Base Oil Market Size (2024 – 2030)

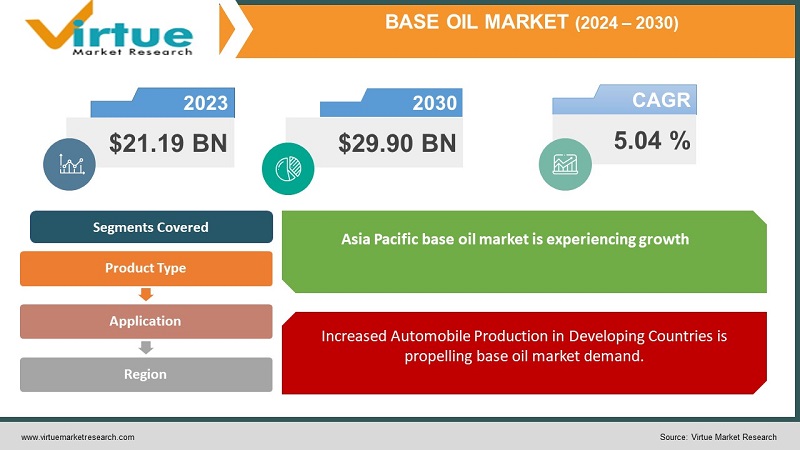

The Global Base Oil Market was valued at USD 21.19 billion and is projected to reach a market size of USD 29.90 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.04 %.

The lubricants sector heavily relies on the base oil market to ensure the functioning of machines and vehicle engines worldwide. The market revenue, for lubricants is experiencing growth due to the impact of industrialization. Various industries, such as machinery, automotive, and energy are increasingly adopting lubricants. In the base oil industry, major players are concentrating on creating products to expand their customer base. These innovative solutions do not meet performance needs. Also, aligns with environmental priorities. As a result, the competitive landscape of the base oil sector is transforming, towards eco resource efficient lubrication options.

Base oils are the building blocks of lubricants. They play a role in enhancing the performance and lifespan of industrial and automotive engines. Typically, base oils are obtained by refining extracts, under temperature and pressure conditions. The global base oil industry is a vital sector within the petroleum domain with its products being indispensable in industrial and aerospace fields. Consequently, both base oil manufacturers and end users are actively seeking solutions that surpass performance benchmarks while aligning with the growing focus, on sustainability and resource conservation.

Key Market Insights:

Based on data, from the World Bank, the manufacturing sector contributed 14% to the GDP in 2021 showing an increase compared to the previous year.

Engine oils are commonly utilized for lubricating combustion engines consisting of approximately 75 90% base oils and 10 25% additives.

Based on the data provided by OICA the production of vehicles, in 2021 reached a total of 80,145,988 units showing a growth of approximately 3% compared to the overall production, in 2020.

Automobile sales experienced a rise, across regions of the world in 2021. China in particular emerged as a thriving single-country market with an impressive 6.6% increase resulting in, over 21 million cars sold.

Car sales, in India experienced a growth of 27% even though the overall size of the vehicle market was relatively small. While Japan and Europe saw a decrease in passenger car registrations in 2021 there was an increase in demand for light vehicles, in Russia, the United States, and Brazil.

Base Oil Market Drivers:

Emerging Economies Experience Rapid Industrialization fueling the demand for base oils.

The demand, for lubricants and their byproducts, finished lubricants is experiencing growth due to the expansion of industries especially in emerging countries. This growth is particularly evident in sectors like machinery, automotive, and energy. The rise in industry development and lubricant consumption go hand in hand. The increasing focus on safety and the decreasing availability of oil is driving the demand for environmentally friendly synthetic hydraulic oils and fluids. These are components in aviation, manufacturing, construction, and automotive sectors. The paced industrialization and automation processes are spurring the need for fluids, which in turn contributes to the growth of the base oil market.

Hydraulic fluids play a role by transferring energy and facilitating flow between pumps and motors reducing wear and tear protecting against corrosion and dissipating heat. Their application extends to automobile transmissions, brake systems, power steering mechanisms, and various types of industrial machinery. The automotive sector has witnessed growth recently with an emphasis on improving fuel efficiency and reducing emissions. As a result of this focus, there has been an increased demand for metalworking fluids and process oils that also find utility as plasticizers and carrier fluids in tire manufacturing processes, such as rubber production.

Increased Automobile Production in Developing Countries is propelling base oil market demand.

Base oils play a role, in the manufacturing of lubricants. These lubricants are widely used in the industry for engine oils, transmission oils, and greases. With the increasing production of vehicles due to population growth and urbanization, the demand, for base oils is expected to rise in the foreseeable future.

The automotive industry is experiencing growth worldwide in emerging economies. There has been an increase, in the number of government individual vehicles on the roads. According to the International Organization of Automobile Manufacturers (OICA), new car sales rose from 87.5 million in 2013 to 95.05 million in 2018. This surge in sales can be attributed to development, efficient car manufacturing technologies, and the expanding middle-class consumer base. Consequently, there will be a rise in demand for base oil due to increased production and sales, shortly.

