Bare Metal Load Balancer Market Size (2024-2030)

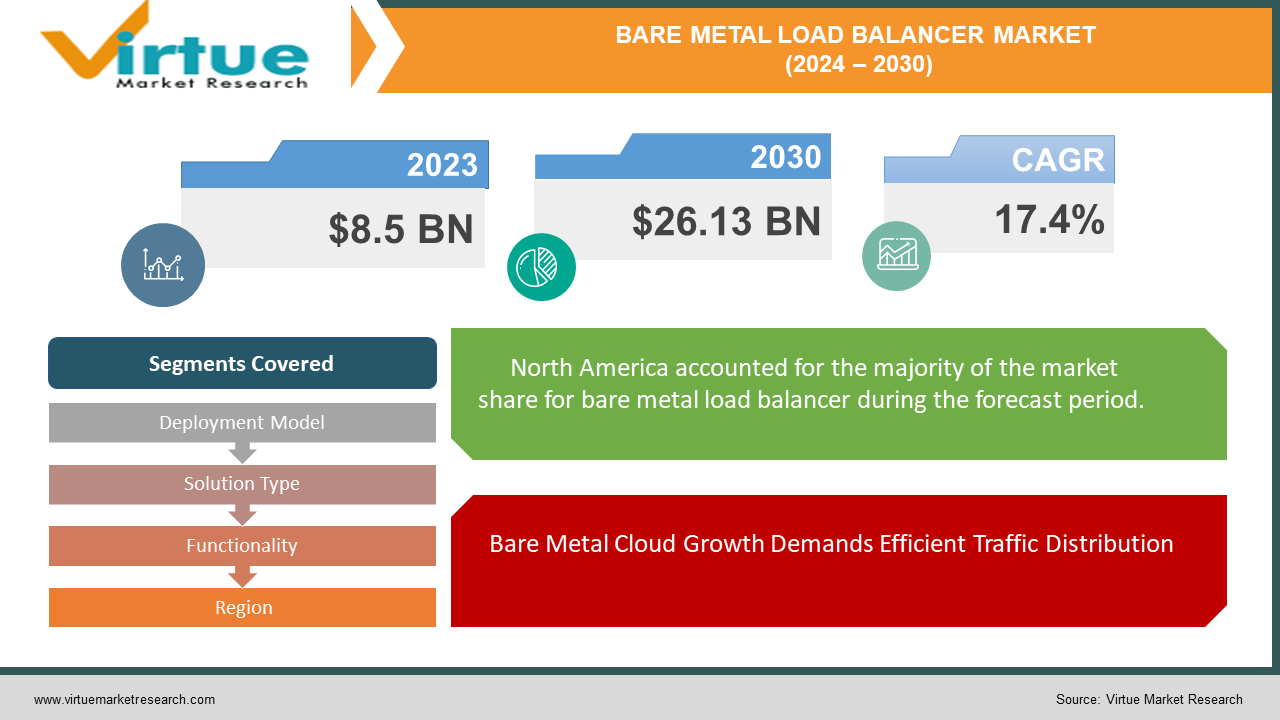

The Bare Metal Load Balancer Market was valued at USD 8.5 billion in 2023 and is projected to reach a market size of USD 26.13 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 17.4%.

Bare metal servers are gaining traction in the cloud space due to their cost-efficiency and control benefits. However, efficiently distributing traffic and resources across these servers requires load balancing. While there isn't a separate market for "bare metal load balancers," the traditional load balancer market fills this need. This broader market offers hardware, software, and cloud-based solutions that can be deployed on-premises, including with bare metal servers.

Key Market Insights:

The concept of a dedicated "bare metal load balancer market" isn't quite there yet. However, the booming bare metal cloud market, projected for explosive growth, is creating a strong demand for load-balancing solutions within the existing load-balancer market. This demand arises because efficiently distributing traffic and resources across bare metal servers is crucial for optimal performance in bare metal cloud deployments.

Traditional load balancer solutions are stepping up to fill this gap. This established market offers a variety of solutions – hardware, software, and cloud-based options – that can be deployed on-premises, including bare metal servers. This caters to a diverse range of needs. Organizations seeking cloud-based scalability can find solutions designed for that purpose, while those prioritizing on-premises security and control have access to robust on-premises options.

The Bare Metal Load Balancer Market Drivers:

Bare Metal Cloud Growth Demands Efficient Traffic Distribution

Bare metal cloud services are experiencing phenomenal growth due to the advantages they offer in terms of cost-efficiency and superior control over resources. However, efficiently distributing traffic and resources across these bare metal servers is crucial for achieving optimal performance in bare metal cloud deployments. Load balancing solutions emerge as a critical component in this scenario, ensuring that incoming traffic is evenly distributed across available servers, preventing overloading and bottlenecks.

