Barcode Scanner Market Size (2024 – 2030)

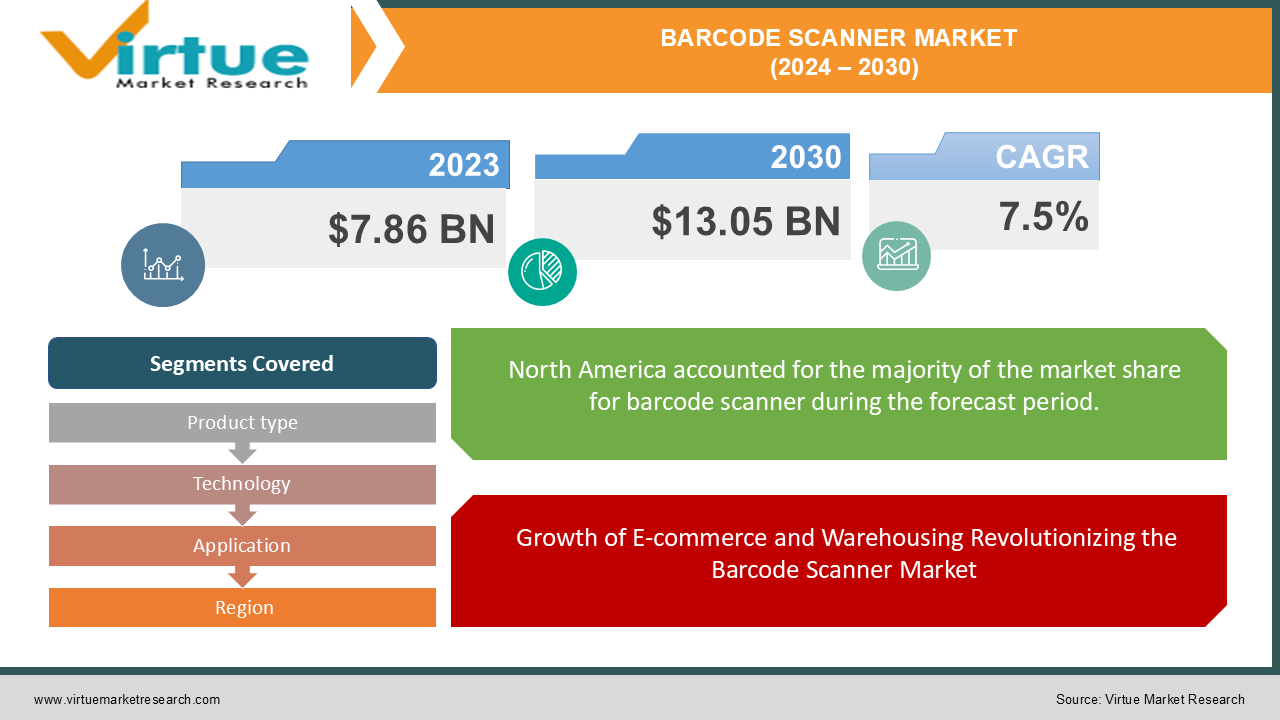

The Global Barcode Scanner Market was valued at USD 7.86 billion in 2023 and is projected to reach a market size of USD 13.05 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 7.5% between 2024 and 2030.

The global barcode scanner market has seen significant growth in recent years, driven by the increasing demand for efficient data capture and inventory management across various industries. Barcode scanners are essential tools in retail, healthcare, logistics, manufacturing, and other sectors for tracking products, managing stock, and streamlining operations. The rise of e-commerce and omnichannel retailing has further amplified the need for fast and accurate data collection, pushing companies to adopt advanced barcode scanning technologies. These devices enhance operational efficiency by reducing human errors, speeding up checkout processes, and enabling real-time tracking of goods. The development of more sophisticated scanners, including those equipped with wireless connectivity, imaging technology, and integration with mobile devices, has expanded their functionality and appeal. Additionally, the adoption of 2D barcodes and QR codes, which hold more data than traditional barcodes, has contributed to the growing popularity of advanced barcode scanners. As businesses across the globe continue to prioritize automation and accuracy in their workflows, the demand for innovative barcode scanning solutions is expected to rise, making it a key component of modern supply chain and retail operations. The global barcode scanner market is poised for sustained growth as these technologies become increasingly integral to efficient business operations.

Key Market Insights:

-

Over 80% of retailers globally use barcode scanners for inventory management and checkout processes.

-

The global barcode scanner market is projected to grow at a CAGR of around 7% from 2023 to 2028.

-

More than 60% of barcode scanners sold can read 2D barcodes like QR codes.

-

The rise of e-commerce has driven a 30% increase in demand for barcode scanners in logistics and warehousing.

-

About 40% of barcode scanners are now integrated with mobile devices for flexible data collection.

