Bakery Processing Equipment Market Size (2024 – 2030)

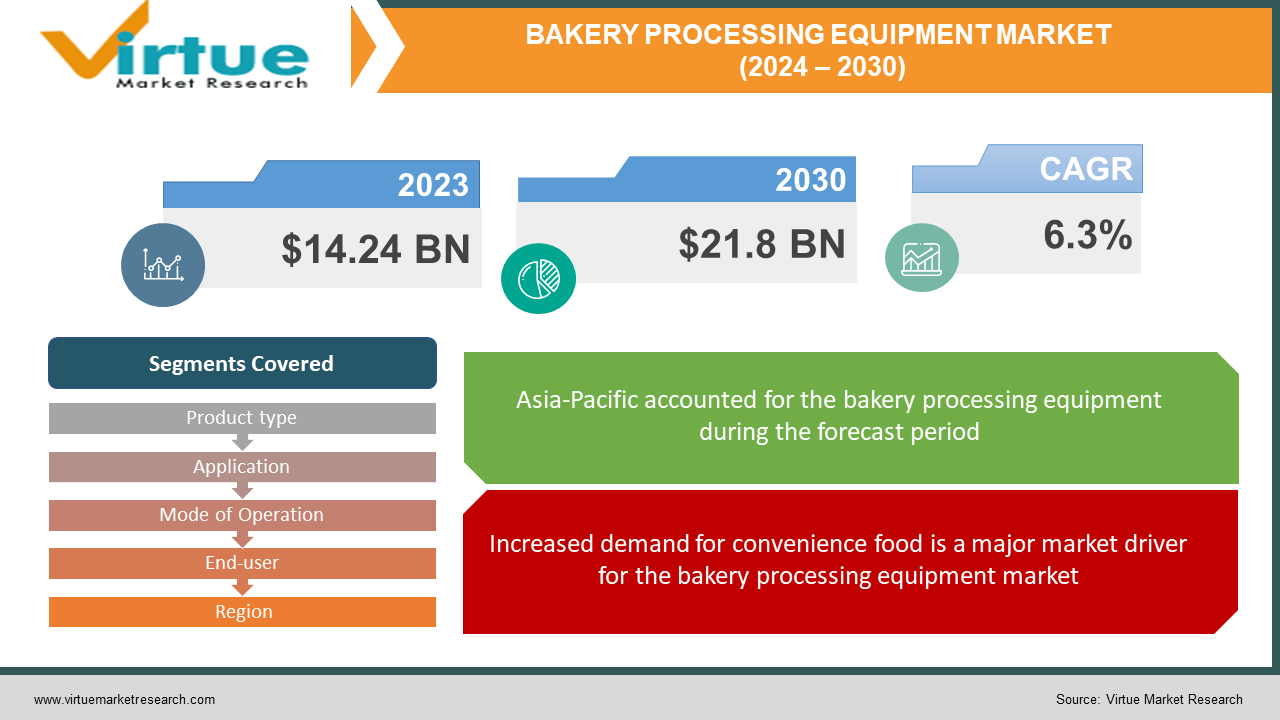

The global bakery processing equipment market size was exhibited at USD 14.24 billion in 2023 and is projected to hit around USD 21.8 billion by 2030, growing at a CAGR of 6.3% during the forecast period from 2024 to 2030.

Bakery processing equipment plays a pivotal role in addressing production challenges for artisans and manufacturers in the bakery industry, facilitating the large-scale production of various bakery products. High-demand items such as bread, pizza bases, and confectioneries command a significant market share, prompting bakery manufacturers to upgrade their production facilities to meet these demands. This upgrade has led to increased adoption of equipment in diverse settings, including bakeries, hotels, restaurants, pilot plants, and low-capacity processors. Key industry players are prioritizing the integration of technologically advanced equipment to automate their baking processes, further bolstering the sales of processing equipment in the bakery sector. The market is also witnessing progressive growth due to a robust demand for ready-to-eat bakery products.

