Beauty Subscription Boxes/Makeup Subscription Boxes Market Size (2024 – 2030)

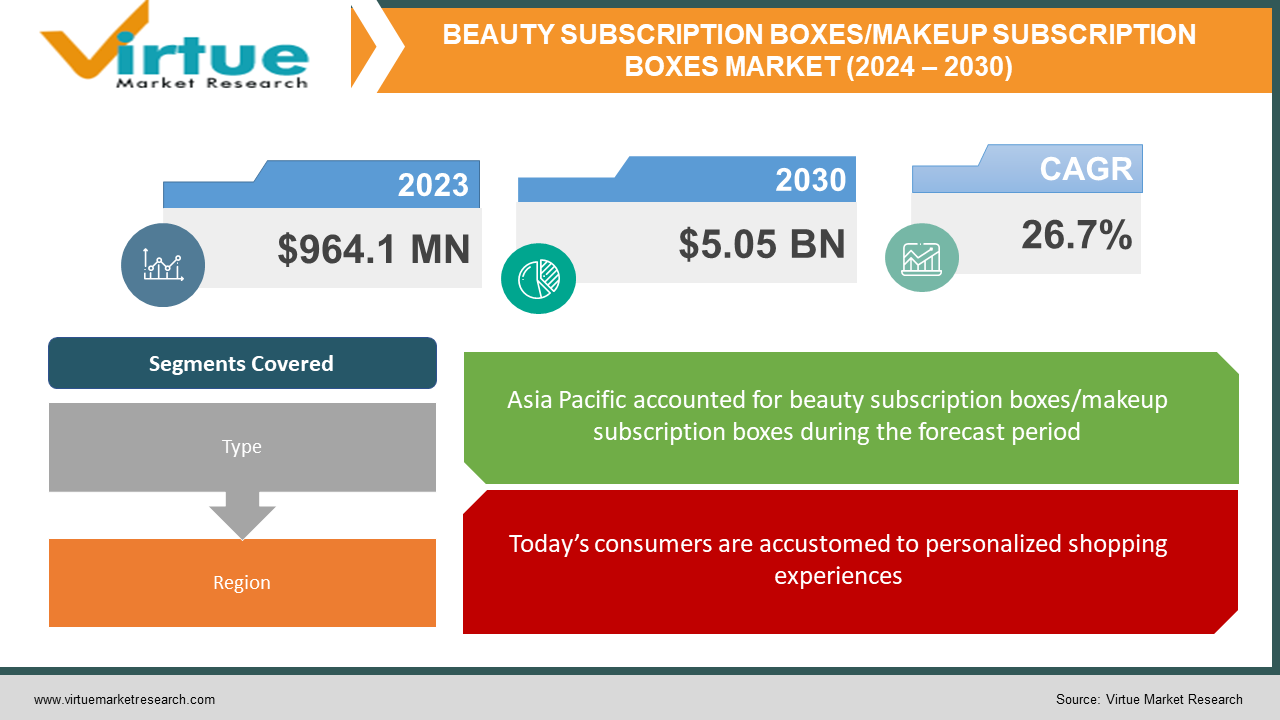

The Beauty Subscription Boxes/Makeup Subscription Boxes Market was valued at USD 964.1 Million in 2023 and is projected to reach a market size of USD 5.05 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 26.7%.

The market for beauty subscription boxes has grown significantly in the last several years. Subscribers receive a surprise assortment of skincare, haircare, cosmetics, and other beauty products in these boxes every month or every two months. Beauty boxes operate on the principle of providing full-sized goods and trial-sized samples that are themed or oriented around a specific brand. Subscribers may personalize their beauty routine, test out new products, and learn about new brands without breaking the bank at brick-and-mortar stores. While the majority solely sell skincare and beauty, some also carry hair products, tools, and related accessories. Targeted boxes appealing to males, youth, fitness enthusiasts, vegan beauty, and other niches are also becoming more and more popular. Because of the element of personalized discovery, convenience, and value they provide to clients, the beauty box market has experienced exponential growth. The popularity of unboxing videos on YouTube and the rise of social media influencers have increased their appeal, particularly with millennials. All things considered, the rise of beauty subscription boxes has completely transformed how consumers find, use, and purchase beauty products in the modern world. Using consumer insights and data will be essential for brands to set themselves apart in this thriving market.

