Beet Sugar Market Size (2024-2030)

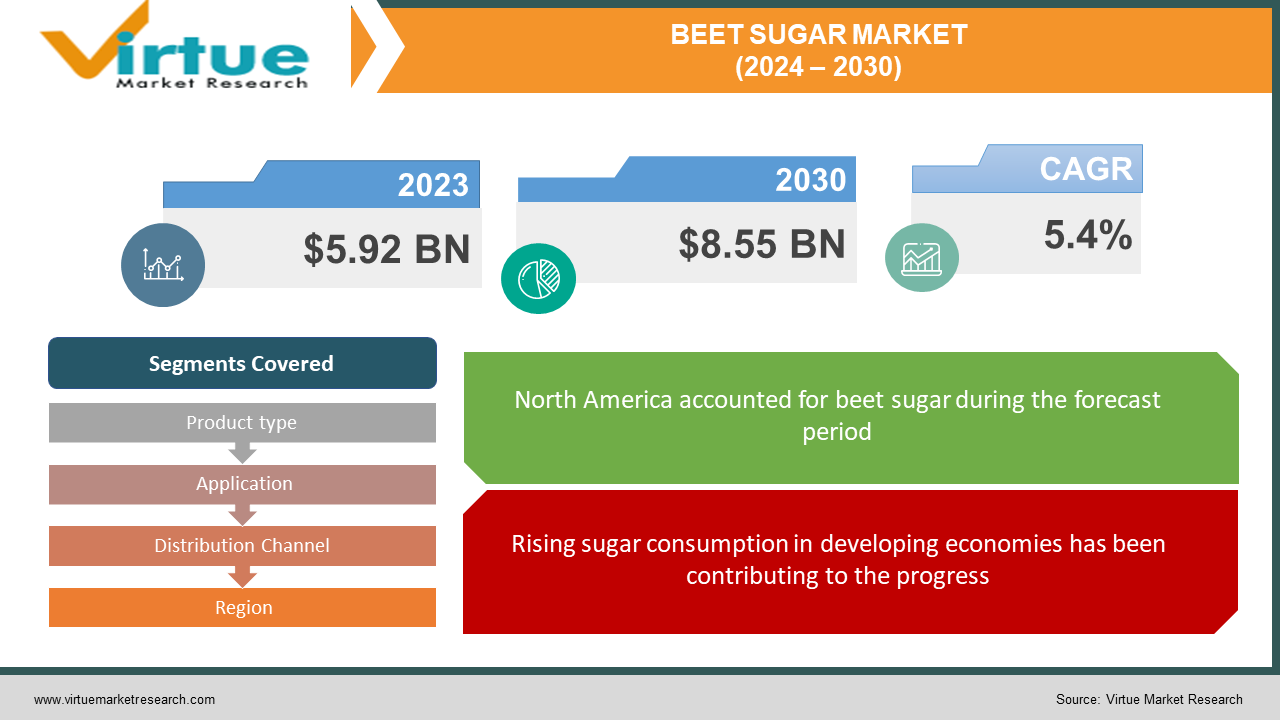

The beet sugar market was valued at USD 5.92 billion in 2023 and is projected to reach a market size of USD 8.55 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.4%.

This growth is fueled by rising sugar cravings in developing economies, busier urban lifestyles relying on convenience foods, and a growing preference for organic options, where beet sugar shines as a perceived healthier alternative. However, competition from subsidized sugarcane sugar, unpredictable weather impacting beet yields, and rising labor costs pose challenges. Despite these hurdles, the future looks promising for beet sugar, with established players like Südzucker and Tereos expanding their reach and new entrants adding to the mix. A new note is also developing from consumers' concerns about sustainability, which is pushing companies to modify their methods to create a more environmentally friendly symphony. Though concentrated in Europe, North America, and Russia, the market remains cyclical, with prices dancing to the tune of supply and demand.

Despite these challenges, the market outlook remains positive. The future promises continued growth and adaptation, with new entrants joining the established players and regional variations resulting in better profits.

Key Market Insights:

Over 261 million metric tonnes of sugar beetroot were produced globally in 2022.

Of all the sugar produced worldwide, beetroot sugar accounts for around 20%.

Globally, sugar beetroot crops generate an average of 58.2 tonnes per hectare.

The roots of sugar beets are normally 75–85% water and up to 21–22% sucrose, and they can weigh up to 2 kg.

