Battery Electrolytes Market Size (2024 – 2030)

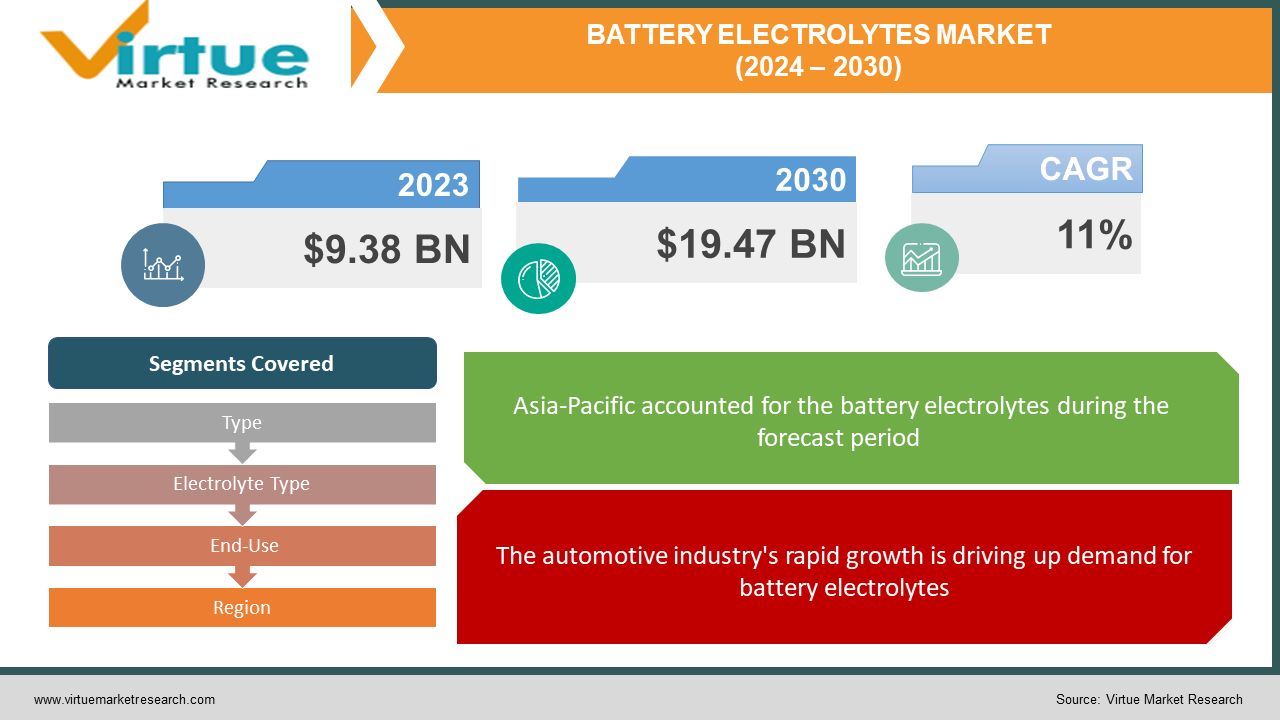

The global battery electrolytes market was valued at USD 9.38 billion and is projected to reach a market size of USD 19.47 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 11% between 2024 and 2030.

The liquid component present in most car batteries is called the battery electrolyte. It is so acidic that it is sometimes referred to as battery acid. Battery electrolyte is a solution of sulfuric acid and water. The three main parts of a battery are the electrolyte, cathode, and anode. The electrolyte in a battery is made up of soluble salts, acids, or other bases in liquid, gelled, or dry forms. It transfers electrical charge from the anode to the cathode, improving battery performance. The market is expected to develop because of growing consumer acceptance of smart gadgets and other electronics, rising demand for electric vehicle (EV) batteries, and growing awareness of renewable energy storage. On the other hand, insufficient infrastructure for charging and ineffective recycling methods for battery-related products impede the industry's growth. Market opportunities are presented by the expanding research efforts focused on creating novel electrolytes as well as the rise in regional electrolyte manufacturers in developing economies.