Base Oil Market Restraints and Challenges:

Fluctuations in base oil prices.

Base oil production heavily relies on oil as its raw material and the prices of crude oil are known for their significant volatility. Consequently, fluctuations, in crude oil prices can lead to erratic changes in the prices of base oils. Such uncertainties make it challenging for manufacturers, in the base oil industry to effectively plan and budget their operations as they struggle to forecast their costs. The fluctuation, in crude oil prices can greatly affect the base oil market. When the prices of crude oil rise manufacturers of base oils have to spend more on their materials leading to an increase in the cost of base oils. This situation can create challenges, for base oil manufacturers in competing with producers, especially those manufacturing synthetic lubricants.

Furthermore, the unpredictable fluctuations, in crude oil prices pose a challenge for base oil manufacturers when it comes to planning and budgeting. If a manufacturer cannot accurately forecast the cost of its materials it may face difficulties in competing in the market. Consequently, base oil manufacturers are actively exploring ways to reduce their dependency on oil. For instance, some manufacturers are investing in the production of base oils that are not derived from oil. Others are focusing on developing technologies for producing base oils using diverse feedstocks like natural gas and biomass. By decreasing their reliance on oil, base oil manufacturers can mitigate their exposure to price volatility. Enhance their ability to plan and budget, for the future.

Base Oil Market Opportunities:

The increasing need, for base oils in developing economies, offers a chance for manufacturers of base oil. By venturing into these markets base oil manufacturers can explore avenues for growth. Enhance their market presence. Some strategies base oil manufacturers can adopt to expand their operations in emerging markets. One approach is to establish production facilities in these regions. While this may require investment it enables base oil manufacturers to gain an edge by being nearby, to their customers. Another option would be to collaborate with businesses, in emerging markets. This approach offers a cost-effective way to expand into these markets while also providing base oil manufacturers with valuable access to local knowledge and expertise.

Regardless of the chosen strategy, base oil manufacturers who successfully expand their operations into emerging markets are in a position to capitalize on the increasing demand for base oils in these regions. Here are some specific instances of how base oil manufacturers extending their operations into emerging markets; ExxonMobil is currently constructing a base oil plant in China set to commence operations by 2024, Shell is expanding its production capacity for base oils in India, Chevron has formed a partnership with a company in China for the construction of a base oil plant. These examples merely scratch the surface of how base oil manufacturers expand their reach into emerging markets. As the demand, for base oils continues its trajectory it is only natural that more companies will invest in these regions.

BASE OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.04% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SK Lubricants Co., Ltd., Shell plc, PETRONAS Lubricants International, Abu Dhabi National Oil Company, Chevron Corporation, Repsol, GS Caltex Corporation, Abu Dhabi National Oil Company, PetroChina Co., Ltd, Indian Oil Corporation Ltd |

Base Oil Market Segmentation: By Product Type

-

-

Group I

-

Group II

-

Group III

-

Group IV

-

Group V

-

In 2022, based on the product type, the Group I segment accounted for the largest revenue share by almost 40% and has led the market. Group III is anticipated to be the fastest-growing segment with a CAGR of 6% from 2023-2030. Group I base oil is the utilized form of base oil because of its affordability and reliable performance. It finds applications, in areas, including lubricants, industrial lubricants, and metalworking fluids. On the other hand Group III base oil stands out as a top-notch option with enhanced performance and environmental advantages when compared to Group I base oil. It finds its place in high-performance scenarios, like luxury vehicle lubricants and demanding industrial lubricant applications.

Base Oil Market Segmentation: By Application

-

Automotive Oils

-

Process Oils

-

Hydraulic Oils

-

Metalworking Fluids

-

Industrial Oils

-

Others

In 2022, based on the application, the Automotive Oils segment accounted for the largest revenue share by almost 40% and has led the market. Industry Oils are anticipated to be the fastest-growing segment with a CAGR of 5% from 2023 to 2030. The automotive oils segment holds the share of revenue, in the base oil market accounting for over 40% in 2023.

One of the growing applications is oils, which is expected to have a compound annual growth rate (CAGR) of over 5% during the forecast period from 2023 to 2030. Automotive oils dominate the base oil market due to the substantial and expanding fleet. These base oils find application in lubricants like engine oil, transmission fluid, and gear oil. Industrial oils have a range of uses in industries, including machinery lubrication, metalworking, and hydraulics. The growth of this market is primarily fueled by increasing industrialization in emerging markets and a rising demand for high-performance lubricants. To cater to industry requirements manufacturers are developing types of industrial oils. For instance, some companies are creating oils that are specifically formulated for use in renewable energy technologies, like wind turbines and solar panels.

Base Oil Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, the Asia-Pacific region dominated the global medical tourism market with a revenue of 45%. The Asia Pacific region is expected to experience a compound growth rate (CAGR) of, more than 5% between the years 2023 and 2030. Due to its expanding population, economic progress, and increasing industrialization, the Asia Pacific region holds a dominant position in the base oils market. Moreover, it is home, to some of the industrial sectors globally.