-

Around 35% of barcode scanner sales come from the healthcare sector for tracking medications, patient information, and equipment.

-

Wireless barcode scanners make up nearly 50% of the market, offering flexibility and convenience in operations.

Global Barcode Scanner Market Drivers:

Rising Demand for Efficient Retail Operations Drives the Growth of the Barcode Scanner Market

The global barcode scanner market is being driven by the increasing need for efficiency in retail operations. Retailers are constantly seeking ways to streamline checkout processes, manage inventory more effectively, and enhance customer experiences. Barcode scanners play a pivotal role in automating these processes, allowing retailers to quickly scan products at checkout, update inventory in real time, and minimize human errors. The growing trend of omnichannel retailing, where businesses operate both physical and online stores, has heightened the demand for barcode scanners to ensure smooth, integrated inventory management across multiple platforms. Additionally, the rise of self-checkout systems in supermarkets and convenience stores has further fueled the adoption of barcode scanners, as they enable faster, more convenient transactions for consumers. As retail environments continue to evolve towards greater automation and efficiency, the demand for barcode scanning technologies is expected to grow steadily. This driver is crucial in helping businesses reduce operational costs while improving overall customer satisfaction, making it a significant factor in the expansion of the global barcode scanner market.

Growth of E-commerce and Warehousing Revolutionizing the Barcode Scanner Market

The booming e-commerce sector is another key driver for the global barcode scanner market. With the rapid expansion of online shopping, there has been a substantial increase in the volume of goods being stored, tracked, and shipped. Barcode scanners have become indispensable tools in warehouses and distribution centers, where they facilitate accurate order picking, packing, and shipping, while also enabling real-time inventory updates. The demand for faster order fulfillment and greater supply chain transparency has made barcode scanning technology essential for e-commerce businesses. Additionally, the rise of fulfillment centers, driven by major e-commerce players like Amazon and Alibaba, has further fueled the demand for advanced barcode scanners capable of handling high-volume operations. The increasing reliance on barcode scanning for efficient logistics management, combined with the growing need for seamless inventory tracking, positions e-commerce as a major contributor to the expansion of the barcode scanner market. As online shopping continues to grow, the role of barcode scanners in optimizing warehousing and supply chain operations will only become more prominent.

Global Barcode Scanner Market Restraints and Challenges:

The global barcode scanner market faces several restraints and challenges that could hinder its growth. One significant challenge is the high cost of advanced barcode scanning technologies, such as 2D and wireless scanners, which can be prohibitive for small and medium-sized enterprises (SMEs) with limited budgets. These businesses may opt for traditional manual methods or cheaper alternatives, slowing the adoption of modern scanning solutions. Additionally, the increasing integration of Radio Frequency Identification (RFID) technology poses a competitive threat, as RFID offers advantages such as the ability to scan multiple items at once without direct line-of-sight, potentially reducing demand for barcode scanners. Another challenge is the need for continuous technological updates, as rapid advancements in scanning technologies require businesses to frequently invest in upgrading their equipment, adding to operational costs. The risk of data breaches and cyber-attacks in wireless barcode scanning systems also raises concerns over security, particularly in sectors like healthcare and retail where sensitive information is handled. Furthermore, the market is impacted by the lack of standardization across various industries, which can lead to compatibility issues and complicate the integration of barcode scanners into existing systems. These challenges present obstacles to widespread adoption and growth of the barcode scanner market.

Global Barcode Scanner Market Opportunities:

The global barcode scanner market presents several growth opportunities driven by technological advancements and expanding industry applications. One major opportunity lies in the increasing adoption of automation across industries such as retail, healthcare, and logistics. As businesses continue to automate processes, barcode scanners will play a crucial role in streamlining inventory management, enhancing productivity, and reducing human errors. The rise of mobile barcode scanning, where smartphones and tablets are equipped with barcode scanning capabilities, opens new avenues for businesses to adopt cost-effective, portable solutions, particularly among small and medium-sized enterprises (SMEs). Additionally, the growing e-commerce sector provides significant opportunities for barcode scanner manufacturers. As online shopping increases globally, the need for efficient warehousing, inventory tracking, and order fulfillment systems becomes more critical, driving demand for advanced barcode scanning solutions. The healthcare sector also offers immense potential for barcode scanner adoption, especially in patient management, medication tracking, and equipment monitoring, as the emphasis on accurate data handling continues to rise. Furthermore, the shift towards cloud-based barcode scanning systems presents another opportunity, offering businesses enhanced scalability, data storage, and real-time insights. These factors, combined with the growing demand for automated and connected systems, provide substantial opportunities for the expansion of the global barcode scanner market.