Key Market Insights:

Several factors are driving a notable upsurge in the battery electrolyte industry. The increasing global demand for consumer electronics is one of the main drivers. The need for battery electrolytes is increasing due to the relentless development of smartphones, laptops, tablets, and other electronic gadgets, which increases the requirement for batteries that are dependable and efficient. The environment is also full of potential because of how quickly technology is developing. These developments not only call for more advanced batteries but also open up new possibilities for creative electrolyte formulations that can meet a variety of needs and improve battery performance. Another significant factor driving the market's expansion is the growing uptake of electric cars (EVs). As a result of the global movement towards environmentally friendly transportation options, demand for high-performance batteries and electrolytes is rising in tandem with the explosive growth in EV sales. The demand for electrolytes is also fueled by the automotive industry's rapid technical progress, which includes developments in battery technology and vehicle electrification. All of these elements are working together to change the battery electrolyte industry and give producers lots of room to grow and innovate to satisfy the growing demands of contemporary electronics and transportation requirements.

Global Battery Electrolytes Market Drivers:

The automotive industry's rapid growth is driving up demand for battery electrolytes.

The primary driver of the demand for battery electrolytes is the expansion of government programs aimed at encouraging the automotive sector to employ more environmentally friendly energy sources. Battery electrolyte sales are anticipated to increase throughout the projected period due to the automotive industry's growing use of electric and hybrid vehicles as well as significant technological advancements in this field. To improve battery electrolyte technology, the automobile industry, battery manufacturers, and research institutes are actively involved in research and development. The main goals are to increase safety, enable fast charging, increase energy density, and prolong cycle life. High-performance electrolytes for car batteries are developed through industry collaboration and continuous research.

Growing urbanization and rising consumer expenditure fuel the battery electrolyte market's growth.

Rising urbanization and consumer expenditure are driving the expansion of the battery electrolytes market; this is especially true of the growing demand for portable electronics like laptops, tablets, and smartphones. Urban lifestyles that prioritize connectivity and mobility are fueling this trend, pushing consumers to want faster charging times and longer battery lives. As a result, there is an increasing demand for sophisticated electrolytes that can improve battery performance by providing increased stability and conductivity. Furthermore, the increase in consumer spending is making it easier for people to acquire technologically sophisticated devices, which highlights the need for high-performance batteries and electrolytes even more. Furthermore, the market is expanding due in large part to the automotive industry's shift to electric vehicles and the rising use of lithium-ion batteries, which are dependent on high-quality electrolytes. This shift highlights the market's significant growth potential for battery electrolytes, as does the continued need for lithium-ion batteries in consumer electronics. In general, the battery electrolyte industry is experiencing rapid growth due to the convergence of urbanization, consumer purchasing patterns, and technical advancements. This industry finds uses in both the consumer electronics and automotive sectors.

Global Battery Electrolytes Market Restraints and Challenges:

Recycling of the raw materials used in lithium-ion battery production is encouraged by the high cost of battery manufacturing. Nevertheless, there aren't many solutions available for recycling these batteries. Legislation in certain countries, like India, is inadequate to stop the illicit disposal of expended lithium batteries. For the safe disposal of EV batteries, the nation lacks a unified set of regulations. In the future, India may find itself in a difficult scenario if it turns into a landfill for lithium trash from both imported wasted batteries and indigenous EVs. Therefore, the absence of effective battery material recycling technologies may hinder the expansion of the battery market, which will lower the need for battery electrolytes. Governments throughout the world are concentrating on providing subsidies and incentives to boost the manufacturing of lithium-ion batteries to promote renewable energy sources. However, the government has not made a significant effort to increase the production of lithium-ion batteries in places like Africa. This is impeding the growth of these batteries, which is detrimental to the market expansion for battery electrolytes. Africa may be a major player in the supply chain for lithium-ion batteries. Therefore, it is anticipated that the absence of government assistance in African nations will pose a significant obstacle to the expansion of the battery electrolyte market.

Global Battery Electrolyte Market Opportunities:

Various organizations and well-known businesses have launched a plethora of research and development projects aimed at improving the properties of lithium battery electrolytes. The main goal of these efforts is to improve the electrolytes' characteristics so that they become more economically viable while also greatly increasing battery capacity. Notably, several research projects focus on investigating new electrolyte forms, like solid electrolytes, to increase their efficiency and, consequently, battery efficiency as a whole. As a result, the increasing focus on battery electrolyte research and development is anticipated to have a significant effect on lithium-ion battery demand. Lithium-ion battery demand is expected to rise in tandem with improvements in battery performance and efficiency brought about by developments in electrolyte technology. This symbiotic relationship between battery demand and electrolyte innovation highlights the critical role that research and development efforts play in advancing energy storage technology, which has significant ramifications for many industries that depend on battery technology, including the consumer electronics, automotive, and renewable energy sectors.

