Binary Cycle Power Plant Market Size (2024 – 2030)

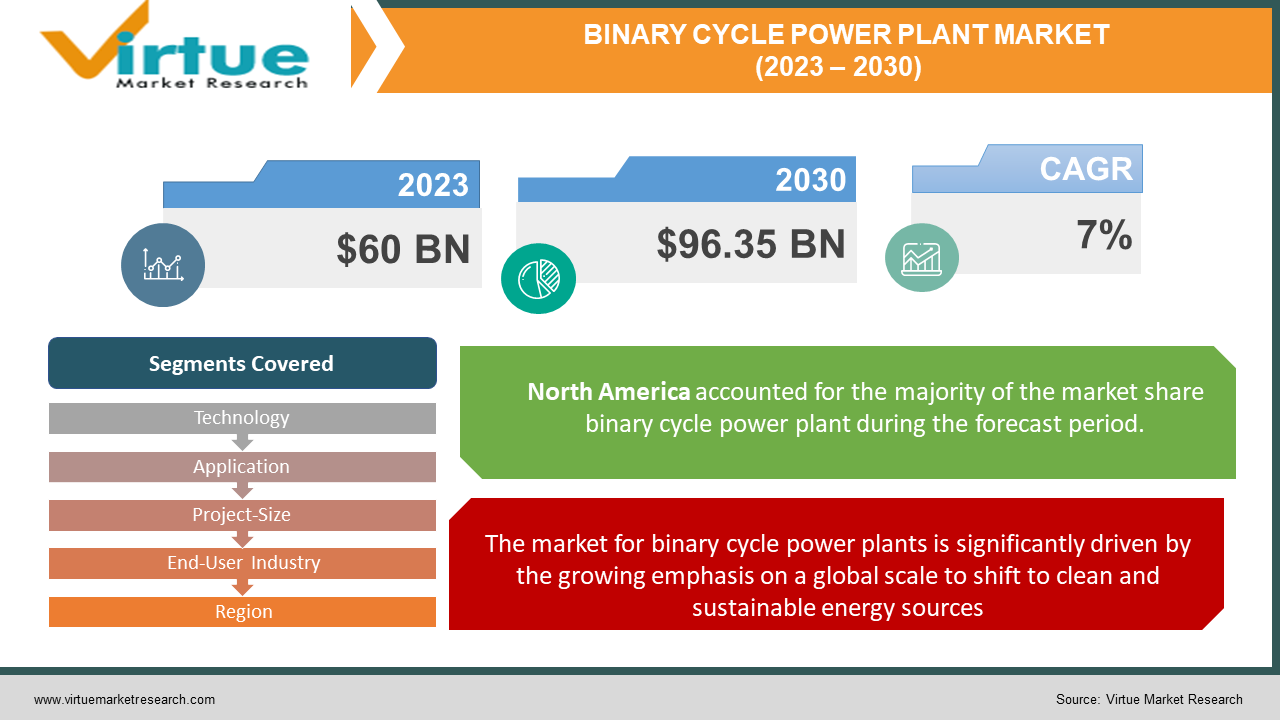

The Binary Cycle Power Plant Market was valued at USD 60 Billion in 2023 and is projected to reach a market size of USD 96.35 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7%.

In a binary cycle power plant, heat from the Earth's interior is extracted to create energy using a geothermal power producing technology. With binary cycle power plants, a secondary working fluid with a lower boiling point than water is used instead of the high-temperature steam from the reservoirs that is used in standard geothermal plants. By vaporising this fluid with the help of geothermal heat, energy is produced by powering a turbine that is connected to a generator.

Key Market Insights:

The growing emphasis on clean and sustainable energy solutions worldwide is propelling the market for binary cycle power plants. A subclass of geothermal power generation known as binary cycle power plants has become more well-known because of its capacity to extract energy from geothermal sources with lower temperatures, hence broadening the geographic range of feasible projects. Supportive government regulations, incentives, and a rising understanding of the necessity of switching to renewable energy sources all contribute to the market's growth. A growing number of binary cycle power plants are being invested in by regions with substantial geothermal potential, including areas of East Africa, Iceland, the Philippines, and the United States. These plants are becoming more competitive in the larger renewable energy market with to technological developments, especially in the efficiency and optimisation of binary cycle systems.

The market for binary cycle power plants nevertheless confronts obstacles in spite of these encouraging developments, such as high upfront costs, site-specific restrictions, and exploratory risks. To overcome these obstacles, more research and development work is needed to improve the scalability and economic viability of binary cycle systems. In order to contribute to a more sustainable energy future, the market for binary cycle power plants is expected to be vital in supplying clean and dependable electricity as the global energy environment changes.

Binary Cycle Power Plant Market Drivers:

The market for binary cycle power plants is significantly driven by the growing emphasis on a global scale to shift to clean and sustainable energy sources.

The need for renewable energy alternatives is rising as countries make commitments to cut carbon emissions and mitigate climate change. Because binary cycle power plants use geothermal energy, they provide a consistent and dependable supply of clean electricity. Geothermal resources are especially appealing because of their capacity to function effectively at lower temperatures, which increases the range of places where geothermal power generation can be financially feasible. In an effort to create a more sustainable energy mix globally, government programmes, incentives, and regulatory support for renewable energy all help to drive the market for binary cycle power plants.

