Bio-based Aprotic Solvents Market Size (2024 – 2030)

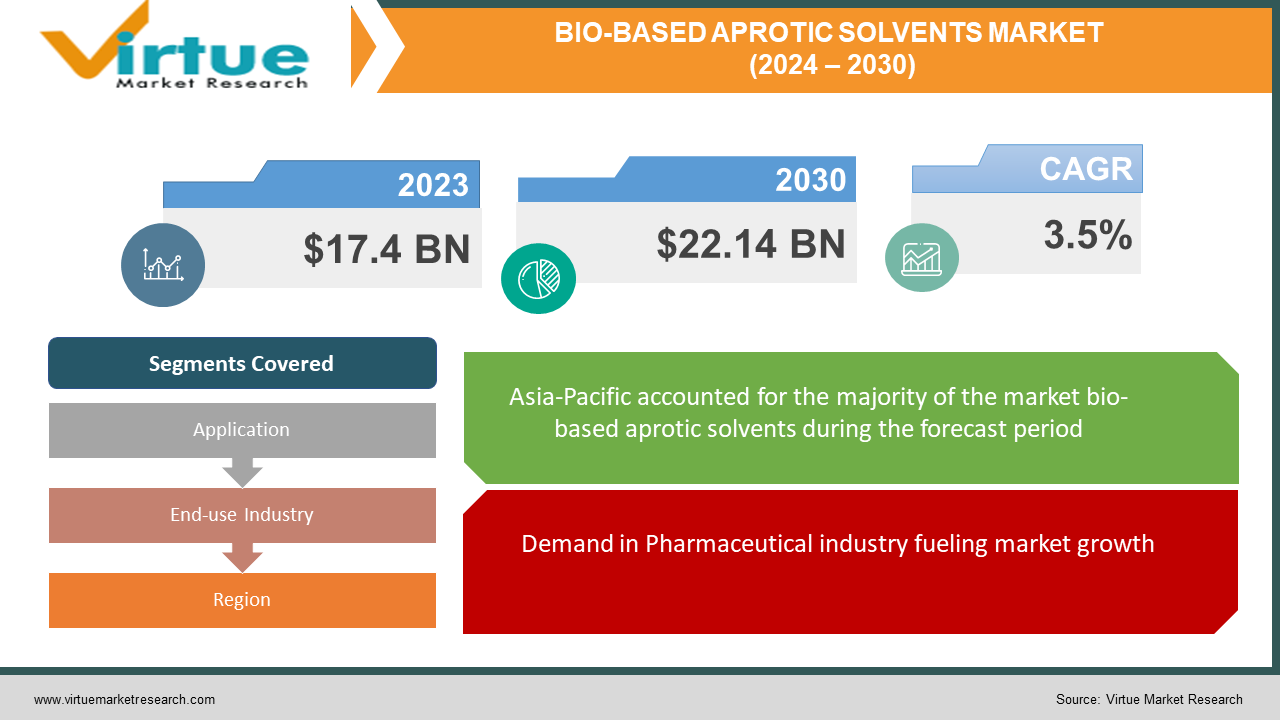

The Bio-based Aprotic Solvents Market was valued at USD 17.4 billion in 2023 and is projected to reach a market size of USD 22.14 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 3.5%.

Green & bio-based solvents are made out of the vegetable oils, lactic acid, bio-succinic acid, beat, sugarcane, corn, and refined glycerine. These solvents are manufactured in a biorefinery that integrates equipment and biomass conversion process, that further creates fuel and power. They are also utilised in the production of chemical products such as bio-glycols and bio-alcohols. Furthermore, their properties constitute eco-friendly, recyclable, non-carcinogenic, non-corrosive, and biodegradable. Additionally, green & bio-based solvents represent low miscibility, low toxicity, and high boiling point, hence, they are used as alternate products for crude oil-based solvents. These solvents are primarily utilized in paints & coatings, printing inks, industrial & domestic cleaners, adhesives, pharmaceuticals, and cosmetics.

The rising application of green & bio-based solvents in various applications such as paints & coatings, pharmaceuticals, and cosmetics has resulted in the growth of the market. The properties such as low VOC emissions and eco-friendly nature make green & bio-based solvents the amazing substitute product than other chemical-based and crude oil-based solvents. These attributes of the products were the prime reason for manufacturers to shift towards green solvents. Hence, rising the growth in various applications will lead to the demand for green &bio-based solvents.

Key Market Insights:

- As per the US Department of Commerce, the privately-owned housing units authorized by building permits in March 2022 were around 1,873,000 which is 0.4% above February 2022 of 1,865,000 units and 6.7% above March 2021 of around 1,755,000 units. Hence, the growing building and construction industry would need more Aprotic Solvents for adhesives & sealants, paints and coatings and polishes owing to their exhibit characteristics, which would drive the demand for the Aprotic Solvents market growth during the estimated period.

