GLOBAL BAY LEAF MARKET (2024 - 2030)

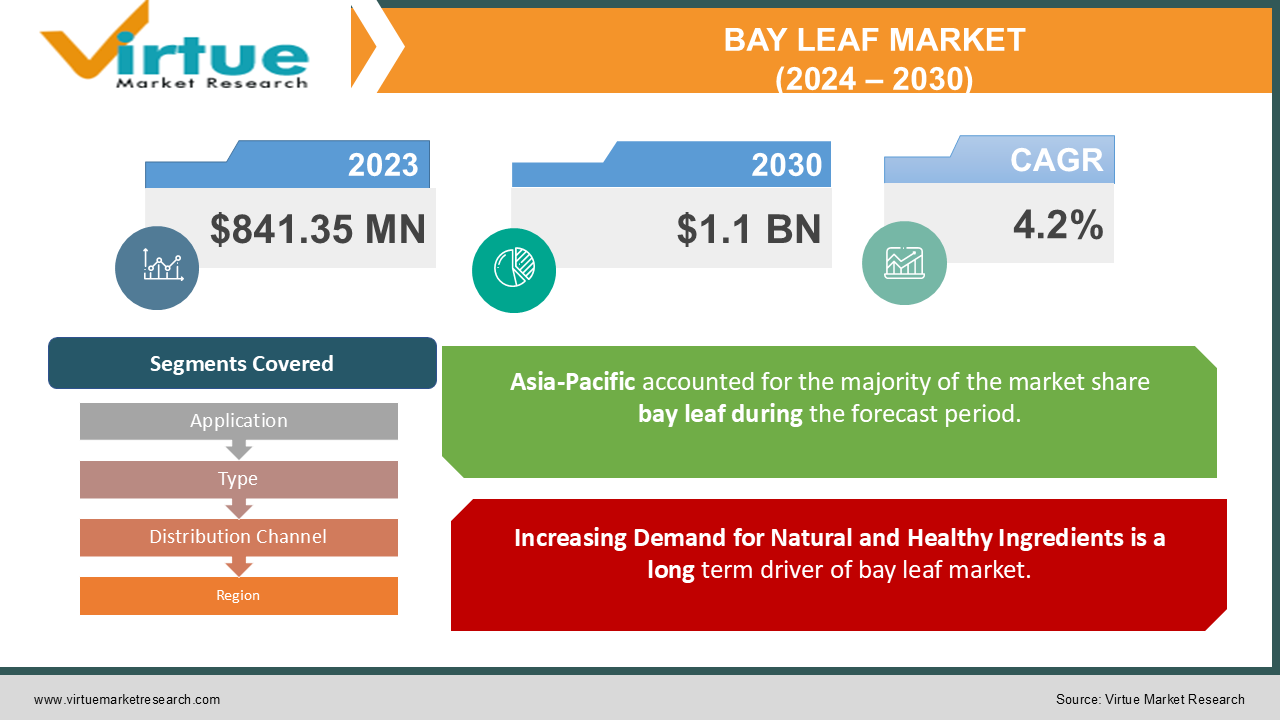

The Bay Leaf Market was valued at USD 841.35 Million in 2023 and is projected to reach a market size of USD 1.1 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.2%.

The bay leaf market is a segment within the global spice industry that revolves around the cultivation, trade, and consumption of bay leaves, derived from the aromatic evergreen bay laurel tree. It operates within the broader realm of culinary herbs and spices, catering primarily to the food and beverage sector, as bay leaves are a fundamental ingredient in various cuisines worldwide. The market's growth is influenced by factors such as increasing demand for natural flavor enhancers, expanding culinary experimentation, and the rising awareness of the health benefits associated with bay leaves, including their anti-inflammatory and antioxidant properties. Key producers like Turkey, India, and the Mediterranean countries play a significant role in supplying high-quality bay leaves to meet global demand. Advancements in technology for cultivation, harvesting, and processing techniques, coupled with a surge in sustainable farming practices, are shaping the market's evolution, making it more dynamic and competitive.

Key Market Insights:

- The market value of the global Bay Leaf Oil industry surged to an impressive USD 1,044 million by the year 2023. Pimenta racemosa, the primary source of bay leaf oil, finds its origins in the Caribbean and a small portion of South America, predominantly thriving in these regions.

- The native habitat of bay leaves traces back to the Asia Minor region in the Middle East, particularly along the coast of present-day Turkey. Turkey has sustained its position as the largest exporter of bay leaves globally, owing to its extensive cultivation and production practices in this fragrant and sought-after spice.