Existing Load Balancers Step Up to Integrate with Bare Metal Servers

Existing load balancer solutions, encompassing a wide range of options including hardware, software, and cloud-based deployments designed for on-premises environments, are effectively stepping up to address the needs of bare metal deployments. These solutions seamlessly integrate with bare metal servers, allowing organizations to leverage their existing load-balancing expertise and infrastructure within their bare metal cloud environment.

Load Balancing Technology Advancements Drive Growth and Applicability

Continuous advancements in load-balancing technology itself are further propelling the overall growth and applicability of these solutions within bare metal environments. Efficiency improvements translate to better resource utilization and lower operational costs. Enhanced security features ensure that bare metal deployments remain protected against potential threats and vulnerabilities. As load-balancing technology continues to evolve, it will offer even greater capabilities for optimizing performance and security within bare metal cloud environments.

The Bare Metal Load Balancer Market Restraints and Challenges:

While the rise of bare metal cloud fuels demand for load-balancing solutions, there are hurdles to overcome. One key challenge is limited awareness. The concept of a dedicated bare metal load balancer market is new, and some organizations might not fully grasp the specific load balancing needs of bare metal environments, potentially leading to inadequate solutions. Integration complexity also presents a hurdle. Integrating load balancers, particularly intricate software, or cloud-based solutions, with bare metal deployments can be more challenging compared to traditional cloud setups. This might require additional expertise and resources for successful implementation. Furthermore, managing separate load balancers for both bare metal and potentially other cloud environments can significantly increase operational complexity and strain IT teams. Security remains a top concern, especially for on-premises bare metal deployments. Organizations need to ensure their chosen load-balancing solutions offer robust security features to mitigate potential vulnerabilities. Finally, the rapidly evolving nature of both load balancing and bare metal cloud technologies presents a challenge. Keeping pace with these advancements and ensuring compatibility between them can be a struggle for some organizations.

The Bare Metal Load Balancer Market Opportunities:

The burgeoning bare metal load-balancing landscape offers fertile ground for innovation. As awareness of the specific needs of bare metal environments grows, vendors have a chance to develop specialized load-balancing solutions. These solutions could address challenges like integration complexity by offering simplified processes, optimizing performance for bare metal workloads, and providing enhanced security features specifically suited for on-premises deployments. Additionally, streamlining integration between cloud-based load balancers and bare metal deployments through pre-configured templates, automation tools, and improved compatibility with bare metal cloud management platforms presents another opportunity. Managed service providers can capitalize on this growing demand by offering expert management and ongoing support for bare metal load balancing, reducing the burden on internal IT teams. The open-source community can also play a vital role by adapting and extending existing open-source load-balancing projects to better address the unique requirements of bare metal environments. Finally, a strong focus on user-friendly interfaces and automation tools within the maturing market will make load balancing more accessible to a wider range of organizations, even those with limited IT expertise. By capitalizing on these opportunities, various stakeholders can ensure bare metal load balancing keeps pace with the rapidly evolving bare metal cloud landscape.

BARE METAL LOAD BALANCER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.4% |

|

Segments Covered |

By Deployment Model, Solution Type, Functionality, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

F5 Networks, Citrix Systems, Microsoft, AWS, GCP, Kemp Technologies |

Bare Metal Load Balancer Market Segmentation: By Deployment Model

-

On-Premises Load Balancers

-

Cloud-Based Load Balancers

While a definitive market breakdown isn't available yet, analyzing deployment models offers insights. On-premises load balancers are likely the dominant segment initially due to security and control needs for bare metal deployments. However, cloud-based load balancers might be the fastest-growing segment due to the increasing adoption of cloud-based management and potential cost benefits, especially for smaller businesses entering the bare metal cloud space.

Bare Metal Load Balancer Market Segmentation: By Solution Type

-

Hardware Load Balancers

-

Software Load Balancers

-

Managed Load Balancing Services

Hardware load balancers offer superior performance and reliability, making them ideal for large enterprises with critical bare metal deployments. However, software load balancers are expected to see the fastest growth due to their increasing feature sets, potential cost savings, and better alignment with the growing popularity of cloud-based management for bare metal environments.

Bare Metal Load Balancer Market Segmentation: By Functionality

-

Basic Load Balancing

-

Advanced Load Balancing

Within the functionality segmentation of the potential bare metal load balancer market, Basic Load Balancing is likely the most dominant segment initially. This is because ensuring high availability and performance optimization are fundamental needs for any bare metal deployment. However, Advanced Load Balancing is expected to be the fastest-growing segment. As bare metal cloud deployments mature and organizations handle increasingly complex workloads, the demand for features like health checks, session persistence, and application-layer routing will rise. This will drive growth in the Advanced Load Balancing segment.

Bare Metal Load Balancer Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is expected to remain a leader in bare metal load balancing due to its early adoption of cloud-based services and high Information and Communication Technology (ICT) spending. Organizations here are likely to embrace advanced load-balancing features to optimize performance and manage complex workloads in their bare metal cloud environments.

