Beverage Packaging Market Size (2024 – 2030)

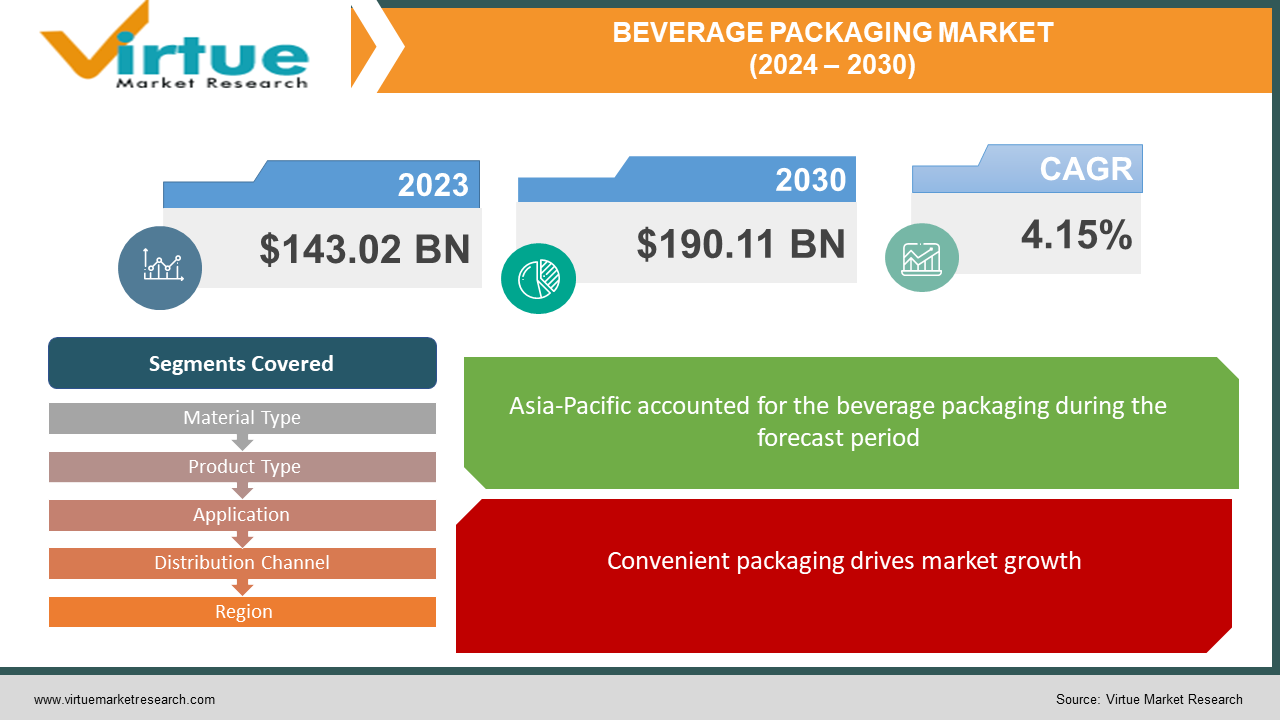

The Beverage Packaging Market was valued at USD 143.02 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 190.11 billion by 2030, growing at a CAGR of 4.15%.

Beverage packaging is crafted specifically for containing various liquids including carbonated soft drinks, dairy products, water, functional beverages, alcoholic drinks, and similar items. It encompasses materials like plastic, glass, paperboard, metals, and other suitable substances. Its primary functions include preserving the freshness of the contents and extending their shelf life. Common varieties of beverage packaging comprise cans, jars, pouches, bottles, and similar alternatives, each offered in a variety of sizes and shapes tailored to suit the requirements of the specific beverage being packaged.

Key Market Insights:

Over recent years, the beverage industry has acknowledged the pivotal role of packaging in shaping consumer preferences. Brands have expanded their product ranges to cater to diverse consumer segments, with packaging design emerging as a key element in both attracting and retaining customers.

Efficient packaging systems have become indispensable for safeguarding products across the supply chain, ensuring the maintenance of quality, freshness, taste, and visual appeal while mitigating the risks associated with recalls and potential hazards.

The surge in evolving consumer tastes has heightened the importance of packaging materials aimed at bolstering attributes such as durability, aroma retention, thermal insulation, sealing effectiveness, and moisture resistance. This trend stands as a significant driver propelling the growth of the beverage packaging market.

