Bio-based 1,4-butanediol Market Size (2024-2030)

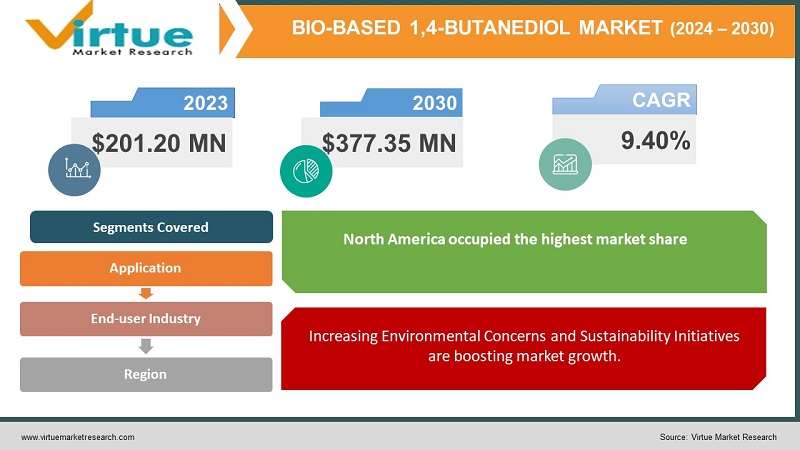

The Global Bio-based 1,4-butanediol Market is estimated to be worth USD 201.20 Million in 2023 and is projected to reach a value of USD 377.35 Million by 2030, growing at a fast CAGR of 9.40% during the forecast period 2024-2030.

Bio-BDO, sometimes referred to as bio-based 1,4-butanediol, is a chemical manufactured from renewable feedstocks via biological or fermentation methods. The conventional 1,4-butanediol, which comes from fossil fuels, can be replaced with this alternative. In comparison to its fossil-based cousin, bio-based BDO has several benefits, especially in terms of sustainability and environmental effect. 1,4-Butanediol made from renewable resources, such as biomass, agricultural waste, sugars, or starches, is known as "bio-based" 1,4-Butanediol. To create bio-based BDO, these feedstocks go through fermentation or other biological processes. Utilizing renewable feedstocks lessens dependency on fossil fuels, lowers carbon emissions, and aids in climate change mitigation. This adaptable chemical substance has uses in a variety of sectors, including solvents, medicines, textiles, and polymers. For the creation of biodegradable polymers like polybutylene terephthalate (PBT) and polyurethanes, it is a crucial raw ingredient. Coatings, adhesives, and sealants all use it as a solvent.

The market for 1,4-butanediol derived from biomaterials is expanding significantly and has a bright future. The transition to bio-based production techniques is being fuelled by the demand for environmentally friendly products, the need for sustainable alternatives, and favorable governmental laws. Despite obstacles, market growth is anticipated as production prices fall as a result of technology developments and economies of scale. The adoption of bio-based BDO offers a variety of economic and environmental advantages, making it a desirable alternative for enterprises aiming to improve their sustainability profiles and satisfy the expanding demand from consumers for environmentally friendly products.

Global Bio-based 1,4-butanediol Market Drivers:

Increasing Environmental Concerns and Sustainability Initiatives are boosting market growth.

The rising environmental concerns and sustainability initiatives are one of the main factors driving the growth of the global bio-based 1,4-butanediol market. There is a significant drive in many businesses to adopt sustainable alternatives as people become more conscious of the harmful effects of fossil fuel consumption and climate change. This is where bio-based 1,4-butanediol has a big advantage because it uses renewable feedstocks and emits less greenhouse gas. This promotes the objectives of environmental efforts and is consistent with the worldwide shift to a low-carbon economy. The usage of 1,4-butanediol and other bio-based chemicals is being promoted by governments and regulatory bodies around the world through the implementation of strict environmental regulations and policies. As a result, the market is favorable for producers of bio-based BDO, who gain from favorable regulations and incentives. Many companies are developing sustainability policies and making commitments to decrease their carbon footprint, which has raised the demand for bio-based 1,4-butanediol as a sustainable raw material in their production processes. The market for 1,4-butanediol made from bio-based materials is growing as sustainability and environmental concerns are given more attention.

Growing Demand for Biodegradable Polymers and Sustainable Textiles is fuelling market growth.

