Bandpass Filter Coatings Market Size (2025-2030)

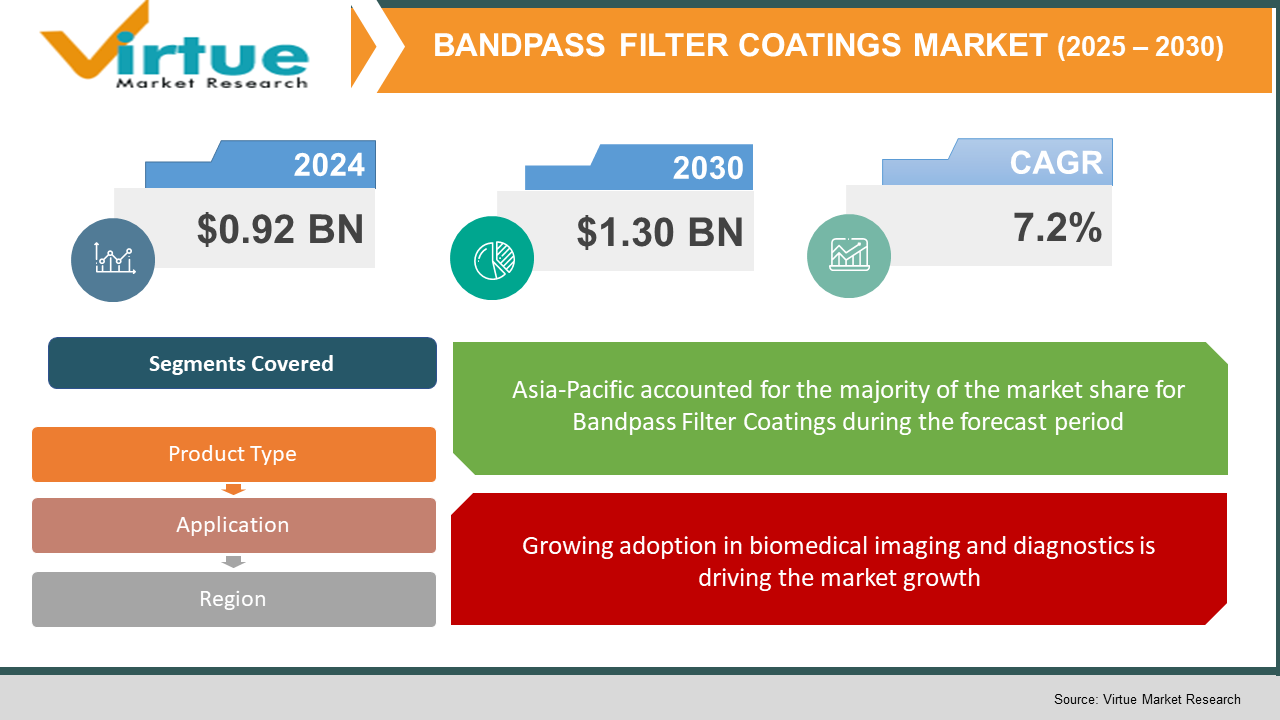

The Global Bandpass Filter Coatings Market was valued at USD 0.92 billion in 2024 and will grow at a CAGR of 7.2% from 2025 to 2030. The market is expected to reach USD 1.30 billion by 2030.

The Bandpass Filter Coatings Market involves optical coatings that allow specific wavelengths of light to pass through while blocking others. These coatings are critical in devices that require precise light control such as medical imaging systems, spectrophotometers, LIDAR, consumer electronics, and industrial equipment. With ongoing advancements in photonics, diagnostics, and optical communication systems, bandpass filter coatings are increasingly used to enhance performance and accuracy. The demand for these coatings is driven by innovations in optical sensors, increasing use of AR/VR systems, and expanding applications in automotive safety systems. As industries seek greater precision and miniaturization, the role of highly engineered coatings becomes more crucial, positioning the market for sustained long-term growth.