- In the Automotive industry, Aprotic Solvents are assisted in Automotive care products such as paints and coatings, greases, automotive washing and cleaning products and polishes and in various applications. According to the European Automobile Manufacturers' Association (ACEA), in 2021, 79.1 million motor vehicles were manufactured around the world, an increase of 1.3% compared to 2020.

- According to the Indian Brand Equity Foundation (IBEF), the Indian electronics manufacturing industry is estimated to reach US$520 billion by 2025. Thus, increasing electrical and electronic device production would demand more aprotic solvents and therefore, is estimated to push the growth of the Aprotic Solvents market.

Bio-based Aprotic Solvents Market Drivers:

Demand in Pharmaceutical industry fueling market growth.

The rising demand for Bio-based Aprotic Solvents in the Pharmaceutical industry due to their use as reaction media and solubilizers in various drug formulations. The growing demand for drugs is attributing to the growth of the market. Furthermore, the use of Aprotic Solvents in the production of electronic devices such as smartphones, laptops, and televisions are also pushing the Aprotic Solvent Market. In addition, the rising demand for these solvents in the production of high-performance coatings accelerating the development of the market. The use of Bio-based Aprotic Solvents in the chemical and petrochemical industries, particularly in the production of high-value chemicals such as polyurethane and acrylonitrile is driving the demand for Aprotic solutions.

Bio-based Aprotic Solvents Market Restraints and Challenges:

Strict rules and regulations are hampering market growth.

Stringent regulations and guidelines related to the application and disposal of Aprotic Solvents, particularly in developed regions such as North America and Europe. For example, the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation. Under REACH, the use of few Aprotic Solvents such as N-methyl-2-pyrrolidone (NMP) and dimethylformamide (DMF) is restricted or authorized only under particular conditions owing to their hazardous nature. All these challenges restraining the market growth.

Health and Environmental concerns Associated with Aprotic Solvents:

The Aprotic Solvents show various advantages and applications in different end-use industries. However, there is a potential danger to health from the usage of aprotic solvents on humans and the environment. The toxic impact on human health such as heart attack, kidney damage and an increased risk of high blood pressure. Environmental rules and regulations continue to impose limitations on the utilization and disposal of toxic chemicals and force the industrial sector to figure out for an environment-friendly and safer substitute. Aprotic solvents are flammable; hence, their transporting is strenuous in the industries. Thus, the health and environmental issues associated with Aprotic Solvents would generate hurdles for the growth of the market.

Bio-based Aprotic Solvents Market Opportunities:

Increasing awareness towards sustainability and environment.

The growing interest in sustainability and environmental consciousness has led to the development of Bio-based solvents as substitutes to traditional petroleum-based aprotic solvents. These bio-based solvents are derived from renewable resources such as biomass and are considered to be less detrimental to the environment and human health. Some of the bio-based aprotic solvents that are currently being developed involves ionic liquids, supercritical fluids, and deep eutectic solvents. These sustainable and eco-friendly solvents are likely to provide lucrative opportunities to the Aprotic Solvent market.

BIO-BASED APROTIC SOLVENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.5% |

|

Segments Covered |

By Application, End-use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, BioAmber Inc, Myriant Corporation, Dow Chemicals, Cargill Incorporated, Gevo Inc, Vertec Bio Solvents Inc, Florida Chemicals, DuPont |

Bio-based Aprotic Solvents Market Segmentation: By Application

-

Paints & Coatings

-

Adhesives & Sealants

-

Lubricants and Greases

-

Inks and Toners

-

Polishes & Waxes

-

Washing & Cleaning Products

-

Agrochemicals

-

Others

The Paints & Coatings segment holds the largest share of the Bio-based Aprotic Solvents Market and is estimated to grow at a CAGR of 3.8% during the estimate period. Aprotic solvents present in paints & coatings have high longevity and durability and are non-flammable. These solvents such as acetone, acetonitrile, pyridine and others are used in paints and coatings to increase adhesion. Aprotic solvents strengthen UV and thermal stability, chemical resistance, surface strength and corrosion and scratch resistance. The market for the paints and coatings segment is predicted to rise, owing to rapidly rising modern advancements in paints & coatings technology and residential construction activities.

Bio-based Aprotic Solvents Market Segmentation: By End-use Industry

-

Oil & Gas

-

Chemical & Petrochemical

-

Pharmaceutical & Healthcare

-

Building & Construction (Residential, Commercial, Industrial, Infrastructure)

-

Electrical & Electronics

-

Agriculture

-

Textile & Apparel

-

Automotive

-

Others

The Building & Construction industry holds the largest Aprotic Solvents Market share in and is estimated to grow at a CAGR of 4.1% during the estimated period. In the building & construction industry, aprotic solvents are used in the form of adhesives & sealants, paints and coatings to increase the bonding between polymer matrix and fibre surface. It is also used in other applications to significantly decrease porosity in renders, concrete and plasters, making them water repellent. It is utilised for joining and sealing the passage of fluids, as a type of mechanical seal.