The harvest of sugar beets resulted in an average annual soil loss of 489,000 metric tonnes. Moreover, each acre of harvesting loses about 9.1 tonnes of soil. To tackle this, organizations have been focusing on country farming techniques that help reduce soil erosion and water runoff. Besides, crop rotation techniques are being implemented to improve the soil texture.

Beet Sugar Market Drivers:

Rising sugar consumption in developing economies has been contributing to the progress.

As economies in developing countries grow, so do disposable incomes, leading to increased consumption of sugar-containing products like soft drinks and confectionery. The economies of many countries have seen notable progress over the years. This stability has changed the standard of living. This change in lifestyle helps generate greater revenue for the market.

Urbanization and convenience food trends have been facilitating the expansion.

Over the years, dual income has become the new norm. This has created hectic schedules for a lot of people. Couples and bachelors find very little time to cook for themselves. As such, they rely on ready-to-eat foods. The growing urban population often adopts busier lifestyles, relying more on convenience foods that often contain sugar. This trend creates a demand for readily available sweeteners, like beet sugar.

The demand for natural products has been rising the demand.

Natural products are those that have been grown without the aid of fertilizers, chemicals, or other pesticides. There has been a lot of awareness about the benefits to mankind and the environment of natural crops. Consumers are increasingly seeking natural and organic alternatives, and beet sugar, perceived as a more natural option compared to sugarcane sugar, benefits from this trend

Government policies are accelerating the growth rate.

Some governments subsidize beet sugar production, making it more competitive and further driving market growth. There have been many policies that have been implemented. This includes improvements in technologies, agricultural practices, water irrigation facilities, etc. Furthermore, investments have increased drastically to support this product.

Product diversification has been fueling the growth.

The culinary industry is constantly working on innovations by experimenting with their food. A lot of people like to explore different food cultures. As such, there is a lot of R&D that is taking place. The industry is expanding beyond just granulated sugar, offering various products like organic beet sugar, powdered beet sugar, and beet molasses, catering to diverse consumer preferences and applications.

Technological advancements are helping with the development.

Innovations in beet processing and sugar extraction are improving efficiency and yield, contributing to cost reduction and market expansion. Farmers are using improved methods to produce better yields. Through the use of genetics, seed processing, treatments, and priming, seed quality has increased. Precision monogerm, multigerm, and hand thinning can all be more expensive than genetic monogerm seed. Sugar beetroot cultivars that are resilient to biotic and abiotic stress conditions can be developed with the use of genome editing tools, particularly CRISPR/Cas9. For instance, CRISPR/Cas9 technology may be used to create sugar beetroot cultivars that are resistant to insects.

Biofuel potential has been driving the market.

Beet sugar can be used to produce biofuels, adding another dimension to its market value and attracting investment. The feedstock for the synthesis of biofuel is sugar beetroot. Because sugar beetroot pulp is low in lignin and can be collected all year, it is a useful feedstock for the biofuel sector. Biodiesel is both biodegradable and harmless. It can be added to diesel to lower particles, carbon monoxide, and hydrocarbons, or used as a fuel in its pure form. Biofuel is frequently combined with bioethanol. Governmental agencies and research institutes are continuously working on biofuels, increasing the demand for beet sugar.

Beet Sugar Market Restraints and Challenges:

Competition from subsidized sugarcane can create barriers.

Sugarcane, often produced with government subsidies, enjoys a significant cost advantage, making it a formidable competitor in the global market. This price difference can squeeze beet sugar producers' margins and limit their market share expansion.

Volatile weather conditions can hamper the growth.

Beet sugar production heavily relies on favorable weather conditions for optimal yield. Unpredictable weather patterns, like droughts or excessive rainfall, can significantly impact beet yields, leading to supply shortages and price fluctuations.

Rising labor costs are another concern.

Labor costs are a significant expense in beet sugar production, and these costs are steadily rising. This adds pressure on producers to maintain profitability and can make it difficult to compete with lower-cost alternatives.

Government regulations and trade policies are challenging.

Government regulations and trade policies can significantly impact the beet sugar market. Trade barriers, import quotas, and environmental regulations can all create hurdles for producers and affect market access.

Environmental concerns pose a lot of complexities for the market.

Beet sugar production can have environmental impacts, such as water usage and greenhouse gas emissions. Consumers increasingly prioritize sustainability, and producers need to address these concerns to remain competitive and maintain a positive public image.