Key Market Insights:

The rise of beauty subscription boxes has redefined the relationship between consumers and cosmetic brands. This vibrant market offers a wealth of unique insights for entrepreneurs, marketers, and investors alike. While one-off purchases have their place, beauty subscriptions create a recurring connection with brands and foster product exploration. With a focus on excitement and curation, companies encourage long-term retention. In return, customers often develop a sense of loyalty they would likely not feel making individual product selections. Beauty subscription services accumulate considerable data on consumer preferences through profiles, product ratings, and even social media interactions. This translates into invaluable market intelligence. Savvy businesses use this data to make informed decisions about what products to include, cater to emerging trends, and even launch their in-house beauty lines tailored perfectly to their subscriber base. In the realm of beauty, social media reigns supreme. Many subscription boxes leverage partnerships with beauty influencers and bloggers to build buzz and trust. They send boxes for review, run collaborative giveaways, and create exclusive influencer-backed lines. This cross-promotion is powerful; subscribers often have pre-existing trust in their favorite influencer's recommendations. It's not just about the products – unboxing videos are massively popular in the beauty niche. Companies know this and invest in the overall presentation of their boxes. It's an extension of the 'self-care' ritual. Think aesthetically pleasing packaging, detailed product cards, and even occasional gifts and bonus items. Successful subscription boxes have broadened their offerings, moving beyond solely makeup and skincare. Services that provide a mix of bath products, wellness items, hair care, and fragrances are seeing increased demand. This allows subscribers to indulge in more aspects of their personal care routine through one convenient subscription. As the market matures, new players face tough competition for subscribers. To break through, it's vital to prioritize innovative services, highly curated experiences, and clear differentiation from existing options. Reviews and social media reactions play a huge role for potential subscribers. Businesses need robust customer service strategies that value feedback. Sometimes, negative comments can present vital opportunities to adapt and improve, maintaining open communication channels with subscribers.

Beauty Subscription Boxes/Makeup Subscription Boxes Market Drivers:

One of the biggest appeals of subscription boxes is that they allow the discovery of new products, brands, and trends. With hundreds of beauty brands in the market, it can get overwhelming for consumers to stay updated.

Among the numerous factors propelling the growth of beauty subscription boxes, the tantalizing pledge of discoveries ranks as a foremost motorist. In a crowded cosmetics business impregnated with endless choices, subscription boxes give a new way for consumers to cut through the noise and find products aligned with their preferences. The curated slice experience offered by yearly beauty boxes allows donors to explore new and innovative brands acclimatized to their taste. This aspect of discovery is inestimable in the Instagram age where new makeup and skincare drops go viral. FOMO (fear of missing out) is real. Boxes tap into this by exposing members to the coming big thing before others. Discovery enables trying out products shoppers wouldn't typically splurge on. This" trial before you buy" benefit allows trial with a different force of brands. According to a survey, tried products have a conversion rate of 2- 6x more advanced than average. The delight of discovering a new holy grail product that impeccably suits their requirements keeps shoppers hooked to their subscription. For brand discovery, boxes frequently feature over- and- coming niche markers alongside big names. BoxyCharm constantly spotlights indie brands infrequently set up in mainstream retail. This provides great marketing to newer brands. Mishi Box focuses solely on Japanese and Korean skincare prolusions. Getting to test drive new entrants builds consumer mindfulness.

Today’s consumers are accustomed to personalized shopping experiences. Subscription boxes deliver just that - providing recipients with products matching their individual preferences each month.

