Global Big Data Market Size (2023 - 2030)

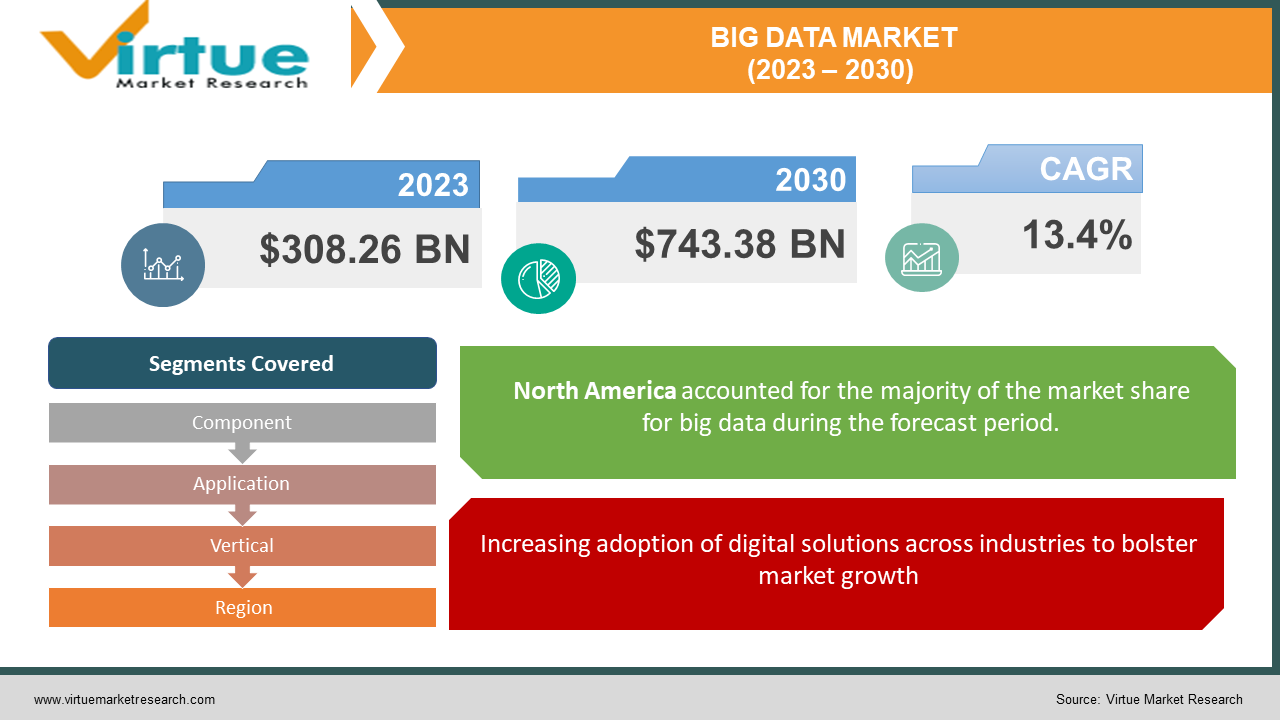

The Global Big Data Market was valued at USD 308.26 Billion and is projected to reach a market size of USD 743.38 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.4%.

The increasing data volume from Facebook, Twitter, WhatsApp, Instagram, Snapchat, and other such social media platforms results in huge databases. Hence, the growing database due to these social media platforms is anticipated to surge the demand for big data solutions and services.

Market Overview:

Big Data, is applied to data sets having size or type beyond the capabilities of a traditional relational databases to process and manage the data with low latency. Big Data is the use of improved and advanced analytic tools and techniques against very huge and diverse data sets from different sources and in different sizes, from terabytes to zettabytes. It examines and analyses the structured and unstructured complex databases to uncover and deliver insights based on hidden patterns, correlation, changing market trends, consumer preferences and more. The staggering growth of data and an increase in the number of mobile applications and IoT devices are the factors contributing to the growth of the big data market. Leading sectors focus on employing several analytical tools to acquire consumer insights by evolving business intelligence to make more informed business decisions. Big data is extensively used in various industries, such as Banking, Financial Services and Insurance Sector, Government Sector, Defence, Healthcare, Manufacturing retail and consumer goods, Education and Research purposes, Travel and Hospitality, Media and Entertainment, Telecommunications and IT, Transportation and Logistics, and others. The benefits may include- more cost-effective marketing, new revenue opportunities, customer personalization, risk management strategies and improved operational efficiency. With an effective strategy, these benefits can provide the company competitive edge over rivals.