Factors fueling market expansion include the rising demand for smaller packaging formats, the increased preference for flexible bags and pouches, and the integration of active and intelligent systems within beverage packaging solutions. The utilization of packaging to prolong shelf life, coupled with the adoption of various materials—such as glass, polymers, metals, and paperboards, either individually or in combination—aligned with the beverage's chemical composition and value, significantly influences the beverage packaging market dynamics.

Furthermore, demographic growth, shifts in lifestyle patterns, the quest for enhanced and convenient packaging technologies, a preference for premium offerings, and rising disposable incomes collectively contribute to the positive trajectory of the beverage packaging market.

Beverage Packaging Market Drivers:

Convenient packaging drives market growth.

The enhancement of lifestyles among populations, particularly in developing economies, alongside the rise in per capita incomes, serves as a significant catalyst for the consumption of packaged beverages. Consequently, this surge in demand drives the need for advanced and convenient packaging technologies within the beverage industry.

The convenience aspect inherent in beverage packaging plays a pivotal role in minimizing wastage during dispensing, offering resealable options, ensuring portability, and reducing the weight of containers, all of which contribute to cost savings and subsequently stimulate market growth.

Additionally, the uptick in per capita incomes and the deterioration of tap water quality, predominantly in urban areas, have spurred a global increase in the consumption of bottled or packaged water. The bottled water market stands out as one of the fastest-growing sectors, consequently driving the demand for packaging required in its manufacturing processes.

Furthermore, the widespread adoption of automation within packaged beverage manufacturing has not only enhanced production quality but also reduced production times. These combined factors contribute significantly to the overall growth trajectory of the beverage packaging market.

Beverage Packaging Market Restraints and Challenges:

For the past decade, the size of beverage packaging has been subject to a divisive trend influenced by numerous factors, notably escalating health concerns. The overconsumption of beverages like aerated drinks has been linked to adverse health effects, including disrupting sugar balance in the bloodstream. This imbalance can impair the liver's ability to process sugar intake, consequently heightening the risk of developing Type 2 diabetes.

In response to these health concerns, beverage manufacturers face mounting pressure to downsize their packaging options. This initiative aims to provide consumers with more choices and empower them to exert greater control over their consumption habits. Furthermore, many manufacturers have committed to reducing the calorie content of their products, further driving the demand for smaller packaging sizes.

Beverage Packaging Market Opportunities:

The surge in ready-to-drink (RTD) beverage consumption, driven by the demands of busy consumer lifestyles and sedentary habits, is significantly boosting the beverage packaging market in Japan. Moreover, heightened consumer awareness regarding gut-related disorders, such as Gastroesophageal Reflux Disease (GERD), ulcers, and gastroenteritis, has spurred increased consumption of functional drinks, serving as a primary growth driver for the market.

The beverage industry in Japan is renowned for its innovation and agility in responding to evolving consumer preferences and trends, particularly the shift towards healthier, fresher, and minimally processed foods with shorter storage times. Innovation, including advancements in processing, separation, and packaging technologies, stands as a crucial factor in the success of beverage packaging in the Asian market.

Anticipated market growth is expected to stem from various factors, including product expansions, launches, upgrades, and sustainability initiatives. Notably, there has been significant adoption of novel packaging techniques. Emerging beverage packaging trends focus on the structural modification of packaging materials and the development of new active systems capable of interacting with the product or its environment, enhancing customer acceptability, ensuring security, and improving the preservation of various beverages.

BEVERAGE PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.15% |

|

Segments Covered |

By Material Type, Product Type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amcor plc, Ball Corporation, Mondi plc, Crown Holdings, Inc, Intrapac International Corporation, Orora Limited, Smurfit Kappa Group plc, SIG Combibloc Group AG, Tetra Laval International S.A., Stora Enso Oyj, Berry Global Inc. |

Beverage Packaging Market Segmentation: By Material Type

-

Plastic

-

Metal

-

Glass

-

Paperboard

The plastic material segment currently holds a dominant position in the market, while paperboard and glass segments are experiencing the most rapid growth. This surge in demand for paperboard and glass materials can be attributed to increasing environmental consciousness among consumers, as plastic is widely recognized as non-eco-friendly and detrimental to nature. Consequently, there is a notable shift towards paperboard and glass material types as more environmentally sustainable alternatives.