While discovery drives exploratory value, personalization fosters deeper brand engagement for beauty subscription boxes. By tapping into consumers' yearning for customized experiences, beauty boxes can delight recipients with tailored assortments each month. Hyper-personalization allows brands to cater offerings to the unique needs of each subscriber. Customers first fill out in-depth profiles indicating their skin type, complexion, style, sensitivities, product preferences, and more. Sophisticated algorithms then get to work finding the optimal product mix. Ipsy's machine learning studies millions of data points to match products suited for each member. Its Glam Bag Ultimate even allows selecting 3 of 5 items. BoxyCharm uses quiz answers to curate boxes, further enhanced via add-ons like BoxyLux. This focus on individual requirements makes customers feel special. Personalization also enables correcting skin or makeup issues. This focused sampling helps consumers achieve their beauty goals. Predictive analytics track feedback and reviews to refine future product selection. Dynamic learning improves personalization accuracy over time. For businesses, the data derived from personalized boxes provides invaluable consumer insights. Consumers today expect and reward brands that cater to their unique needs. By providing tailored assortments, beauty boxes satisfy the customer craving for a personalized service that truly understands their preferences. The delight of receiving a customized ensemble is a potent retention tool. Furthermore, it fosters brand affinity by making consumers feel special, cared for, and "known" emotionally. This allure of personalization is a compelling driver that is only becoming more influential as consumers seek tailored experiences.

Beauty Subscription Boxes/Makeup Subscription Boxes Market Restraints and Challenges:

A major concern is subscription fatigue - where consumers get bored of receiving boxes month after month. The novelty wears off over time causing subscribers to eventually pause or cancel subscriptions. Brands constantly need to innovate and surprise to retain subscribers.

Subscription fatigue is the biggest threat facing beauty box brands today. The initial novelty of receiving monthly surprise packages wears thin over time, causing subscribers to eventually cancel their memberships. With cutthroat competition, preventing subscription fatigue through innovation and personalization is critical. The key is to keep surprising and delighting customers month after month. Sticking to a fixed formula of products and brands leads to boredom. Strategic rotation of samples along with discovery items rejuvenates the experience. However, brands must go beyond basic profiles to capture richer data on preferences, product reactions, and lifestyle. Collaborations with beauty YouTubers who can creatively showcase monthly unboxings generate a constant stream of marketing. Leveraging consumer data to identify users at high risk of churn enables targeted campaigns. For example, special discounts on next month’s box may incentivize wavering subscribers.

The business model faces innate challenges for profitability. The low monthly fee makes it difficult to cover the costs of high-end sample products, curation, kitting, and shipping. Many brands are still operating at losses despite rapid top-line growth.

The biggest expense is the sample products included in each box. Brands need to negotiate better deals with vendors - highlighting the marketing benefits of sampling. Multi-month contracts and bundling less popular items with hot sellers give vendors more incentive to offer discounts. Developing your product lines allows for higher margins as costs are controlled in-house. Algorithmic optimization of box composition to maximize the value/cost ratio is also effective. Streamlining logistics and kitting processes through automation reduces overhead costs. Inventory management systems track product availability. Robotic sorting and assembly systems enable swift fulfillment with minimal waste. Location-based kitting, where samples are sourced from regional warehouses, cuts shipping expenses. Demand forecasting and capacity planning minimizing excess stock also lowers costs. Upselling full-sized purchases of sampled products provides additional income. Letting customers customize boxes by adding extra products for a fee boosts profitability. Allowing redemption of loyalty points for purchases instead of discounts has the same effect.

Beauty Subscription Boxes/Makeup Subscription Boxes Market Opportunities:

Brands have only scratched the surface of using AR technology to enhance the sampling experience. For example, apps could allow customers to virtually “try on” makeup items at home. Users can see how a lipstick shade will look on them using their smartphone camera. AR-enabled mirrors in the subscription box packaging can take the experience further by showing the complete look together. Companies like Midface already work with beauty majors like L'Oreal, and Estee Lauder on AR. Subscription box brands should also integrate this technology to engage millennials. While subscription boxes have focused on mass to prestige offerings, the ultra-luxury beauty segment remains untapped. Targeting informed beauty lovers who appreciate luxury cosmetics gives this underserved niche a chance for growth. Leading subscription box brands have primarily focused on the North American market. However, the model can be expanded globally by targeting underpenetrated regions like Asia Pacific and Latin America where rising incomes are fueling cosmetics demand. Localization and partnerships will be key to success abroad. Countries like India, China, Japan, and Brazil are billion-dollar beauty markets ripe for subscription box disruption. International expansion provides access to a vast new pool of potential subscribers. Partnerships with retailers to create in-store subscription box counters will merge discovery with immersive sampling. Consumers can receive personalized product recommendations, build their boxes, and have a fun shopping experience.

