Battery Materials Market Size (2024 – 2030)

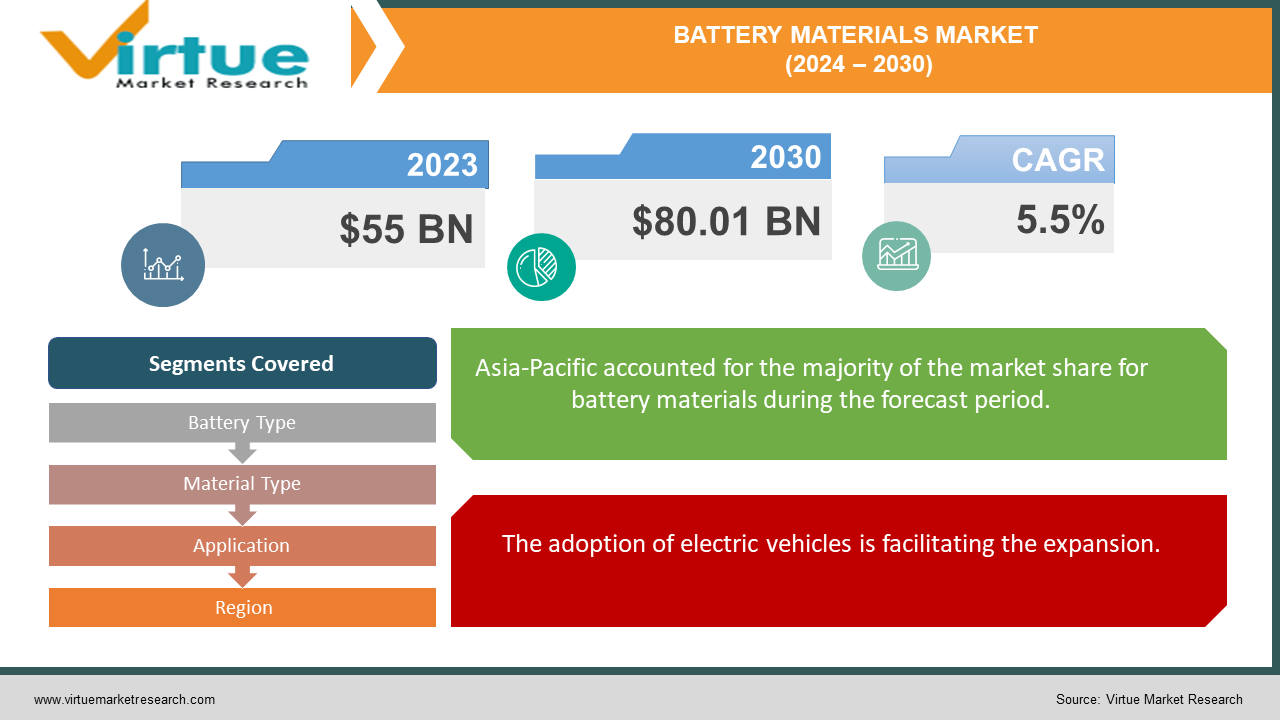

The global battery materials market was valued at USD 55 billion and is projected to reach a market size of USD 80.01 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.5%.

Materials that satisfy the quality requirements of a standard battery refining facility are referred to as battery materials. They store charges, which are seldom reversible, via profound faradaic processes. Metals, polymers, and other materials are among the materials used to make batteries. The anode (negative electrode), cathode (positive electrode), electrolyte, separator, and current collectors are the essential parts of a battery. Over the past decade, there has been a rapid adoption of battery materials due to a surge in electronic devices. Presently, the diversification of applications is fueling the growth. Electric vehicles are one such application that is elevating demand. In the future, with a focus on recycling technologies and integration with renewable energy, immense acceleration is anticipated.

Key Market Insights:

By 2028, the demand for lithium, graphite, cobalt, and nickel for battery manufacturing is predicted to rise by a ratio of 2.5 to 12.4.

In 2022, the total demand for lithium-ion batteries for electric vehicles was estimated to be 550 gigawatt-hours worldwide.

In 2022, China was the place of manufacturing for over 85% of the Tesla vehicles equipped with LFP batteries.

The demand for lithium-ion batteries is expected to rise roughly seven times between 2022 and 2030, reaching 4.7 terawatt-hours.

Global emissions from the extraction and processing of cobalt, graphite, lithium, and nickel for energy technologies are expected to reach around 700 million metric tons by 2050. To tackle this problem, a lot of companies are investing in R&D activities about recycling technologies. Additionally, responsible mining practices are being encouraged through regulations and certification.