Key Market Insights:

The global bakery processing equipment market is undergoing substantial growth, propelled by the increasing worldwide demand for a diverse range of bakery products. A crucial market insight underscores a growing focus on automation and technological advancements in processing equipment to optimize efficiency and meet rising production requirements. The surging popularity of artisanal and specialty baked goods continues to drive the market, prompting manufacturers to invest in innovative solutions tailored to evolving consumer preferences. Furthermore, there is a notable uptick in the adoption of energy-efficient and sustainable equipment, aligning with the broader industry trend toward environmental consciousness. Emerging economies are emerging as key focal points for market expansion, with urbanization and evolving consumer lifestyles fueling the demand for processed bakery products. Amidst a rapidly evolving competitive landscape, key industry players are strategically engaging in collaborations, diversifying their product portfolios, and expanding geographically to maintain a competitive edge in this dynamic market.

Global Bakery Processing Equipment Market Drivers:

Increased demand for convenience food is a major market driver for the bakery processing equipment market.

The surge in demand for convenient food products is propelled by the escalating need for ease and efficiency in the busy lives of consumers. The increase in per-capita income has fostered a greater preference for ready-to-eat and on-the-go food items, subsequently driving the demand for bakery products. The positive outlook for market growth is attributed to the robust expansion of the bakery industry. Consumers benefit from the purchase of bakery products due to their ease of use, consumption, and extended storage capabilities. Developing countries like China, India, Brazil, and the Middle East have witnessed a shift from traditional homemade breakfasts to ready-to-eat products. Innovations in equipment enable easy handling, extend product shelf life, and enhance aesthetic properties and flavor characteristics, contributing to the growth of the bakery processing equipment market.

The increased interest in energy-efficient equipment by manufacturers is also driving the market.

The adoption of energy-efficient equipment by manufacturers is a key driver of market growth, influenced by heightened research activities and technological advancements in the global bakery industry. Prominent players prioritize product research and development to create energy-efficient and cost-effective equipment. Strategic changes to meet consumer needs have fostered competitiveness among manufacturers, resulting in increased product varieties and market offerings. Despite labor shortages, manufacturers focus on automation, R&D, and marketing strategies to boost demand for bakery foods. Growing consumer demand for bakery products is expected to accelerate production and drive demand for bakery processing equipment.

Global Bakery Processing Equipment Market Restraints and Challenges:

Wastewater management in the production of bakery items may pose a challenge

The maintenance of wastewater in bakery production lines poses a significant challenge to the industry. The bakery sector, with varying production scales and processes, relies heavily on water for equipment maintenance. Hot water mixed with detergents is used for washing baking plates, molds, and trays, characterized by high loading, fluctuating flow, and rich oil and grease content. Additionally, waste components include flour, oil, sugar, and yeast, impacting the overall wastewater management in bakery production.

The competition from local manufacturers who are providing low-cost products may also impede market growth

Competition from local manufacturers in Asia offering low-cost products presents a restraint for high-end equipment manufacturers in developed regions. To remain competitive, these manufacturers must either reduce profits to offer products at competitive prices or enhance production and sales, providing increased functionality at minimal costs. This strategy aims to enable bakery product manufacturers to reduce installation expenses without compromising on quality.

Global Bakery Processing Equipment Market Opportunities:

The ever-increasing demand for new bakery products such as frozen bakery presents a great opportunity for the bakery processing equipment market.

An opportunity in the market lies in the increasing demand for new products, particularly frozen bakery items. The popularity of frozen bakery products stems from their ease of preparation, time efficiency, and cost-effectiveness for institutional outlets. There is a rising demand for various frozen bakery products due to their diverse tastes and applicability in Quick Service Restaurants and food chains. The emergence of international specialties in domestic food markets is a notable trend in the global frozen bread and bakery markets. Crossover bakery products, such as frozen bread, are gaining consumer preference. The growing popularity of frozen bakery products has led to increased production and a corresponding demand for various types of bakery processing equipment in the market.

BAKERY PROCESSING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Product type, Application, Mode of Operation, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ali Group S.r.l., Baker Perkins Limited, Bühler AG, GEA Group Aktiengesellschaft, The Middleby Corporation, JBT Corporation, Anko Food Machine Co., Ltd., Markel Food Group, Koenig Maschinen GmbH, Heat & Control, Inc. |

Global Bakery Processing Equipment Market Segmentation: By Product Type

-

Mixers

-

Ovens and Proofers

-

Sheeters and Molders

-

Divider

-

Others

The categorization of the global bakery processing equipment market includes various product types, such as Mixers, Ovens and Proofers, Sheeters and Molders, Divider, and Others. The pivotal role of ovens in the baking industry is noteworthy, as they facilitate simultaneous heat and transfer phenomena, initiating biochemical and physiochemical changes in the product. Ovens also serve as a crucial kill step, preventing pathogen growth within the product, and contribute to final characteristics like color, aroma, texture, flavor, and shelf life.

