Beta-Glucan Market Size (2025 – 2030)

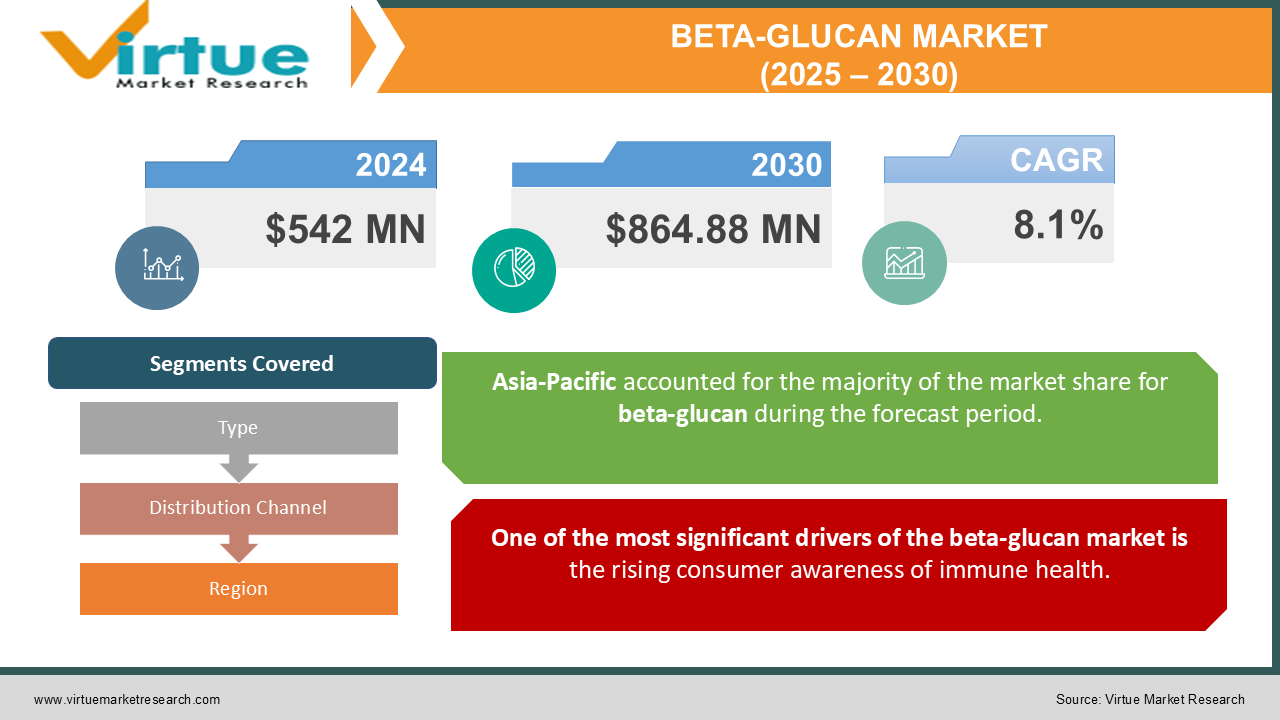

The Beta-Glucan Market was valued at USD 542 Million in 2024 and is projected to reach a market size of USD 864.88 Million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.1%.

Beta-glucans, a group of naturally occurring polysaccharides found in sources such as cereals, yeast, bacteria, and fungi, have become a cornerstone of innovation in the global health and wellness industry. Their bioactive properties, including immune modulation, cholesterol reduction, and gut health benefits, are propelling their adoption across sectors such as pharmaceuticals, nutraceuticals, functional foods, and personal care. Beta-glucans have cemented their position as a critical ingredient due to their potential to address contemporary health challenges, such as lifestyle-related diseases and immune system vulnerabilities. The demand for beta-glucans is surging in tandem with heightened consumer awareness regarding preventative healthcare.

Key Market Insights:

-

Oat-derived beta-glucans accounted for 45% of the total market revenue in 2023. Yeast-derived beta-glucans saw a 13% increase in demand compared to the previous year.

-

The pharmaceutical application of beta-glucans contributed $148 million to the market.

-

Over 68% of functional foods launched in 2023 contained beta-glucans. The use of beta-glucans in personal care grew by 9% in 2023. Beta-glucan-based dietary supplements represented 25% of the overall market volume.

-

Over 200 new product formulations containing beta-glucans were introduced in 2023. Sales of beta-glucan-fortified beverages grew by 11% in 2023.

-

40% of global beta-glucan production came from Europe in 2023.

-

Consumer awareness campaigns about beta-glucans increased by 27% in 2023. Beta-glucans were included in 15% of the immune-support products launched globally.

Key Market Drivers:

One of the most significant drivers of the beta-glucan market is the rising consumer awareness of immune health.