Battery Materials Market Drivers:

The adoption of electric vehicles is facilitating the expansion.

Over the last 5 years, electric vehicles have gained significant prominence. Instead of utilizing fossil fuels like gasoline or diesel to charge their batteries, electric vehicles use electricity. Electric vehicles are more energy-efficient. Since electric vehicles (EVs) convert electricity straight into motion rather than burning fuel to produce heat before turning it into motion, EVs are more energy-efficient than traditional automobiles. As soon as they start up, electric vehicles (EVs) may attain an efficiency of over 70%, but a diesel engine that has reached full temperature can only get 40% efficiency. Regenerative braking is another technique used by EVs to recover and repurpose energy lost while braking. Besides this, charging an electric car is more affordable than filling it up with petrol or diesel. Additionally, since electric cars have fewer moving parts than internal combustion vehicles, their maintenance costs are significantly lower. Installing renewable energy sources, like solar panels, at home can help lower the cost of power even more while charging. All these advantages make this an attractive option for a broader consumer base. As such, materials like lithium, cobalt, manganese, and nickel that are used in these vehicles have seen a tremendous rise.

Energy storage systems have been boosting the market.

The implementation of energy storage systems (ESS) for backup power, grid stabilization, and integration of renewable energy sources is enabling the development. The demand for effective energy storage technology grows as the demand shifts to more renewable sources, such as wind and solar energy. To store and distribute renewable energy, lithium-ion batteries and other innovative technologies, such as solid-state batteries, are essential. Energy storage systems like lithium-ion batteries use electricity to store and transform it into other forms of energy that may be released as needed. With its round-trip efficiency, which is usually around 90%, more of the energy collected by the solar panels is stored for later use. Renewable energy sources such as hydropower, solar, wind, tidal currents, and biofuels may all be stored in them. Since ESS projects need large amounts of resources like lithium, cobalt, nickel, and other essential components, this generates a huge demand for battery materials.

Battery Materials Market Restraints and Challenges:

Environmental & health concerns, price volatility, technological limitations, and low recycling rates are the main issues that the market is currently facing.

One of the major barriers in the industry is the extraction of battery materials. Extraction and mining can contaminate the water, pollute the air, cause deforestation, and have side effects on human health. Mining operations are linked to several health issues, including headaches, skin irritation, open wounds, respiratory issues, and breathing hazardous fumes. Organizations must adhere to environmental regulations and sourcing practices and wear protective equipment as well as clothing. Secondly, these materials are subject to high prices. This leads to competition among the companies to get the best ones, subsequently taking a toll on the selling price. Medium- and small-scale industries can face obstacles in balancing product quality and price. Thirdly, there are chances of limited energy density and performance degradation over time. To overcome these obstacles and create next-generation battery technologies with increased efficiency, safety, and longevity, advancements in battery chemistry, materials science, and manufacturing techniques are needed. Moreover, certain statistics indicate the recycling of these materials is very low in a few countries. This leads to resource waste and landfills. Suitable strategies need to be taken by the governmental agencies to introduce recycling rules. Additionally, cost-effective recycling technologies need to be made accessible to the public. Education through campaigns might help spread better awareness.

Battery Materials Market Opportunities:

The increasing demand for consumer electronics has been providing the market with an ample number of possibilities. In the modern world, devices such as computers, iPads, and smartphones are necessary for daily tasks. Most of the corporate work takes place with the aid of these devices. Besides, education is being conducted online, further fueling the need. As such, a greater percentage of the public has been purchasing these devices. Apart from this, wearables and IoT devices have gained prominence owing to their help in tracking health and other activities. Manufacturers have been using battery materials like lithium-ion, nickel metal hydride, and nickel-cadmium in these electronics. These materials have longer lifespans and faster charging rates. This has tremendously increased the demand in this industry. Secondly, investing in recycling techniques is beneficial. This helps with better replacement costs and has a minimal impact on our environment. Energy is saved, as manufacturing new batteries requires a lot of energy. Furthermore, resources are conserved, making the whole process sustainable. Companies can recover valuable materials that can be used for different applications by incorporating these technologies. Apart from this, R&D activities are advantageous. Organizations can explore sectors of aerospace, healthcare, and marine to find new applications that help in better revenue generation.