In 2023, the Ovens & Proofers segment dominated with the largest revenue share of 34.2%, driven by extensive use in baking and the increasing demand for baked goods. The Sheeters & Molders segment is anticipated to exhibit the fastest CAGR of 7.0%, propelled by the adaptability of dough sheeters to different operating rates and their expected significant growth in demand despite higher prices.

Global Bakery Processing Equipment Market Segmentation: By Application

-

Bread

-

Cakes and Pastries

-

Cookies and Biscuits

-

Pizza Crust

-

Others

The segmentation based on application comprises Bread, Cakes and Pastries, Cookies and Biscuits, Pizza Crust, and Others. The Bread segment led with the highest revenue share of 34.7% in 2023, driven by high demand in North America and Europe, along with steady growth expected in emerging economies like India and China. The Pizza Crusts segment is projected to achieve the fastest CAGR of 7.0%, fueled by the expansion plans of major American pizza companies in developing nations.

Global Bakery Processing Equipment Market Segmentation: By Mode of Operation

-

Semi-Automatic

-

Automatic

The mode of operation categorization includes Semi-Automatic and Automatic equipment. Automation, driven by factors like flexibility, modularity, and labor reduction, has significantly influenced the adoption of both automatic and semi-automatic equipment in the bakery industry. The Semi-Automatic segment holds the largest market share, propelled by the primary factors supporting automation in production lines.

Global Bakery Processing Equipment Market Segmentation: By End-user

-

Retail Bakeries

-

Hotels & Restaurants

-

Pilot Plants

-

Low-Capacity Processors

End-users are classified into Retail Bakeries, Hotels & Restaurants, Pilot Plants, and Low-Capacity Processors. The retail segment dominates the market share and is anticipated to experience the fastest growth. The rising demand for fresh artisan bakeries, particularly essential items like bread and toast, has boosted sales, with fresh bakery products maintaining positive demand from retail stores.

Global Bakery Processing Equipment Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, the bakery processing equipment market is anticipated to witness Asia-Pacific taking the lead, followed by Europe, North America, Latin America, and the Middle East & Africa. Asia-Pacific's substantial market share can be attributed to multiple factors, including the escalating demand for bakery product manufacturing equipment, a flourishing bakery industry, swift industrialization, and governmental initiatives focused on bolstering the food processing sector.

Furthermore, the Asia-Pacific market is expected to demonstrate the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. The growth in this regional market can be attributed to factors such as the expanding middle class with elevated purchasing power and technological advancements in bakery processing equipment. In 2023, China is poised to hold the major share of the bakery processing equipment market in Asia-Pacific, primarily driven by its extensive population, heightened demand for convenient and ready-to-eat products, cost-effective manufacturing operations, and the availability of low labor costs in the country.

COVID-19 Impact Analysis on the Global Bakery Processing Equipment Market:

The global bakery sector faced significant repercussions across various industries due to the COVID-19 situation, leading to disruptions in cash flow. The trade came to a halt temporarily, affecting situations worldwide, including altered consumer needs resulting from inactive lifestyles. Amid the pandemic, the demand for a diverse range of bakery products contributed to revenue growth in the market. Factors such as labor shortages and high wages maintained a steady demand for automated bakery equipment in the manufacturing sector. Furthermore, many bakery product manufacturers upgraded their existing facilities during the pandemic to meet the surging consumer demand for ready-to-eat packaged and confectionery food items. Thus, it is evident that COVID-19 moderately impacted the global market, with automation and evolving consumer demands playing a significant role in fostering market growth.

Recent Trends and Developments in the Global Bakery Processing Equipment Market:

In February 2023, The Middleby Corporation disclosed its acquisition of Escher Mixers, a manufacturer and designer specializing in technologically advanced spiral and planetary mixers for the baking industry.

In April 2023, GEA introduced a new generation of its CrumbMaster, a dedicated crumb breeder designed for applying coatings to convenience foods. The GEA CrumbMaster Gen 2 (Generation 2) is a fully enclosed machine, delivering consistently high-quality output, rapid product changeover, a cleaner working environment with up to 90 percent less dust, reduced waste, and minimal crumb breakdown.