With a booming tech sector and increasing cloud adoption, the Asia-Pacific region presents a significant potential market for bare metal load balancers. Cost-effectiveness might be a key consideration here, leading to strong demand for both basic and potentially open-source load-balancing solutions. As deployments mature, advanced functionalities will likely gain traction as well.

COVID-19 Impact Analysis on the Bare Metal Load Balancer Market:

The COVID-19 pandemic, while not directly creating a dedicated bare metal load balancer market, has had a positive indirect impact on the demand for load balancing solutions within the existing market, particularly for bare metal deployments. This surge can be attributed to the rapid shift to remote work and increased reliance on online services during the pandemic. This led to a significant rise in traffic for many organizations, straining their existing infrastructure. Load balancing solutions emerged as a critical tool for efficiently distributing traffic across bare metal servers, optimizing performance, and preventing outages as organizations grappled with the surge in workload and ensured application availability for their remote workforce. The pandemic also highlighted the need for both scalability and control. Cloud-based load balancing offered scalability for organizations facing fluctuating workloads, while on-premises solutions provided security and control for sensitive data. While not creating a new market segment, COVID-19 accelerated the adoption of load-balancing solutions within the existing market, specifically for optimizing performance and resource utilization in bare metal cloud environments during a period of significant growth in online activities. It's important to note that the long-term impact of the pandemic on the load balancer market, including its influence on bare metal deployments, is still evolving and will depend on ongoing economic trends and technological advancements.

Latest Trends/ Developments:

The concept of a dedicated bare metal load balancer market is still emerging, but the existing load balancer market is adapting to address the needs of bare metal deployments. A key trend is simplifying integration between cloud-based load balancers and bare metal servers through pre-configured templates, automation tools, and better compatibility with bare metal cloud platforms. The open-source community is also playing a role by adapting existing projects for bare metal environments, fostering innovation and potentially cost-effective solutions. Recognizing the growing demand for expertise, Managed Service Providers are offering managed load balancing services, taking the burden off internal IT teams. Security remains a top concern, especially for on-premises deployments, so load balancer vendors are prioritizing robust security features within their solutions. Finally, load-balancing configurations are being integrated into Infrastructure as Code (IaC) workflows, allowing for automation and consistency in infrastructure provisioning and load-balancing configuration. These trends highlight the focus on simplifying integration, leveraging open-source innovation, providing managed services expertise, prioritizing security, and aligning with modern infrastructure management practices. As bare metal cloud adoption grows, we can expect further advancements in load-balancing solutions tailored for this dynamic environment.

Key Players:

-

F5 Networks

-

Citrix Systems

-

Microsoft

-

AWS

-

GCP

-

Kemp Technologies

Chapter 1. Bare Metal Load Balancer Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Deployment Models

1.5 Secondary Deployment Models

Chapter 2. Bare Metal Load Balancer Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bare Metal Load Balancer Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bare Metal Load Balancer Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bare Metal Load Balancer Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bare Metal Load Balancer Market – By Deployment Model

6.1 Introduction/Key Findings

6.2 On-Premises Load Balancers

6.3 Cloud-Based Load Balancers

6.4 Y-O-Y Growth trend Analysis By Deployment Model

6.5 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 7. Bare Metal Load Balancer Market – By Solution Type

7.1 Introduction/Key Findings

7.2 Hardware Load Balancers

7.3 Software Load Balancers

7.4 Managed Load Balancing Services

7.5 Y-O-Y Growth trend Analysis By Solution Type

7.6 Absolute $ Opportunity Analysis By Solution Type, 2024-2030

Chapter 8. Bare Metal Load Balancer Market – By Functionality

8.1 Introduction/Key Findings

8.2 Basic Load Balancing

8.3 Advanced Load Balancing

8.4 Y-O-Y Growth trend Analysis By Functionality

8.5 Absolute $ Opportunity Analysis By Functionality, 2024-2030

Chapter 9. Bare Metal Load Balancer Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Deployment Model

9.1.3 By Solution Type

9.1.4 By Functionality

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Deployment Model

9.2.3 By Solution Type

9.2.4 By Functionality

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Deployment Model

9.3.3 By Solution Type

9.3.4 By Functionality

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Deployment Model

9.4.3 By Solution Type

9.4.4 By Functionality

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Deployment Model

9.5.3 By Solution Type

9.5.4 By Functionality

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Bare Metal Load Balancer Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 F5 Networks

10.2 Citrix Systems

10.3 Microsoft

10.4 AWS

10.5 GCP

10.6 Kemp Technologies

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Bare Metal Load Balancer Market was valued at USD 8.5 billion in 2023 and is projected to reach a market size of USD 26.13 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 17.4%.

Explosive Growth of Bare Metal Cloud, Traditional Load Balancers Rise to the Challenge, Catering to a Diverse Set of Needs, Technological Advancements in Load Balancing Fuel Growth.

Basic Load Balancing, Advanced Load Balancing.

North America is likely the most dominant region for potential Bare Metal Load Balancing solutions.

F5 Networks, Citrix Systems, Microsoft, AWS, GCP, Kemp Technologies.