Covid-19 Impact on the Big Data Market:

During the COVID-19 pandemic, consumers moved dramatically towards the online channel and companies and industries responded in turn. This digital transformation in almost all the sectors generated massive amount of data and resulted in boosting market opportunities for the Big Data market. Artificial Intelligence technology is being executed in asset and inventory management, predictive maintenance, manufacturing industry, real-time alerts and more to upsurge the growth of the production sector during challenging business conditions. Similarly, organizations of different sectors shifted to remote, work from home culture and implemented advanced analytical tools to draw insights and understand new market trends. Businesses have changed the way it operated and adopted new digital strategies to work efficiently in this constantly changing environment amid the pandemic. In July 2021, KPMG conducted a transformation strategy leaders survey across 12 sectors in 10 countries. The survey results stated that 67% of the respondents improvised their digital transformation strategy due to COVID-19, and 63% increased their digital transformation budgets. This factor resulted in boosting the market growth post the pandemic. According to the data by International Data Corporation (IDC), 152,200 IoT devices are likely to connect per minute by 2025. Thus, the rising adoption of Data Analytics and IoT is bound to create lucrative opportunities for the market in the near future.

Market Drivers:

Increasing adoption of digital solutions across industries to bolster market growth:

The increasing augmentation of databases and digital solutions across various business sectors such as healthcare, BFSIs, retail, agriculture, telecommunication and media worldwide are significantly generating data, creating massive volume of data sets, and to analyse these data sets, big data analytical tools are being applied.

Similarly, industries are executing bots to automate and reform the work scenarios. Virtual assistants, such as Google Assistant, Amazon’s Alexa, Apple’s Siri and some others generate huge data sets. With the evolving advancements in smart phone technology and network connectivity it is anticipated to increase the social media users worldwide. This industrial revolution is anticipated to produce enormous databases across industries. Thus, these factors together project at an increased need of big data analytics tool fuelling the big data market.

Plummeting cost of technology has made it more affordable making it a key factor to boost the market growth:

Technology associated to collecting and processing large quantities of data has become more and more affordable. The data storage and processing costs has declined significantly, making it possible for individuals and small businesses to adopt Big Data. Another contributing factor is, the development of open-source software frameworks for Big Data. The most popular and widely used framework being Apache Hadoop for distributed storage and processing. Due to it being highly available, it has become highly inexpensive to start Big Data projects in various organizations, making the market grow exponentially.

Market Restraints:

Increasing security concerns may hinder the market expansion during the forecast period:

With larger amounts of data, its storage and processing become complicated, making them difficult to incorporate in an analytical platform. The complexity of big data systems present unique security risks and challenges including data vulnerability, fake data generation, need for real-time security, data privacy, data storage etc.

BIG DATA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

13.4% |

|

Segments Covered |

By Component, Application, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM Corporation (U.S.), SAP SE (Germany), Microsoft Corporation (U.S.), SAS Institute Inc. (U.S.), Fair Isaac Corporation (U.S.), Oracle Corporation (U.S.), Salesforce Inc. (U.S.), Equifax Inc. (U.S.), TransUnion (U.S.), OlikTech International AB (U.S.) |

Big Data Market – By Component.

-

Software

-

Hardware

-

Services

The software segment accounts for the maximum revenue share, and is estimated to grow at the highest CAGR, during the outlook period owing to its variety of vast digital solution offerings such as risk management, business intelligence solutions, Customer-relationship management analytics, compliance analytics, workforce analytics and others. These solutions provide insights and visualizations that provide advanced decision-making capabilities.

The hardware segment is estimated to grow at a comparatively steady growth rate.

Similarly, the service segment is estimated to showcase notable growth during the forecast period. These factors are likely to surge the big data market growth.

Big Data Market – By Application.

-

Data Discovery and Visualization

-

Advanced Analytics

-

Others (Data preparation and others)

The data discovery and visualization segment hold the maximum segment share, and is estimated to grow at a rapid speed during the forecast period. The growing size of data sets are likely to fuel the demand for big data analytics for data discovery and visualization. Advanced Analytics is also estimated to gain significant growth during the forecast period. The amalgamation of machine learning and data mining in advanced analytics are the major factors boosting the demand for big data market.

Big Data Market– By Vertical

-

BFSI

-

Automotive

-

Telecom/Media

-

Healthcare

-

Life Sciences

-

Retail & Energy Sector

-

Government Sector

The retail industry is estimated to grow at the highest CAGR during the forecast period. The BFSI segment is estimated to hold the maximum revenue share in the industry due to the rapidly growing customer base. The implementation of big data analytics is benefiting the BFSI industry to acquire and retain customers. The massive client base of the Telecom Industry is surging the product demand. Also, the shift in Healthcare and Life Sciences sector to the analytics tool to better understand customer’s need and improve healthcare services together accounts for the growth of demand for big data market.