In August 2022, Koenig unveiled the I Rex Compact EC, featuring the I-Rex Compact EC Divider and Rounder. This head machine's design allows the operator to open the lid on three sides simultaneously, providing ample space for cleaning and maintenance.

In July 2022, John Bean Technologies Corporation completed the acquisition of Alco-food Machines, a producer of manufacturing lines and food processing solutions. This strategic move was part of the company's initiative to diversify its product offerings in the convenience meal and plant-based protein technology sectors.

Key Players:

-

Ali Group S.r.l.

-

Baker Perkins Limited

-

Bühler AG

-

GEA Group Aktiengesellschaft

-

The Middleby Corporation

-

JBT Corporation

-

Anko Food Machine Co., Ltd.

-

Markel Food Group

-

Koenig Maschinen GmbH

-

Heat & Control, Inc.

Chapter 1. BAKERY PROCESSING EQUIPMENT MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. BAKERY PROCESSING EQUIPMENT MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. BAKERY PROCESSING EQUIPMENT MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. BAKERY PROCESSING EQUIPMENT MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. BAKERY PROCESSING EQUIPMENT MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. BAKERY PROCESSING EQUIPMENT MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Mixers

6.3 Ovens and Proofers

6.4 Sheeters and Molders

6.5 Divider

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. BAKERY PROCESSING EQUIPMENT MARKET – By Application

7.1 Introduction/Key Findings

7.2 Bread

7.3 Cakes and Pastries

7.4 Cookies and Biscuits

7.5 Pizza Crust

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. BAKERY PROCESSING EQUIPMENT MARKET – By Mode of Operation

8.1 Introduction/Key Findings

8.2 Semi-Automatic

8.3 Automatic

8.4 Y-O-Y Growth trend Analysis By Mode of Operation

8.5 Absolute $ Opportunity Analysis By Mode of Operation, 2024-2030

Chapter 9. BAKERY PROCESSING EQUIPMENT MARKET – By End-user

9.1 Introduction/Key Findings

9.2 Retail Bakeries

9.3 Hotels & Restaurants

9.4 Pilot Plants

9.5 Low-Capacity Processors

9.6 Y-O-Y Growth trend Analysis By End-user

9.7 Absolute $ Opportunity Analysis By End-user , 2024-2030

Chapter 10. BAKERY PROCESSING EQUIPMENT MARKET , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By Application

10.1.3 By Mode of Operation

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Application

10.2.4 By Mode of Operation

10.2.5 By End-user

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Application

10.3.4 By Mode of Operation

10.3.5 By End-user

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Application

10.4.4 By Mode of Operation

10.4.5 By End-user

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Application

10.5.4 By Mode of Operation

10.5.5 By End-user

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. BAKERY PROCESSING EQUIPMENT MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Ali Group S.r.l.

11.2 Baker Perkins Limited

11.3 Bühler AG

11.4 GEA Group Aktiengesellschaft

11.5 The Middleby Corporation

11.6 JBT Corporation

11.7 Anko Food Machine Co., Ltd.

11.8 Markel Food Group

11.9 Koenig Maschinen GmbH

11.10 Heat & Control, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bakery Processing Equipment Market size is valued at USD 14.24 billion in 2023.

The worldwide Global Bakery Processing Equipment Market growth is estimated to be 6.3% from 2024 to 2030.

The Global Bakery Processing Equipment Market is segmented By Product Type (Mixers, Ovens and Proofers, Sheeters and Molders, Divider, and Others), By Application (Bread, Cakes and Pastries, Cookies and Biscuits, Pizza Crust, and Others), By Mode of Operation (Semi-Automatic and Automatic), By End-user (Retail Bakeries, Hotels & Restaurants, Pilot Plants, and Low Capacity Processors).

The future of the Global Bakery Processing Equipment Market holds promising trends and opportunities. Anticipated advancements include smart automation, sustainable equipment, and innovations catering to health-conscious consumers. Growing demand for diverse bakery products and expanding markets in emerging economies present significant growth prospects.

The global bakery sector faced disruptions and cash flow challenges due to COVID-19, causing temporary trade halts and impacting consumer needs. Despite labor shortages, demand for automated bakery equipment remained steady, and manufacturers upgraded facilities to meet growing consumer demand for ready-to-eat products, moderating the pandemic's impact.