Big Carp Aquaculture Market Size (2024-2030)

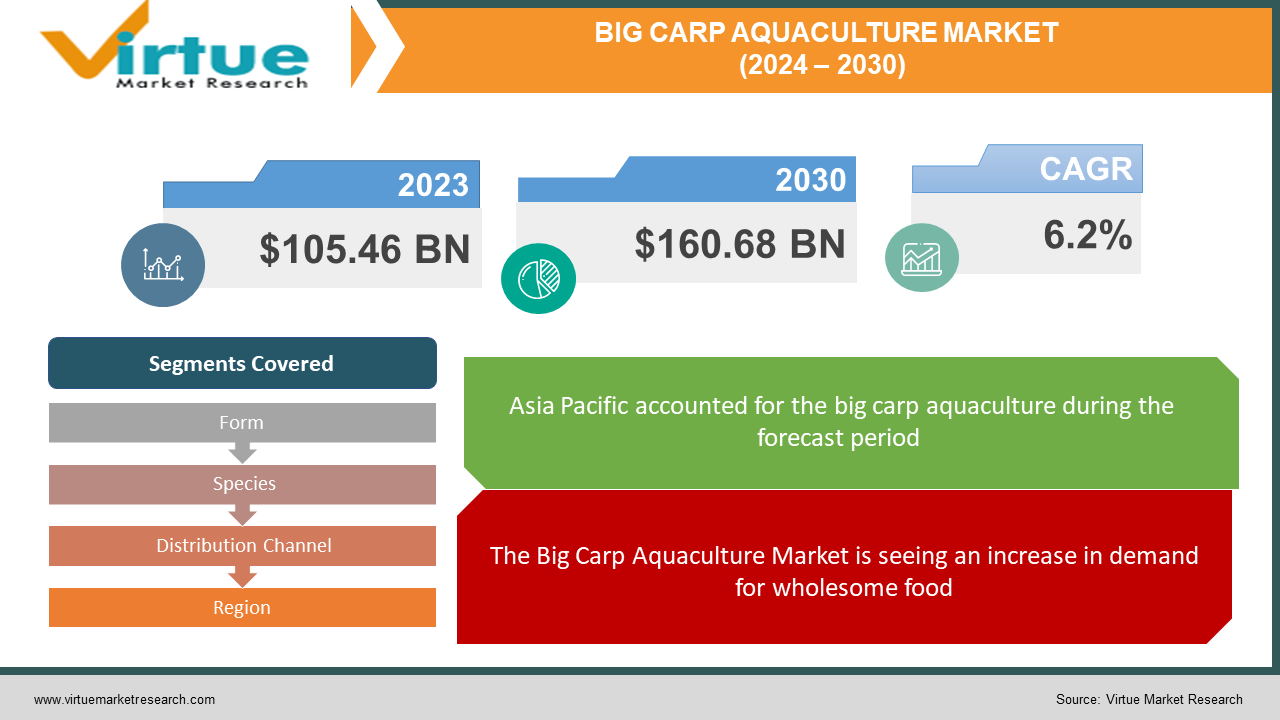

The Global Big Carp Aquaculture Market was valued at USD 105.46 Billion and is projected to reach a market size of USD 160.68 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.2%.

Fish that are commonly found in freshwater environments include carp, which are found in several varieties. Bighead, grass, and common carp are a few varieties. Omega-3 fatty acids, lean proteins, vitamins, and important minerals are abundant in carp fish, which is why they are considered to have many health benefits, including enhanced immunity, improved vision, and support for heart health. The expanding aquaculture sector and heightened fish trading activities are the main drivers of the global carp market. With millions of tons harvested annually, China is one of the world's top producers of carp. Large, scaleless heads, large mouths, and low-positioned eyes are characteristics of carp fish. They have the potential to reach notable dimensions, reaching lengths of 146 cm and weights of up to 40 kg.

Key Market Insights:

There are many players operating in various parts of the world in the fiercely competitive carp market. In order to meet the growing demand for carp, carp farming has gained popularity. Several nations have invested in these farms to increase production. Thailand, Indonesia, Vietnam, China, India, and Hungary are among the major carp-producing nations. According to a report from the US Department of Agriculture, the United States imported 1,470 metric tons of carp in North America last year, a 9% drop from the year before. China is where most of these imported carp came from.

Global Big Carp Aquaculture Market Drivers:

The Big Carp Aquaculture Market is seeing an increase in demand for wholesome food.

