Bakery Premixes Market Size (2024 – 2030)

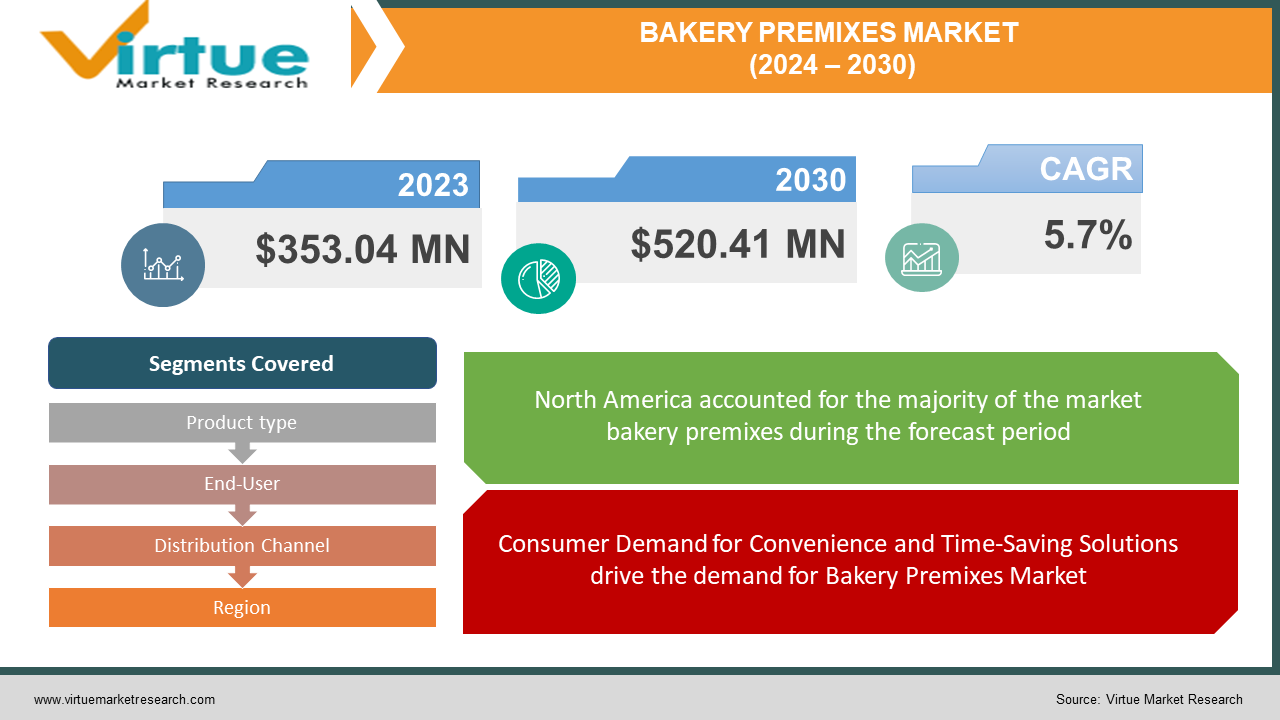

The Global Bakery Premixes Market was valued at USD 353.04 million and is projected to reach a market size of USD 520.41 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.7%.

Bakery premixes involve a combination of ingredients that are pre-mixed and formulated for use in baking various bakery products. These premixes include a blend of flour, leavening agents, sugar, and other necessary ingredients. This provides convenience to bakers and food manufacturers. The Bakery Premixes Market is expected to grow significantly in the coming years due to changing consumer lifestyles, increasing demand for convenience foods, and the rising popularity of bakery products. The major well-established key players in the Bakery Premixes Market are Associated British Foods plc (ABF), Cargill, Incorporated, Corbion N.V., Kerry Group plc, and Puratos Group. Please verify the current status from recent reports or business sources.

Key Market Insights:

Bakery premixes provide convenience to bakers by saving time and effort in measuring and mixing individual ingredients. This is particularly helpful to both commercial and home bakers looking for efficiency in their baking processes. Manufacturers in the bakery premix continuously innovate to meet consumer demands for new and unique bakery products such as gluten-free options, organic and natural formulations, and healthier alternatives. The rise of e-commerce platforms has helped the distribution and availability of bakery premixes to a broader consumer base. Consumer demand for convenience and time-saving solutions, coupled with ongoing product innovation and health-conscious choices are propelling the Bakery Premixes Market. The restraints to the Bakery Premixes Market include quality concerns, clean label preferences, and price sensitivity. North America occupies the highest share of the Bakery Premixes Market. Asia-Pacific is the fastest-growing segment during the forecast period.