BATTERY MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Battery Type, Material Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Albemarle Corporation, Sumitomo Metal Mining Co., Ltd., Tianqi Lithium Corporation, Ganfeng Lithium Co., Ltd., SQM (Sociedad Química y Minera de Chile), Umicore, Glencore plc, BASF SE, Mitsubishi Chemical Corporation, Johnson Matthey plc |

Battery Materials Market Segmentation: By Battery Type

-

Lithium-Ion

-

Lead Acid

-

Others

Lithium-ion is the largest growing battery material. Because lithium-ion batteries are lightweight, have a high energy density, and can be recharged, they are found in a wide range of devices. In addition to being lighter and smaller than other battery types, lithium-ion batteries have an identical energy capacity. As a result, people are using smaller, wireless, and portable devices more frequently. Furthermore, due to its tiny ions and small atomic weight, lithium diffuses rapidly, which makes it a perfect material for batteries. Lead-acid batteries are the fastest-growing type. It is extensively utilized because of its low cost, dependability, and potent surge capacity. For both on- and off-grid energy storage, lead-acid batteries are utilized in 5% of applications. In addition, they are utilized in large-format designs for emergency power systems such as hospitals, mobile phone towers, and backup power sources. They are mostly used for vehicle starting, lighting, and ignition and are typically used for solar and wind-powered applications.

Battery Materials Market Segmentation: By Material Type

-

Cathode

-

Anode

-

Electrolyte

-

Separator

-

Others

The cathode material is the largest growing type. Batteries' cathode materials can have an impact on the battery's performance, cost, and safety. There are a lot of advantages to using different cathode materials. Ni-rich cathode materials are inexpensive to produce, have excellent cycling performance, and have a high energy density. They can be utilized in energy storage and electric car batteries. Secondly, lithium iron phosphate (LFP) cathode is cheap, safe, and has a 10,000-cycle life. It is commonly used in electric cars and doesn't contain any hazardous materials. Thirdly, transition metal oxides are stable chemically and structurally, and they have a large lithium-ion capacity and advantageous electrical characteristics. Apart from this, MOF-based nanomaterials have an enormous specific surface area, a tunable aperture, and controlled architectures. All these different properties make them an ideal choice to be used in the industry. Anode is the fastest-growing material. Carbon and silicone-based anodes are the main ones. Materials based on carbon have a high specific capacity, a long cycle life, and a high coulombic efficiency. They are frequently found in lithium-ion batteries (LIBs).

Anodes made of silicon are more stable and have a greater energy density than graphite. Moreover, they can boost battery capacity by up to 30%, which may result in quicker charging periods and longer battery life. Lithium-silicon batteries have a 20% longer lifespan than graphite, and silicon anodes are safer and lighter.

Battery Materials Market Segmentation: By Application

-

Automotive

-

Consumer Electronics

-

Power Storage

-

Others

Consumer electronics is the largest growing application. Because batteries can store chemical energy and transform it into electrical energy, which powers gadgets, they are employed in consumer electronics. Lithium-ion batteries offer a high energy-to-weight ratio, excellent energy efficiency, and a long life. They are frequently employed in portable consumer devices like laptops and cell phones. They are appropriate for portable devices since they are lightweight and have a lengthy battery life. The automotive sector is the fastest-growing application. Batteries are used in automobiles to power the electrical systems, turn on the motor, and shield the computer from surges. When the engine is off, they also supply temporary power for the car's wipers, GPS, lights, and audio. In electric vehicles (EVs), batteries may account for over half of the vehicle's value and are essential to the vehicle's cost, performance, and range. In electric vehicles, lithium-ion batteries are the most commonly utilized battery type.

Battery Materials Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest growing market. Countries like China, Japan, India, and South Korea are at the top. The area is the biggest user of battery materials due to the high number of factories producing a wide range of industrial, electronics, and automotive products. Secondly, as a result of increased government efforts to promote industrialization, Asia-Pacific is the global center for manufacturing. Moreover, the region's enormous population, rising rate of urbanization, and increasing demand for electronic gadgets from consumers are accelerating the growth rate. North America is the fastest-growing market. The United States and Canada are at the forefront. This is mostly due to the population's steadily increasing desire for electric cars. The North American battery materials industry has grown rapidly due to several factors, including severe government laws addressing car emissions, increasing consumer awareness of sustainability and environmental preservation, and high disposable income. In addition, the region's active R&D programs and partnerships with government, business, and academic institutions are encouraging creativity and propelling the development of ground-breaking battery technology.