People are choosing low-calorie, high-protein diets, which is driving growth in the market for products made from carp fish food. Fish is low in fat, high in protein, and rich in vital nutrients like iron, vitamins, omega-3 fatty acids, and B-12 that are good for building muscle and general health. The Food and Agriculture Organization (FAO) reports that the world's consumption of fish meal has been rising more quickly than the rate of population expansion. In the upcoming years, this trend is anticipated to support the market's ongoing expansion.

The Big Carp Aquaculture Market is being driven by the rise in technological advancements.

There is now more demand for carp fish products due to increased production of fish products globally as well as improvements in cold chain, transportation, and distribution systems. Two of the main factors propelling the global market are the expansion of the aquaculture sector and the rise in fish trading activities. Moreover, during the anticipated period, there is anticipated to be a rise in demand for packaged and processed food items.

Big Carp Aquaculture Market Challenges and Restraints:

Due to their cold blood, carp are affected by the water's temperature, which has an impact on their metabolism and ability to reproduce. Their ability to breathe and produce energy is also greatly influenced by the oxygen content of the water. The chemical equilibrium and biological processes in their environments can be impacted by variations in the pH of water, which indicates how acidic or alkaline it is. Water balance in carp can be affected by salinity, or the amount of salt in the water. Conditions for aquaculture are impacted by precipitation patterns, which affect the quantity and quality of water in lakes and ponds used for carp farming.

Big Carp Aquaculture Market Opportunities:

Carp farmers have a fantastic opportunity to benefit the environment and draw in more business. They can increase the appeal of their carp by implementing eco-friendly techniques like employing renewable energy and effective waste management. Farmers should look into organic and sustainable feeding options for carp, as customers enjoy eating them. Furthermore, ongoing research in carp farming can result in improved techniques, guaranteeing healthier fish and a more resilient sector as a whole. It's all about growing carp in more intelligent ways, using high-quality food, and being ecologically conscious.

BIG CARP AQUACULTURE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Form, Species, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Priory Fishery Ltd, Hampshire Carp Hatcheries, Quintons Orchard Fish Farm, VS Fisheries, Anhui Fuhuang Sungem Foodstuff Group Co. Ltd., Baiyang Investment Group Inc., Coarse Fish UK, Greenwater Fish Farm, Dahu Aquaculture, Zhangzidao Group |

Global Big Carp Aquaculture Market Segmentation: By Form

-

Frozen

-

Canned

The frozen category accounted for over half of the global carp market revenue in 2022, and it is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. Because there is a growing global demand for packaged and processed seafood, the industry has been expanding. Frozen carp is becoming more and more popular as consumers look for fish that is high in protein. The market is anticipated to expand over the course of the forecast period as a result of the growing working population worldwide.

Over the course of the forecast period, the canned segment is expected to grow at the fastest rate. The main reason for this growth is that people are choosing to eat more carp seafood because of its many health advantages, which include a decreased risk of chronic illness. This market segment is growing quickly because of the rising demand for processed seafood due to changing lifestyles and busy schedules, such as canned carp.

Global Big Carp Aquaculture Market Segmentation: By Species

-

Grass

-

Silver

-

Common

-

Bighead

-

Catla

The grass carp industry accounted for more than 20% of the global carp market's revenue in 2022. Because more people are becoming aware of the health benefits of eating fish, the market is anticipated to expand during the forecast period. The belief that fish products are healthier and that the number of chronic illnesses may be declining is driving up demand for fish products. The grass carp market is expanding thanks in part to emerging nations like China, Indonesia, and India.

It is predicted that the common carp industry will grow at the quickest rate. The availability of safe and nutrient-rich fish is driving market expansion and satisfying consumer demand for premium protein sources. Silver carp consumption is rising as a result of the aquaculture industry's ongoing expansion globally, which is also propelling market expansion.

Global Big Carp Aquaculture Market Segmentation: By Distribution Channel

-

Hypermarkets and Supermarkets

-

Convenience Store Online

-

Others

Supermarkets and hypermarkets held more than 40% of the global carp market in 2022, making them important players in the industry. Carp product suppliers use word-of-mouth marketing and advertising to drive sales through conventional retail channels like supermarkets and hypermarkets. Because they can inspect the products in person and determine their quality, customers prefer to shop at these establishments for seafood. Supermarkets and hypermarkets are predicted to continue to rule the retail landscape in the years to come thanks to their globally established distribution networks.

Over the course of the forecast period, the carp market's online segment is expected to grow at a rapid pace. A significant portion of the e-commerce sector has grown as a result of consumers' growing reliance on the Internet for dining and other shopping needs. A lot of carp suppliers have websites where customers can purchase their goods. Online sales are predicted to increase in the market during the next few years.