Beverage Packaging Market Segmentation: By Product Type

-

Bottles

-

Cans

-

Pouches

-

Cartons

-

Beer Kegs

Cartons stand as a cornerstone in beverage packaging, maintaining a robust presence in the global market, and projected to capture a significant share therein. Renowned for their ability to uphold the freshness and quality of beverages, especially those necessitating prolonged shelf life, cartons play an indispensable role in the industry. Their reliability and safety during transportation further reinforce their status as a preferred packaging choice among consumers.

The burgeoning demand for dairy beverages across diverse regions, alongside the widespread consumption of carton milk, serves as a driving force behind the escalating demand for cartons. The liquid beverage packaging market is poised for continued growth in the coming years, with a focus on environmentally friendly and lightweight packaging solutions.

Beverage Packaging Market Segmentation: By Application

-

Carbonated Drinks

-

Alcoholic Beverages

-

Bottled Water

-

Milk

-

Fruit & Vegetable Juices

-

Energy Drinks

-

Plant-based Drinks

Bottled water is expected to emerge as a key driver in propelling the beverage packaging market forward. The beverage industry has consistently demonstrated a commitment to expansion and technological advancements, with significant investments in modernization. Packaging water presents a sophisticated technical challenge within the industry, and the packaged and bottled water packaging sectors are witnessing rapid growth in response to increasing public awareness regarding the importance of access to pure drinking water.

Bottled water holds a prominent position among the most consumed beverages, primarily due to its inherent convenience. Moreover, bottled water packaging offers suitability for long-distance transportation, making it a preferred choice for consumers. The traditional method of boiling water at home is perceived as time-consuming and energy-inefficient, further augmenting the appeal of bottled water packaging solutions. In emerging markets, bottled water has transcended its utility to become symbolic of a healthy lifestyle, driving further demand and contributing significantly to the growth of the bottled water packaging market.

Beverage Packaging Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online Retail

-

Others

Supermarkets and hypermarkets hold a dominant position within the market, serving as key pillars of distribution and sales channels. However, convenience stores have emerged as the fastest-growing segment in the market, characterized by their accessibility and convenience for consumers seeking quick purchases. This growth trend underscores the evolving consumer preferences towards convenience-oriented shopping experiences, driving increased market share for convenience stores within the beverage packaging sector.

Beverage Packaging Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region is poised to witness the highest growth in the beverage packaging market, presenting significant development opportunities, particularly in key countries within the region. India, in particular, has experienced notable growth in beverage packaging in recent years, driven by rapid shifts in packaging trends across the country.

China's packaging industry has demonstrated steady and rapid growth, fueled by the country's expanding economy and a burgeoning middle class with increased purchasing power. The demand for beverage packaging in China has surged alongside considerable growth in the beverage market. While each beverage category presents unique challenges and opportunities, emerging trends in Chinese consumer lifestyles are shaping the market landscape.

In Canada, consumers are displaying a notable preference for non-alcoholic, healthy beverage options featuring reduced sugar content and improved nutritional profiles. This demand aligns with global trends toward health-conscious choices, emphasizing convenience and on-the-go consumption.

The growing popularity of bio-based alternatives and environmentally friendly packaging options is reshaping the Canadian beverage packaging landscape, reducing reliance on petroleum-based products and further propelling the market growth.

COVID-19 Pandemic: Impact Analysis

The outbreak of COVID-19 has precipitated significant shifts in consumer behavior, with heightened concerns surrounding product hygiene and sustainability. As buyers become increasingly mindful of these factors, adapting to their evolving needs and maintaining a consumer-centric approach will be imperative throughout the duration of this crisis. It is anticipated that consumer behavior will continue to evolve over the forecast period as the market adjusts to the prevailing circumstances. Consequently, the outlook for post-COVID-19 beverage packaging appears promising in terms of demand, with continued emphasis on addressing evolving consumer preferences and priorities.

Latest Trends/ Developments:

-

In June 2022, Packamama introduced eco-flat bottles in Australia, manufactured locally from recycled PET sourced within Australia. The production of these bottles is carried out by Visy, a leading packaging company based in Melbourne.