Bay Leaf Market Drivers:

Increasing Demand for Natural and Healthy Ingredients is a long term driver of bay leaf market.

Consumer preferences have been shifting towards natural, organic, and healthy food choices. Bay leaves, known for their aromatic flavor and medicinal properties, have gained popularity as a natural ingredient in cooking. The rising awareness of the health benefits associated with bay leaves, such as their anti-inflammatory, antibacterial, and antioxidant properties, has propelled their demand. As people become more health-conscious and seek alternatives to artificial flavor enhancers, the demand for bay leaves in various cuisines worldwide continues to grow. This trend has led to an increased use of bay leaves not only in traditional culinary practices but also in health and wellness products, driving the market forward.

Growing Global Culinary Diversity is propelling the bay leaf market.

The growing interest in diverse cuisines and culinary experimentation across the globe has contributed significantly to the demand for bay leaves. Bay leaves are a staple ingredient in many international cuisines, including Mediterranean, Indian, and Latin American dishes, among others. As the culinary landscape continues to evolve, chefs, home cooks, and food enthusiasts explore new flavors and cooking techniques, thereby increasing the demand for versatile ingredients like bay leaves. This trend is driving the market as bay leaves are sought after for their ability to add depth, aroma, and flavor complexity to a wide range of dishes, catering to the evolving tastes of consumers worldwide.

Bay Leaf Market Restraints and Challenges:

Seasonal Variability and Supply Chain Constraints are major issues beign faced by bay leaf industry.

Bay leaf cultivation is subject to seasonal fluctuations, affecting the availability and supply of the product. This seasonality can create challenges in maintaining a consistent supply throughout the year, impacting market stability and pricing. The global supply chain for bay leaves may encounter disruptions due to geopolitical factors, transportation issues, or natural disasters, leading to delays or shortages in the market. Such constraints can affect both producers and consumers, causing price volatility and difficulties in meeting demand, particularly during peak seasons or unexpected disruptions.

Quality Control and Standardization is crucial to be maintained in bay leaf market.

Ensuring consistent quality standards for bay leaves can be a significant challenge within the market. Factors like varying climate conditions, cultivation techniques, and post-harvest processing methods can influence the quality and flavor profile of bay leaves. Lack of standardized grading systems across different regions or countries can lead to ambiguity in quality assessment, impacting buyer confidence and market transparency. Maintaining quality standards becomes crucial for export-oriented markets, as meeting regulatory requirements and consumer preferences for high-quality, pesticide-free, and organic products becomes increasingly important. Implementing stringent quality control measures throughout the supply chain poses a challenge for producers and distributors, requiring investments in technology, training, and adherence to strict quality guidelines.

Bay Leaf Market Opportunities:

The bay leaf market presents numerous opportunities for growth and diversification. As global culinary trends continue to embrace natural and healthy ingredients, there's a rising demand for exotic and traditional flavors, thereby creating a favorable environment for bay leaves. With increasing consumer awareness regarding the health benefits and natural properties of bay leaves, there's an opportunity for product innovation and diversification, including the development of value-added products like essential oils, extracts, and organic variants. The expanding preference for sustainable and ethically sourced ingredients opens doors for market players to adopt eco-friendly cultivation practices, capitalize on certifications like organic and fair trade, and explore new markets or segments such as the pharmaceutical or cosmetic industries where bay leaf extracts find applications. Technological advancements in farming techniques and processing methods offer avenues for improving yield, quality, and cost-effectiveness, enabling producers to meet growing demand while maintaining competitive pricing in the market.

GLOBAL BAY LEAF MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.2 % |

|

Segments Covered |

By Application, type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Elantas GmbH (Germany), Axalta Coating Systems (the U.S.), Von Roll Holdings AG (Switzerland), Hitachi Chemicals Company Ltd. (Japan), 3M Company (the U.S.), and Kyocera Corporation (Japan) |

Bay Leaf Market Segmentation:

Bay Leaf Market Segmentation: By Type:

- Turkish bay leaves

- Indian bay leaves

- Californian bay leaves

- Mediterranean bay leaves

The largest segment by type in the bay leaf market is the Mediterranean bay leaves having market share of 43%. Mediterranean bay leaves are highly regarded for their robust flavor profile and aromatic qualities, which are widely preferred in diverse cuisines across the globe. These bay leaves are known for their distinct aroma, slightly minty and eucalyptus-like notes, which enhance the taste of various dishes, from Mediterranean cuisines to international recipes. Countries within the Mediterranean region have a long-standing tradition of bay leaf cultivation, utilizing ideal climatic conditions and expertise in harvesting and processing techniques. The geographical advantage and reputation for producing high-quality bay leaves have contributed to the dominance of the Mediterranean segment in the global bay leaf market. Turkish bay leaves segment is experiencing the fastest growth. Turkish bay leaves are renowned for their robust flavor and aroma, making them highly sought after in the culinary world. Turkey has been investing in modern agricultural practices and technology, enhancing the quality and yield of bay leaf production. The country's strategic geographic location and efficient export capabilities have contributed to the increased availability and accessibility of Turkish bay leaves in international markets.

Bay Leaf Market Segmentation: By Application:

- Food and Beverages

- Pharmaceuticals

- Household Products

In the bay leaf market, the largest segment by application is the food and beverage industry having significant market share of 56%. Bay leaves are extensively utilized in culinary preparations worldwide, imparting a unique aroma and flavor to a variety of dishes. Their versatile nature allows their inclusion in soups, stews, sauces, marinades, and other savory recipes across diverse cuisines. The robust demand from the food and beverage sector stems from the fundamental role bay leaves play in enhancing the taste profiles of dishes while adding subtle herbal notes. Their inclusion is deeply ingrained in culinary traditions, making them an indispensable ingredient in households, restaurants, and food manufacturing. Moreover, the trend toward natural, additive-free ingredients has further bolstered their popularity in the food industry, contributing significantly to the dominant position of bay leaves within this application segment. The pharmaceutical segment is witnessing the fastest growth within the bay leaf market expected to grow with a CAGR of 9.8%. This growth can be attributed to the increasing recognition of the medicinal properties and health benefits associated with bay leaves. These leaves contain compounds like essential oils, flavonoids, and antioxidants, which exhibit anti-inflammatory, antimicrobial, and potential therapeutic effects. The pharmaceutical industry is exploring bay leaf extracts for their potential in various health supplements, herbal medicines, and natural remedies targeting conditions like diabetes, digestive disorders, and respiratory ailments.

Bay Leaf Market Segmentation: By Distribution Channel:

- Supermarkets

- Specialty stores

- Online retail platforms

- B2B channels

The largest segment by distribution channel in the bay leaf market is the supermarket channel holding market share of 66%. Supermarkets and hypermarkets hold this distinction due to their extensive reach, wide consumer base, and diverse product offerings. These retail outlets cater to the mass market, providing convenience, accessibility, and a one-stop shopping experience for consumers seeking everyday culinary ingredients like bay leaves. They benefit from high foot traffic, offering a variety of spice options, including bay leaves, in different forms and brands. Supermarkets and hypermarkets often emphasize quality assurance, standardized packaging, and competitive pricing, appealing to a broad customer base seeking both convenience and reliability in their spice purchases. The fastest-growing segment in the distribution channel for bay leaves is online retail platforms. This surge is primarily attributed to evolving consumer behavior driven by convenience, accessibility, and the digitalization of shopping experiences. The online retail channel offers a wide array of bay leaf products, providing consumers with a diverse selection and the convenience of purchasing from the comfort of their homes. COVID-19 pandemic accelerated the shift towards online shopping, as lockdowns and social distancing measures prompted consumers to turn to e-commerce for their spice and ingredient needs. Additionally, the online space allows for easier comparison of prices, access to product reviews, and the ability to explore specialty or organic variants, appealing to a growing segment of health-conscious and quality-seeking consumers.

Bay Leaf Market Segmentation: Regional Analysis:

- North America

- Asia- Pacific

- Europe

- South America

- Middle East and Africa

The largest region in the bay leaf market is Asia-Pacific having market share of 40%. Countries like India and Turkey are significant contributors to the global bay leaf market, with extensive cultivation and export capabilities. India, in particular, stands out as a major producer and exporter of bay leaves, offering diverse varieties like Indian bay leaves renowned for their strong aroma and flavor. The favorable climate conditions in these regions support the growth of bay laurel trees, ensuring a consistent and abundant supply of high-quality bay leaves. The rich culinary heritage and widespread use of bay leaves in Asian cuisines, along with the region's growing export-oriented agriculture, further solidify Asia-Pacific's dominance in the global bay leaf market. The Asia-Pacific region stands out as the fastest-growing market in the bay leaf industry growing at a CAGR of 13%. This growth is primarily attributed to several factors, including the increasing demand for natural and traditional spices in the region's diverse culinary landscape. Countries like India and China, among others, have a rich heritage of using bay leaves in their cuisines, contributing significantly to the local consumption and production of this spice. The rising awareness of the health benefits associated with bay leaves, such as their antioxidant and anti-inflammatory properties, has spurred their inclusion in various food and wellness products, driving market growth.