Seasonality and storage can create losses.

Sugar beet production is seasonal, creating challenges in managing supply and ensuring consistent availability throughout the year. Storage and transportation costs also add to the complexity of the supply chain.

Beet Sugar Market Opportunities:

While challenges like subsidized competition and volatile weather loom, the beet sugar market also has many opportunities. Emerging markets with growing populations offer fertile ground for expansion. Value-added products like organic and functional sugars cater to diverse preferences and command premium prices. Sustainability is a key driver, and eco-friendly practices give producers a competitive edge. Technological advancements boost efficiency and resource utilization. Biofuel potential opens new avenues for market growth and value creation. Strategic partnerships foster innovation and expand reach. Diversification into non-food applications like pharmaceuticals and bioplastics creates new revenue streams. Building brand awareness and educating consumers about the unique benefits of beet sugar can overcome negative perceptions. Adapting to health trends with sugar-reduced options and highlighting natural aspects can win over health-conscious consumers. Embracing transparency and data-driven decision-making empowers producers to navigate the evolving market landscape. By capitalizing on these opportunities and addressing challenges head-on, the beet sugar market can carve out a sustainable and prosperous future, ensuring its place in the global sugar bowl for years to come.

BEET SUGAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Product type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Südzucker AG, Tereos, Pfeifer & Langen GmbH & Co. KG, American Crystal Sugar Company, COSMOS CO, Ltd., Agrana, Südzucker Polska S.A., Tereos France |

Beet Sugar Market Segmentation: By Product Type

-

Granulated Sugar

-

Refined Sugar

-

Organic Beet Sugar

-

Powdered Beet Sugar

-

Speciality Sugars

Granulated sugar dominates the product type sector and is used in countless food and beverage applications. Its familiarity and affordability solidify its position. However, the organic beet sugar segment is the fastest-growing. This is because of the demand for organic yield. People have begun to realize the importance of crops that have no fertilizers or pesticides. Research studies have shown that these crops have a better nutritional profile and can reduce the prevalence of chronic diseases.

Beet Sugar Market Segmentation: By Application

-

Food and Beverages

-

Pharmaceuticals

-

Cosmetics

-

Biofuels

-

Other Industrial Uses

Food and beverages are the largest growing segment in the beet sugar market, accounting for the largest share due to their extensive use in bakery, confectionery, dairy, and soft drinks. Moreover, with the rising preference for unique and diverse cuisines, a greater number of restaurants and other food services have been offering menus that include beet sugar as a main ingredient. However, the biofuel segment is the fastest-growing category. Biofuels are fuels made from sustainable biological sources that might be liquid, solid, or gaseous. They are used to generate power and heat and as fuels for transportation. They are sustainable and can be replenished naturally. This reduces the dependency on fossil fuels and even contributes to a lower greenhouse effect.

Beet Sugar Market Segmentation: By Distribution Channel

-

Direct Sales

-

Bulk Sales

-

Retail

Direct sales show the largest growth in the beet sugar market. This model prioritizes control and efficiency, catering to large food and beverage manufacturers with specific requirements. Individuals can visually inspect the product and assess its quality and quantity. However, the retail sales segment is the fastest-growing. This is because the product can be delivered to the customer's house. This convenience attracts a broad consumer base. Besides, people can choose from a wide range of options and compare the prices.

Beet Sugar Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe remains the dominant force, with Germany, France, and Poland contributing over half of global production. Established practices, efficient operations, and strong distribution networks give Europe a competitive edge. However, concerns regarding an aging population and potential market saturation in domestic regions cannot be ignored.

Asia-Pacific is the fastest-growing market, fuelled by rising sugar demand in countries like China, India, and Pakistan. Increasing disposable incomes and urbanization create fertile ground for further expansion. However, the region needs to improve its infrastructure and adopt efficient production methods to unlock its full potential.

North America boasts a prominent player in the US, leveraging advanced technology and infrastructure. Despite this strength, subsidized sugarcane from neighboring Mexico poses a significant challenge. However, North America finds promise in its expanding organic and specialty sugar segments, catering to the growing health-conscious consumer base

Despite Brazil's strong sugarcane industry, beet sugar production in South America is limited. However, countries like Brazil hold potential for expansion thanks to favorable climatic conditions and government support. Political and economic instability pose challenges, but overcoming these hurdles could unlock significant growth opportunities.