Key market insights:

- Biomedical devices account for over 25% of the total market demand in 2024, owing to growing use in diagnostics and imaging

- Hard coatings are the dominant product type, capturing more than 60% of the market share due to superior durability

- Asia-Pacific leads the market with over 35% share, driven by electronics manufacturing and expanding healthcare infrastructure

- Consumer electronics applications are witnessing a CAGR of 8.5%, supported by integration of optical systems in smartphones and AR devices

Global Bandpass Filter Coatings Market Drivers

Growing adoption in biomedical imaging and diagnostics is driving the market growth

The increasing use of bandpass filter coatings in biomedical imaging and diagnostic devices is one of the key growth drivers of the market. In applications like fluorescence microscopy, endoscopy, and spectroscopy, precise wavelength filtering is crucial for accurate imaging and analysis. These coatings allow the passage of specific wavelength ranges that correspond to fluorophores or biological markers, improving clarity and contrast. As non-invasive diagnostic techniques gain traction due to patient comfort and reduced recovery time, the demand for advanced optical filters continues to grow. Hospitals and research institutions are adopting high-end diagnostic equipment that rely on optical precision, which enhances the role of these coatings. The pandemic has also elevated investment in optical diagnostic devices, increasing awareness and accessibility. Additionally, research and development in optical biosensors and point-of-care testing devices further expand the role of bandpass filter coatings. The rising prevalence of chronic diseases and emphasis on early detection necessitate advanced optical systems for diagnostics, thereby fueling demand for filter coatings. Moreover, the integration of multi-spectral imaging and advanced light control in new diagnostic devices creates more avenues for market growth.

Rising integration in consumer electronics and AR/VR systems is driving the market growth

Consumer electronics have increasingly become dependent on optical elements for features such as face recognition, ambient light detection, and enhanced camera functionalities. Bandpass filter coatings are employed in these systems to isolate certain light wavelengths while suppressing noise and irrelevant signals. In smartphones and tablets, these coatings are applied to camera modules and proximity sensors for improved accuracy and performance. Additionally, with the growing popularity of AR and VR technologies, there is a surge in demand for filters that support high-definition imaging and precise light modulation. These filters enable clear visual processing and immersive experiences in head-mounted displays and smart glasses. Manufacturers are investing in compact and energy-efficient filter technologies that can be seamlessly integrated into sleek, miniaturized electronic devices. The demand for wearables and IoT-enabled optical systems also contributes to the need for robust, lightweight, and stable coatings. As electronics evolve toward more sensor-rich platforms with multiple optical functionalities, the role of bandpass filter coatings expands significantly, supporting both performance and user experience improvements.

Advancements in deposition technologies and nanocoatings is driving the market growth

The evolution of thin-film deposition technologies has significantly improved the quality, durability, and customization of bandpass filter coatings. Techniques such as ion beam sputtering (IBS), electron beam evaporation, and plasma-enhanced chemical vapor deposition (PECVD) offer precise control over layer thickness and uniformity. These methods allow manufacturers to tailor coatings for highly specific wavelength ranges, thermal stability, and environmental resistance. Recent innovations have introduced nanostructured coatings that provide enhanced spectral performance while minimizing reflection and scattering. Nanocoatings also facilitate anti-fog and anti-scratch functionalities, expanding usability across various harsh environments. With growing demands for compact and multi-functional optical devices, manufacturers are focusing on scalable processes that ensure high throughput and low defect rates. The integration of machine learning and simulation tools in the design of optical stacks has further reduced the time-to-market and improved customization capabilities. These advancements collectively enhance product performance and open new markets in aerospace, defense, and automotive sectors where reliability and precision are critical. The ongoing innovation in this space makes it a foundational growth pillar for the bandpass filter coatings market.

Global Bandpass Filter Coatings Market Challenges and Restraints

High production cost and technological complexity is restricting the market growth

Producing high-performance bandpass filter coatings involves complex processes and significant capital investment. The precision required in thin-film deposition and the use of expensive raw materials such as high-purity oxides or nitrides drive up manufacturing costs. Coating equipment like ion beam sputtering machines, cleanroom environments, and optical metrology tools also require large initial outlays and maintenance. These high costs can limit the entry of smaller players and restrict market competition. Moreover, any slight error in layer thickness or uniformity can result in functional failure, requiring stringent quality control and skilled technicians. As product customization increases, maintaining consistency across production batches becomes even more challenging. Smaller manufacturing volumes for niche or specialized coatings often further increase the unit price. In markets where price sensitivity is high, especially in consumer electronics, manufacturers may hesitate to adopt premium coatings. The technical expertise required and the long development cycles associated with these coatings pose additional hurdles for rapid innovation and mass adoption. While R&D is working to simplify and reduce costs, the current state of technology presents a significant restraint for market expansion.