With the global population increasingly focusing on preventative healthcare, particularly in the wake of the COVID-19 pandemic, beta-glucans have emerged as a critical ingredient in the health and wellness landscape. Known for their ability to modulate the immune system, beta-glucans are widely sought after in dietary supplements, functional foods, and beverages. Beta-glucans activate macrophages and other immune cells, helping the body defend against infections and illnesses. This property has become particularly important as individuals look to boost their natural defenses against viruses, bacteria, and environmental stressors. The nutraceuticals industry has responded by launching a wide range of immune-boosting products that prominently feature beta-glucans, further driving demand. Additionally, the growing elderly population, which is more susceptible to immune-related challenges, is fueling the need for effective, natural solutions. Beta-glucans are increasingly included in supplements targeting this demographic, as they help reduce susceptibility to infections while promoting overall health. Manufacturers are also promoting the inclusion of beta-glucans in food products such as cereals, baked goods, and dairy alternatives, making immune-boosting benefits accessible to a broader audience. The post-pandemic consumer shift toward holistic health solutions has solidified beta-glucans' position as a go-to ingredient. E-commerce platforms, which have become a preferred channel for purchasing health products, are helping amplify their visibility. The rising popularity of clean-label, natural, and plant-based products is another complementary trend driving the adoption of beta-glucans, particularly those derived from oats and mushrooms.

The global surge in chronic lifestyle diseases, such as cardiovascular conditions, diabetes, and obesity, is another critical driver for the beta-glucan market.

These illnesses are closely linked to modern dietary habits, sedentary lifestyles, and stress, and they represent a significant burden on healthcare systems worldwide. Beta-glucans, with their well-documented health benefits, offer a natural and effective solution to combat these conditions. One of the primary mechanisms through which beta-glucans contribute to managing chronic diseases is their ability to lower cholesterol levels. Beta-glucans form a viscous gel in the digestive tract, which binds to bile acids and prevents cholesterol reabsorption. This reduces LDL (bad cholesterol) levels, which is essential for cardiovascular health. Recognized by health authorities like the FDA and EFSA, this cholesterol-lowering property has made beta-glucans a staple ingredient in heart-health products, particularly in oat-based functional foods. Beta-glucans also play a role in regulating blood sugar levels, making them highly beneficial for individuals with diabetes or at risk of developing the condition. By slowing glucose absorption, beta-glucans help maintain stable blood sugar levels, reducing the risk of insulin resistance. With diabetes becoming a global epidemic, these benefits are driving the incorporation of beta-glucans into specialized food products and supplements targeting glycemic control. Furthermore, beta-glucans support gut health, which has been increasingly linked to overall wellness and disease prevention. By acting as prebiotics, beta-glucans foster the growth of beneficial gut bacteria, which play a critical role in digestion, immunity, and even mental health. This multifaceted functionality has positioned beta-glucans as a versatile ingredient in the fight against chronic diseases, creating strong market demand across various segments.

Market Restraints and Challenges:

Despite the robust growth, the beta-glucan market faces several significant challenges. One of the primary barriers is the high cost of extraction and production, particularly for high-purity beta-glucans used in pharmaceuticals and premium products. The complexity of the extraction process and the need for specialized equipment limit scalability, which can hinder the market's growth potential. Additionally, while consumer awareness of beta-glucans is increasing, it remains relatively low in developing markets, where demand for functional ingredients has not yet reached its full potential. This poses a challenge for manufacturers seeking to expand their geographical footprint. Another challenge lies in regulatory hurdles. Different countries impose varying standards on the use and labeling of beta-glucans, which complicates market entry and product approval. Ensuring that beta-glucans meet stringent safety and efficacy requirements is both time-consuming and costly. Furthermore, competition from alternative functional ingredients, such as probiotics and omega-3s, can dilute market growth. These alternatives often have greater consumer awareness and established markets, making it essential for beta-glucan manufacturers to differentiate their products effectively.

Market Opportunities:

The beta-glucan market is ripe with opportunities, particularly in the areas of personalized nutrition and preventive healthcare. With consumers increasingly focusing on tailor-made health solutions, beta-glucans have the potential to become a key ingredient in customized dietary plans targeting specific health concerns such as immunity, gut health, and metabolic disorders. Another opportunity lies in the pet food industry, where beta-glucans are being integrated into premium formulations to support the immune systems of companion animals. This niche but growing sector offers significant untapped potential. The development of sustainable and cost-efficient production methods also presents an opportunity for the market. Innovations in biotechnology and fermentation processes can reduce production costs and environmental impact, making beta-glucans more accessible to a broader range of manufacturers and consumers. Additionally, the increasing penetration of e-commerce provides a platform for smaller brands to reach global audiences, further expanding the market’s reach. Collaborations with research institutions to explore novel applications, such as in cancer immunotherapy and advanced skincare formulations, can also unlock new revenue streams for the market.