Bakery Premixes Market Drivers:

Consumer Demand for Convenience and Time-Saving Solutions drive the demand for Bakery Premixes Market

One of the drivers for the bakery premixes market is the increasing demand for convenience and time-saving solutions among consumers. Modern lifestyles are characterized by busier schedules, with individuals having limited time for elaborate cooking or baking. Bakery premixes offer a ready-to-use solution. This significantly reduces the time and effort required for baking various products. Bakery premixes are designed to be user-friendly, catering to individuals with varying levels of baking expertise. Premixes ensure consistency in the final product. The formulations are precisely controlled. This reliability is important for commercial bakeries that need to maintain product quality across batches. Bakery premixes simplify pre-measured and pre-mixed ingredients. This eliminates the need for consumers, both at home and in commercial settings, to individually measure and combine ingredients. This ultimately reduces preparation time.

Product Innovation and Health-Conscious Choices are propelling the Bakery Premixes Market

The bakery premixes market is influenced by ongoing product innovation to meet evolving consumer preferences. There is a growing awareness of health and wellness. Consumers are seeking bakery products that align with their dietary preferences and nutritional goals. This leads to the development of innovative and healthier premix formulations. Manufacturers are introducing bakery premixes to specific dietary needs, such as gluten-free, organic, and low-sugar formulations. Incorporating functional ingredients, such as whole grains, superfoods, and natural additives, into bakery premixes enhances the nutritional profile of the baked goods. Many bakery premix manufacturers are focusing on clean label formulations, avoiding artificial additives and preservatives. This not only attracts a broader consumer base but also contributes to the sustained growth of the bakery premixes market.

Bakery Premixes Market Restraints and Challenges

The major challenge faced by the Bakery Premixes Market is maintaining the quality and taste consistency of bakery products produced from premixes. This can be a concern for both consumers and commercial bakers. Another challenge is the cost considerations. This limits the adoption of bakery premixes, especially in price-sensitive markets. The products are perceived as more expensive compared to traditional baking ingredients. The other restraints to the Bakery Premixes Market include clean label preferences, limited customization, competition from scratch baking, supply chain disruptions, sustainability issues, regulatory compliance, educating consumers, and technological advancements.

Bakery Premixes Market Opportunities:

The Bakery Premixes Market has various opportunities in the market. With the capitalizing on the opportunity to expand and diversify product offerings, including specialized and premium bakery premixes cater to various dietary preferences and trends. There are opportunities for market expansion globally while tapping into emerging economies where there is a growing demand for convenient and ready-to-use baking solutions. The increasing popularity of e-commerce for the distribution of bakery premixes, reaching a broader consumer base, and offering convenience in product accessibility create significant opportunities. Other Opportunities in the Bakery Premixes Market include innovation in formulations, collaboration with retailers, customization, sustainability focus, educational initiatives, health and wellness partnerships, and technological advancements.

BAKERY PREMIXES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By Product type, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Associated British Foods plc (ABF), Cargill, Incorporated, Corbion N.V., Kerry Group plc, Puratos Group, Dawn Food Products, Inc., Lesaffre et Compagnie, Bakels Group, Archer Daniels Midland Company (ADM), Ingredion Incorporated |

Bakery Premixes Market Segmentation: By Product Type

-

Cake Mixes

-

Bread Mixes

-

Pastry Mixes

-

Muffin Mixes

-

Pancake and Waffle Mixes

-

Others

In 2023, based on market segmentation by Product Type, Cake Mixes occupy the highest share of the Bakery Premixes Market. This is mainly due to the increasing popularity, convenience, and consistency offered by cake mixes. Cakes are widely consumed globally, both in households and commercially.

However, Pancake and Waffle Mixes is the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 11%. This is due to the increasing popularity of breakfast items. Pancake and Waffle mixes offer a quick and convenient solution for consumers.

Bakery Premixes Market Segmentation: By End-User

-

Industrial/Commercial Bakeries

-

Artisanal Bakeries

-

Household/Individual Consumers

In 2023, based on market segmentation by End-User, the Industrial/Commercial Bakeries segment occupies the highest share of the Bakery Premixes Market. This is mainly due to the high demand for bulk premixes in large-scale production settings.

However, the Household/Individual Consumers are the fastest-growing segment during the forecast period. This is mainly due to the increasing interest in home baking, especially during times like the COVID-19 pandemic.

Bakery Premixes Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online Retail

-

Specialty Stores

In 2023, based on market segmentation by the Distribution Channel, the Supermarkets and Hypermarkets segment occupies the highest share of the Bakery Premixes Market. This is due to their wide reach and the convenience of finding baking products alongside other groceries.

However, Online Retail is the fastest-growing segment during the forecast period. This growth is driven by the increasing trend of e-commerce and online shopping, coupled with the convenience it offers to consumers.