BARCODE SCANNER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Product type, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Zebra Technologies Corporation, Honeywell International Inc., Datalogic S.p.A., Cognex Corporation, SATO Holdings Corporation, Toshiba TEC Corporation, Opticon Sensors Europe B.V., Scandit AG, Bluebird Inc., Advantech Co., Ltd., TSC Auto ID Technology Co., Ltd., Wasp Barcode Technologies |

Global Barcode Scanner Market Segmentation: By Product Type

-

Handheld Scanners.

-

Fixed Scanners

-

Mobile Scanners

-

Industrial Scanners

In 2023, based on market segmentation by Product Type, Fixed Scanners had the highest share of the Global Barcode Scanner Market. Fixed scanners play a pivotal role in industrial applications, particularly in settings requiring high-volume scanning, such as production lines and conveyor systems. These devices are strategically integrated into automated workflows, allowing for seamless and continuous data capture. One of their primary advantages is their ability to withstand the harsh environments typical of industrial settings, offering durability and reliability that reduce downtime and maintenance costs. Fixed scanners are often paired with other automated systems, such as robotic arms or sorting machines, further streamlining operations and boosting efficiency. This integration optimizes production processes, ensuring that tasks such as product identification, sorting, and inventory management occur with minimal human intervention. Additionally, fixed scanners provide a cost-effective solution in environments where frequent scanning is necessary, as their robust design reduces the need for replacements or repairs over time. The efficiency they introduce into high-volume operations translates into long-term savings by minimizing labor costs and maximizing throughput. Overall, fixed scanners are indispensable tools for industries looking to enhance productivity and maintain operational efficiency through automation.

Global Barcode Scanner Market Segmentation: By Technology

-

Laser Scanners

-

Image Scanners

-

Radio Frequency Identification (RFID)

In 2023, based on market segmentation by Technology, Laser Scanners had the highest share of the Global Barcode Scanner Market. Laser scanners are widely recognized for their reliability and accuracy, making them a go-to solution across numerous industries. These devices excel in reading barcodes from various distances and angles, even in challenging conditions such as poor lighting or damaged codes. Their ability to decode different barcode symbologies, including 1D, 2D, and stacked barcodes, adds to their versatility, making them suitable for diverse applications in sectors ranging from retail to manufacturing. Durability is another hallmark of laser scanners, as they are built to withstand harsh industrial environments, ensuring consistent performance over time. This robustness reduces the need for frequent replacements, contributing to their cost-efficiency. As laser scanning technology has advanced, the price point for these devices has become more affordable, making them a viable option for businesses of all sizes, from small enterprises to large corporations. Despite the rise of newer technologies like imagers and CCD scanners, laser scanners maintain their dominance in the barcode scanner market due to their proven track record of reliability, durability, and performance. These factors continue to position laser scanners as a preferred choice for companies looking to enhance operational efficiency and ensure accurate data capture across various environments.

Global Barcode Scanner Market Segmentation: By Application

-

Retail

-

Healthcare

-

Manufacturing

-

Logistics and Transportation

-

Government

In 2023, based on market segmentation by Application, Retail had the highest share of the Global Barcode Scanner Market. Barcode scanners are essential tools in retail, particularly in point-of-sale (POS) systems, where they streamline the checkout process by quickly and accurately identifying products, verifying prices, and updating inventory in real time. By automating these tasks, barcode scanners significantly enhance operational efficiency and reduce the risk of human errors, such as incorrect pricing. Retailers also rely on barcode scanners for effective inventory management, ensuring that stock levels are maintained accurately to avoid stockouts or overstocking, which can negatively impact sales and customer satisfaction. The use of barcode scanners in price verification further contributes to accuracy, as prices are automatically matched with product information from the barcode, minimizing discrepancies and improving transparency for both customers and staff. Additionally, the speed and precision of barcode scanners at checkout enhance the overall customer experience, leading to faster transactions and fewer errors, which fosters customer loyalty. While industries like healthcare, manufacturing, and logistics also utilize barcode scanning technology, the retail sector remains a major driver of demand due to its high volume of daily transactions and its emphasis on efficiency and customer service. As a result, barcode scanners continue to be an integral part of modern retail operations.

Global Barcode Scanner Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, North America had the highest share of the Global Barcode Scanner Market. North America has established itself as a leading region in the barcode scanner market, driven by its early adoption of barcode technology, particularly in key industries like retail and logistics. This early adoption has created a robust market presence for barcode scanners, positioning North America as a pioneer in the sector. The region's well-developed infrastructure, encompassing a vast network of retail stores, warehouses, and manufacturing facilities, heavily relies on barcode scanners to optimize operations, streamline inventory management, and enhance efficiency. Additionally, North America's status as a hub for technological innovation has spurred the development and advancement of barcode scanner technologies, further reinforcing its dominance in the global market. The region's strong economic growth has also fueled demand for barcode scanners across various industries, including healthcare, manufacturing, and retail, where accurate data capture and operational efficiency are crucial. While regions like Asia-Pacific and Europe have experienced significant growth in their barcode scanner markets, North America's combination of early adoption, advanced infrastructure, and continued technological advancements has solidified its position as the market leader in barcode scanner adoption and innovation.