COVID-19 Impact Analysis on the Bay Leaf Market:

The COVID-19 pandemic significantly affected the bay leaf market, causing disruptions across the supply chain and altering consumer behavior. The initial phases of the pandemic led to logistical challenges, including transportation restrictions, labor shortages, and disruptions in international trade, impacting the production and distribution of bay leaves globally. Fluctuating demand patterns emerged as lockdowns and restaurant closures affected the foodservice industry, a significant consumer of bay leaves, while the surge in home cooking bolstered retail sales. The pandemic accelerated digitalization trends, promoting online retail channels for spice purchases. Heightened health awareness among consumers further emphasized the demand for natural, immune-boosting ingredients like bay leaves. Despite initial challenges, the adaptability of producers and retailers to evolving market dynamics and shifting consumer preferences has paved the way for recovery and potential growth opportunities in the post-pandemic bay leaf market.

Latest Trends/ Developments:

In the bay leaf market there is increasing demand for organic and sustainably sourced products. Consumers are progressively leaning towards organic and ethically produced bay leaves due to growing concerns about health, environmental impact, and sustainable farming practices. This trend aligns with the broader movement toward clean-label foods and ingredients, prompting producers to adopt organic cultivation methods, obtain certifications, and implement sustainable farming practices to cater to this demand.

A significant development in the bay leaf market involves the application of advanced technology in cultivation, harvesting, and processing. Innovations in agricultural technology, such as precision farming techniques, optimized irrigation systems, and improved post-harvest processing methods, have enhanced the efficiency, yield, and quality of bay leaf production. Advancements in packaging technologies and storage solutions help maintain the freshness and aroma of bay leaves, extending their shelf life and ensuring better product quality for consumers. Integration of technology across the supply chain contributes to increased productivity, reduced wastage, and higher-quality bay leaf products meeting stringent market standards.

Key Players:

- Badia Spices Inc.

- McCormick & Company Inc.

- Harris Seeds

- Penzeys Spices

- Monterey Bay Spice Company

- Spice Islands

- Mountain Rose Herbs

- Frontier Co-op

Morton & Bassett Spices

Chapter 1. GLOBAL BAY LEAF MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL BAY LEAF MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL BAY LEAF MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL BAY LEAF MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL BAY LEAF MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL BAY LEAF MARKET – By Type

6.1. Turkish bay leaves

6.2. Indian bay leaves

6.3. Californian bay leaves

6.4. Mediterranean bay leaves

Chapter 7. GLOBAL BAY LEAF MARKET – By Application

-

- Food and Beverages

- Pharmaceuticals

- Household Products

Chapter 8. GLOBAL BAY LEAF MARKET – By Distribution Channel

8.1. Supermarkets

8.2. Specialty stores

8.3. Online retail platforms

8.4. B2B channels

Chapter 9. GLOBAL BAY LEAF MARKET, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Type

9.1.3. By Application

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Product Type

9.2.3. By Material Type

9.2.4. By End Use Industry

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Type

9.3.3. By Application

9.3.4. By Distribution Channel

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest South America

9.4.2. By Type

9.4.3. By Application

9.4.4. By Distribution Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Type

9.5.3. By Application

9.5.4. By Distribution Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL BAY LEAF MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Badia Spices Inc.

10.2. McCormick & Company Inc.

10.3. Harris Seeds

10.4. Penzeys Spices

10.5. Monterey Bay Spice Company

10.6. Spice Islands

10.7. Mountain Rose Herbs

10.8. Frontier Co-op

10.9. Morton & Bassett Spices

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Bay Leaf Market was valued at USD 841.35 Million in 2023 and is projected to reach a market size of USD 1.1 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.2%.

Increasing Demand for Natural and Healthy Ingredients along with Growing Global Culinary Diversity are drivers of Bay Leaf market.

Based on application, the Bay Leaf Market is segmented into Food and Beverages, Pharmaceuticals, Household Products.

Asia Pacific is the most dominant region for the Bay Leaf Market.

Badia Spices Inc., McCormick & Company Inc., Harris Seeds, Penzeys Spices are few of the key players operating in the Bay Leaf Market.