Big Data and Data Engineering Services Market Size (2024-2030)

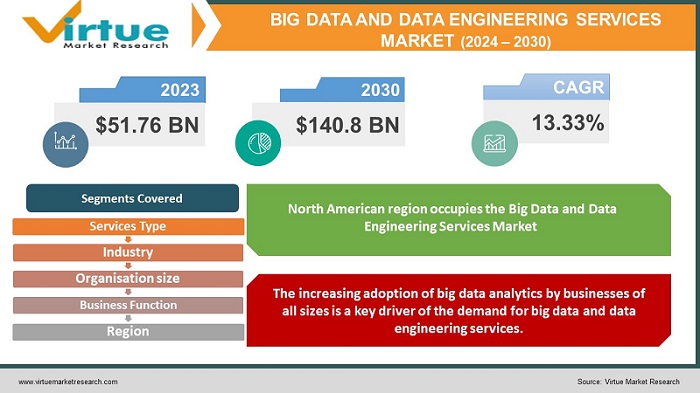

The Global Big Data and Data Engineering Services Market was valued at USD 51.76 billion and is projected to reach a market size of USD 140.8 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.33%.

The utilization of big data and data engineering services can greatly benefit businesses in many ways. It allows them to extract insights, from their data enabling the identification of product opportunities and markets streamlining business processes, and eliminating inefficiencies.

For instance, retailers can leverage data to analyze customer purchase records identify emerging trends, forecast demand, and optimize their marketing campaigns to reach a wider customer base. Financial service companies can utilize data to detect activities evaluate risks more accurately and develop innovative financial products that cater to a broader range of customers. In the healthcare industry, big data can be instrumental in conducting research enhancing patient care practices, and devising treatments that benefit a larger population. Similarly, manufacturing companies can harness data to optimize production processes enhance quality control measures, and reduce costs to stay competitive.

In summary, the integration of big data and data engineering services empowers businesses, with decision-making capabilities while fostering the development of products/services and improving overall operational efficiency.

Key Market Insights:

As per the Open Banking Implementation Entity (OBIE), there was an increase in API calls during the month of June 2019 reaching 66.7 million. It is required by P502 that banks develop APIs, which serve as means, for exchanging data sets between organizations facilitating banking transactions.

Danske Bank, being the bank, in Denmark, has a customer base exceeding 5 million individuals. The bank leverages its analytics to detect fraud and minimize instances of false positives. As a result of implementing a business analytics solution the bank successfully decreased positives by 60% while simultaneously enhancing true positives by 50%.

According to the US Bureau of Labor Statistics (BLS), there will be an increase, in job opportunities for data scientists between 2020 and 2030. The BLS also predicts that employment for database administrators and architects will experience, above-average growth during the period.

The bank reports that 70% of its programs have already been moved to the cloud. Additionally, it recently achieved a milestone by being the major Australian bank to transition its online business banking platform.

Big Data and Data Engineering Services Market Drivers:

The increasing adoption of big data analytics by businesses of all sizes is a key driver of the demand for big data and data engineering services.

For businesses to derive value from their data it is crucial to utilize data and data engineering services. Big data engineers play a role, in assisting businesses with tasks such, as gathering, storing, processing, and analyzing amounts of data. Additionally, they assist in designing and implementing customized data solutions tailored to meet the requirements of each business. The utilization of data and data engineering can greatly benefit businesses by enhancing their decision-making processes optimizing their operations and gaining an edge.

In the industry big data analytics are employed to comprehend customer behaviour optimize inventory management and tailor marketing campaigns. Similarly, financial services companies leverage data analytics to identify activities evaluate risks, and innovate new financial products. Healthcare professionals utilize data analytics to enhance care conduct clinical studies and advance treatment options. Manufacturing industries employ data analytics to streamline production procedures enhance quality control and minimize expenses. The growing acceptance of data analytics is expected to sustain the need, for data and data engineering services in the foreseeable future. Companies of all sizes are acknowledging the significance of data and allocating resources toward establishing the required infrastructure and expertise to extract valuable insights from their data, for improved decision-making.

Growing demand for cloud-based big data and data engineering services is propelling market growth.