COVID-19 Impact Analysis on the Global Battery Materials Market:

The virus epidemic affected the market in several ways. Lockdowns, mobility limitations, and social isolation were all part of the new normal. This affects supply chain management, logistics, and transportation. Most of the companies were closed. This disrupted the processes of manufacturing and production as a lot of rules and regulations were enforced. Operations were hampered by safety regulations. Working remotely was the primary focus. Numerous people experienced job loss. The initiatives about healthcare received the majority of the funding. Launches and partnerships were delayed as a result. Many only bought essentials. According to Benchmark Source, the lithium-ion battery industry faced a decline of 15–25% during the first half of the pandemic. Post-pandemic, the market has started to pick up. A lot of awareness was spread about electric vehicles due to their economic friendliness. This has helped in augmenting the sales of these vehicles and increasing the demand for battery materials.

Latest Trends/ Developments:

Initiatives to modernize the grid to increase its efficiency, flexibility, and dependability present potential for suppliers of battery materials. Demand response initiatives, distributed energy supplies, and infrastructure for electric car charging are all made possible by energy storage technology. Businesses can collaborate with technology suppliers, grid operators, and utilities to provide customized solutions for grid modernization initiatives.

Key Players:

-

Albemarle Corporation

-

Sumitomo Metal Mining Co., Ltd.

-

Tianqi Lithium Corporation

-

Ganfeng Lithium Co., Ltd.

-

SQM (Sociedad Química y Minera de Chile)

-

Umicore

-

Glencore plc

-

BASF SE

-

Mitsubishi Chemical Corporation

-

Johnson Matthey plc

-

In April 2024, Ascend Elements, a maker of EV battery materials, and Ernst & Young LLP (EY US), a professional services business, collaborated to achieve net zero carbon emissions. To be ready for the Q1 2025 opening of its one-million-square-foot Apex 1 EV battery materials (pCAM) production plant in Hopkinsville, Kentucky, Ascend Elements recently chose EY US to create a sophisticated logistics simulation model. In addition to providing environmentally designed battery materials for up to 750,000 electric vehicles annually, the Apex 1 site will employ approximately 400 people.

-

In April 2024, Green Li-ion, a lithium-ion battery recycling technology firm, announced the opening of its first commercial-scale installation to generate sustainable, battery-grade materials in North America. Using Green Li-ion's unique multi-cathode-producing Green-hydrorejuvenationTM technology, the plant, which is housed within an existing recycling facility, will create useful battery-grade cathode and anode materials from concentrated components of used batteries.

-

In January 2024, to further its mine-to-battery strategy, Northern Graphite Corporation announced the formation of the NGC Battery Materials Group. This would position Northern as one of the few integrated developers, producers, and processors of natural graphite outside of China.

Chapter 1. Battery Materials Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Battery Materials Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Battery Materials Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Battery Materials Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Battery Materials Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Battery Materials Market – By Battery Type

6.1 Introduction/Key Findings

6.2 Lithium-Ion

6.3 Lead Acid

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Battery Type

6.6 Absolute $ Opportunity Analysis By Battery Type, 2024-2030

Chapter 7. Battery Materials Market – By Material Type

7.1 Introduction/Key Findings

7.2 Cathode

7.3 Anode

7.4 Electrolyte

7.5 Separator

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Material Type

7.8 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 8. Battery Materials Market – By Application

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Consumer Electronics

8.4 Power Storage

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Battery Materials Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Battery Type

9.1.3 By Material Type

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Battery Type

9.2.3 By Material Type

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Battery Type

9.3.3 By Material Type

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Battery Type

9.4.3 By Material Type

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Battery Type

9.5.3 By Material Type

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Battery Materials Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Albemarle Corporation

10.2 Sumitomo Metal Mining Co., Ltd.

10.3 Tianqi Lithium Corporation

10.4 Ganfeng Lithium Co., Ltd.

10.5 SQM (Sociedad Química y Minera de Chile)

10.6 Umicore

10.7 Glencore plc

10.8 BASF SE

10.9 Mitsubishi Chemical Corporation

10.10 Johnson Matthey plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global battery materials market was valued at USD 55 billion and is projected to reach a market size of USD 80.01 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.5%.

The adoption of electric vehicles and energy storage system are the main factors propelling the global battery materials market.

Based on application, the global battery materials market is segmented into automotive, consumer electronics, power storage, and others.

Asia-Pacific is the most dominant region for the global battery materials market.

Albemarle Corporation, Sumitomo Metal Mining Co., Ltd., and Tianqi Lithium Corporation are the key players operating in the global battery materials market.