Continuous improvements in the technology related to binary cycle power plants are another important factor propelling the market.

The allure of this type of geothermal power generation is enhanced by research and development initiatives aimed at increasing the effectiveness and affordability of binary cycle systems. Improvements in working fluid selection, heat exchanger design, and plant architecture as a whole have raised competitiveness and improved performance. In addition to increasing their economic viability, these technological advancements position binary cycle power plants as a dependable and scalable geothermal energy harvesting option. The use of binary cycle power plants in the global energy market is anticipated to be further propelled by the ongoing technological advancements in this field.

Binary Cycle Power Plant Market Restraints:

The substantial upfront expenditures involved in developing and implementing geothermal projects are a significant market barrier for binary cycle power plants.

Installing specialised equipment for binary cycle systems and conducting the necessary exploration and drilling to identify and access geothermal reserves can result in significant upfront costs. When compared to more established and conventional sources of energy generation, this financial barrier may provide difficulties for prospective investors and project developers. Even though geothermal power has long-term advantages including steady power production and low operational costs, the initial capital expenditure is still a major barrier. The implementation of financial mechanisms, government incentives, and technological improvements is necessary to mitigate this constraint. The objective is to lower the total cost of developing binary cycle power plants, hence increasing their appeal in the wider energy market.

BINARY CYCLE POWER PLANT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Technology, Application, Project-Size, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ormat Technologies, Mitsubishi Power, Turboden S.p.A., Toshiba Energy Systems & Solutions Corporation, Exergy ORC,. ElectraTherm, Inc., Climeon AB, Enel Green Power, Ansaldo Energia, Baker Hughes |

Binary Cycle Power Plant Market Segmentation: By Technology

-

Organic Rankine Cycle

-

Kalina Cycle

The Kalina and Organic Rankine Cycles (ORC). Due to its dependability, maturity, and broad use, the Organic Rankine Cycle has historically held the biggest market share. Because ORC technology is flexible and can be applied to a range of heat sources, it commands a significant share of the market for binary cycle power plants. But as the energy scene changes, the Kalina Cycle is becoming recognised as a technology with room to expand. Despite having a lower market share than ORC at the moment, the Kalina Cycle is nevertheless one to keep an eye on, especially in applications where its novel design—which combines two fluids to increase efficiency—aligns well with particular heat source temperature profiles. It is anticipated that the Kalina Cycle will have the quickest rate of growth in the binary cycle power plant market. The Kalina Cycle has drawn interest due to its potential to provide increased efficiency under specific circumstances, even if ORC is still the most widely used technique. With further improvements and refinements, Kalina Cycle technology should gain a greater portion of the market, particularly in applications where the heat source's temperature profile is well suited to the technology's architecture.

Binary Cycle Power Plant Market Segmentation: By Application

-

Electricity

-

Direct Use

Due to the rising emphasis on renewable energy capacity worldwide and the versatility of these systems in contributing to grid power, the electricity generating segment has historically had the highest position in the binary cycle power plant market. A key component of the renewable energy landscape, geothermal energy offers a consistent and dependable source of clean electricity when it is utilised in binary cycle power plants. Direct use applications are anticipated to be the market segment in binary cycle power plants with the quickest rate of growth. When geothermal heat is used directly, it doesn't need to be converted into electricity first. It can be used for heating buildings, factories, and farms.

Binary Cycle Power Plant Market Segmentation: By Project-Size

-

Small-Scale

-

Large-Scale

The market share that the large-scale segment has historically enjoyed has been the highest. Greater capacity and frequent deployment in utility-scale projects are the distinguishing features of large-scale binary cycle power plants, which provide a substantial contribution to the total production of clean electricity. Utility firms and governments seeking to satisfy significant energy demand using renewable sources find these projects appealing due to their economies of scale. It is anticipated that the small-scale category of binary cycle power plants will increase at the fastest rate. Small-scale binary cycle power plants are frequently used for dispersed generating or in areas where grid connection may be difficult due to their smaller capacity.

Binary Cycle Power Plant Market Segmentation: By End-User Industry

-

Industrial

-

Residential

-

Commercial

The market's largest share has always belonged to the industrial category. The production processes of industrial users frequently necessitate substantial power consumption, and binary cycle power plants offer a dependable and sustainable electricity supply to fulfil these demands. The commercial sector is expected to grow at the fastest rate in the binary cycle power plant market. Commercial entities are increasingly looking into cleaner and renewable energy sources as sustainability becomes a priority for corporations globally. In order to lessen their carbon footprint and provide dependable on-site power generation, binary cycle power plants are a feasible option for commercial buildings including hotels, malls, and office complexes.