COVID-19 Impact Analysis on the Global Barcode Scanner Market.

The COVID-19 pandemic had a notable impact on the global barcode scanner market, both positively and negatively. On one hand, the surge in e-commerce and online shopping during the pandemic led to an increased demand for barcode scanners, particularly in logistics, warehousing, and retail sectors, as businesses scrambled to keep up with soaring demand for home deliveries and contactless transactions. This boosted the adoption of barcode scanning technologies to streamline inventory management and order fulfillment processes. In healthcare, barcode scanners play a critical role in tracking medical supplies, managing patient data, and ensuring the accuracy of medication administration, further driving market growth. However, the pandemic also caused supply chain disruptions and delays in the manufacturing of barcode scanners due to lockdowns and restrictions on production facilities, particularly in countries with heavy manufacturing bases like China. Small and medium-sized enterprises (SMEs), especially in retail, were financially impacted by the pandemic and delayed their investments in new technologies, including barcode scanners, further challenging the market. Despite these obstacles, the barcode scanner market is poised for recovery and growth as industries increasingly prioritize automation and efficient data management in the post-pandemic world, with a continued focus on contactless technologies.

Latest trends / Developments:

The global barcode scanner market is witnessing several notable trends and developments driven by advancements in technology and evolving industry needs. One key trend is the increasing shift towards 2D barcode scanners, which are capable of reading QR codes and other data-rich barcodes, making them more versatile than traditional 1D scanners. This shift is fueled by the growing demand for more detailed information encoded in barcodes, particularly in industries like healthcare and retail. Another significant trend is the rise of mobile and wireless barcode scanners, offering greater flexibility and mobility for businesses, especially in sectors like warehousing and logistics. These devices allow workers to scan barcodes in real time from various locations, improving operational efficiency. The integration of barcode scanning technology into smartphones and tablets is also on the rise, enabling small businesses and retailers to use cost-effective, portable scanning solutions without investing in dedicated hardware. Additionally, cloud-based barcode scanning systems are gaining traction, providing businesses with enhanced data storage, scalability, and real-time access to inventory data from anywhere. Sustainability is another emerging focus, with businesses increasingly adopting eco-friendly, energy-efficient scanners. These trends indicate a continued evolution of the barcode scanner market towards more advanced, flexible, and connected solutions to meet the growing demands of automation and efficiency.

Key Players:

-

Zebra Technologies Corporation

-

Honeywell International Inc.

-

Datalogic S.p.A.

-

Cognex Corporation

-

SATO Holdings Corporation

-

Toshiba TEC Corporation

-

Opticon Sensors Europe B.V.

-

Scandit AG

-

Bluebird Inc.

-

Advantech Co., Ltd.

-

TSC Auto ID Technology Co., Ltd.

-

Wasp Barcode Technologies

Chapter 1. Barcode Scanner Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Barcode Scanner Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Barcode Scanner Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Barcode Scanner Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Barcode Scanner Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Barcode Scanner Market – By Product Type

6.1 Introduction/Key Findings

6.2 Handheld Scanners.

6.3 Fixed Scanners

6.4 Mobile Scanners

6.5 Industrial Scanners

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Barcode Scanner Market – By Technology

7.1 Introduction/Key Findings

7.2 Laser Scanners

7.3 Image Scanners

7.4 Radio Frequency Identification (RFID)

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Barcode Scanner Market – By Application

8.1 Introduction/Key Findings

8.2 Retail

8.3 Healthcare

8.4 Manufacturing

8.5 Logistics and Transportation

8.6 Government

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Barcode Scanner Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Technology

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Technology

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Technology

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Technology

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Technology

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Barcode Scanner Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Zebra Technologies Corporation

10.2 Honeywell International Inc.

10.3 Datalogic S.p.A.

10.4 Cognex Corporation

10.5 SATO Holdings Corporation

10.6 Toshiba TEC Corporation

10.7 Opticon Sensors Europe B.V.

10.8 Scandit AG

10.9 Bluebird Inc.

10.10 Advantech Co., Ltd.

10.11 TSC Auto ID Technology Co., Ltd.

10.12 Wasp Barcode Technologies

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Barcode Scanner market is expected to be valued at US$ 7.86 billion.

Through 2030, the Global Barcode Scanner market is expected to grow at a CAGR of 7.5%.

By 2030, the Global Barcode Scanner Market is expected to grow to a value of US$ 13.05 billion.

Asia-Pacific is predicted to lead the Global Barcode Scanner market.

The Global Barcode Scanner Market has segments By Technology, Product Type, Application, and Region.