Bakery Premixes Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Bakery Premixes Market. This growth is due to the high consumer demand for convenience, and the presence of major bakery premix manufacturers. North America is a technologically advanced region with a well-established baking industry.

Europe has a robust market for bakery premixes. The growth is driven by both industrial/commercial bakeries and a strong traditional culture of home baking.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to rapid urbanization, changing consumer lifestyles, and an increasing preference for Western-style baked goods. The rising middle class in these countries is also a factor, as more consumers seek convenient and time-saving solutions for baking. Countries like China, India, and Japan have significant markets for bakery premixes.

COVID-19 Impact Analysis on the Global Bakery Premixes Market:

The COVID-19 pandemic had a significant impact on the Bakery Premixes Market. The pandemic has led to lockdowns, restrictions on transportation, safety measures, and disruptions in global supply chains. This affected the sourcing of raw materials for bakery premixes and impacted the availability and cost of key ingredients. The closure or limited operations of restaurants, cafes, and other food service establishments affected the demand for bakery premixes in the food service industry. During the pandemic, consumer behavior influenced the demand for bakery products, including premixes. Increased home baking during lockdowns boosted sales of premixes for household consumers.The pandemic accelerated the adoption of online retail. Bakeries and consumers increasingly turned to e-commerce platforms for purchasing bakery premixes.

Latest Trends/ Developments:

One of the developments, in the Bakery Premixes Market is sustainable packaging solutions for bakery premixes. Consumers continue to prioritize health and wellness. This leads to a demand for bakery products with functional ingredients, reduced sugar content, and clean label formulations. This trend influences the development of healthier bakery premixes. There is a growing interest in plant-based diets. This trend extends to baked goods. Bakery premixes with plant-based ingredients, such as almond flour or plant-based protein sources, are gaining popularity. The demand for gluten-free products remains strong. Gluten-free bakery premixes, including those made with alternative flours, are in demand for consumers with gluten intolerance or those choosing gluten-free diets for health reasons. Consumers are seeking unique and innovative flavor experiences. Bakery premix manufacturers are introducing new and exotic flavors. The interest in artisanal and craft baking led to the development of premium and specialty bakery premixes

Key Players:

-

Associated British Foods plc (ABF)

-

Cargill, Incorporated

-

Corbion N.V.

-

Kerry Group plc

-

Puratos Group

-

Dawn Food Products, Inc.

-

Lesaffre et Compagnie

-

Bakels Group

-

Archer Daniels Midland Company (ADM)

-

Ingredion Incorporated

Chapter 1. Bakery Premixes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bakery Premixes Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bakery Premixes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bakery Premixes Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bakery Premixes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bakery Premixes Market – By Product Type

6.1 Introduction/Key Findings

6.2 Cake Mixes

6.3 Bread Mixes

6.4 Pastry Mixes

6.5 Muffin Mixes

6.6 Pancake and Waffle Mixes

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Bakery Premixes Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets and Hypermarkets

7.3 Convenience Stores

7.4 Online Retail

7.5 Specialty Stores

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Bakery Premixes Market – By End-User Industry

8.1 Introduction/Key Findings

8.2 Industrial/Commercial Bakeries

8.3 Artisanal Bakeries

8.4 Household/Individual Consumers

8.5 Y-O-Y Growth trend Analysis By End-User Industry

8.6 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 9. Bakery Premixes Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Distribution Channel

9.1.4 By End-User Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Distribution Channel

9.2.4 By End-User Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Distribution Channel

9.3.4 By End-User Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Distribution Channel

9.4.4 By End-User Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Distribution Channel

9.5.4 By End-User Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Bakery Premixes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Associated British Foods plc (ABF)

10.2 Cargill, Incorporated

10.3 Corbion N.V.

10.4 Kerry Group plc

10.5 Puratos Group

10.6 Dawn Food Products, Inc.

10.7 Lesaffre et Compagnie

10.8 Bakels Group

10.9 Archer Daniels Midland Company (ADM)

10.10 Ingredion Incorporated

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Bakery Premixes Market was valued at USD 353.04 million and is projected to reach a market size of USD 520.41 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.7%.

Consumer demand for convenience and time-saving solutions, coupled with ongoing product innovation and health-conscious choices are the market drivers of the Global Bakery Premixes Market.

Industrial/Commercial Bakeries, Artisanal Bakeries, and Household/Individual Consumers are the segments under the Global Bakery Premixes Market by End-User.

North America is the most dominant region for the Global Bakery Premixes Market.

Associated British Foods plc (ABF), Cargill, Incorporated, Corbion N.V., Kerry Group plc, and Puratos Group. Please verify the current status from recent reports or business sources. are the key players in the Global Bakery Premixes Market.