The Middle East and Africa show steady potential. Emerging markets like Egypt and Iran demonstrate small but growing beet sugar production. Government subsidies and favorable climates act as catalysts for expansion. However, these regions face limitations in infrastructure and technological advancements compared to other established players.

COVID-19 Impact Analysis on the Beet Sugar Market:

The COVID-19 pandemic, while disruptive, delivered mixed impacts on the beet sugar market. Initial panic buying and supply chain disruptions were concerning, but the market displayed resilience due to its essential nature. While restaurant closures dampened demand, increased home cooking and a surge in e-commerce sales created new opportunities, particularly for packaged food and baking ingredients. Health-conscious consumers drove growth in the organic and natural sugar segments, and government support helped producers weather the storm. Looking ahead, the market is expected to continue growing moderately, fueled by population growth and urbanization. Sustainability and health concerns will influence consumer preferences, opening doors for niche segments like organic sugar. Technological advancements and efficient production methods can further enhance competitiveness. However, challenges like subsidized sugarcane competition and volatile weather persist. The specific impact of COVID-19 varied across regions and segments, and ongoing economic uncertainties and potential future waves pose additional risks. Stakeholders will need to adapt, innovate, and form strategic partnerships to navigate the evolving landscape and ensure the beet sugar market continues to thrive in a post-pandemic world.

Latest Trends/ Developments:

The beet sugar market is buzzing with activity, driven by a blend of challenges and exciting trends. Sustainability is being prioritized, with producers adopting eco-friendly practices like precision agriculture and biochar utilization to reduce their environmental impact. Health-conscious consumers are driving the growth of organic and natural beet sugar, and producers are highlighting potential health benefits like prebiotic properties. Sugar reduction is a major trend, leading to the development of low-sugar beet sugar options and the exploration of alternative sweeteners.

Technology plays a vital role, with automation and robotics boosting efficiency, advanced breeding techniques improving yields and disease resistance, and AI optimizing agricultural practices. Emerging markets like China and India promise significant growth, while Africa's favorable climate offers expansion potential. Beyond food and beverages, beet sugar is finding new applications in biofuels, cosmetics, pharmaceuticals, and even bioplastics.

Key Players:

-

Südzucker AG

-

Tereos

-

Pfeifer & Langen GmbH & Co. KG

-

American Crystal Sugar Company

-

COSMOS CO, Ltd.

-

Agrana

-

Südzucker Polska S.A.

-

Tereos France

Chapter 1. Beet Sugar Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Beet Sugar Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Beet Sugar Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Beet Sugar Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Beet Sugar Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Beet Sugar Market – By Product Type

6.1 Introduction/Key Findings

6.2 Granulated Sugar

6.3 Refined Sugar

6.4 Organic Beet Sugar

6.5 Powdered Beet Sugar

6.6 Speciality Sugars

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Beet Sugar Market – By Application

7.1 Introduction/Key Findings

7.2 Food and Beverages

7.3 Pharmaceuticals

7.4 Cosmetics

7.5 Biofuels

7.6 Other Industrial Uses

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Beet Sugar Market – By Distributional Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Bulk Sales

8.4 Retail

8.5 Y-O-Y Growth trend Analysis By Distributional Channel

8.6 Absolute $ Opportunity Analysis By Distributional Channel, 2024-2030

Chapter 9. Beet Sugar Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By By Distributional Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By Distributional Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By Distributional Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Distributional Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By Distributional Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Beet Sugar Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Südzucker AG

10.2 Tereos

10.3 Pfeifer & Langen GmbH & Co. KG

10.4 American Crystal Sugar Company

10.5 COSMOS CO, Ltd.

10.6 Agrana

10.7 Südzucker Polska S.A.

10.8 Tereos France

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The beet sugar market was valued at USD 5.92 billion in 2023 and is projected to reach a market size of USD 8.55 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.4%.

Rising sugar consumption in developing economies, urbanization, convenience food trends, natural product demand, government policies, product diversification, technological advancements, and biofuel potential are the major drivers.

Based on product type, the market is segmented into granulated sugar, refined sugar, organic beet sugar, powdered beet sugar, and specialty sugars.

Europe reigns supreme in the beet sugar market.

Südzucker AG, Tereos, Pfeifer & Langen GmbH & Co. KG, American Crystal Sugar Company, COSMOS CO, Ltd., Agrana, Südzucker Polska S.A., and Tereos France are the major players.