Bio-based Aprotic Solvents Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific region dominates the Bio-based Aprotic Solvents Market owing to its huge market share. It was due to the escalating requirement for Aprotic solvents in developing countries such as China, Japan, India and South Korea. China is predicted to continue its dominance in the Bio-based Aprotic Solvents market during the forecast period. This is due to the development of the building & construction industry in the country. According to the Singapore Government, the building and construction sector remains healthy in Singapore, with strong government spending on public infrastructure, with about S$2 billion (US$1.43 billion) in contracts being awarded each month. Such increasing building & construction activities in the APAC countries are expected to increase the demand for Aprotic Solvents applications in the forecasted period and are offering to be a market booster for the Aprotic Solvents market size in Asia

COVID-19 Impact Analysis on the Bio-based Aprotic Solvents Market:

Outbreak of COVID-19 posed crucial challenges in all the sectors including Bio-based Aprotic Solvents Market across the globe. It has resulted in the negative growth of the Aprotic Solvents as supply chain disruptions due to trade regulations and restrictions affected the product demand.

Latest Trends:

The increasing demand for electronic products is expected to influence the growth of the aprotic solvents market going forward. Electronic products include a wide range of devices that depend on electronic components and technology for their functionality. Aprotic solvents are applied in electronic products to clear soldering flux residues and other contaminants from the surface of the printed circuit boards (PCBs) used in electronic devices. They are also utilised in the cleaning and preparation of silicon wafers before multiple process steps, such as thin-film deposition or etching, in making metal surfaces for electroplating processes, to dissolve adhesives, coatings, and encapsulants in electronic components and devices.

The growing infrastructural and construction activities are expected to boost the growth of the Bio-based Aprotic solvents market going forward. Infrastructural and Construction activities are increasing due to growing population, economic growth, and rising urbanization. Aprotic solvents are used in adhesives and sealants, paints, and coatings to better the adhesion between the polymer matrix and the fibre surface during construction.

Key Players:

-

BASF SE

-

BioAmber Inc

-

Myriant Corporation

-

Dow Chemicals

-

Cargill Incorporated

-

Gevo Inc

-

Vertec Bio Solvents Inc

-

Florida Chemicals

-

DuPont

Recent Developments

In April 2022, Merck introduced Cyrene, a new sustainable dipolar aprotic solvent. The new bio-derived product is a non-toxic alternative for N-Methyl-2-pyrrolidone, and Dimethylformamide solvents.

Chapter 1. Bio-based Aprotic Solvents Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bio-based Aprotic Solvents Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bio-based Aprotic Solvents Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bio-based Aprotic Solvents Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bio-based Aprotic Solvents Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bio-based Aprotic Solvents Market – By End-use Industry

6.1 Introduction/Key Findings

6.2 Oil & Gas

6.3 Chemical & Petrochemical

6.4 Pharmaceutical & Healthcare

6.5 Building & Construction (Residential, Commercial, Industrial, Infrastructure)

6.6 Electrical & Electronics

6.7 Agriculture

6.8 Textile & Apparel

6.9 Automotive

6.10 Others

6.11 Y-O-Y Growth trend Analysis By End-use Industry

6.12 Absolute $ Opportunity Analysis By End-use Industry, 2024-2030

Chapter 7. Bio-based Aprotic Solvents Market – By Application

7.1 Introduction/Key Findings

7.2 Paints & Coatings

7.3 Adhesives & Sealants

7.4 Lubricants and Greases

7.5 Inks and Toners

7.6 Polishes & Waxes

7.7 Washing & Cleaning Products

7.8 Agrochemicals

7.9 Others

7.10 Y-O-Y Growth trend Analysis By Application

7.11 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Bio-based Aprotic Solvents Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-use Industry

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-use Industry

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-use Industry

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-use Industry

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-use Industry

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Bio-based Aprotic Solvents Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 BioAmber Inc

9.3 Myriant Corporation

9.4 Dow Chemicals

9.5 Cargill Incorporated

9.6 Gevo Inc

9.7 Vertec Bio Solvents Inc

9.8 Florida Chemicals

9.9 DuPont

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Bio-based Aprotic Solvents Market was valued at USD 17.4 billion in 2023 and is projected to reach a market size of USD 22.14 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 3.5%.

The heightened consciousness about environment and sustainability among consumers is propelling the Bio-based Aprotic Solvents Market.

Bio-based Aprotic Solvents Market is segmented based on Application, End User and Region.

Asia- Pacific is the most dominant region for the Bio-based Aprotic Solvents Market.

BASF SE, BioAmber Inc, Myriant Corporation, Dow Chemicals, Cargill Incorporated and Gevo Inc are the few of the key players operating in the Bio-based Aprotic Solvents Market.