNobel, BASF, PPG, Sherwin‑Williams, Hempel, Dow, DSM, Clariant, Evonik, Jotun, Covestro. |

Bio‑Based Coating Market segmentation

Bio‑Based Coating Market Segmentation By Type:

• Waterborne coatings

• Powder coatings

• High‑solid coatings

• Radiation‑curable coatings

Waterborne coatings are the most dominant segment in the bio‑based coatings market, commanding the largest share across architectural and industrial applications. They offer low volatile organic compound (VOC) content, compliance with sustainability standards, ease of use, and cost effectiveness. Innovations in waterborne bio-resins—such as plant-based acrylics and polyurethane dispersions—have enhanced performance to match solventborne alternatives. Their compatibility with standard application equipment and installation protocols makes conversion easier for producers and contractors. In architectural coatings, which represent over half of the market, waterborne systems are the default choice. Regulations limiting solvent emissions further elevate waterborne adoption. Their balanced profile—eco-friendly, performant, and cost-aligned—positions them as the leading product type in the evolving bio-based landscape.

Bio‑Based Coating Market Segmentation By End‑use Industry:

• Construction

• Automotive

• Packaging

• Furniture

• Industrial and Others

Construction is the dominant end‑use industry for bio‑based coatings, representing approximately 50–55% of the market. Green building initiatives, government regulations, and growing environmental awareness among builders and home‑owners drive widespread adoption of low‑VOC paints, primers, and protective finishes. Architectural coating installers prioritize sustainable solutions to meet LEED, WELL, and national green building standards. Bio-based alkyd primers and waterborne topcoats are commonly specified in commercial, residential, and infrastructure projects. The large volume and recurring nature of construction coatings, coupled with mid‑level pricing tolerance and performance requirements, make this sector ideal for scale deployment. As buildings prioritize sustainable materials, construction continues to anchor bio‑based coating adoption worldwide.

Bio‑Based Coating Market Regional segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the dominant region in the global bio‑based coating market. The region accounted for around 35–40% of global market revenue in 2024, driven by strict environmental regulations, strong consumer preference for eco-certified products, and robust green building activity. The United States, in particular, leads due to robust demand across construction, automotive, furniture, and packaging sectors, supported by regulatory agencies like EPA and California’s SCAQMD, along with widespread LEED adoption. Significant innovation ecosystems and industrial capacity for waterborne and powder coating production enhance North America’s position. Europe follows closely with similarly active policy support and advanced green building standards. Asia-Pacific, the fastest-growing region, benefits from rapid urbanization and industrial expansion in China, India, Japan, and Korea . Although its absolute market value is still smaller, its growth trajectory is steeper. Latin America and MEA remain smaller, with limited regulatory drivers but rising interest in sustainable materials. North America retains dominance due to an advanced sustainability ecosystem, high spending power, and established production infrastructure.

COVID-19 Impact Analysis on the Bio‑Based Coating Market

The COVID‑19 pandemic had a multifaceted impact on the bio‑based coating market, affecting supply chains, demand patterns, and strategic priorities. Early lockdowns in 2020–2021 disrupted raw material pipelines and manufacturing operations. Many bio‑resin producers rely on agricultural feedstocks; restrictions affected extraction and transportation, leading to short-term price fluctuations. Some companies reported constrained supplies of bio‑alkyds and biomass-derived monomers. Meanwhile, conventional petrochemical coatings also faced lockdown disruptions, elevating demand for waterborne alternatives due to simpler supply chains and lower customization complexity. End-use sectors responded differently: construction resumed more quickly in several regions due to government stimulus and infrastructure projects, boosting demand for low‑VOC architectural coatings; conversely, automotive coatings saw temporary slowdowns due to halted vehicle production. Despite initial dips, sustainability-focused green recovery plans in the EU, US, China, and India emphasized the role of eco‑friendly materials. Recovery packages included incentives for green building and manufacturing, creating structural tailwinds for bio‑based materials incorporation in public projects. Furthermore, the pandemic accelerated corporate sustainability commitments, with brands accelerating transitions to low-carbon and biobased supply chains. Bio‑based coating adoption surged in packaging, driven by e-commerce growth and consumer preference for eco‑friendly packaging. Remote working also spurred home renovation trends, supporting DIY paint and renovation markets. R&D pipelines were affected—lab closures and collaboration delays slowed new product development. However, virtual trials and reformulation projects continued with digital laboratory platforms. Overall, while COVID‑19 initially disrupted supply and demand, it also highlighted supply chain resilience, accelerated consumer sustainability awareness, and positioned bio‑based coatings more firmly in the post-pandemic recovery and sustainability strategy.