Cloud-based big data and data engineering services are highly sought after because they offer benefits compared to, on-premises solutions. These advantages include the ability to easily scale up or down based on changing needs providing businesses of all sizes with flexibility. Additionally, cloud-based services allow businesses to choose features and services that align with their requirements helping them save costs by avoiding expenses. Moreover, opting for cloud-based solutions can be more cost-effective for businesses with budgets since they eliminate the need, for investing in and maintaining their hardware and software infrastructure.

Cloud-based big data and data engineering services offer advantages. Apart, from the mentioned benefits they also contribute to enhancing business agility speeding up innovation, and minimizing impact. The increasing demand for these services can be attributed to the multitude of advantages they provide compared to, on-premises solutions.

Big Data and Data Engineering Services Market Restraints and Challenges:

The market, for data and data engineering services is growing rapidly. It faces several challenges and limitations. One major hurdle is the scarcity of professionals who possess the expertise to effectively implement and manage big data solutions. This shortage of talent can make it challenging for businesses to find the resources they require to support their data initiatives. Another obstacle revolves around security and privacy concerns. Big data solutions often involve the collection and processing of amounts of information which raises apprehensions about unauthorized access and misuse. Businesses must take measures to safeguard their data and adhere to data privacy regulations.

Furthermore, implementing data solutions can be intricate and costly. This complexity can pose difficulties for medium enterprises seeking to embrace big data analytics. Additionally, big data solutions frequently entail processing information from sources, which may give rise to challenges, in maintaining high-quality data. Businesses must establish processes that ensure the integrity of their data before undertaking analysis.

Big Data and Data Engineering Services Market Opportunities:

Businesses can leverage data analytics to gain valuable insights, into their customers, operations, and markets. This valuable information can then be utilized to make decisions across aspects such as product development and marketing campaigns. Furthermore, big data analytics offers businesses the opportunity to identify areas where they can enhance efficiency and reduce costs.

Healthcare providers on the other hand can improve care and even develop groundbreaking treatments through the power of big data analytics. Lastly, manufacturing companies have the potential to optimize their production processes and enhance quality control with the aid of this technology.

BIG DATA AND DATA ENGINEERING SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.33% |

|

Segments Covered |

By Services Type, Industry, Organisation size, Business Function, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Accenture PLC, Genpact Inc., Cognizant Technology Solutions Corporation, Infosys Limited, Hexaware Technologies Inc., KPMG LLP, Capgemini SE, NTT Data Inc., Mphasis Limited, L&T Technology Services, Ernst & Young LLP, Latent view Analytics CorporationF |

Big Data and Data Engineering Services Market Segmentation:

Big Data and Data Engineering Services Market Segmentation: By Service Type

- Data modeling

- Data integration

- Data quality

- Analytics

In 2022, based on the service type, the Data integration segment accounted for the largest revenue share by almost 30% and has led the market. Analytics is experiencing growth and is currently the fastest-growing service type, with a compound annual growth rate (CAGR) exceeding 20%.

Data integration involves the merging of data from sources to create a comprehensive view. This process is crucial for businesses aiming to gain an understanding of their customers, operations, and markets. Although data integration can be intricate and demanding it is indispensable for businesses seeking to derive insights, from their data.

Analytics involves utilizing data to extract insights. Big data analytics is employed to detect trends, and patterns and forecast future outcomes enabling decision-making. The field of analytics is rapidly expanding, leading to a demand, for data analysts. To stay ahead businesses should make data and data engineering services a top priority particularly focusing on analytics. By leveraging data analytics to gain insights from their data businesses can enhance their decision-making processes, optimize operations and gain an edge, over competitors.

Big Data and Data Engineering Services Market Segmentation: By Business Function

- Marketing and sales

- Operations

- Human Resources (HR)

- Finance

In 2022, based on the business function, the Marketing and sales segment accounted for the largest revenue share by almost 30% and has led the market. The operations department is growing faster with a CAGR of 20%. Marketing and sales teams are utilizing data and data engineering services to gain insights, into customer behavior. This empowers them to enhance their marketing strategies and improve sales effectiveness. For example, marketing teams can efficiently divide customers into segments focus on markets, and develop marketing campaigns by leveraging the power of data. Similarly, sales teams can make use of data to identify leads assess prospects, and forecast customer attrition. Moreover, operations teams are tapping into the possibilities offered by data analytics and data engineering services to boost productivity while cutting down costs. They can analyze data to streamline manufacturing processes optimize inventory levels and improve supply chain management.