Big Data Market – By Region.

-

North America

-

Asia-Pacific

-

South America

-

Europe

-

Middle-East & Africa

North America is estimated to gain maximum revenue share during the outlook period. The region is indulgent in eminent businesses across all industries and has been extensively implementing data analytics in all the sectors. The entire region will showcase rapid growth owing to the growing demand for advanced and improved analytical tools resulting in the exponential growth of the market.

Asia-Pacific is also estimated to witness a remarkable CAGR during the forecast period due to the growth of BFSIs, retail, healthcare and other industries. With booming economies like China, India Singapore, Japan, South Korea and others, the market’s growth potential in unlimited in the region.

Europe has also remarkably boosted the adoption of data analytics. The extensively growing data and its demand to manage data has resulted in the growth of the market.

Similarly, the growing digitalization and competitiveness in South America, Middle-East and Africa may drive a steady growth in the market size.

Big Data Market – By Company.

-

IBM Corporation (U.S.)

-

SAP SE (Germany)

-

Microsoft Corporation (U.S.)

-

SAS Institute Inc. (U.S.)

-

Fair Isaac Corporation (U.S.)

-

Oracle Corporation (U.S.)

-

Salesforce Inc. (U.S.)

-

Equifax Inc. (U.S.)

-

TransUnion (U.S.)

-

OlikTech International AB (U.S.)

Strategic acquisition to boost market expansion:

-

In December 2021, Oracle Corporation acquired Cerner, a supplier of digital information systems used in healthcare systems and hospitals. This acquisition, will allow medical professionals to deliver better services to communities and individual patients.

-

In February 2021, Salesforce acquired Acumen Solution, an U.S. based industry solutions provider to accelerate and deliver innovation and performance.

Recent Industry Developments:

-

In 2022, Salesforce, a cloud-based software company, introduced CRM Analytics, an AI-based Big Data analytics platform that can be utilized in every industry.

-

In March 2022, Microsoft launched Azure Health Data Services, a Platform as a Service (PaaS) specially designed to support both analytical and transactional workloads.

-

In January 2021, Dun & Bradstreet acquired Bisnode. This acquisition helped its clients by offering business intelligence insights to achieve the goals.

Chapter 1. Big Data Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Big Data Market– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Big Data Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Big Data Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapt er 5. Big Data Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Big Data Market– By Component

6.1. Introduction/Key Findings

6.2 Software

6.3 Hardware

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2023-2030

Chapter 7. Big Data Market– By Application

7.1. Introduction/Key Findings

7.2 Data Discovery and Visualization

7.3 Advanced Analytics

7.4 Others (Data preparation and others)

7.5 Freight Rail Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. Big Data Market– By Vertical

8.1. Introduction/Key Findings

8.2 BFSI

8.3 Automotive

8.4 Telecom/Media

8.5 Healthcare

8.6 Life Sciences

8.7 Retail & Energy Sector

8.8 Government Sector

8.9 Freight Rail Y-O-Y Growth trend Analysis By Vertical

8.10 Absolute $ Opportunity Analysis By Vertical , 2023-2030

Chapter 9. Big Data Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2 By Component

9.1.3 By Application

9.1.4. By Vertical

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1. U.K.

9.2.2. Germany

9.2.3. France

9.2.4. Italy

9.2.5. Spain

9.2.6. Rest of Europe

9.2.2 By Component

9.2.3 By Application

9.2.4. By Vertical

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. Rest of Asia-Pacific

9.3.2 By Component

9.3.3. By Application

9.3.4. By Vertical

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.3.6. South America

9.4.1. By Country

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Colombia

9.4.4. Chile

9.4.5. Rest of South America

9.4.2 By Component

9.4.3. By Application

9.4.4. By Vertical

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.4.6. Middle East & Africa

9.5.1. By Country

9.5.1. United Arab Emirates (UAE)

9.5.2. Saudi Arabia

9.5.3. Qatar

9.5.4. Israel

9.5.5. South Africa

9.5.6. Nigeria

9.5.7. Kenya

9.5.8. Egypt

9.5.9. Rest of MEA

9.5.2. By Component

9.5.3. By Application

9.5.4. By Vertical

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Big Data Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Bureau Veritas SA

10.2 TÜV SÜD Group

10.3 SGS SA

10.4 DEKRA SE

10.5 Applus+

10.6 Eurofins Scientific

10.7 TV Rheinland Group

10.8 Intertek Group plc

10.9 Lloyd's Register Group Services Limited

10.10 Kiwa N.V

Download Sample

Choose License Type

2500

4250

5250

6900