Latest trends/Developments

A range of notable developments is shaping the future of bio‑based coatings. One key trend is the rise of bio‑based alkyd resins derived from plant oils with high biocontent (70–100%), offering sustainable alternatives in architectural and industrial coatings. These alkyds perform comparably to petrochemical variants and are gaining traction for primers and wood finishes. Another trend is the advancement of waterborne high‑solid and powder bio‑coatings, eliminating solvents and enhancing sustainability. Powder systems using bio‑resins are especially notable for industrial and packaging applications. UV‑curable biodegradable coatings are also emerging, leveraging natural monomers to enable rapid curing and solvent-free finishes with low emissions. On the automotive front, OEMs are increasingly exploring plant-derived clear coats and sustainable undercoats to support brand sustainability goals. Partnerships between coating manufacturers like AkzoNobel, BASF, and PPG and innovators in biotechnology (e.g., DSM, Evonik) are accelerating new product pipelines. In packaging, there is a growing shift to bio-resin linings in metal and paper packaging to reduce plastic use. Meanwhile, green building certification programs are incorporating bio‑based materials into pilot product lists, prompting architects to specify these coatings. Policy incentives—such as grants for renewable materials R&D in the EU’s Horizon Europe and US Department of Energy’s renewable chemicals funding—are catalyzing innovation. Noteworthy market moves include BASF launching 14C traceable monomers, Engineered Polymer Solutions launching PC‑Mull 815 for wood coatings, and PPG introducing sustainable interior paints. Emerging regions like China, India, and South Korea are scaling production capacity for biopolymers, supported by government subsidies for green chemicals . As technology matures, supply chains integrate vertically, and brand demand for eco-credentials rises, bio‑based coatings are evolving from niche offerings toward mainstream status in multiple industrial value chains.

Key Players:

- AkzoNobel

- BASF SE

- PPG Industries

- Sherwin‑Williams

- Hempel

- Dow

- DSM

- Clariant

- Evonik

- Jotun

- Covestro

Chapter 1. Bio Based Coating Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. BIO BASED COATING MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. BIO BASED COATING MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. BIO BASED COATING MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. BIO BASED COATING MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. BIO BASED COATING MARKET – By Type

6.1 Introduction/Key Findings

6.2 Waterborne coatings

6.3 Powder coatings

6.4 High solid coatings

6.5 Radiation curable coatings

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. BIO BASED COATING MARKET – By End use Industry

7.1 Introduction/Key Findings

7.2 Construction

7.3 Automotive

7.4 Packaging

7.5 Furniture

7.6 Industrial and Others

7.7 Y-O-Y Growth trend Analysis By End use Industry

7.8 Absolute $ Opportunity Analysis By End use Industry , 2025-2030

Chapter 8. BIO BASED COATING MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End use Industry

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By End use Industry

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By End use Industry

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By End use Industry

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By End use Industry

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. BIO BASED COATING MARKET – Company Profiles – (Overview, Type Type , Portfolio, Financials, Strategies & Developments)

9.1 AkzoNobel

9.2 BASF SE

9.3 PPG Industries

9.4 Sherwin Williams

9.5 Hempel

9.6 Dow

9.7 DSM

9.8 Clariant

9.9 Evonik

9.10 Jotun

9.11 Covestro

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global bio‑based coating market was valued at approximately USD 12.50 billion in 2024 and is expected to grow to around USD 19.95 billion by 2030, registering a compound annual growth rate (CAGR) of approximately 9.8% over 2025–2030.

Drivers include tighter environmental regulations, binder innovations, and demand from construction and automotive industries.

Segments include waterborne, powder, high‑solid, UV-curable coatings; end‑users: construction, automotive, packaging, furniture

North America leads with ~35–40% of the market due to strong regulations and sustainability demand

Key players include AkzoNobel, BASF, PPG, Sherwin‑Williams, Hempel, Dow, DSM, Clariant, Evonik, Jotun, Covestro.