Big Data and Data Engineering Services Market Segmentation: By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

In 2022, based on the organization size, the Large Enterprises segment accounted for the largest revenue share by almost 70% and has led the market. medium sized businesses (SMEs) are experiencing a growth rate of, over 25% annually. Unlike corporations, SMEs are gradually adopting data and data engineering services. Due, to resources they are investing in the required infrastructure and expertise to enhance their operations and maintain a competitive edge.

Big Data and Data Engineering Services Market Segmentation: By Industry

- Banking, Financial Services, and Insurance (BFSI),

- Government,

- Healthcare and Life Sciences,

- Retail and eCommerce,

- Manufacturing,

- Media and telecom Others

In 2022, based on the Industry, the Banking, Financial Services, and Insurance (BFSI) segment accounted for the largest revenue share by almost 25% and has led the market. The retail and online shopping industries are growing rapidly with a growth rate of, over 20%. In the banking, financial services, and insurance (BFSI) industry companies are leveraging data and data engineering services to combat fraud evaluate risks, and foster innovation in their products. For example, banks depend on data to identify transactions and credit card scams. Insurance companies also leverage data to identify risks and develop insurance packages. Similarly, businesses in the e-commerce sectors employ data analysis and engineering services to gain insights into customer behavior optimize inventory management, and personalize marketing campaigns. Retailers analyze customer behavior patterns using data analytics to provide tailored product recommendations. Meanwhile, e-commerce organizations utilize data, for shipping processes that allow inventory control while reducing costs.

Big Data and Data Engineering Services Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2022, the North American region occupies the Big Data and Data Engineering Services Market with a revenue of 40%. The Asia Pacific region is currently witnessing growth with a compound annual growth rate (CAGR) surpassing 20%. When it comes to embracing data and data engineering services North America has taken the lead. Prominent companies such, as IBM, Amazon Web Services, and Microsoft Azure are based in this region. American businesses are renowned, for their utilization of data analytics.

COVID-19 Impact Analysis on the Global Big Data and Data Engineering Services Market:

The COVID-19 pandemic has had an impact, on the market for data and data engineering services. Businesses have reduced their demand, for these services as they focus on streamlining operations and cutting down on costs. However, the pandemic has also expedited the adoption of technologies and big data analytics across businesses of all sizes. Nowadays an increasing number of companies are leveraging data analytics to gain insights, into the impact of pandemics make decisions, and improve their overall operations. Additionally, there has been a shift towards cloud-based solutions for data and data engineering services, which offer scalability and cost-effectiveness compared to on-premises options. It is expected that the long-term effect of COVID-19 on the global market for big data and data engineering services will be positive. The pandemic has accelerated the implementation of data analytics and cloud-based solutions, in this field. Businesses that invest in these services will be well-positioned to thrive in a pandemic world.

Latest Trends/ Developments:

The future holds growth, for data analytics in the banking industry. As technology progresses consumers are using an increasing number of devices like smartphones to carry out transactions. This upward trend in device usage leads to a volume of transactions. Consequently, there is a pressing need, for improved methods of acquiring organizing integrating, and analyzing this expanding pool of data. Based on the analysis of government regulations, in regions it is evident that the level of focus from the government varies. European banks adopt measures compared to their Asian counterparts. To illustrate in Europe regulations have played a role in promoting banking. Examples of these regulations include the implementation of the Second Payment Services Directive (PSD2) and the Open Banking Regulations, by the UK Competition and Markets Authority (CMA).

In April 2020 Capgemini SE announced their acquisition of Advectas All a company specializing in data science and business intelligence based in Sweden. Capgemini integrated Advectas, into their Insights and Data business unit to meet the increasing demand for data analytics services from customers. Looking ahead Capgemini expects a growth rate of 4% by 2020. Plans to expand into the intelligence industry market. Moving to March 2020 Infosys Limited revealed that they have invested USD 4.5 million in Waterline Data Science, a US-based company using their innovation funds. Waterline Data Science offers software, for data discovery and governance empowering business analysts and data scientists with a self-service data catalog to enhance their understanding of information.

Key Players:

- Accenture PLC

- Genpact Inc.

- Cognizant Technology Solutions Corporation

- Infosys Limited

- Hexaware Technologies Inc.

- KPMG LLP

- Capgemini SE

- NTT Data Inc.