The arising need for biodegradable polymers and sustainable textiles is another significant factor propelling the worldwide bio-based 1,4-butanediol market. There is a rising need for materials that are biodegradable, recyclable, and have a lower environmental impact as customer preferences shift toward eco-friendly items. 1,4-Butanediol with a bio-based basis is essential for satisfying these requirements. Bio-based 1,4-butanediol is a crucial raw material in the manufacture of biodegradable polymers like polybutylene succinate (PBS) and polybutylene adipate terephthalate (PBAT) in the plastics industry. These environmentally friendly alternatives to conventional petroleum-based plastics are used in packaging, consumer goods, and other industries. The demand for bio-based 1,4-butanediol is driven by the growing awareness of plastic pollution and the need for sustainable packaging alternatives. In addition, the demand for sustainable fibers is rising in the textile industry. Eco-friendly fibers such as spandex and polybutylene terephthalate (PBT) are made using bio-based 1,4-butanediol. These fibers have better sustainability credentials and meet the demands of customers who care about the environment. The market is expanding as demand for bio-based 1,4-butanediol as a raw ingredient for sustainable textiles rises as sustainability increasingly serves as a differentiator in the textile sector.

Global Bio-based 1,4-butanediol Market Challenges:

The cost competitiveness of bio-based BDO in comparison to its fossil-based counterpart is one of the main issues the worldwide market for 1,4-butanediol faces. The price of bio-based BDO has decreased thanks to improvements in production methods and economies of scale, although it is still somewhat more expensive than BDO made from petroleum. It is difficult to persuade end users to transition to bio-based substitutes because of the cost disparity, particularly in price-sensitive industries. To close the cost gap, improve the cost competitiveness of bio-based 1,4-butanediol, and ensure its wider market acceptance, additional technological developments, and higher production quantities are required.

Global Bio-based 1,4-butanediol Market Opportunities:

The global 1,4-butanediol market, which is based on biofuels, has a sizable potential due to the growing need for renewable chemicals. As sustainability and environmental concerns continue to shape market trends, there is an increasing preference for chemicals generated from renewable feedstocks. Bio-based 1,4-butanediol, which is produced from renewable resources like biomass and agricultural waste, satisfies this demand. By providing bio-based 1,4-butanediol as a sustainable and renewable alternative to chemicals obtained from fossil fuels, producers may meet the demands of environmentally conscious consumers and industry.

COVID-19 Impact on Global Bio-based 1,4-butanediol Market:

The COVID-19 outbreak has brought to light the importance of sustainable supply networks and their need for resilience. Because of this, demand for bio-based substitutes like 1,4-butanediol has surged. The outbreak has expedited the transition to sustainable and ecologically friendly products by raising the need for bio-based chemicals. The emphasis on environmental awareness and resilience has given bio-based 1,4-butanediol new business potential across several industries. The manufacturing and distribution of bio-based 1,4-butanediol have been impacted by the disruption of global supply chains brought on by the COVID-19 outbreak. The supply of raw materials has been affected, which has interrupted production processes in addition to lockdowns, travel restrictions, and limited industrial activity. Consumer spending and investment across several industries have also been hindered by the pandemic-induced economic downturn, potentially reducing the market for 1,4-butanediol generated from biomaterials immediately soon. These difficulties cause temporary setbacks, but it is anticipated that they will eventually improve as circumstances improve and markets stabilize.

Global Bio-based 1,4-butanediol Market Recent Developments:

- In September 2022, QIRA, a brand-new 1,4-butanediol (BDO) molecule, was created by The LYCRA Company and Qore jointly to create bio-derived spandex. With 70% of the LYCRA fiber coming from sustainable feedstock thanks to this technology, commercial spandex may now be produced on a massive scale. By substituting fossil-based resources for LYCRA fiber, it is possible to achieve the same high level of performance while reducing the carbon footprint by up to 44%. As a result of this relationship, the development of environmentally friendly and sustainable solutions for the textile and apparel sectors has evolved dramatically.

BIO-BASED 1,4-BUTANEDIOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.40% |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, DSM, Genomatica Inc., Global Bio-chem Technology Group Company Limited, Novamont S.p.A, Qira, Shandong LanDian Biological Technology Co. Ltd, Yuanli Science and Technology |

Global Bio-based 1,4-butanediol Market Segmentation:

Global Bio-based 1, 4-butanediol Market Segmentation: By Application

- Polybutylene Terephthalate (PBT)

- Gamma-Butyrolactone (GBL)

- Polyurethane (PU)

- Tetrahydrofuran (THF)

- Others

Gamma-Butyrolactone (GBL), Polybutylene Terephthalate (PBT), Polyurethane (PU), and other products can be found on the market for 1,4-butanediol generated from biofuels. PBT has a significant market share in various sectors because of its extensive use across a variety of industries, including automotive, electrical and electronics, and consumer goods. The great heat resistance and excellent mechanical strength of bio-based PBT, among other noteworthy characteristics, are what drive the market need for it. Another well-known application for GBL is as an intermediary in the production of solvents, agrochemicals, and pharmaceuticals. The PU category is rapidly growing in response to the increased demand for bio-based materials across industries like furniture, automotive, and construction. THF requirement, a solvent that is widely used in bio-based 1,4-butanediol, is anticipated to increase steadily. Numerous uses, including lubricants, tastes and scents, and cosmetics, are included in the "Others" division. Overall, PBT dominates the market for bio-based 1,4-butanediol, followed by GBL, PU, THF, and others, which reflects the market's wide range of opportunities and applications.