BEAUTY SUBSCRIPTION BOXES/MAKEUP SUBSCRIPTION BOXES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

26.7% |

|

Segments Covered |

By Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ipsy, BoxyCharm, Birchbox, GlossyBox, FabFitFun Allure Beauty Box, Kinder Beauty Box, FaceTory, Scentbird |

Beauty Subscription Boxes/Makeup Subscription Boxes Market Segmentation: By Type

-

Luxury Boxes

-

Mid-range Boxes

-

Budget-Friendly Boxes

Luxury Boxes, these top-tier boxes are packed with high-end brands and often incorporate full-sized products. Their appeal lies in the indulgence factor and access to prestige cosmetics. Price points tend to range from $50 - $100+ per month. Mid-range Boxes, this segment sits as the sweet spot for many subscribers. Their curated boxes house a pleasing mix of established brands and exciting niche finds, featuring deluxe samples alongside occasional full-sized products. These subscriptions run roughly $15 - $50 per month. Budget-Friendly Boxes Cater to price-conscious consumers, these boxes focus largely on deluxe samples. This model maximizes product exposure at an accessible price point, usually between $10 - $25 per month. Mid-range boxes arguably hold the largest overall market share. Their balanced pricing and mix of quality products appeal to a vast consumer segment. Several well-known players operate in this tier. Budget-friendly boxes are displaying strong growth as they make product exploration and discovery more accessible. Younger consumers and those hesitant to commit to full-priced beauty products readily explore this market segment.

Beauty Subscription Boxes/Makeup Subscription Boxes Market Segmentation: Regional Analysis

-

Europe

-

North America

-

Asia Pacific

-

South America

-

Middle East and Africa

In terms of global beauty subscription boxes, North America accounted for around 40% of the market in 2023. The U.S. boasts early innovation in this space. Companies like Birchbox and Ipsy set the standard, captivating consumers with the concept of curated beauty samples and discovery delivered right to their door. This head start firmly established the subscription box model within the beauty sector. High disposable incomes, particularly in the U.S., allow consumers to indulge in subscription services. Coupled with an established culture of "try-before-you-buy," this financial freedom opens doors for market growth. In 2023, Europe accounts for almost 25% of the total. Europe confidently claims second place in the beauty box domain. Its robust presence is mainly led by the UK, Germany, France, and Italy. European consumers stay attuned to emerging beauty trends and demonstrate a thirst for novel, expertly chosen products. The subscription box model perfectly fulfills this desire. Although it held only 15% of the worldwide market in 2023, Asia Pacific (APAC) displays rapid growth potential. China, Japan, India, South Korea, and Australia showcase distinct qualities that will significantly contribute to this expected advancement. Asia boasts trend-forward beauty scenes, especially in countries like Japan and South Korea. The desire for new, innovative products aligns perfectly with the box discovery model. Rising disposable incomes within Asia’s burgeoning middle class translate into greater spending power for discretionary options like beauty subscriptions. Currently, each of South America the Middle East, and Africa has a comparatively smaller market share of 10%, they stand to benefit from a combination of developing e-commerce and shifting consumer preferences towards personalized beauty experiences.

COVID-19 Impact Analysis on the Beauty Subscription Boxes/Makeup Subscription Boxes Market.