BETA-GLUCAN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.1% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Incorporated, Kerry Group plc, Koninklijke DSM N.V., Tate & Lyle PLC, Lantmännen, Lesaffre, Associated British Foods plc, Biothera,Garuda International, Inc., Super Beta Glucan Inc., Ceapro Inc., Angel Yeast Co., Ltd., AIT Ingredients, Orffa International Holding B.V., ImmunoMedic, Inc. |

Beta-Glucan Market Segmentation: by Type

-

Oat-derived Beta-Glucans

-

Yeast-derived Beta-Glucans

-

Barley-derived Beta-Glucans

-

Mushroom-derived Beta-Glucans

Yeast-derived beta-glucans are witnessing rapid growth due to their superior immunomodulatory properties and increasing adoption in pharmaceuticals and dietary supplements.

Oat-derived beta-glucans remain the most dominant type, accounting for a significant share of the market due to their well-documented cardiovascular benefits and widespread use in functional foods and beverages.

Beta-Glucan Market Segmentation: by Distribution Channel

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Online Retail

-

Pharmacies and Drugstores

Online retail is the fastest-growing channel, driven by the convenience of e-commerce platforms and the rising popularity of health-focused products sold through digital marketplaces.

Supermarkets and hypermarkets hold the largest share, as they provide direct access to consumers and allow for on-the-spot purchases of functional foods and supplements.

Beta-Glucan Market Segmentation: by Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Europe leads the market, owing to high consumer awareness, robust demand for functional foods, and favorable regulatory support for health-boosting ingredients.

Asia-Pacific is the fastest-growing region, driven by increasing health consciousness, rising disposable incomes, and a burgeoning nutraceuticals industry.

COVID-19 Impact Analysis:

The COVID-19 pandemic significantly impacted the beta-glucan market, amplifying its importance as a health-boosting ingredient. With immunity becoming a primary consumer concern, demand for beta-glucans surged, particularly in dietary supplements and functional foods. The pandemic also accelerated the shift toward online retail, as lockdowns and social distancing measures pushed consumers to shop for health products through e-commerce platforms. However, supply chain disruptions posed challenges, leading to increased production costs and delayed deliveries.

Latest Trends and Developments:

The beta-glucan market is evolving with notable trends such as the rise of personalized nutrition and the incorporation of beta-glucans into plant-based and vegan products. Manufacturers are leveraging advanced extraction technologies to improve yield and purity, catering to the demand for high-quality formulations. Sustainability has also become a critical focus, with efforts to source beta-glucans from renewable and eco-friendly materials gaining traction. Innovations in beta-glucan delivery systems, such as encapsulated forms and combination products, are also driving market growth by enhancing bioavailability and consumer convenience.

Key Players in the Market:

-

Cargill, Incorporated

-

Kerry Group plc

-

Koninklijke DSM N.V.

-

Tate & Lyle PLC

-

Lantmännen

-

Lesaffre

-

Associated British Foods plc

-

Biothera

-

Garuda International, Inc.

-

Super Beta Glucan Inc.

-

Ceapro Inc.

-

Angel Yeast Co., Ltd.

-

AIT Ingredients

-

Orffa International Holding B.V.

-

ImmunoMedic, Inc.

Chapter 1. Beta-Glucan Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Beta-Glucan Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Beta-Glucan Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Beta-Glucan Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Beta-Glucan Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Beta-Glucan Market – By Type

6.1 Introduction/Key Findings

6.2 Oat-derived Beta-Glucans

6.3 Yeast-derived Beta-Glucans

6.4 Barley-derived Beta-Glucans

6.5 Mushroom-derived Beta-Glucans

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Beta-Glucan Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets and Hypermarkets

7.3 Specialty Stores

7.4 Online Retail

7.5 Pharmacies and Drugstores

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Beta-Glucan Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Beta-Glucan Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cargill, Incorporated

9.2 Kerry Group plc

9.3 Koninklijke DSM N.V.

9.4 Tate & Lyle PLC

9.5 Lantmännen

9.6 Lesaffre

9.7 Associated British Foods plc

9.8 Biothera

9.9 Garuda International, Inc.

9.10 Super Beta Glucan Inc.

9.11 Ceapro Inc.

9.12 Angel Yeast Co., Ltd.

9.13 AIT Ingredients

9.14 Orffa International Holding B.V.

9.15 ImmunoMedic, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global shift toward preventative healthcare is a primary driver of the beta-glucan market. Consumers are increasingly aware of the importance of maintaining a robust immune system and preventing chronic illnesses through diet and lifestyle. Beta-glucans, renowned for their immune-modulating and cholesterol-lowering properties, align perfectly with this trend.

The extraction and purification of beta-glucans can be expensive, especially when sourced from high-quality raw materials like oats and mushrooms. Advanced processing techniques required to maintain bioactivity and purity add to the overall production costs. These high costs can translate to premium pricing, limiting accessibility for price-sensitive consumers and creating a barrier to market penetration in developing regions.

Cargill, Incorporated, Kerry Group plc, Koninklijke DSM N.V., Tate & Lyle PLC, Lantmännen, Lesaffre, Associated British Foods plc.

Europe currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.