Environmental and durability limitations of some coatings is restricting the market growth

Although bandpass filter coatings are designed for durability, certain types, especially soft coatings, are more prone to degradation under harsh environmental conditions such as high humidity, extreme temperatures, or UV exposure. These environmental factors can affect the optical properties, leading to performance drift or complete failure over time. In industrial or military applications where robustness is critical, these limitations can be a major barrier to adoption. The coatings may also be sensitive to mechanical abrasion, requiring protective layers that add to production complexity and cost. Moreover, recycling or disposal of coated optical components can pose environmental challenges due to the non-biodegradable nature of many coating materials and potential toxicity. Compliance with increasingly stringent environmental regulations around materials and emissions during manufacturing can impact operational flexibility and increase compliance costs. As end-user industries seek to enhance sustainability, the demand for eco-friendly coating processes and materials is rising, but the current options may not yet fully meet performance requirements. These environmental and durability challenges pose a barrier to full-scale adoption in high-demand applications.

Market opportunities

The growing reliance on advanced optical technologies across industries presents vast opportunities for the Bandpass Filter Coatings Market. The expansion of biomedical applications, particularly in early diagnostics and personalized medicine, is increasing the demand for sophisticated optical filters that can enhance imaging precision and wavelength specificity. Furthermore, the automotive sector, with its rapid embrace of LIDAR systems and in-cabin sensing, offers a fertile ground for specialized coatings that can withstand vibration, temperature fluctuations, and dust exposure. The burgeoning space and defense sectors also require high-performance optical filters for imaging, communication, and navigation, thus opening niche but lucrative markets for highly durable coatings. Emerging markets such as India, Southeast Asia, and parts of Africa are witnessing rapid growth in healthcare infrastructure and consumer electronics manufacturing, creating a robust demand base. Additionally, the integration of optical components in AI-enabled devices, machine vision systems, and quantum computing offers long-term growth avenues. Innovations in green coating technologies and sustainable materials can tap into growing environmental consciousness, particularly in Europe and North America. Strategic collaborations between academic institutions, tech companies, and filter manufacturers can expedite the development of next-generation nanocoatings and multifunctional filters. This innovation pipeline, combined with expanding application areas, positions the market for long-term profitability and diversification beyond traditional sectors.

BANDPASS FILTER COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Product Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

|

Bandpass Filter Coatings Market segmentation

Bandpass Filter Coatings Market By Product Type

• Hard Coatings

• Soft Coatings

Hard coatings dominate the Bandpass Filter Coatings Market due to their superior durability, resistance to environmental degradation, and extended operational lifespan. These coatings are well-suited for demanding applications such as industrial equipment, medical devices, and aerospace systems. Hard coatings typically offer better scratch resistance and perform reliably in extreme conditions, making them the preferred choice for high-performance optical components. Their ability to withstand repeated cleaning and sterilization processes adds further value in medical environments, reinforcing their leading position in the market.

Bandpass Filter Coatings Market By Application

• Optical Instruments

• Consumer Electronics

• Biomedical Devices

• Others

Biomedical devices are the dominant application segment, accounting for the largest market share due to their extensive use in diagnostics and surgical imaging systems. Bandpass filter coatings in biomedical devices enable accurate detection and visualization of specific biological markers. Their integration in devices like endoscopes, fluorescence microscopes, and biosensors is driven by the increasing prevalence of chronic diseases, the shift toward non-invasive diagnostics, and rapid technological progress in imaging systems. This consistent demand solidifies their leading role in application-based segmentation.

Bandpass Filter Coatings Market Regional segmentation

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

Asia-Pacific is the leading region in the Bandpass Filter Coatings Market, contributing over 35% of the global revenue in 2024. The region's dominance is fueled by its strong electronics manufacturing base, particularly in countries like China, Japan, and South Korea, where optical components are produced at scale for global consumption. The expansion of the healthcare sector in emerging economies such as India and Southeast Asia further boosts demand for coated biomedical optics. Government investments in industrial automation, photonics, and research infrastructure support continuous innovation and adoption. Additionally, the growth of automotive and consumer electronics sectors in this region aligns with the increasing need for high-performance optical components, solidifying Asia-Pacific’s lead in the market.