Binary Cycle Power Plant Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

South-America

-

Middle East and Africa

-

Europe

The binary cycle power plant market is characterised by a varied landscape with prominent players and distinct dynamics across many continents, as revealed by the regional analysis. With its vast geothermal resources, especially in the western states, and its implementation of supportive laws and incentives, the United States stands out as a leader in North America when it comes to the development of binary cycle power plants. Europe has achieved great progress in the field of geothermal energy, as demonstrated by Iceland, an island nation that mostly uses binary cycle power plants to extract electricity from its vast geothermal resources. Europe is positioned as a major hub for the development of binary cycle power projects due to its commitment to renewable energy and the supportive policies of nations such as Iceland.

The Philippines develops as a major participant in Asia-Pacific, leveraging government programmes to promote the adoption of renewable energy sources and its significant geothermal potential. Kenya and Ethiopia, two nations in East Africa that benefit greatly from the Rift Valley's geothermal resources, are actively investing in geothermal power, especially binary cycle facilities. These areas demonstrate the significance of advantageous geological features and political backing for the development of binary cycle power plants, thereby advancing the worldwide transition to sustainable and eco-friendly energy sources.

Binary Cycle Power Plant Market COVID-19 Impact Analysis:

The market for binary cycle power plants has seen a variety of impacts from the COVID-19 epidemic. The acquisition of crucial components for binary cycle power plants was greatly affected by supply chain interruptions resulting from worldwide lockdowns and limitations. Project delays and higher expenses could have resulted from delays in the production and delivery of tools and supplies. Furthermore, project finance was probably impacted by the economic uncertainty brought on by the epidemic, as investors grew more risk adverse and financing became harder to come by. The creation of new binary cycle power projects may have been hampered by the general slowdown in economic activity and changes in investment priorities during the pandemic. Disruptions to the current binary cycle power plants demonstrated operational issues as well. The efficiency and dependability of these plants may have been impacted by lockdowns and travel restrictions that interfered with daily operations, maintenance plans, and on-site inspections. Power plants may have changed workforce ratios and work practises in response to the pandemic's focus on worker health and safety, adding to the already complex situation. Moreover, the binary cycle power sector may have experienced a slowdown in regulatory procedures and policy support due to government responses to the crisis, which frequently involved reallocating resources to address pressing health and economic issues. This could have had an effect on the sector's overall growth trajectory during the pandemic.

Latest Trends/ Developments:

- The goal of ongoing research and development was to increase binary cycle power plants' economic viability and efficiency. Enhancing the entire performance of the system was the goal of innovations in heat exchangers, working fluids, and other parts.

- Ethiopia is currently working on a 520 MW geothermal power station that, when finished, will be the biggest in Africa. It uses binary cycle technology. As part of their efforts to switch to renewable energy sources, other nations like Mexico, Chile, and Costa Rica are also making investments in binary cycle power plants.

Key Players:

-

Ormat Technologies

-

Mitsubishi Power

-

Turboden S.p.A.

-

Toshiba Energy Systems & Solutions Corporation

-

Exergy ORC

-

ElectraTherm, Inc.

-

Climeon AB

-

Enel Green Power

-

Ansaldo Energia

-

Baker Hughes

Chapter 1. Binary Cycle Power Plant Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Binary Cycle Power Plant Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Binary Cycle Power Plant Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Binary Cycle Power Plant Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Binary Cycle Power Plant Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Binary Cycle Power Plant Market – By Technology

6.1 Introduction/Key Findings

6.2 Organic Rankine Cycle

6.3 Kalina Cycle

6.4 Y-O-Y Growth trend Analysis By Technology

6.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Binary Cycle Power Plant Market – By Application

7.1 Introduction/Key Findings

7.2 Electricity

7.3 Direct Use

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Binary Cycle Power Plant Market – By Project-Size

8.1 Introduction/Key Findings

8.2 Small-Scale

8.3 Large-Scale

8.4 Y-O-Y Growth trend Analysis By Project-Size

8.5 Absolute $ Opportunity Analysis By Project-Size, 2024-2030

Chapter 9. Binary Cycle Power Plant Market – By End-User

9.1 Introduction/Key Findings

9.2 Industrial

9.3 Residential

9.4 Commercial

9.5 Y-O-Y Growth trend Analysis By End-User

9.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 10. Binary Cycle Power Plant Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Technology

10.1.2.1 By Application

10.1.3 By Project-Size

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Technology

10.2.3 By Application

10.2.4 By Project-Size

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Technology

10.3.3 By Application

10.3.4 By Project-Size

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Technology

10.4.3 By Application

10.4.4 By Project-Size

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Technology

10.5.3 By Application

10.5.4 By Project-Size

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Binary Cycle Power Plant Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Ormat Technologies

11.2 Mitsubishi Power

11.3 Turboden S.p.A.

11.4 Toshiba Energy Systems & Solutions Corporation

11.5 Exergy ORC

11.6 ElectraTherm, Inc.

11.7 Climeon AB

11.8 Enel Green Power

11.9 Ansaldo Energia

11.10 Baker Hughes

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Binary Cycle Power Plant Market was valued at USD 60 Million in 2023

Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7%.

The market for binary cycle power plants is significantly driven by the growing emphasis on a global scale to shift to clean and sustainable energy sources.

The substantial upfront expenditures involved in developing and implementing geothermal projects are a significant market barrier for binary cycle power plants.

Organic Rankine Cycle and Kalina Cycle are the segments.