BATTERY ELECTROLYTES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11% |

|

Segments Covered |

By Type, Electrolyte Type, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

LG Chem, Mitsui Chemicals, Inc., BASF SE, Asahi Kasei Corporation, Mitsui & Co Ltd., Daikin Industries Ltd., Central Glass Co., Ltd., 3M Company, GS Yuasa International Ltd., American Elements |

Global Battery Electrolytes Market Segmentation: By Type

-

Lead-Acid

-

Lithium-Ion

Lithium-ion is the largest and fastest-growing type. This rise can be attributed to the unique qualities of lithium-ion batteries, which have solidified their position as the go-to option in several industries. Lithium-ion batteries have completely changed the energy storage market by providing unmatched energy and power density in a small form factor, as well as remarkable charge/discharge efficiency and lightweight design when compared to conventional lead-acid batteries. Their many uses, which range from supplying electricity to consumer devices to enabling energy storage systems and driving electric cars, demonstrate how versatile they are. Forecasts show that this market will continue to grow, driven by growing demand in important industries like electric cars and supported by government programs that encourage sustainability, like the Electric Cars Initiative (EVI). The predicted rise is also supported by the ongoing development of battery technology and the growing infrastructure that encourages the use of electric vehicles. Lithium-ion batteries' efficiency and versatility are highlighted by the widespread use of liquid electrolytes, which are made up of lithium salts dissolved in organic solvents. This further establishes lithium-ion batteries as the industry leader, with continued growth anticipated shortly.

Global Battery Electrolytes Market Segmentation: By Electrolyte Type

-

Solid

-

Liquid

The liquid segment is the largest growing. Liquid electrolytes are very common in lead-acid batteries and are essential for enabling energy storage and transfer. Because lead-acid batteries are so inexpensive, they are widely used in developing industries like automotive and energy storage systems, which creates a significant need for liquid electrolytes. This segment has a strong market outlook due to several variables. First off, lead-acid batteries are a cost-effective option, particularly in situations where price is a top priority. This drives demand for the liquid electrolytes that go along with lead-acid batteries. Lead-acid batteries and liquid electrolytes are in high demand due to the expanding automotive industry and the growing need for dependable energy storage solutions in industries like renewable energy and grid stabilization. Moreover, continuous battery technology developments targeted at improving lead-acid battery performance and efficiency are expected to support the liquid electrolyte market, highlighting its continuing importance in the battery sector. Solid electrolytes are the fastest-growing. Solid electrolytes are superior in several ways, including increased stability, safety, and energy density. The growing need for long-lasting, high-performance batteries for devices like energy storage systems, portable gadgets, and electric cars is focusing a lot of attention and capital on solid-state battery technology.

Global Battery Electrolytes Market Segmentation: By End-Use

-

EV

-

Consumer Electronics

-

Energy Storage

EV is the largest growing end-user segment. Growing demand for electric vehicles in areas like Asia-Pacific and North America is driving the industry. Lithium-ion battery demand is mostly driven by vehicles, which include automated guided vehicles, e-bikes, and electric automobiles. The adoption of electric vehicles by consumers has been driven by various causes, including the reduction of pollution and energy consumption. The primary factors driving the growth of the battery electrolyte market are the growing demand for electric vehicles to reduce carbon emissions, the quick increase in automotive revenues, the high demand from the battery replacement market, and the rising proportion of alternative energy sources in the energy mix. The consumer electronics segment is the fastest-growing. High-performance batteries are essential to consumer electronics, which include wearables, tablets, laptops, smartphones, and portable electronic devices, to address the growing need for energy storage in small and light designs. These rechargeable batteries' battery electrolytes are crucial parts that enable effective energy transfer and guarantee long-lasting performance. Battery electrolytes have grown rapidly in this industry because of the ongoing improvements in consumer electronics, the increase in disposable money, and the growing number of people using portable gadgets.