Global Big Carp Aquaculture Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Asia Pacific leads the world carp market, contributing nearly 60% of the total due to high consumption in nations like Indonesia, China, and India. A growing emphasis on healthier lifestyles and increased disposable income, along with a growing demand for seafood high in protein, have all contributed to an increase in carp production, particularly in China and India. Due to growing awareness of the health benefits and concerns about sustainability, the carp market in South America is growing at the fastest rate. Health factors like aging skin, strong bones, and a high incidence of cardiovascular diseases also contribute to the region's increased demand for fish products.

COVID-19 Impact on the Global Big Carp Aquaculture Market:

Transportation was disrupted and fish food product deliveries were temporarily halted by the COVID-19 pandemic. Regulations aimed at stopping the virus's spread had an impact on the fishing and aquaculture supply chains. A rise in live fish populations in aquaculture due to the excess carp production that was unable to be sold raised the risk of fish mortality and increased feeding expenses on a global scale. Positively, market participants stand to gain from the pandemic's increased demand for fish products, which is projected to fuel the industry's projected growth in the upcoming years.

Latest Trend/Development:

The use of environmentally friendly carp-raising techniques by more farmers is a major trend in the carp market. There is a growing demand for sustainably raised carp due to concerns about the environmental impact of fish farming. Farmers are implementing practices such as cutting back on pollution and waste, feeding fish organic food, and better managing water resources. Consumers of carp are also conscious of these environmentally friendly methods, and they have a preference for ethically farmed carp.

Key Players:

-

Priory Fishery Ltd

-

Hampshire Carp Hatcheries

-

Quintons Orchard Fish Farm

-

VS Fisheries

-

Anhui Fuhuang Sungem Foodstuff Group Co. Ltd.

-

Baiyang Investment Group Inc.

-

Coarse Fish UK

-

Greenwater Fish Farm

-

Dahu Aquaculture

-

Zhangzidao Group

Market News:

-

A Brazilian propolis manufacturer and a Japanese pharmaceutical company named Takeda teamed up in March 2023 to develop new natural health products.

-

A Brazilian propolis manufacturer and a Spanish food company called Florette teamed up in February 2023 to create a new range of propolis-infused functional foods.

-

A new propolis supplement called Purica, made by Canadian health product manufacturer Purica, was released in January 2023 with the intention of bolstering the immune system.

-

To broaden its selection of natural products, a Greek pharmaceutical company named Elpen purchased a majority interest in Ouro Fino, a Brazilian propolis manufacturer, in August 2022.

-

An Italian cosmetics company called Diego dalla Palma debuted a new skincare range in June 2022 that contains propolis for anti-aging properties.

Chapter 1. Big Carp Aquaculture Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Big Carp Aquaculture Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Big Carp Aquaculture Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Big Carp Aquaculture Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Big Carp Aquaculture Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Big Carp Aquaculture Market – By Form

6.1 Introduction/Key Findings

6.2 Frozen

6.3 Canned

6.4 Y-O-Y Growth trend Analysis By Form

6.5 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 7. Big Carp Aquaculture Market – By Species

7.1 Introduction/Key Findings

7.2 Grass

7.3 Silver

7.4 Common

7.5 Bighead

7.6 Catla

7.7 Y-O-Y Growth trend Analysis By Species

7.8 Absolute $ Opportunity Analysis By Species, 2024-2030

Chapter 8. Big Carp Aquaculture Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Hypermarkets and Supermarkets

8.3 Convenience Store Online

8.4 Others

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Big Carp Aquaculture Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Form

9.1.3 By Species

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Form

9.2.3 By Species

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Form

9.3.3 By Species

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Form

9.4.3 By Species

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Form

9.5.3 By Species

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Big Carp Aquaculture Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Priory Fishery Ltd

10.2 Hampshire Carp Hatcheries

10.3 Quintons Orchard Fish Farm

10.4 VS Fisheries

10.5 Anhui Fuhuang Sungem Foodstuff Group Co. Ltd.

10.6 Baiyang Investment Group Inc.

10.7 Coarse Fish UK

10.8 Greenwater Fish Farm

10.9 Dahu Aquaculture

10.10 Zhangzidao Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The term "carp" refers to a species of greenish-brown fish from the Cyprinidae family that is most frequently seen in freshwater habitats.

The Global Big Carp Aquaculture Market was valued at USD 105.46 Billion and is projected to reach a market size of USD 160.68 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.2%.

The demand for nutritious food and the increase in technological advancements are the driving factors of the Big Carp Aquaculture Market.

Environmental factors can hinder the growth of the big carp aquaculture market.

The Canned, Common, Online sector, and South America segments are the fastest growing in the Big Carp Aquaculture Market.