Global Bio-based 1,4-butanediol Market Segmentation: By End-user Industry

- Automotive

- Electrical and Electronics

- Textile

- Other End-user Industries

The global 1,4-butanediol market for bio-based products can be divided into segments depending on end-user sectors including automotive, electrical and electronics, textile, and others. The vehicle industry presently holds a substantial market share as a result of the growing need for lightweight materials, such as bio-based 1,4-butanediol-based polymers, to improve fuel efficiency and reduce carbon emissions. The electrical and electronics industry has grown significantly as a result of the need for eco-friendly materials in the production of electronic components and systems. The textile industry is growing as a result of consumer demand for eco-friendly and sustainable fibers that use bio-based 1,4-butanediol as a raw ingredient. Other end-user industries like packaging, coatings, adhesives, and pharmaceuticals have an impact on the market share as well. The market insights draw attention to the wide range of uses and the considerable contribution of different industries to the development and use of bio-based 1,4-butanediol on a global scale.

Global Bio-based 1,4-butanediol Market Segmentation: By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America, Europe, Asia Pacific, South America, and the Middle East & Africa are the regions into which the global market for 1,4-butanediol derived from biological sources can be divided. Due to strict environmental restrictions and growing acceptance of sustainable chemicals, North America maintains a sizable market share. Due to supportive government legislation and the existence of significant producers, Europe is another important market for bio-based 1,4-butanediol. With the increased need for bio-based products across industries, notably in nations like China and India, the Asia Pacific area is expanding significantly. The expanding industrial sectors and rising environmental consciousness in South America, the Middle East, and Africa present economic potential. According to market research, North America and Europe now dominate the market, but the Asia-Pacific region is expected to experience significant expansion due to the region's industrial development and environmental policies that support sustainable practices.

Global Bio-based 1,4-butanediol Market Key Players:

- BASF SE

- DSM

- Genomatica Inc.

- Global Bio-chem Technology Group Company Limited

- Novamont S.p.A

- Qira

- Shandong LanDian Biological Technology Co. Ltd

- Yuanli Science and Technology

Chapter 1. BIO-BASED 1,4-BUTANEDIOL MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. BIO-BASED 1,4-BUTANEDIOL MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. BIO-BASED 1,4-BUTANEDIOL MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. BIO-BASED 1,4-BUTANEDIOL MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. BIO-BASED 1,4-BUTANEDIOL MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. BIO-BASED 1,4-BUTANEDIOL MARKET – By Application

6.1 Polybutylene Terephthalate (PBT)

6.2. Gamma-Butyrolactone (GBL)

6.3. Polyurethane (PU)

6.4. Tetrahydrofuran (THF)

6.5. Others

Chapter 7. BIO-BASED 1,4-BUTANEDIOL MARKET– By End-user Industry

7.1 Automotive

7.2. Electrical and Electronics

7.3. Textile

7.4. Other End-user Industries

Chapter 8. BIO-BASED 1,4-BUTANEDIOL MARKET – By Region

8.1. North America

8.2. Europe

8.3.The Asia Pacific

8.4.Latin America

8.5. Middle-East and Africa

Chapter 9. BIO-BASED 1,4-BUTANEDIOL MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. BASF SE

9.2. DSM

9.3. Genomatica Inc.

9.4. Global Bio-chem Technology Group Company Limited

9.5. Novamont S.p.A

9.6. Qira

9.7. Shandong LanDian Biological Technology Co. Ltd

9.8. Yuanli Science and Technology

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bio-based 1,4-butanediol Market is estimated to be worth USD 201.20 Million in 2023 and is projected to reach a value of USD 377.35 Million by 2030, growing at a fast CAGR of 9.40% during the forecast period 2024-2030.

The Global Bio-based 1,4-butanediol Market is driven by the Growing Demand for Biodegradable Polymers and Sustainable Textiles

The Segments under the Global Bio-based 1,4-butanediol Market by the End-user Industry are Automotive, Electrical and Electronics, and Textile.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Bio-based 1,4-butanediol Market

BASF SE, DSM, and Genomatica Inc. are the three major leading players in the Global Bio-based 1,4-butanediol Market