-

In September 2022, Ball Corporation teamed up with Boomerang, a developer of water bottling technology, to offer refillable aluminum bottles. Ball Corporation will supply aluminum bottles for the Boomerang Bottling System, aimed at meeting the demand for sustainable beverage packaging in various locations such as resorts, cruise ships, and campuses. The collaboration is focused on reducing waste and carbon emissions associated with the production and transportation of conventional bottles.

-

In September 2022, Ardagh Glass Packaging Europe partnered with B&B Studio and Belvoir Farm to design a new glass bottle for Belvoir Farm's sophisticated non-alcoholic Botanical Sodas. The innovative design features a fully recyclable 500ml flint glass bottle comprising 45% recycled glass, with a reduced weight of only 380g.

-

In September 2022, Stora Enso and Tetra Pak joined forces to launch a collaborative initiative aimed at accelerating beverage carton recycling in the Benelux region. This initiative seeks to promote circular paper-based packaging solutions through the establishment of a new recycling facility.

Key Players:

These are the top 10 players in the Beverage Packaging Market: -

-

Amcor plc, Ball Corporation

-

Mondi plc

-

Crown Holdings, Inc

-

Intrapac International Corporation

-

Orora Limited

-

Smurfit Kappa Group plc

-

SIG Combibloc Group AG

-

Tetra Laval International S.A.

-

Stora Enso Oyj

-

Berry Global Inc.

Chapter 1. Beverage Packaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Beverage Packaging Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Beverage Packaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Beverage Packaging Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Beverage Packaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Beverage Packaging Market – By Material Type

6.1 Introduction/Key Findings

6.2 Plastic

6.3 Metal

6.4 Glass

6.5 Paperboard

6.6 Y-O-Y Growth trend Analysis By Material Type

6.7 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 7. Beverage Packaging Market – By Application

7.1 Introduction/Key Findings

7.2 Carbonated Drinks

7.3 Alcoholic Beverages

7.4 Bottled Water

7.5 Milk

7.6 Fruit & Vegetable Juices

7.7 Energy Drinks

7.8 Plant-based Drinks

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Beverage Packaging Market – By Product Type

8.1 Introduction/Key Findings

8.2 Bottles

8.3 Cans

8.4 Pouches

8.5 Cartons

8.6 Beer Kegs

8.7 Y-O-Y Growth trend Analysis By Product Type

8.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 9. Beverage Packaging Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Supermarkets and Hypermarkets

9.3 Convenience Stores

9.4 Online Retail

9.5 Others

9.6 Y-O-Y Growth trend Analysis By Distribution Channel

9.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 10. Beverage Packaging Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Material Type

10.1.2.1 By Application

10.1.3 By Product Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Material Type

10.2.3 By Application

10.2.4 By Product Type

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Material Type

10.3.3 By Application

10.3.4 By Product Type

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Material Type

10.4.3 By Application

10.4.4 By Product Type

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Material Type

10.5.3 By Application

10.5.4 By Product Type

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Beverage Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Amcor plc, Ball Corporation

11.2 Mondi plc

11.3 Crown Holdings, Inc

11.4 Intrapac International Corporation

11.5 Orora Limited

11.6 Smurfit Kappa Group plc

11.7 SIG Combibloc Group AG

11.8 Tetra Laval International S.A.

11.9 Stora Enso Oyj

11.10 Berry Global Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The beverage industry has acknowledged the pivotal role of packaging in shaping consumer preferences. Brands have expanded their product ranges to cater to diverse consumer segments, with packaging design emerging as a key element in both attracting and retaining customers.

The top players operating in the Beverage Packaging Market are - Amcor plc, Ball Corporation, Mondi plc, Crown Holdings, Inc., Intrapac International Corporation, Orora Limited, Smurfit Kappa Group plc, SIG Combibloc Group AG, Tetra Laval International S.A., Stora Enso Oyj, Berry Global Inc.

The outbreak of COVID-19 has precipitated significant shifts in consumer behavior, with heightened concerns surrounding product hygiene and sustainability.

The surge in ready-to-drink (RTD) beverage consumption, driven by the demands of busy consumer lifestyles and sedentary habits, is significantly boosting the beverage packaging market.

The Asia-Pacific region is poised to witness the highest growth in the beverage packaging market, presenting significant development opportunities, particularly in key countries within the region.