Global Battery Electrolytes Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest growing market. With the bulk of sales of electronic appliances, China is anticipated to be the top nation in the Asia-Pacific area. In addition, the nation leads the industry in car sales and solar PV installations, both ground- and rooftop-mounted. During the forecast period, lithium-ion battery utilization is predicted to rise due to the growing popularity of electric vehicles and battery energy storage systems in solar PV projects. As a result, the region's market for battery electrolytes may be driven by this circumstance. In recent years, solar and wind power installations have grown significantly in India. The nation has primarily relied on alternate strategies to fulfill peak demand, such as the use of generators, energy storage systems, batteries, etc. Furthermore, the use of lithium-ion batteries is anticipated to rise due to China's favorable government regulations and growing EV adoption, which is anticipated to affect market growth throughout the projection period positively. The market for battery electrolytes in China is expected to increase because of the growing penetration of communications services. North America is the fastest-growing region. The need for batteries and electrolytes is being driven by the region's significant emphasis on renewable energy and energy storage solutions. The North American market for battery electrolytes has grown as a result of rising grid-scale energy storage project deployment and government programs supporting sustainable energy.

COVID-19 Impact Analysis on the Global Battery Electrolytes Market:

The COVID-19 pandemic is wreaking havoc on our communities, but its full, long-term ramifications are still unknown. Its scale and impact are unparalleled in modern times. The disruption of essential material supply chains is just one of the challenges that battery and energy storage technologies will have to overcome in the next ten years. When global oil prices fell to all-time lows earlier this year, buyers became more interested in gasoline-powered cars. Already, tense raw material supply chains and the relocation of some manufacturing and recycling facilities to Japan and Europe were the results of fluctuating tariffs, changes in economic and environmental policies, and protracted trade disputes between the governments of the United States and China. Even yet, there is still a significant need for electric energy storage for vehicles and personal devices, and efforts to promote renewable energy ultimately hinge on having easily accessible battery banks to decarbonize, decentralize, and lower the cost of energy. Despite the obstacles outlined above, several organizations are working to strengthen the manufacturing supply chain and battery materials while ultimately seeking to create innovations that could completely rebuild the system.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Key Players:

-

LG Chem

-

Mitsui Chemicals, Inc.

-

BASF SE

-

Asahi Kasei Corporation

-

Mitsui & Co Ltd.

-

Daikin Industries Ltd.

-

Central Glass Co., Ltd.

-

3M Company

-

GS Yuasa International Ltd.

-

American Elements

Chapter 1. Battery Electrolytes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Battery Electrolytes Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Battery Electrolytes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Battery Electrolytes Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Battery Electrolytes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Battery Electrolytes Market – By Type

6.1 Introduction/Key Findings

6.2 Lead-Acid

6.3 Lithium-Ion

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Battery Electrolytes Market – By Electrolyte Type

7.1 Introduction/Key Findings

7.2 Solid

7.3 Liquid

7.4 Y-O-Y Growth trend Analysis By Electrolyte Type

7.5 Absolute $ Opportunity Analysis By Electrolyte Type, 2024-2030

Chapter 8. Battery Electrolytes Market – By End-Use

8.1 Introduction/Key Findings

8.2 EV

8.3 Consumer Electronics

8.4 Energy Storage

8.5 Y-O-Y Growth trend Analysis By End-Use

8.6 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 9. Battery Electrolytes Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Electrolyte Type

9.1.4 By By End-Use

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Electrolyte Type

9.2.4 By End-Use

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Electrolyte Type

9.3.4 By End-Use

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Electrolyte Type

9.4.4 By End-Use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Electrolyte Type

9.5.4 By End-Use

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Battery Electrolytes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 LG Chem

10.2 Mitsui Chemicals, Inc.

10.3 BASF SE

10.4 Asahi Kasei Corporation

10.5 Mitsui & Co Ltd.

10.6 Daikin Industries Ltd.

10.7 Central Glass Co., Ltd.

10.8 3M Company

10.9 GS Yuasa International Ltd.

10.10 American Elements

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the global battery electrolyte market is expected to be valued at US$ 9.38 billion.

Through 2030, the battery electrolytes market is expected to grow at a CAGR of 11%.

By 2030, the global battery electrolytes market is expected to grow to a value of US$ 19.47 billion.

Asia-Pacific is predicted to lead the battery electrolyte market.

Battery electrolytes were widely used in the EV sector.