The Asia Pacific base oil market is experiencing growth due, to factors, including; Rapid economic expansion, Increasing industrialization, the Growing automotive industry, and Strict government regulations on emissions and fuel efficiency. China stands out as the largest market for base oils in this region and is expected to maintain its leading position in the coming years. India also plays a role in the base oil market. Is anticipated to witness rapid growth. Other countries in the Asia Pacific region such as Vietnam, Thailand, and Indonesia are projected to experience growth in the base oil market. These nations are undergoing development and industrialization which drives the demand for lubricants. Additionally, their governments have implemented regulations on emissions and fuel efficiency further boosting the demand for high-performance lubricants. To cater to this growing demand base oil manufacturers are investing in expanding their production capacity across the Asia Pacific region. This investment is expected to contribute to the growth of the base oil market, in this area.

COVID-19 Impact Analysis on the Global Base Oil Market:

The implementation of transport restrictions had an impact, on both production and supply chains leading to a notable decrease in global economic growth as a result of the COVID-19 pandemic. The outbreak of COVID-19 had a severe effect on the automotive industry. Shipments of parts from China have been disrupted manufacturing disruptions are widespread in Europe and assembly plants, in the U.S. Are experiencing challenges. This situation adds stress, to the industry, which is already facing a decline in worldwide demand. This will likely result in mergers and acquisitions taking place. Additionally with the COVID-19 pandemic and the need for distancing manufacturing companies have been operating with a workforce causing adverse effects, on production and the automotive sector.

Latest Trends/ Developments:

The demand, for high-performance base oils, is on the rise due to the development of lubricants and their increasing use in demanding applications. In response base oil manufacturers are working towards creating high-performance base oils that cater to their customer's requirements. The preference for synthetic base oils is growing steadily because of their performance and positive impact on the environment. This has prompted base oil manufacturers to invest in producing options. Base oil manufacturers are witnessing an increase in demand from emerging markets like China and India. As a result, they are expanding their operations into these markets to meet the rising needs. To reduce reliance on oil and enhance cost competitiveness there is research and development focused on new technologies for producing base oils. These advancements aim to utilize feedstocks, like gas and biomass.

In January of 2023, Exxon Mobil Corporation joined forces with Sinopec Corp. To explore ventures in the base oil market.

In February of the year, Shell plc collaborated with Neste Oyj to establish a brand base oil production facility, in Finland.

Key Players:

-

SK Lubricants Co., Ltd.

-

Shell plc

-

PETRONAS Lubricants International

-

Abu Dhabi National Oil Company

-

Chevron Corporation

-

Repsol

-

GS Caltex Corporation

-

Abu Dhabi National Oil Company

-

PetroChina Co., Ltd

-

Indian Oil Corporation Ltd

In September 2023 Petronas and Pertamina reached an agreement to consider the construction of a base oil facility, at Pertaminas fuels refinery located in Cilacap, Indonesia.

In April 2022 Chevron Global Energy Inc. which is an owned subsidiary of Chevron Corporation completed the acquisition of Nestle Corporation NEXBASE brand. This acquisition includes the associated qualifications and approvals, as well as the sales and marketing business related to it.

Chapter 1. Base Oil Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Base Oil Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Base Oil Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Base Oil Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Base Oil Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Base Oil Market – By Product Type

6.1 Introduction/Key Findings

6.2 Group I

6.3 Group II

6.4 Group III

6.5 Group IV

6.6 Group V

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Base Oil Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive Oils

7.3 Process Oils

7.4 Hydraulic Oils

7.5 Metalworking Fluids

7.6 Industrial Oils

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application , 2023-2030

Chapter 8. Base Oil Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.1.4 By Product Type

8.1.2 By Application

8.1.3 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Base Oil Market – Company Profiles – (Overview, Base Oil Market Portfolio, Financials, Strategies & Developments)

9.1 SK Lubricants Co., Ltd.

9.2 Shell plc

9.3 PETRONAS Lubricants International

9.4 Abu Dhabi National Oil Company

9.5 Chevron Corporation

9.6 Repsol

9.7 GS Caltex Corporation

9.8 Abu Dhabi National Oil Company

9.9 PetroChina Co., Ltd

9.10 Indian Oil Corporation Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Base Oil Market was valued at USD 21.19 billion and is projected to reach a market size of USD 29.90 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.04 %.

Emerging Economies Experience Rapid Industrialization and Increased Automobile Production in Developing Countries.

Based on application, the Global Base Oil Market is segmented as Automotive Oils, Process Oils, Hydraulic Oils, Metalworking Fluids, Industrial Oils, and Others.

Asia-Pacific is the most dominant region for the Global Base Oil Market.

SK Lubricants Co., Ltd., Shell plc, PETRONAS Lubricants International, Abu Dhabi National Oil Company, and Chevron Corporation are the key players operating in the Global Base Oil Market.