- Mphasis Limited

- L&T Technology Services

- Ernst & Young LLP

- Latent view Analytics CorporationF

In January 2023 DataStax, a company specializing in real-time AI acquired Kaskada, a machine learning company. The expertise of DataStax, in ML and data engineering enables businesses to adapt to evolving circumstances and develop features asynchronously. This empowers applications to make millions of predictions tailored to situations.

In November 2022 Accenture acquired by purchasing ALBERT Inc., a data Science Company based in Japan. This move allows Accenture to enhance its capabilities, in data and AI by bringing on board a team of data scientists. With these expanded resources Accenture aims to support clients in navigating the process of reinventing their businesses over the decade. Leveraging ALBERT data methodologies Accenture will assist organizations in managing this transformation.

Chapter 1. Global Big Data and Data Engineering Services Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Big Data and Data Engineering Services Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Big Data and Data Engineering Services Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Big Data and Data Engineering Services Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Big Data and Data Engineering Services Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Big Data and Data Engineering Services Market– By Service Type

6.1. Introduction/Key Findings

6.2. Data modeling

6.3. Data integration

6.4. Data quality

6.5. Analytics

6.6. Y-O-Y Growth trend Analysis By Service Type

6.7. Absolute $ Opportunity Analysis By Service Type , 2024-2030

Chapter 7. Global Big Data and Data Engineering Services Market– By Business Function

7.1. Introduction/Key Findings

7.2. Marketing and sales

7.3. Operations

7.4. Human Resources (HR)

7.5. Finance

7.6. Y-O-Y Growth trend Analysis By Business Function

7.7. Absolute $ Opportunity Analysis By Business Function , 2024-2030

Chapter 8. Global Big Data and Data Engineering Services Market– By Organization Size

8.1. Introduction/Key Findings

8.2. Large Enterprises

8.3. Small and Medium-sized Enterprises (SMEs)

8.4. Y-O-Y Growth trend Analysis Organization Size

8.5. Absolute $ Opportunity Analysis Organization Size , 2024-2030

Chapter 9. Global Big Data and Data Engineering Services Market– By Industry

9.1. Introduction/Key Findings

9.2. Banking, Financial Services, and Insurance (BFSI),

9.3. Government,

9.4. Healthcare and Life Sciences,

9.5. Retail and eCommerce,

9.6. Manufacturing,

9.7. Media and telecom Others

9.8. Y-O-Y Growth trend Analysis Industry

9.9. Absolute $ Opportunity Analysis Industry , 2024-2030

Chapter 10. Global Big Data and Data Engineering Services Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Service Type

10.1.3. By Business Function

10.1.4. By Industry

10.1.5. Organization Size

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Service Type

10.2.3. By Business Function

10.2.4. By Industry

10.2.5. Organization Size

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Service Type

10.3.3. By Business Function

10.3.4. By Industry

10.3.5. Organization Size

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Service Type

10.4.3. By Business Function

10.4.4. By Industry

10.4.5. Organization Size

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Service Type

10.5.3. By Business Function

10.5.4. By Industry

10.5.5. Organization Size

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Big Data and Data Engineering Services Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Accenture PLC

11.2. Genpact Inc.

11.3. Cognizant Technology Solutions Corporation

11.4. Infosys Limited

11.5. Hexaware Technologies Inc.

11.6. KPMG LLP

11.7. Capgemini SE

11.8. NTT Data Inc.

11.9. Mphasis Limited

11.10. L&T Technology Services

11.11. Ernst & Young LLP

11.12. Latent view Analytics CorporationF

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

According to the report published by Virtue Market Research in Global Big Data and Data Engineering Services Market was valued at USD 58.66 billion and is projected to reach a market size of USD 140.85 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.33 %.

The increasing adoption of big data analytics by businesses of all sizes is a key driver of the demand for big data and data engineering services, Growing demand for cloud-based big data and data engineering services are the Global Big Data and Data Engineering Services Market drivers

Based on Service type, the Global Big Data and Data Engineering Services Market is segmented into Data modeling, Data integration, Data quality, and Analytics

North America is the most dominant region for the Global Big Data and Data Engineering Services Market

Accenture PLC, Genpact Inc., Cognizant Technology Solutions Corporation, Infosys Limited, Hexaware Technologies Inc., and KPMG LLP are the key players operating in the Global Big Data and Data Engineering Services Market.