COVID-19 Impact Analysis on the Bandpass Filter Coatings Market

The COVID-19 pandemic had a multifaceted impact on the Bandpass Filter Coatings Market. Initially, the disruption of global supply chains and manufacturing operations led to delayed production timelines and reduced output across several industries reliant on optical components. Restrictions on workforce mobility and raw material shortages, particularly in Asia-Pacific and Europe, negatively affected coating production facilities. However, the healthcare sector witnessed a surge in demand for diagnostic and imaging devices, prompting accelerated adoption of optical filters and coatings in those segments. Companies rapidly adjusted to prioritize biomedical applications, temporarily offsetting losses in other verticals such as automotive and consumer electronics. The shift to remote work and online education also boosted demand for consumer electronics, particularly devices with optical sensors and imaging capabilities, contributing to partial recovery. In the medium term, the pandemic emphasized the importance of localized supply chains and the need for resilient, adaptable manufacturing ecosystems. It also accelerated R&D in non-contact diagnostic tools and biosensing technologies, offering new opportunities for filter coating applications. Overall, while the pandemic presented short-term operational and financial challenges, it also revealed untapped growth potential in healthcare, remote diagnostics, and wearable devices.

Latest trends/developments

Recent trends in the Bandpass Filter Coatings Market revolve around material innovation, sustainability, and application-specific customization. The development of nanostructured coatings has enabled superior spectral control and reduced energy losses, making them ideal for compact, high-resolution optical systems. Manufacturers are increasingly adopting environmentally friendly deposition methods and exploring lead-free, recyclable materials in response to stricter global regulations. The miniaturization trend in electronics has pushed coating manufacturers to deliver ultra-thin, highly efficient layers with minimal optical distortion. In biomedical applications, multi-bandpass filters that allow simultaneous transmission of multiple wavelength bands are gaining popularity, improving the efficiency of multi-channel imaging systems. Additionally, automotive OEMs are integrating these coatings into LIDAR and camera systems to improve performance in autonomous navigation. Another notable trend is the use of AI and simulation software in the design phase, which helps accelerate development cycles and reduce prototyping costs. Strategic collaborations between universities, research labs, and commercial players are fostering rapid innovation. These developments signal a transformation in how coatings are designed, produced, and deployed across both traditional and emerging sectors.

Key Players:

- Alluxa

- Edmund Optics

- Chroma Technology Corporation

- Materion Corporation

- Thorlabs Inc.

- Iridian Spectral Technologies

- Omega Optical

- SCHOTT AG

- Semrock

- Newport Corporation

Chapter 1. Bandpass Filter Coatings Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. BANDPASS FILTER COATINGS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. BANDPASS FILTER COATINGS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. BANDPASS FILTER COATINGS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. BANDPASS FILTER COATINGS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. BANDPASS FILTER COATINGS MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Hard Coatings

6.3 Soft Coatings

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. BANDPASS FILTER COATINGS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Optical Instruments

7.3 Consumer Electronics

7.4 Biomedical Devices

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. BANDPASS FILTER COATINGS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. BANDPASS FILTER COATINGS MARKET – Company Profiles – (Overview, Product , Portfolio, Financials, Strategies & Developments)

9.1 Alluxa

9.2 Edmund Optics

9.3 Chroma Technology Corporation

9.4 Materion Corporation

9.5 Thorlabs Inc.

9.6 Iridian Spectral Technologies

9.7 Omega Optical

9.8 SCHOTT AG

9.9 Semrock

9.10 Newport Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bandpass Filter Coatings Market was valued at USD 0.92 billion in 2024 and will grow at a CAGR of 7.2% from 2025 to 2030. The market is expected to reach USD 1.30 billion by 2030.

Key drivers include growth in biomedical imaging, AR/VR devices, and advancements in coating technologies.

Segments include product type (hard coatings, soft coatings) and application (biomedical, electronics, instruments, others).

Asia-Pacific dominates the market with over 35% share due to strong electronics and medical device industries

Leading players include Alluxa, Edmund Optics, Chroma Technology, Materion, and Thorlabs