Store closures and lockdown measures forced a dramatic shift toward e-commerce for beauty products. This worked heavily in favor of subscription services, which offer ease, convenience, and doorstep delivery. Many consumers who may have traditionally purchased cosmetics in-store turned to subscription boxes, driving new signups. With social events reduced and routines shifted, many people initially spent less time and effort on full makeup looks. This fueled a pivot towards a greater focus on skincare and "at-home spa" experiences. Many subscription services capitalized on this by including more skincare products, masks, and wellness-oriented items in their boxes. In stressful times, consumers often look for comfort and the novelty of small treats. Beauty boxes fit this need perfectly. The pandemic brought immense global supply chain disruptions. Box curators felt the impact, facing stock shortages, shipping delays, and the challenge of fulfilling customer expectations during turbulent times. This forced many businesses to innovate sourcing strategies or introduce flexibility in their box creation process. Companies in the beauty box market needed to be transparent and adaptable to address these heightened consumer concerns. As restrictions eased, in-store experiences became accessible again. Some new subscribers, particularly those attracted by pandemic-specific reasons, experienced "subscription fatigue" or reduced use of services they once heavily valued. Companies had to focus on recapturing the 'delight factor' beyond simple convenience.

Latest Trends/ Developments:

For even more accurate product matching, smart algorithms consider not just fundamental categories like "dry" or "oily" skin, but also subscriber skin tones, lifestyle characteristics, special goals, and previous product reactions. A.I. can recommend diverse product choices from month to month. Platforms that allow users to deeply review products not only give other subscribers valuable info but also refine the system's ability to recommend those boxes. They foster online communities for subscribers to share their experiences, creating a social buzz beyond the contents of the box. Boxes featuring supplements, healthy teas, aromatherapy elements, and sleep care products go beyond traditional makeup and skincare. Mental and emotional well-being are getting attention alongside outward beauty goals. Limited-edition drops focused on themes like stress relief, post-trip rebalancing, or seasonal changes tap into specific mind-body needs. There's increased demand for boxes featuring environmentally conscious brands, with recyclable packaging, natural and organic products, and cruelty-free certifications. Subscription boxes promote discovery by acting as curators for smaller, ethically focused beauty brands.

Key Players:

-

Ipsy

-

BoxyCharm

-

Birchbox

-

GlossyBox

-

FabFitFun

-

Allure Beauty Box

-

Kinder Beauty Box

-

FaceTory

-

Scentbird

Chapter 1. BEAUTY SUBSCRIPTION BOXES/MAKEUP SUBSCRIPTION BOXES MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. BEAUTY SUBSCRIPTION BOXES/MAKEUP SUBSCRIPTION BOXES MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. BEAUTY SUBSCRIPTION BOXES/MAKEUP SUBSCRIPTION BOXES MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. BEAUTY SUBSCRIPTION BOXES/MAKEUP SUBSCRIPTION BOXES MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. BEAUTY SUBSCRIPTION BOXES/MAKEUP SUBSCRIPTION BOXES MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. BEAUTY SUBSCRIPTION BOXES/MAKEUP SUBSCRIPTION BOXES MARKET – By Type

6.1 Introduction/Key Findings

6.2 Luxury Boxes

6.3 Mid-range Boxes

6.4 Budget-Friendly Boxes

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. BEAUTY SUBSCRIPTION BOXES/MAKEUP SUBSCRIPTION BOXES MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Type

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Type

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Type

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Type

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Type

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. BEAUTY SUBSCRIPTION BOXES/MAKEUP SUBSCRIPTION BOXES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Ipsy

8.2 BoxyCharm

8.3 Birchbox

8.4 GlossyBox

8.5 FabFitFun

8.6 Allure Beauty Box

8.7 Kinder Beauty Box

8.8 FaceTory

8.9 Scentbird

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Subscribing offers an endless flow of new products to try before fully committing. The perceived value subscribers get often far outweighs the cost of the box itself. Deluxe samples let consumers test premium brands they might hesitate to purchase full-size without prior experience.

For customers who aren't diligent users, there's a risk of sample build-up leading to unused products that may expire or create a sense of overwhelm rather than pleasure. While great for testing products, a never-ending influx of samples may mean consumers never actually commit to repurchasing their full-size favorites, creating a cycle of consumption more than focused discovery.

Ipsy, BoxyCharm, Birchbox, GlossyBox, FabFitFun, Allure Beauty Box.

North America currently holds the largest market share, estimated at around 40%.

Asia Pacific exhibits the fastest growth, driven by its increasing population, and expanding economy.